Business Update - 18th Sleep Well Pick - H1'25 Results, 31% Revenue growth, 95% Gross Margin, Opportunities Hiding In Plain Sight

H1'25 results were excellent, valuation of 15.5x EV/FCF is now cheaper than when I first bought. A candidate for the next buy.

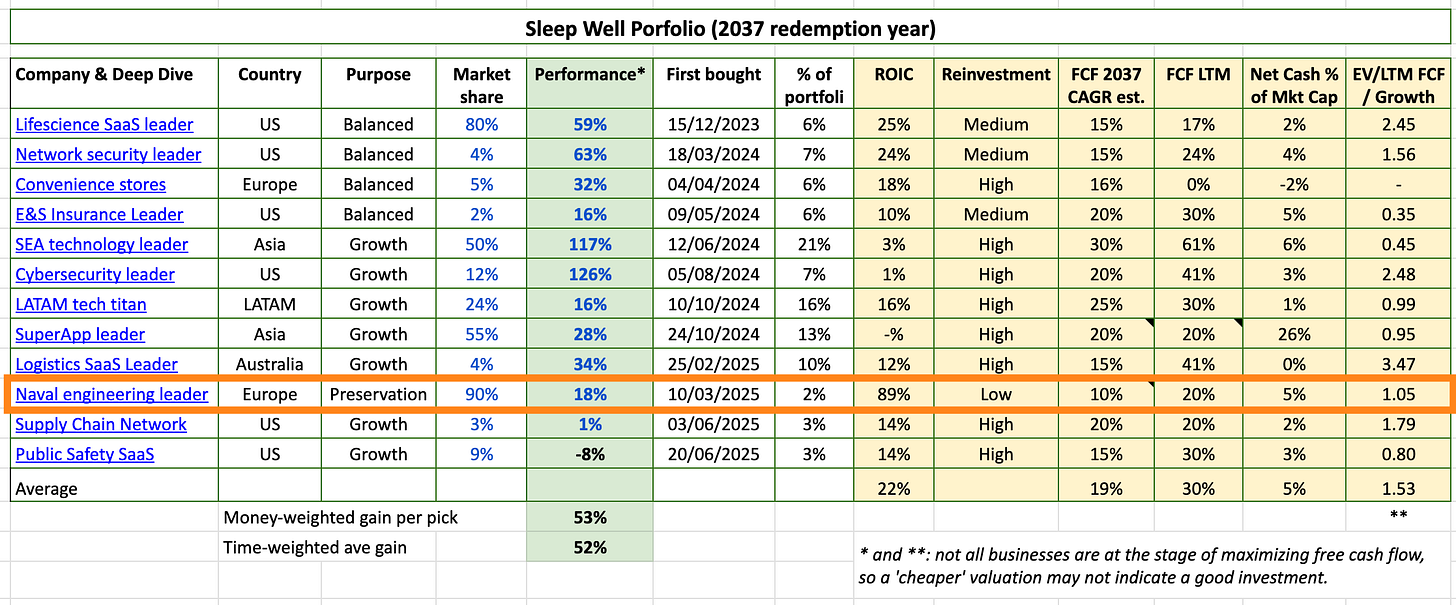

The 18th Sleep Well Pick is the most recent European pick alongside TFF. I like both from a capital preservation perspective, with number 18th hiding long-term growth prospects that short-term investors/traders aren’t aware of.

Both European picks operate in industries that change very slowly and are difficult to disrupt, mainly because they have been pioneers and leaders for decades, with multiple advantages (TFF - 110 years, no.18th - 60 years).

Today, I’ll discuss the 18th’s excellent H1’25 results, revenue (up 32%), EBITDA (up 45%), and guidance remains the same. Best of all, it was hiding growth opportunities in plain sight.

First, let’s be reminded why it was chosen as the 18th Sleep Well Pick and why it has entered the portfolio since March 2025.

No. 18th Sleep Well readings: deep dive, 1st buy alert