Business Update - Intellego stock dived after the 1st Live Event

First investor live event, low expectations, the real test is Q3.

Hi friends,

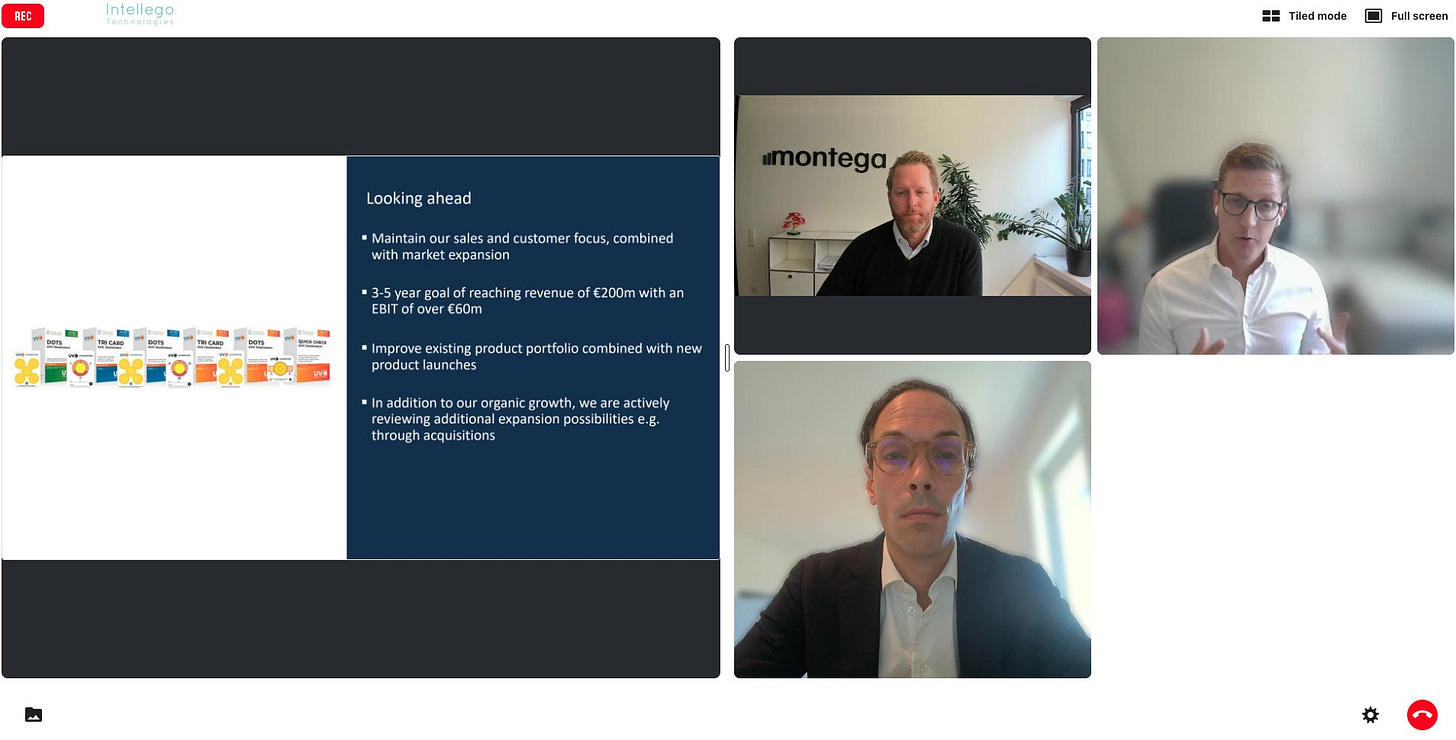

Intellego just hosted its first live video presentation in response to questions about the company and potential business risks summarized in the previous write-up.

I will summarise the event in this post and wait until Q3 to reassess my 5% (now 3% after the share decline) position in the company.

Before you proceed, here are the Intellego’s required readings [deep dive, 1st buy, 2nd buy, risk management].

Key points

Business application of Intellego’s color indicators remains extremely valuable and promising. Claes elaborated on how cities are disinfecting their main water supply using UV, and how companies also disinfect food products.

3-5year guidance remains the same: SEK 2 billion in revenue and SEK 600 million in EBIT, or €200 million in revenue and €60 million in EBIT. This aligns with the guidance from the Q3’24 report (old guidance). Claes hinted it will be revised on the Q3’25 results day.

Market size & growth remain the same: UV Disinfection is valued at ~€1.6B annually (~1.6B disinfections × 1 dosimeter/run). Curing at ~€5B, growing at ~19%. Horticulture at ~€4B, growing at ~22%

Improvements mentioned: (i) Stronger corporate governance, more detailed information in the reports (better revenue segmentation in the future) & potentially more regular earnings calls. A potential uplisting will naturally force the change. (ii) Hiring of a PR person to help with the communications.

Cost efficiency & offices: The company's DNA is to be cost-efficient. Claes provided an example showing that, in the first 10 years, the company raised just around €1 million. And that there is no need for an office, given that the potential cost of €25,000 could be allocated more productively to R&D. It would also save time for Claes and Hans (the new CFO), who live outside of Stockholm and need to travel 45 minutes to an office in the city.

Recent team changes: The two layoffs have no material effect, and that was ‘business as usual’. A Daro (UK subsidiary) replacement has already been found. They aim to have new hirings across R&D, finance, and sales, in addition to the mentioned new Head of PR.

Henkel & Likang partnerships are moving in the right direction. Order sizes are improving, but timing is not in the company’s control. In the past, big orders came once every six months and have now been reduced to every quarter, and can now arrive monthly. As a result, quarterly results could be lumpy.

Customer base: Intellego has hundreds of customers, with more customers inbound organically, thanks to the reputation boost from the Henkel/Likang deals. Additionally, ~60% of customers are recurring, buying more than once. A returns policy is not provided to customers unless there are quality issues.

A new professional app has been developed to convert color to a number for a more precise indication. It is in the early roll-out phase and was built based on customer feedback. A small number of customers are already paying, and can be available for general customer use (in app stores) in the future.

Long-term SEK 10B revenue ($1B revenue), not an official target, is possible given the right investments & new UV-curing use cases (printing, coating, etc.)

Regulations: China is the front-runner; the US & Canada are relatively new. Claes provided more context, stating that ~20 billion medical devices are disinfected each year, indicating a strong revenue potential for Intellego’s dosimeter.

Yuvio requires some additional documentation to satisfy the new regulatory pathway, but it is not seen as a new hurdle.

Conservative reporting: Last year, the company's share price suffered a significant decline due to the missed guidance, so they have adopted an ‘under promise over deliver’ approach. However, it was also said that large orders can shift timing materially. Hence, the guidance will be updated in the third quarter. [This seems to be the key point that upset/confused the market the most—but nothing has changed since Q2’25 report]

Short-term margin: The ~70% EBIT margin from Q2 is expected to decline slightly, but the 3-5 year EBIT margin was projected to decrease to 30% (as per the old guidance, the new target should be around 50% EBIT).

Payment terms: The company is working to shorten payment days (as indicated in a direct email from Claes, a 30-60 day target was mentioned, compared to the previously stated 60-90 day period, which was publicly announced). The company is prepared to utilize more factoring if needed.

Revenue by region is volatile due to bulk orders, as shipping may be to one area (where revenue is then recognized) with subsequent global redistribution.

Operating cash flow for Q2 was €6 million, and the cash position remains strong at €9 million (approximately SEK 100 million, improving fast). The 12-month operating cash flow run rate would equate to €24 million ($28 million). The current market capitalization of approximately $400 million implies a valuation of 15 times operating cash flow.

Capital allocation: Claes mentioned the board is in discussion about what to do with the SEK 100 million. Buybacks, dividends, and even acquisitions are considered.

My impression

Intellego required readings [deep dive, 1st buy, 2nd buy]

To learn more about SWI, check out our Owner Manual and FAQ.