Buy Alert: 20% Durable Growth 30% FCF margin and a New Sleep Well Pick

I have a perfect track record (some luck yes, but not so much if I am correct 16 out of 17 transactions). Both companies discussed today will become a core position of the Sleep Well Portfolio.

Hi friends,

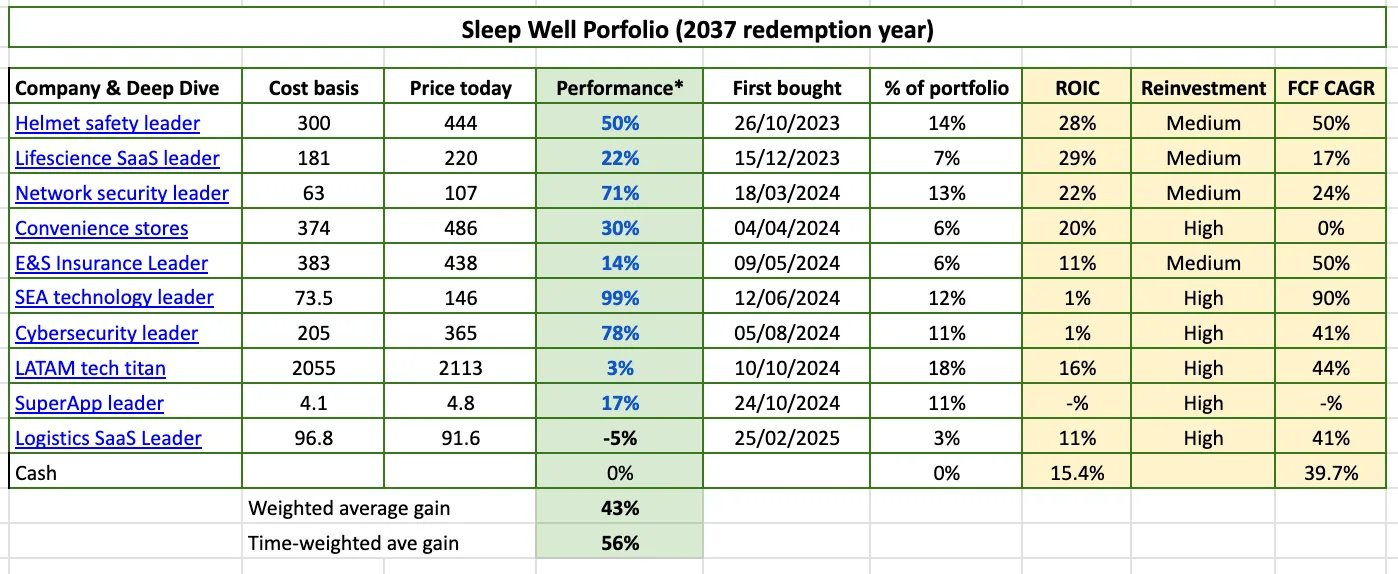

This morning, I alerted my paid Sleep-Well readers about my 10th position in the portfolio. This was a planned purchase laid out in detail a week prior.

The stock dropped significantly for reasons unrelated to the business. Rarely does a company with a 95% gross and 40% profit margin drop this much (not The Trade Desk), and I am a happy buyer. This will become a core position for my family portfolio, and we are willing to own it for 10-15 years, provided it passes my thesis tracking systems—see below.

I have updated the portfolio spreadsheet and published my reasoning in-depth here.

You can also see the tracking of all my positions here. Green is good, yellow is as expected, and pink indicates when the company has lost some pricing power or deviated from long-term targets.

The depth and discipline of my tracking have allowed me to cut losses quickly and invest in companies that consistently outperform their competition.

See below; I rarely make mistakes.

The portfolio rarely has a loser—the only one is due to the timing of the purchase. I bought it a week ago before the tariff rhetoric.

The results above will always be part luck and part skill, but luck will be a minor contributor as my system is refined. Read my deep dives and follow-up report, and you will know why.

New Pick this weekend - Don’t miss out.

Preview here:

NO viable alternative to this company’s product.

95%+ gross 40%+ free cash flow margin,

market cap between $5B-$10B.

net cash position

5-year backlog

The company will be the prime beneficiary of the multi-decade green energy transition. I plan to add this to my portfolio next week. Paid members will be notified as well.

Best,

Trung