SWI Pick #4 - Floor and Decor - Future Home Improvement Monopoly With Compelling Reinvestment Economics At An Attractive Price

Winning market shares from Home Depot and Lowe's with potential to reach ~30% at maturity. Compounded revenue and EBIT at 25%+ CAGR in the last 12 years, 17% ROE, 12% ROIC.

Hi all,

After well-received feedback on the VAT Group $VACN.SW - the vacuum valve monopoly, and Shimano $7309.T / $SMNNY - the bike component monopoly, I want to bring you the third sleep-well investment - Floor and Decor FND 0.00%↑

Floor and Decor is a hard-flooring warehouse retailer with a 9% market share operating 178 stores across the US. It has a compelling expansion plan that destines to win more market share. At maturity (450 stores in 10 years), I estimate that Floor and Decor could command 25-30% of the market at the expense of the industry leaders, Home Depot HD 0.00%↑ , Lowe’s LOW 0.00%↑ , and even more so, the independent and ‘mom-and-pop’ shops.

To size up the challenge, Floor and Decor is up against Home Depot, the home renovation leader, with 2300 stores generating $65M revenue per location, commanding 30%+ of the flooring market. And Lowe’s, in second, with 20%. In comparison, Floor and Decor has just 178 stores (Q3’22), generating $19M per store.

So, what convinces me to bet on Floor and Decor to beat Home Depot and Lowe’s? Three reasons:

+Floor and Decor has superior product offerings (variety and price) and more loyal customers (60% are professionals) than Home Depot (40%), Lowe’s (30%), and other peers. They offer a superior shopping experience by giving DIY homeowners free technical classes and aligning their interests with professionals by not competing for installation jobs, among many added services not seen elsewhere. The business is also time-tested, coming out stronger from crises since 2001, and, crucially,

+Floor and Decor has the right management team. Tom Taylor, the CEO, and two other executives have worked their way up at Home Depot through various roles to eventually serve as executive positions responsible for all 2,200 Home Depot stores. Particularly, Tom has lived through HD’s growth period, which saw the company expand store count 10x over 16 years to 2234 stores ending FY2007, or at 17% CAGR, roughly the same as FND’s last five-year rate (20%). Tom would have learned the customers' problems deeply and know how to empathize with them more than other CEOs.

+Finally, Floor and Decor is still at the early stage of growth, where its expansion formula is compelling. Its new store unit economics pays back in three years and has revenue potential twice the old format. Floor and Decor’s target of 500 stores by 2032 would grow sales by 14% CAGR and free cash flow by 20% CAGR. But even if it underdelivers, the investment makes sense, providing room for error and a margin of safety.

Nevertheless, even the best business at an expensive price would not make a sleep-well investment.

As I require a 30% margin of safety for the business, Floor and Decor’s stock, at ~$88/share, is fast approaching my buy price, at $83/share. If this doesn’t meet your right price, at least you would be ready to own it when opportunities come.

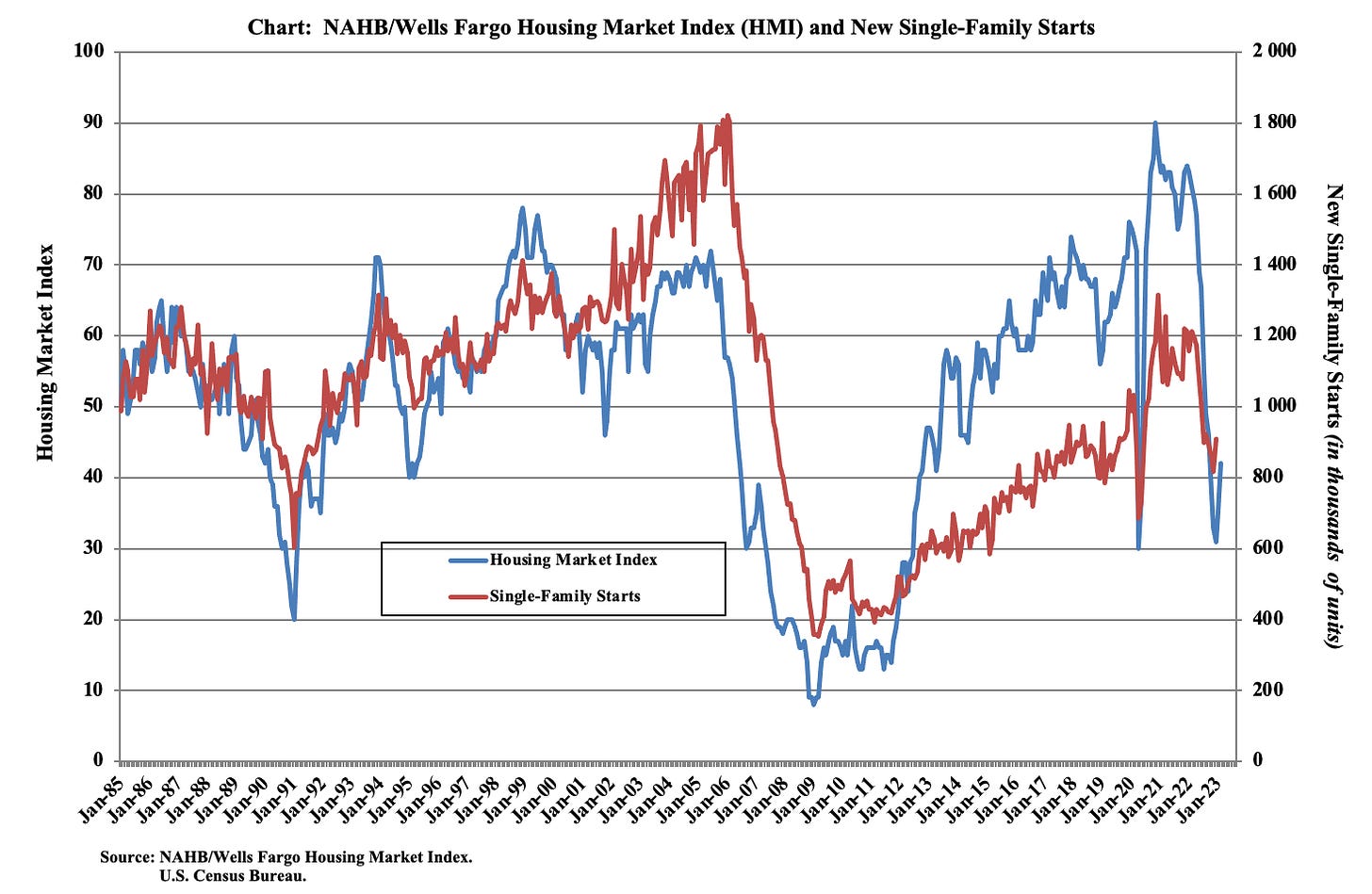

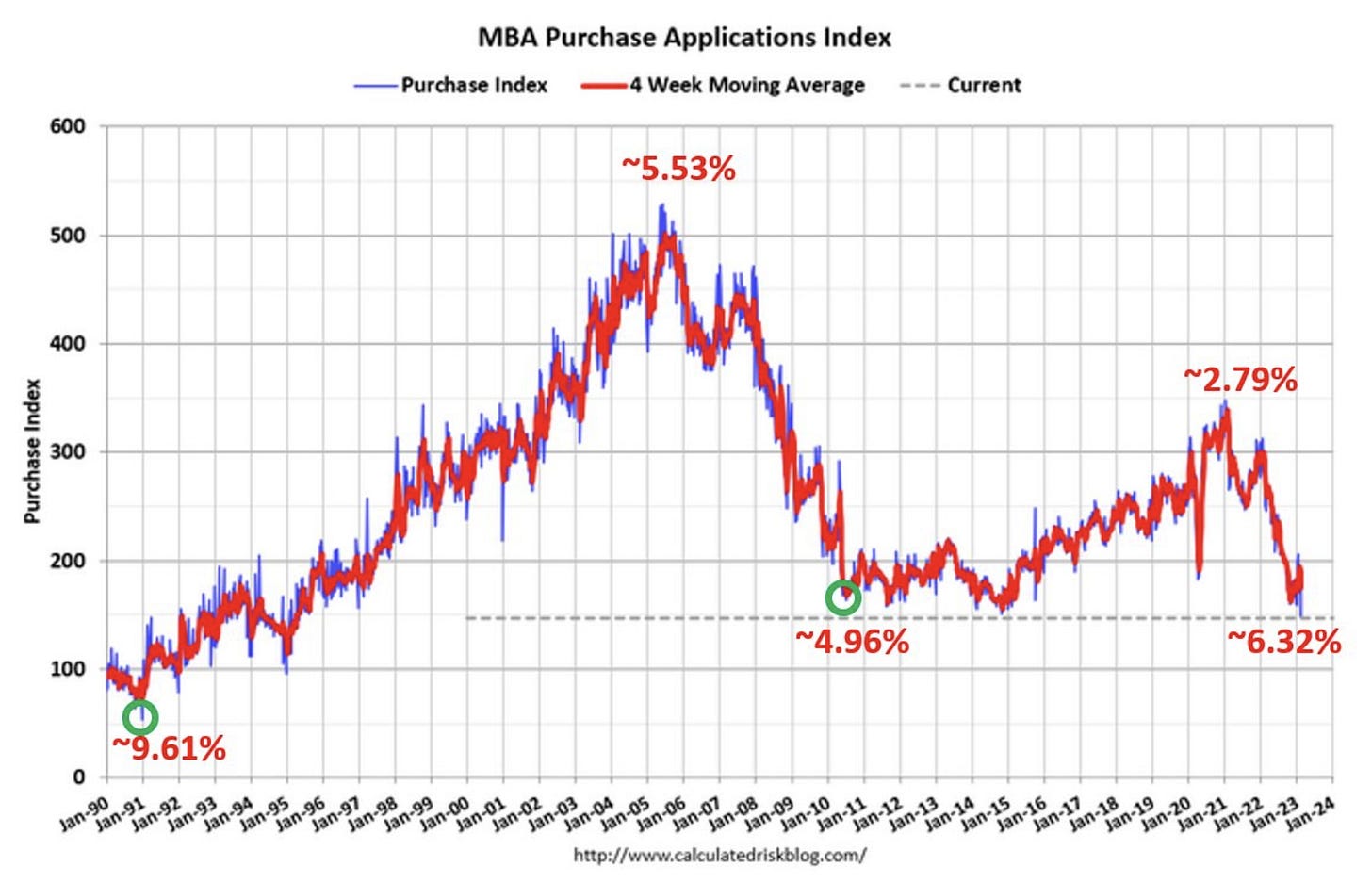

There are considerable uncertainties in the housing market. For context, see the following three charts suggesting a grim outlook in the housing market. Businesses’ FY2023 commentaries ($POOL, NVR 0.00%↑ , H 0.00%↑ H 0.00%↑ WMT 0.00%↑ ), and Larry Summers, former Treasury chief‘s cautious view of the US economy.

Chart 1: NAHB housing index

Chart 2: Mortage Approval rates

Chart 3: Home improvement spending - a lagging indicator

In addition, FND 0.00%↑ ’s Q4’22 earnings uncertainty reading could provide patient and long-term investors an opportunity to add or initiate a position.

*Quick disclosure, I have a 1.5% position and am waiting for the price to come down to $83/share to make it a 3% position. If it doesn’t, I’ll add to the VAT Group, Shimano, or my fifth sleep-well investment (to be released next month), provided their prices are correct.

Below is what you can expect to learn about Floor and Decor.

Why Floor and Decor is a sleep-well business?

The expansion formula to win market share

Management - The three musketeers from Home Depot

Competition

Risks

Valuation - The right price for acquiring shares

Sleep Well Investment scorecard