Business Update - Grab Q4'24: Profitable Growth and Low Disruption Risk From Robotaxi

Grab reached 44M MTU users, profitable for three consecutive quarters, $400M+ Adj. EBITDA makes this business 40x EV/EBITDA, reasonable for the 40% near term growth and 15%+ 10 yr CAGR.

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Hi, sleep well friends,

This post updates Grab’s Q4-24 thesis (a review of its direct peer—GOTO will follow). Read my deep dive last October to learn about the business and why I bought it for the Sleep Well Portfolio. I recommend reading Sea Limited and Mercado Libre to appreciate the strength of the marketplace model in different regions.

Q4’24 results are going full steam; all positive so far. I have reviewed

The Sleep Well Portfolio looks strong, up 51% per pick on average.

All other thesis tracking can be found here and linked in the Sleep Well Portfolio spreadsheet (annual sub only). You can also access all buy-and-sell, and deep dives.

As a reminder, I focus on the long-term story/execution of the business, not the quarterly Wall Street beat/miss quarterly records. So, my thesis tracker primarily checks how my picks build their value propositions, cope with adversity, and maintain/grow moats and market share.

For all sleep-well writeups, please visit this link.

Grab Q4’24 - Feb 20th

For context, Grab burned $5B in cash between 2019 and 2023,

2023: -6M,

2022: -$900M,

2021: -$1B,

2020: - $700M, and

2019: - $2B.

FY2024 is a huge inflection point, and kudos to the management for getting Grab to get to where it is today.

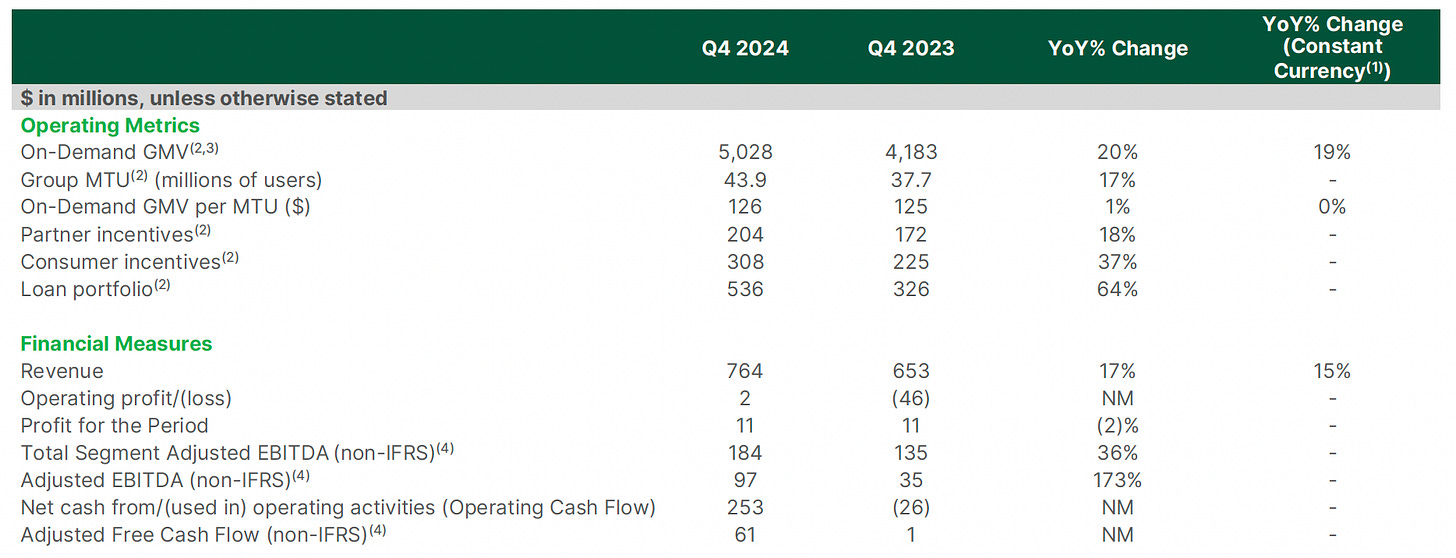

In Q4’24, operationally, it achieved

43M MTU (monthly transacting users), up 17%, a slight YoY and sequential acceleration

$5B GMV (gross merchandise volume), up 20%, a YoY and sequential acceleration

Partner incentives are up 18% and remain high but will naturally decline (my expectation)

Financially, revenue continues to rise steadily, and free cash flow has improved markedly.

Revenue was $764M, up 17%

Free cash flow was $61M, up from breakeven last year.

For the full year in 2024, Adj. EBITDA and free cash flow improved by nearly $500M and $370M, respectively.

So Grab’s $5B ‘investment’ in the past 5 years is starting to pay off. Yes, I agree; it is still in the early days. However, read my short paragraph about Grab next to appreciate its position of strength. As I expect it to maintain this position, free cash flow will grow steadily in the next 5-10 years, barring disruptions (not that I can think of right now).

So, if you are new, Grab is a Southeast Asian (‘SEA’) super-app with a 55%+ market position in deliveries (foods, groceries, beauty, medicine, documents) and 50%+ in mobility (taxis, 4x larger than the next). The company has been operating unchallenged across verticals and SEA after beating Uber in 2018 (6 years after its founding), except for Indonesia, where Gojek (GOTO) is neck and neck (but with issues, and it was rumored to be bought out by Grab!!!). Covid disrupted Grab’s growth with prolonged lockdowns. Still, since reopening, Grab has been capturing market shares, reaching profitability, and leveraging its scale to expand successfully to Fintech products (digital bank accounts, loans, investment, BNPL, insurance). Financially, it has posted the first year of free cash flow at $136M and guided $300+ free cash flow for next year ($400M+ Adj.EBITDA). Again, that is massive after burning nearly $5B five years prior. The company has a long way to go to grow profitably, with 2/3 of SEA still underbanked.

Q4’24 was another step in the right direction - showing growing demand and increased stickiness of the super app.

Let’s explore how Grab’s super app model has improved its:

Stickiness - are people using it more frequently and spending more?

Scalability - are people using Grab’s other products, fintech, advertising, and others?

That’s more important than gauging Grab’s valuation. Currently, it’s 40x EV/EBITDA, but that can change quickly with the operating leverage Grab will benefit from.