Business Update - Q1'25 Sleep Tracking: A Focus on Tariff, VAT, Kinsale, MIPS AB

How they manage tariff uncertainties, impact on long-term business operations. Which one will join the Sleep Well portfolio?

Hi, sleep well friends.

Funny how just 30 days ago, Sleep Well picks’ annualized return per pick was 38%, and today it’s 46%! The portfolio is again a sea of green with just one loser (at -2%)!

I made just one change last month and largely sat on my hands; more tricky said than done. The April Portfolio Review, in a few days, will be fun!

Ok, I lied. I didn’t just sit on my hands.

I thoroughly reviewed the business model of all Sleep Well picks, from customers’ profiles to the supply chain. That led me to trim MIPS and roll part of the proceeds into buying Sea Limited, yielding a total 40% gain in just 3 weeks.

As Q1'25 earnings begin, we are receiving more granular data on how these businesses, their customers, and suppliers are managing tariff uncertainties. I will review all holdings Q1 and evaluate if / how the new geopolitical environment leads to any structural changes.

Today’s business reviews are:

VAT Group - a strong contender for the portfolio.

MIPS AB - lower visibility, supply chain ‘handcuffed’, recurring legal expenses.

Kinsale - more competition in the larger commercial line, testing Kinsale’s operational discipline.

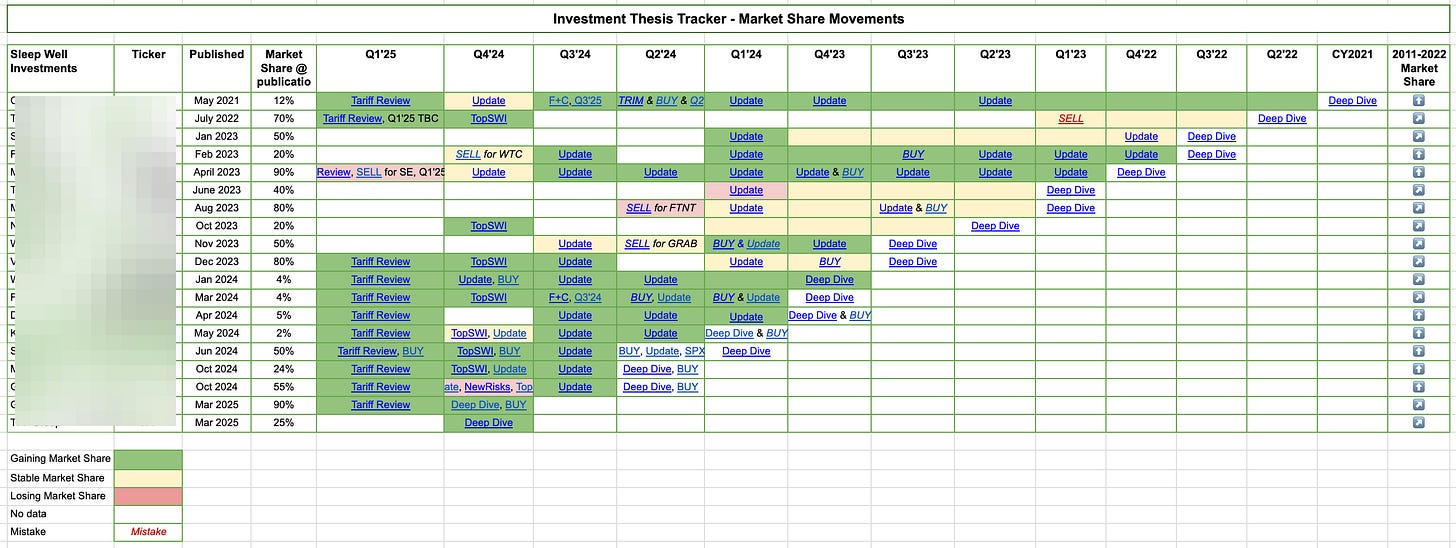

To track every update, review, and deep dive, click on the "Tracking Update" tab in the provided spreadsheet.

Access available to annual premium sub. Consider becoming one here.

For all other write-ups, start here.