Sleep Well Portfolio - SWI outperformed on the way down and up. Still time to add.

What did we learn from the recent bear market? Dissecting the 2018-19 trade spat and opportunities to add today.

Hi all,

I've returned from my no-screen time holiday. I hope you have had a relaxing time with family and friends.

Checking stock charts for the first time, it looks like the past month was the first test for Sleep Well Investments.

I am glad it outperformed the market both during the downturn and on the way up; the purchase I made before leaving yielded a 32% return. Great! However, no other orders set before my holiday were filled.

In this brief note, I outline:

How Sleep Well Investments outperformed in volatile times,

What does history from 1870 tell us?

What opportunities can we take today?

Outperform the way down.

The chart below presents the stock movement of the portfolio companies from December 31, 2024, to April 7, 2025.

The S&P 500 declined 13.94%, underperforming eight sleep well picks and overperforming two (-26% and -44%).

Outperform on the way up.

On the rebound since April 7th, the S&P500 gained 4.38%, below nine sleep well picks and higher than just one.

During this time, one of the companies highlighted in the tariff impact review report I wrote before the holiday had also reached a new all-time high. Yes, it’s Dino Polska.

The overperformance in both the downturn and the upturn, albeit for a short period, is very encouraging, demonstrating the resilience and quality of the businesses.

But if you have been following my work, you would know the portfolio was built for events like this.

You would also know that I love events like the current one.

Why?

Fear drives short-term investors out, providing more attractive prices for high-quality companies.

Market-changing events expose weak businesses and show which ones are well-prepared.

I took the opportunity before my holiday to make Sleep Well more resilient.

How?

Revaluated all 11 holdings for tariff resiliency.

Reviewed Haven businesses - The Magnificent 7.

Result?

Short-term: Added to the least impacted business and sold the most impacted one. (no. 23rd and 24th) yielded a 32% gain.

Medium-term: Raised some cash to take advantage of future volatility. (Not saying the market will drop more)

Long-term: The portfolio now owns only companies that have a limited and indirect impact on tariffs.

Did we learn anything?

The tariff war has had the most significant impact on the US stock market. Opportunities abound in non-US regions, as they have also been sold off.

More volatility is expected for now.

What’s next?

The US is the largest consumer, and China is the largest producer. One is trying to stay as the world leader, and one is starting to become one. Will there ever be a mutually beneficial situation for both parties?

I don’t know.

However, my simplistic prediction is that by 2037, when the Sleep Well Portfolio is passed on to my children, global trade will continue to grow from today, even if we have a World War III.

Below, you can see that international trade has grown steadily since 1870, with an increasing number of countries engaging in trade with each other, as indicated by the higher S index.

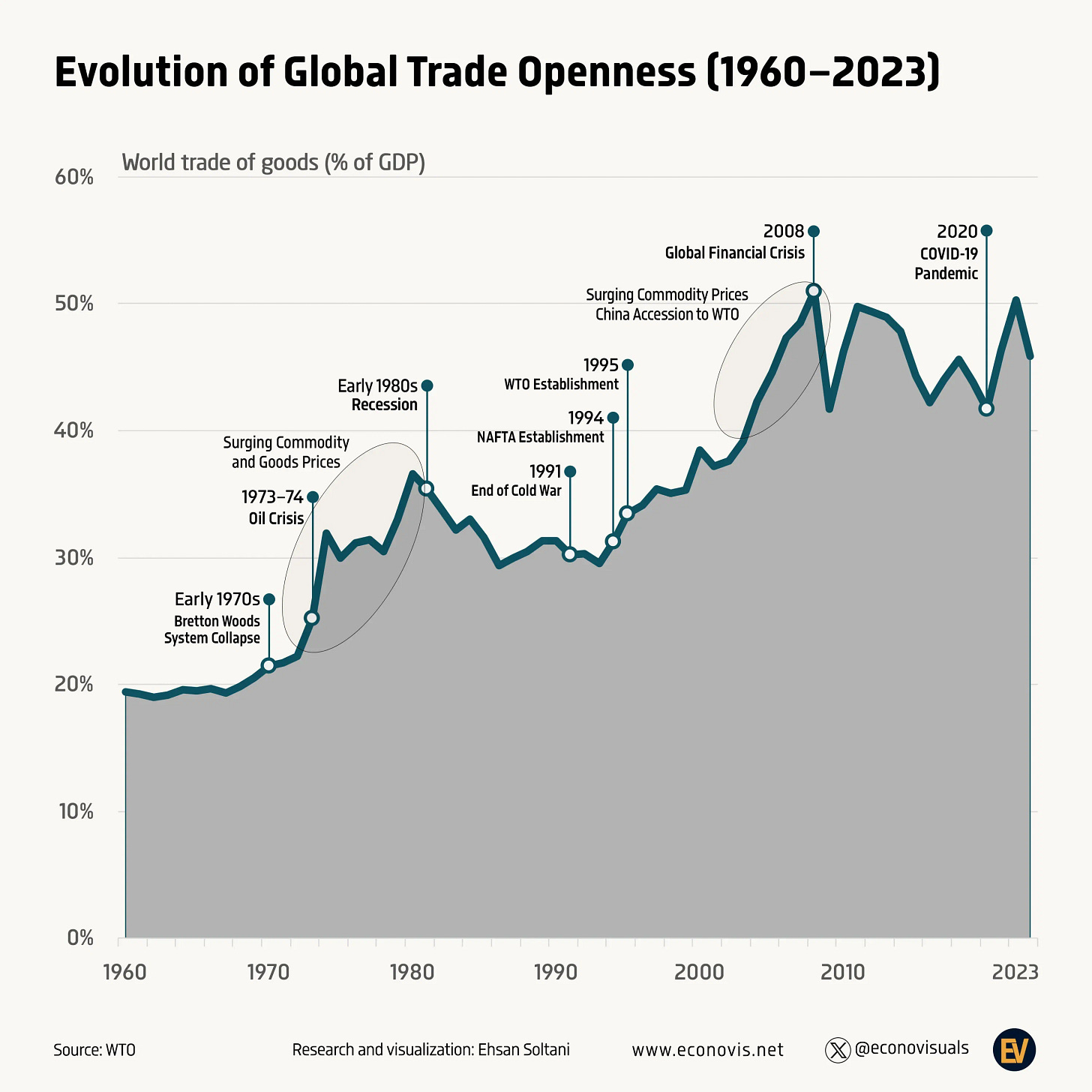

The following shows that global trade contributes to 40-50% of the world’s GDP, having steadily increased from 20% after World War II.

Even if the US succeeds in reshoring the manufacturing of key goods and services, imports and exports of raw materials, in-process goods, and finished goods will still involve the rest of the world.

Yes, that is naive and simplistic thinking, but I can’t invest in the stock market long-term if I am not an optimist capitalist (could be grammatically wrong).

Next, the 2018-2019 US-China trade war provides a glimpse of what could unfold in the next 12 to 24 months.

First, the US-China bilateral trade is expected to decline; however, this will be compensated by increased trade from ‘bystanders’ (EU countries) and rerouted trade routes, such as those through Vietnam and Malaysia.

In addition, if we split out trade in goods and services, we can expect trade in goods to decline, as it did in 2018-19. However, services are expected to remain stable and even increase in some sectors, as they are mostly exempt from tariffs.

Overall, nothing surprising.

But here lies the opportunity.

(i) The global trade makes the supply chain more complicated with elongated freight routes,

(ii) There could be more trades from bystanders to the US/China and between themselves,

(iii) Services trade flow could remain stable or even increase in some sectors.

You may see lots of opportunities.

Within the Sleep Well universe. I see many!

Point (i) will bring more business to