Sleep Well Portfolio - Sea of Greens, 16% Outperformance, Future-Proof

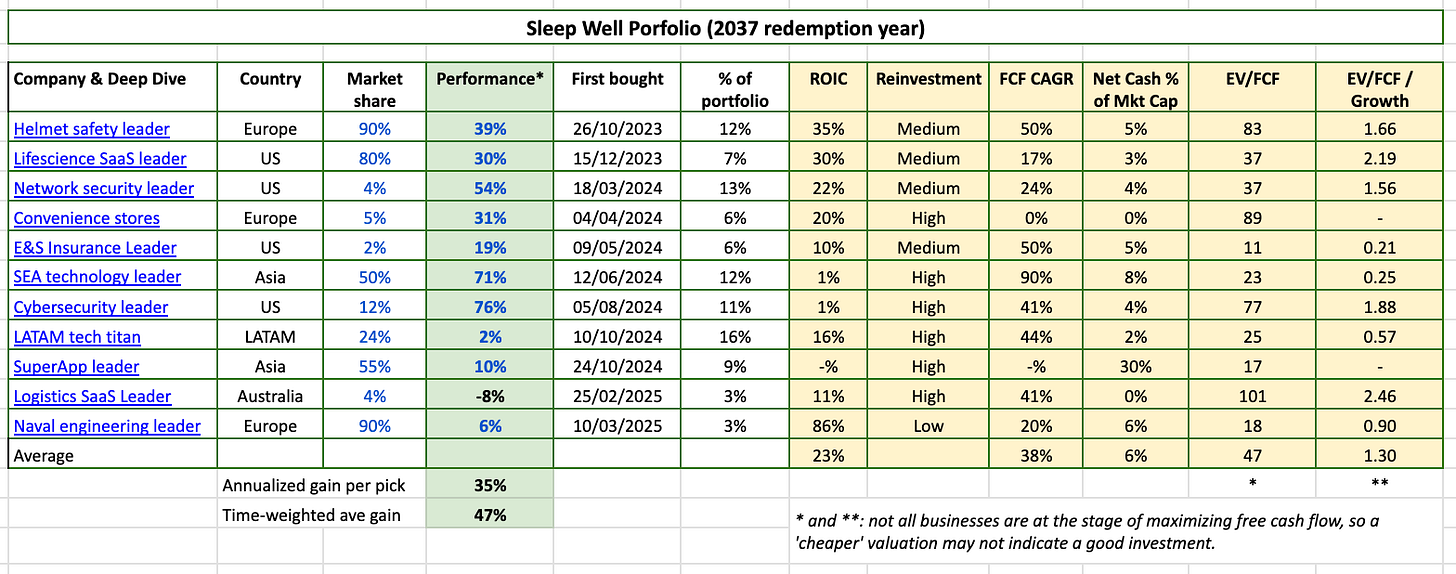

Diversified: 6/10 are non-US, Growing profitably: 23% ROIC, 70% reinvestment rate, High cash buffers: 9/10 are net cash, Outperformance: 16% vs. S&P500, average return per pick 49%. Only 1 loser.

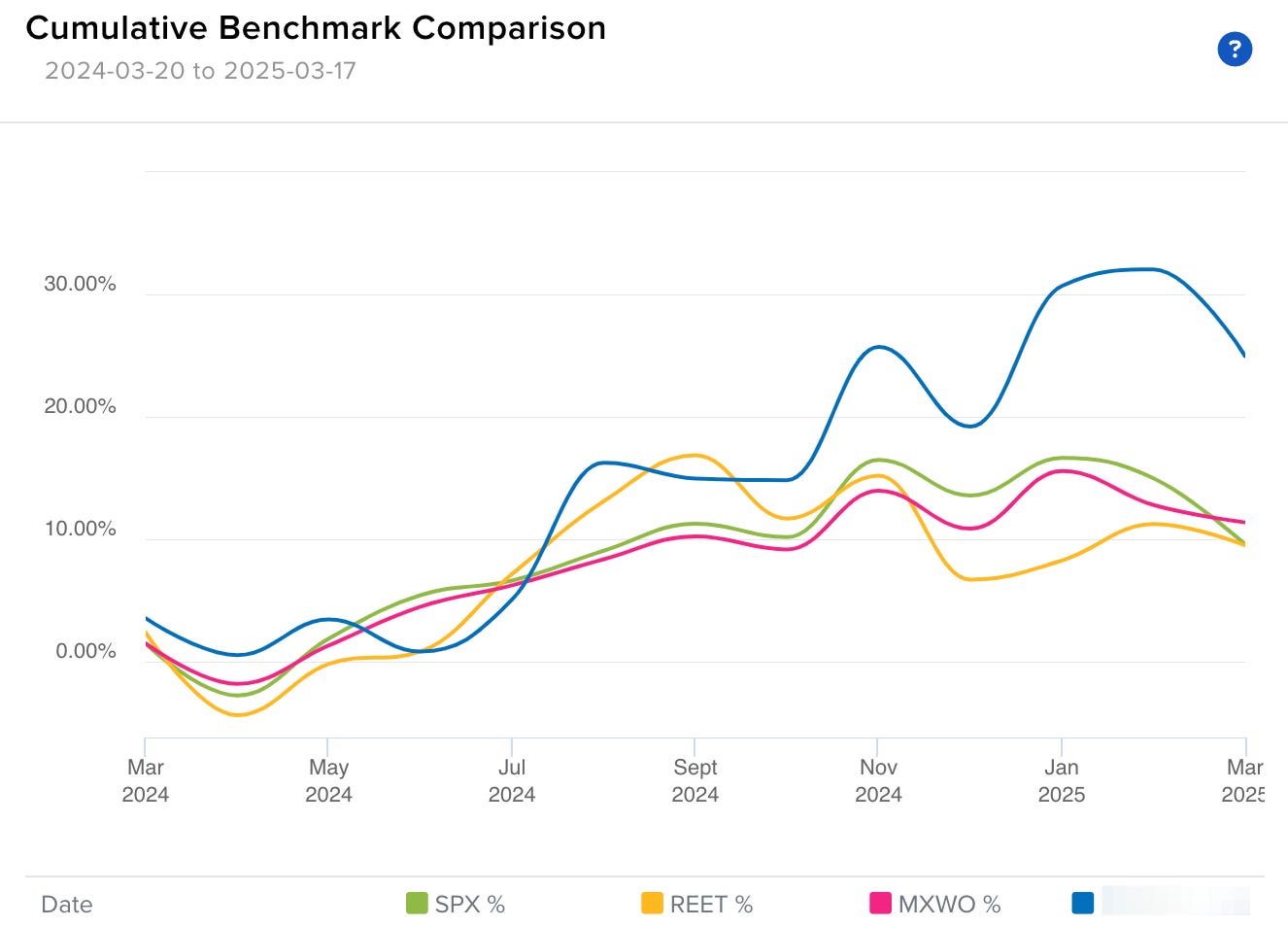

The Sleep Well Portfolio outperforms the S&P500 by 16%, with average holding gains of 47%. I’m proud that all holdings are niche leaders diversified across countries, industries, and business models. What’s more? There is only one loser.

I feel well-prepared for the unknown.

Look through

Average return on capital invested (ROIC): 23%

Average reinvestment rate: 70%+

Average free cash flow per share growth: 38%

Average net cash as % of market cap: 6%, 9 of 10 are net cash

4 US, 3 Europe, 2 Asia, 1 Australia, 1 Latin America

Capital allocation: 2 pay dividends, 6 reinvest all excess cash on growth.

The portfolio is concentrated with 10 holdings, and the investment universe is highly selective, with 18 so far (goal: <40).

There is no point investing in your 20th best idea.

I build the portfolio to prepare for the knowable unknowns:

Wars

Tariffs

Recessions

US overvaluation

Region-specific volatilities

It is well-diversified across

5 Continents: N. America - 3, Europe - 3, Asia -2, Australia - 1, S. America - 1.

8 Industries: life science, cyber security, technology, logistics, consumer discretionary, insurance, semiconductors.

Customers: large enterprises, SMEs, consumers, and governments.

Products: physical goods, services, royalties, use-base, per seat, long-term contracts

Business models: platforms, licensing, product-as-a-service, fabless manufacturing,

Capital allocation priorities: Six are focused on growth, and four are balanced, with two paying dividends (2% and 5.5%).

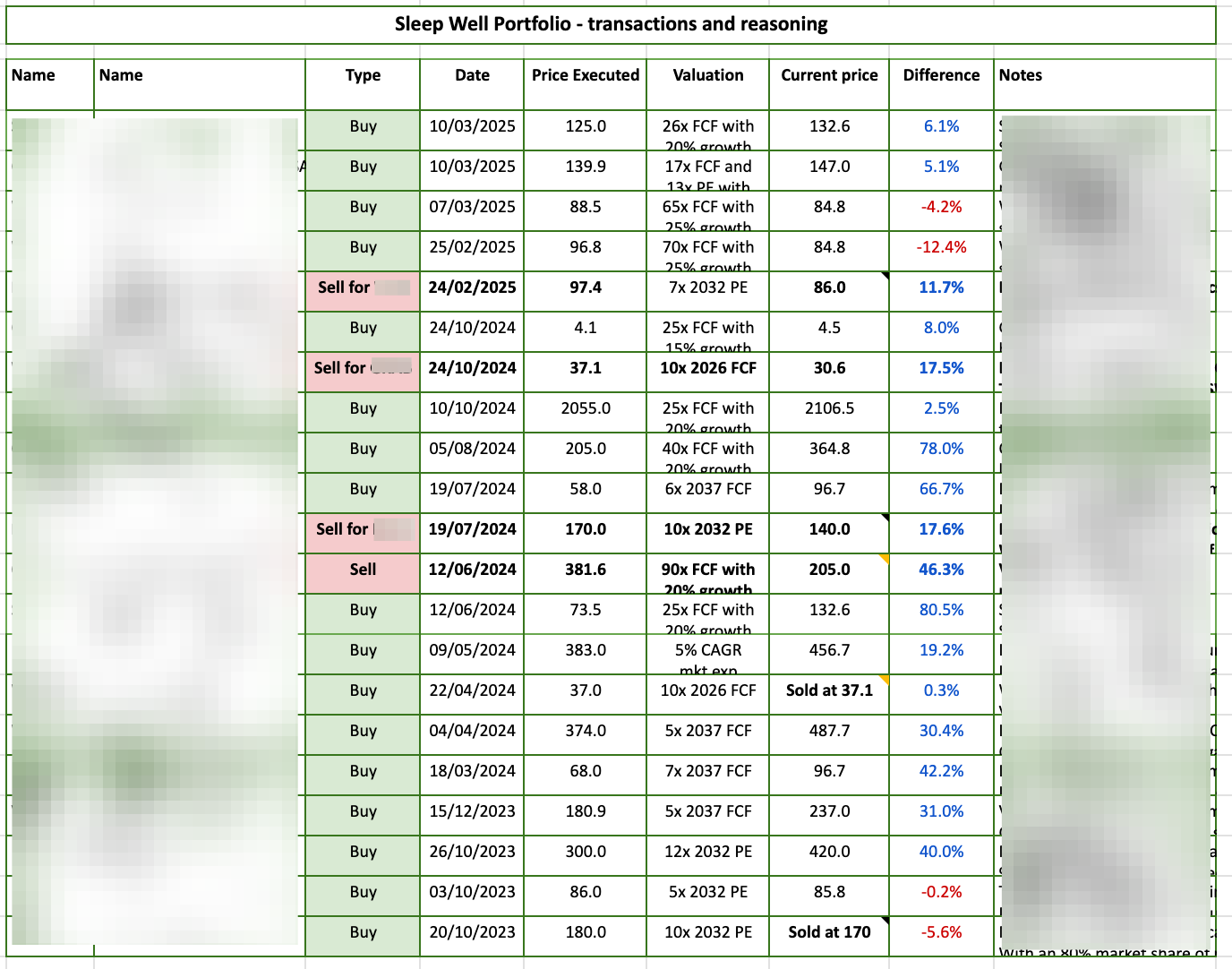

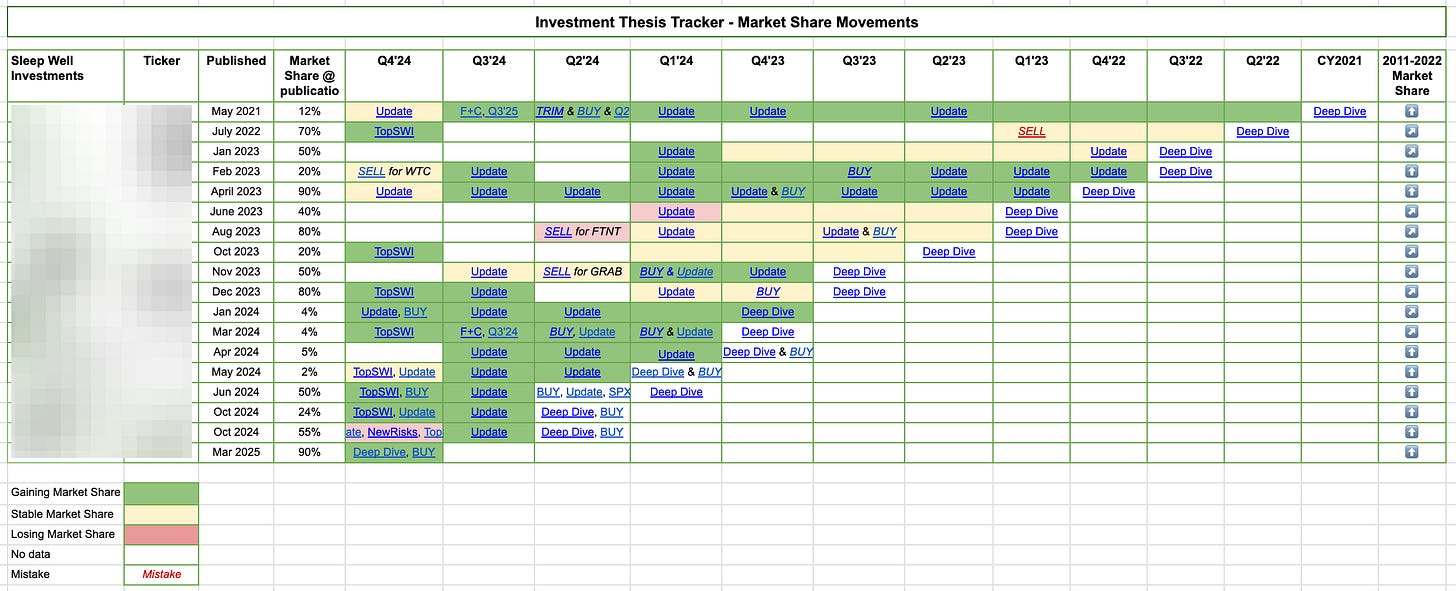

I track all holdings methodologically to identify mistakes early and capitalize on market overactions. 4 sales out of 4 have been correct, and 9 out of 10 purchases have an average gain of 49%.

The tracking sheet above helps visualize each pick's progress very quickly. Green means good, yellow means need to watch closely, and red indicates a candidate to trim.

The result?

16% outperformance, and more importantly, only one loser.

All decisions are nearly spot on. A founding member with 40 years of professional experience in the market, with whom I provide personalized research service, said my track record is like landing head 20 times. Lucky? Yes, but my process ensures I will continue getting ‘lucky’ for a long time.

I encourage you to check out my free content. I don’t give trials because my research process is highly proprietary (I know what to focus on) with a high success rate, and multiple free riders have copied them already (Yes, I can track all readers' clicks). I don’t intend to provide discounts, but you can lock in the current prices today.

See you on the sea of greens.

Best wishes,

Trung