SWI #18 - (Q3'25), Royalty Business Growing 29%YoY, 2 full year revenue visibility

9M'25 results were great, valuation rose to 23x EV/FCF, is now more expensive than when I first bought. But I regret not adding earlier. A candidate to buy in dips.

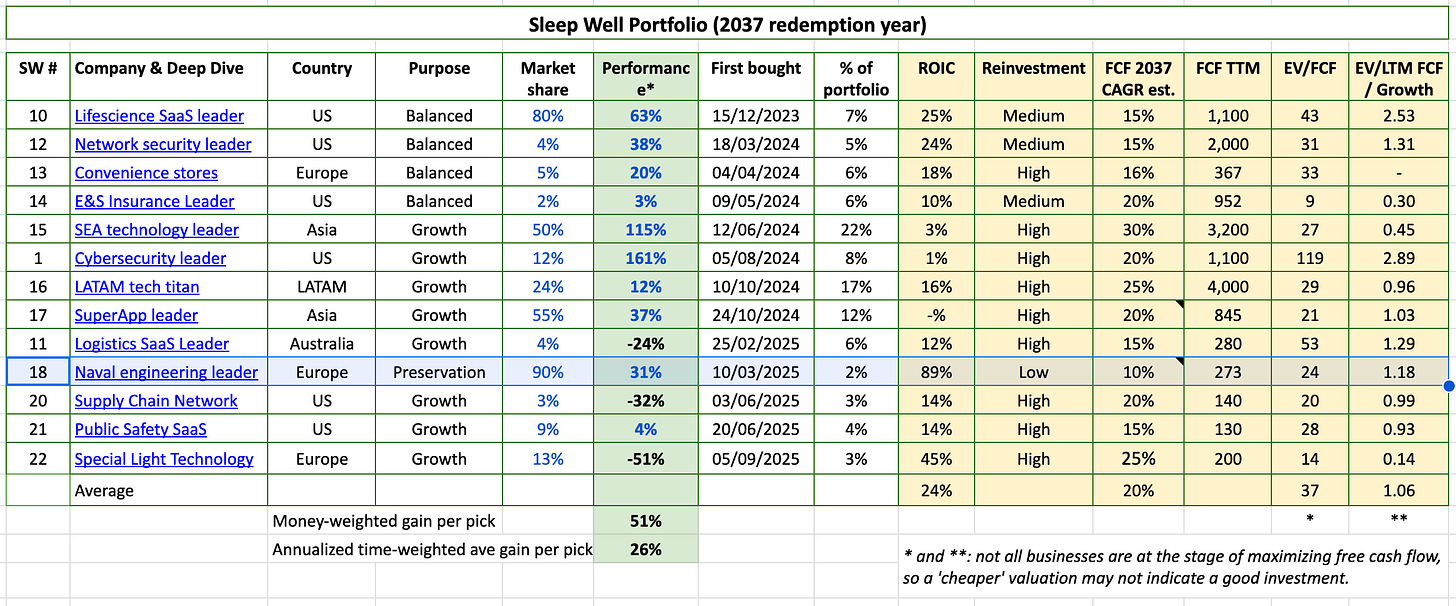

The 18th Sleep Well Pick, a position acquired in March 2025. I like it from a capital preservation perspective, given its mostly a royalty earning business (95% gross margin, 60% operating margin, low reinvestment), but revenue growth and future revenue visibility have been stronger than I thought.

Better, it’s a leader for the last 60 years in an incredibly slow-changing, highly regulated LNG industry, making it difficult to disrupt.

Today, I’ll discuss the its excellent 9M 2025 results, revenue (up 29%), 67% EBITDA margin, and guidance upgrade. Best of all, it was hiding growth opportunities in plain sight.

No. 18th Sleep Well readings: deep dive, 1st buy alert, H1’25

First, let’s be reminded why it was chosen as the 18th Sleep Well Pick and why it has entered the portfolio since March 2025.

The company provides me ownership in the green energy megatrend and also an European business: importantly, it offers a top-of-class, resilient quality, and AI proofing business, that my Sleep Well Portfolio requires.

It has been the gold standard in membrane containment technology for LNG transportation for over half a century. In the past 5 years, 90% of new builds have used this technology, i.e., a 90% market share. Its best sleep-well qualities: