Useful Resources on Long-term Investment

Industry primers, investing lessons, case studies

Hi SWIs,

I learn a bunch from fellow investors on Substack, X (formerly Twitter), and Seeking Alpha - so when I come across useful resources, I’ll link them here to share with others.

Industry primers

Cyber security - Beginner’s guide, CISO insights, SASE, MSFT

Moats

Charlie Munger often spent most of his time discussing the qualitative aspect of a business’s universal appeal, economies of scale, and other moats rather than the numbers everyone could see.

Distribution - “Superior sales and distribution by itself can create a monopoly, even with no product differentiation.”- Peter Theil - by The Nomad Investor

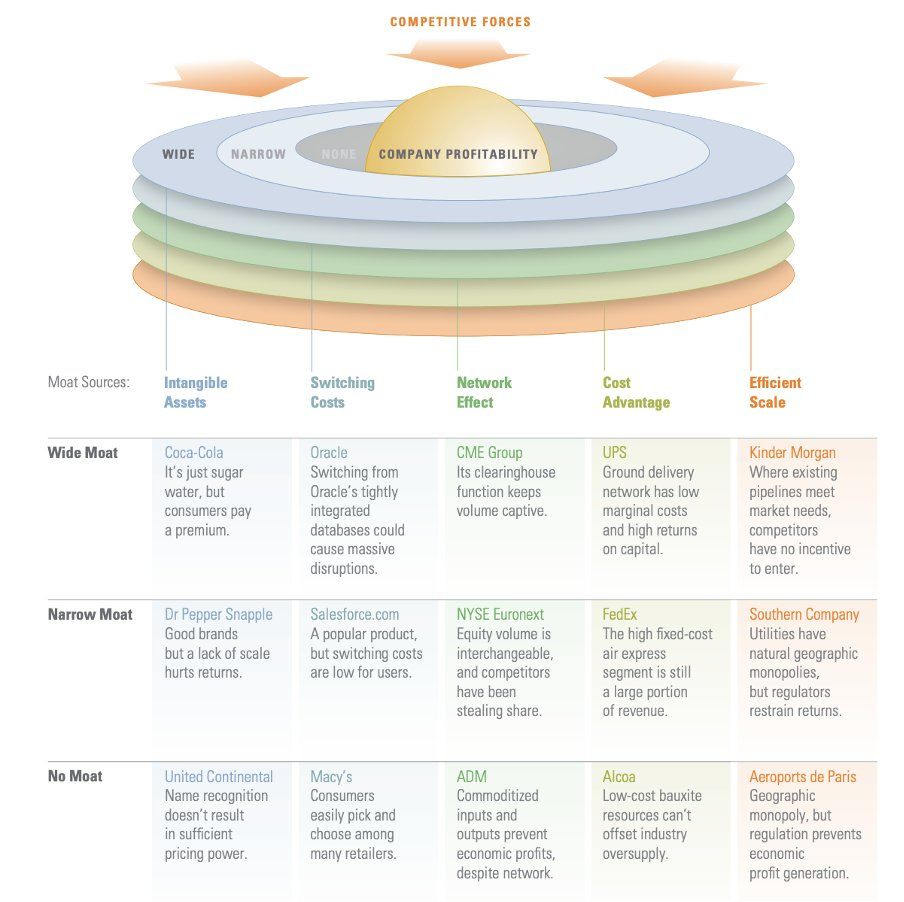

Moats, according to Morning Star

Valuation

Lessons from Professor Aswath Damodaran

1. Valuation is simple. We choose to make it complex.

2. Valuation is more about the story than about the numbers.

3. Valuations go bad because of biases, uncertainty, and complexity.

Lessons from Joel Greenblatt

Sleep Well Investing Pillars

At the core, the Sleep Well Investments process/checklist is adapted from

Anti-fragility concept borrowed from Nassim Taleb,

Irreplaceability from Anthony Deden,

Mundane businesses from Matthew McLennan,

Clear thinking from Chris Mayer

Equity compounders from Morgan Stanley

The above are interviews. You can also find more resources on their websites, biographies, and books. I’ll link them here once I get a chance.

Lindy effect from Nassim Taleb - demonstrated by Toby Ord

the longer something has been in business, the longer it will remain in business […] even when the object itself is not becoming more robust over time.

Fewer losers, more winners from Howard Marks's risk control is the number one rule at OakTree. Howard often asks analysts to questions about their analysis:

How much money can I make if things go well?

What will happen if events don’t go as planned?

How much could I lose if things get bad?

And how bad would things have to get?

Howard made a lovely comparison of investing to tennis. In most amateur tennis games and even professional tennis, the play style that minimizes errors (instead of going for winners - risker shots) often wins Grand Slams (the biggest prize in tennis). Risk control wins.

Study the Downside

X (formerly Twitter) handles who help give out bear cases - in no particular order:

White Diamond @WhiteResearch

NINGI Research @NingiResearch

Guasty Winds @guastywinds

Friendly Bear @FriendlyBearSA

Grizzly research @ResearchGrizzly

The Bear Cave @BearCaveEmail @StockJabber

Muddy Waters @muddywatersre

Safkhet Capital @SafkhetCapital

Hindenburg Research @HindenburgRes

Spruce Point @sprucepointcap

Viceroy @viceroyresearch

Kerrisdale Capital @KerrisdaleCap

Iceberg Research @IcebergResear

Culper Research @CulperResearch

TheUndefinedMystic @pennycheck

Quintessential Capital Management @QCMFunds

Others

Playing the long game - find ROIC machines by Ensemble Capital.

Why does competitive advantage die? - Morgan Housel >40% of all public companies lose all value.

How Long Does A Bear Market Last? - Ben Carlon (A Wealth Of Common Sense), the history of S&P 500 bear markets since 1950.

The Lindy effect from Toby Ord, the longer something has been in business, the longer it will remain in business. "it is possible to have a Lindy effect even when the object itself is not becoming more robust over time."

Growth is tough! - McKinsey study - Only 13% of the company can grow revenue by 10%+ CAGR over 10 years preceding COVID (23% for inorganic growth and 6% organic)

Why is hard to predict the future - A piece written by an officer in the White House, cced to George W Bush before he planned the US defense strategies.

I’ll add more resources as I go, so do share with your friends, subscribe & check back :)