The Trade Desk - The Winner Of Google's Cookieless World

The largest DSP platform and future of digital advertising

Google is removing third-party cookies in 2022, and it won’t track user-level data in any way.

Third-party cookies have been the lifeblood of the internet because they facilitate free content.

We look at why Google removes them and what a cookieless world will look like.

The Trade Desk has Unified ID 2.0, but Google is also working on an alternative. Why would The Trade Desk win?

The Trade Desk positions itself as the leader of the open internet, in contrast to the walled gardens, and Unified 2.0 could fortify this position.

Introduction

On March 3 of this year, two weeks ago, at the moment of writing, Google (GOOG) (GOOGL) announced that third-party cookies will be phased out from the Chrome browser in 2022. That didn’t come as a big surprise, as there had been talks about this for a while. But many were surprised that Google wouldn’t be building an alternative ID. In this article, we will look at the implications of what Google does and the effects it will have on The Trade Desk (TTD), the biggest independent DSP (demand-side platform).

Destroying the open internet?

At first glance, removing third-party cookies looks like destroying the open internet's economic foundation, which relies heavily on advertising revenue. Advertisers who depend on third-party cookies to produce targeted ads would be the biggest losers; then the domino piece would fall on content publishers and, ultimately, on consumers. So, is Google destroying the open and free internet?

If you look closer, abolishing third-party cookies represents an opportunity for the open internet to create a new and better alternative for third-party cookies. Whatever will replace these cookies will have to be able to educate consumers about the quid pro quo concept of the internet: relevant ads for free content while respecting consumers' privacy.

Following Google’s announcement, Jeff Green, the founder and CEO of the Trade Desk, responded assertively in a blog post:

Not much has changed. But what has changed, will ultimately prove positive.

This statement is reassuring to The Trade Desk’s investors, but there is much more to it. Third-party cookies have been around for almost 30 years and have remained the most viable means for the internet to operate. So, why is Google abandoning this standard practice? What will a cookieless world look like? Are there any alternatives to cookies? Are they better?

Understanding the reasoning behind Jeff Green’s statement and answers to the questions above could provide you with deeper insights into the ad tech space, helping you to gain conviction in The Trade Desk.

Taking a step back – what are cookies?

Before we look at the wider implications of what Google does, we first need to define our terms. Cookies are text files/programs that collect personal data, including device identifiers, IP addresses, and browsing activities. These information bits are used to provide a better user experience and to make targeted ads.

There are two types of cookies. First-party cookies are directly stored by the website (domain) you visit, while third-party cookies are created by domains outside of the website you visit, hence the name. Advertisers or partners of the website create these.

Google is removing third-party cookies from Chrome, and it won’t create a replacement:

[…] today, we’re making explicit that once third-party cookies are phased out, we will not build alternate identifiers to track individuals as they browse across the web, nor will we use them in our products.

(Source)

The impact of no alternatives for third-party cookies

Without a replacement of third-party cookies, the result could be detrimental to the open internet because third-party cookies have always been the fundament of the economic model for the internet. Third-party cookies have been an effective tool for advertisers to know about users. Without this knowledge, advertisers can’t produce effective ads. Ineffective ads don’t make money. Thus, publishers won’t be able to produce quality content, which ultimately bites consumers.

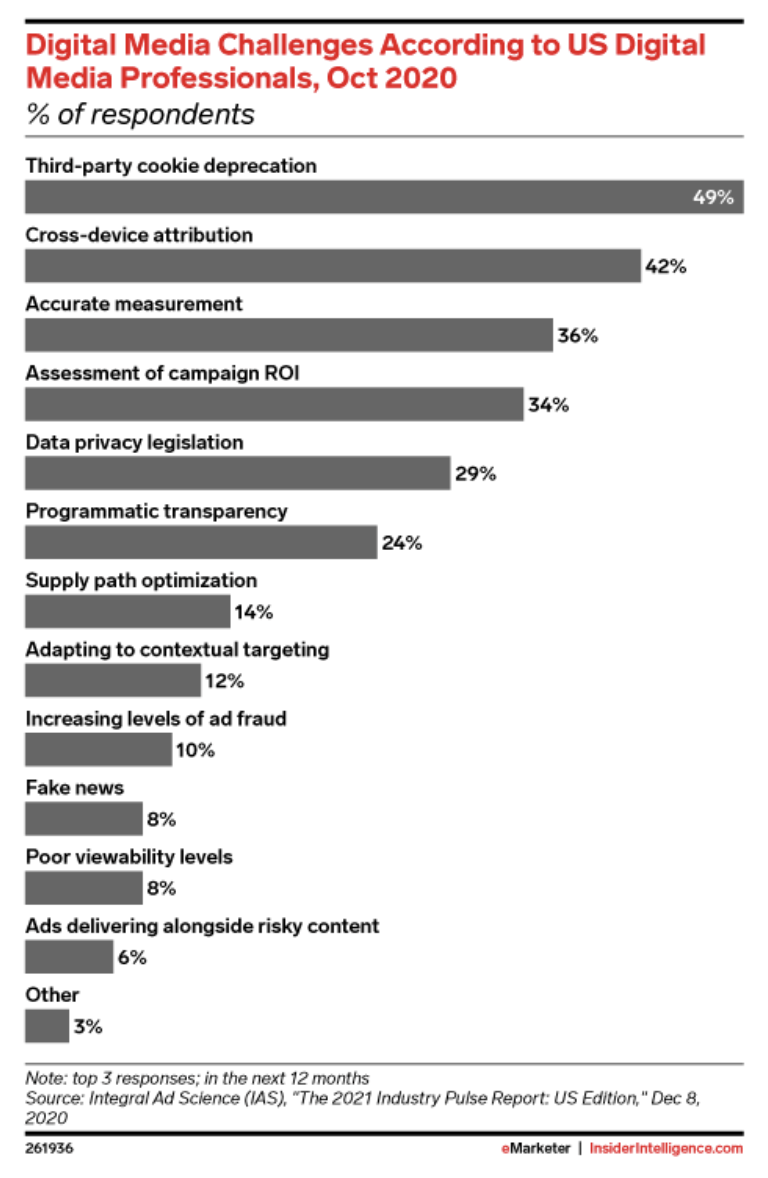

So, putting the pieces together like a domino chain and phasing out third-party cookies without any replacements is harmful to all. And it includes the Trade Desk. The chart below makes it look quite scary. Nearly half (49%) of US digital media professionals polled by Integral Ad Science in October 2020 cited third-party cookie deprecation as one of their top three challenges for the industry in the following 12 months.

Why are third-party cookies removed?

Now that we have a basic understanding of cookies and their importance to the internet let’s look at why Google is phasing them out. I see five reasons.

Firstly, cookies have existed since 1994 as an economical means to run the internet. Despite that, the people, organizations, and companies behind the websites failed to explain to users the reason for their existence. If you were like me, you would have found it too confusing and probably just clicked ‘accept’ and browsed. You probably felt slightly annoyed and scared clicking that button without understanding that the internet must show you relevant content.

Despite regulators’ efforts (GDPR, European ePrivacy Directive, and CCPA) to educate consumers about cookies and protect user privacy, they made no real progress.

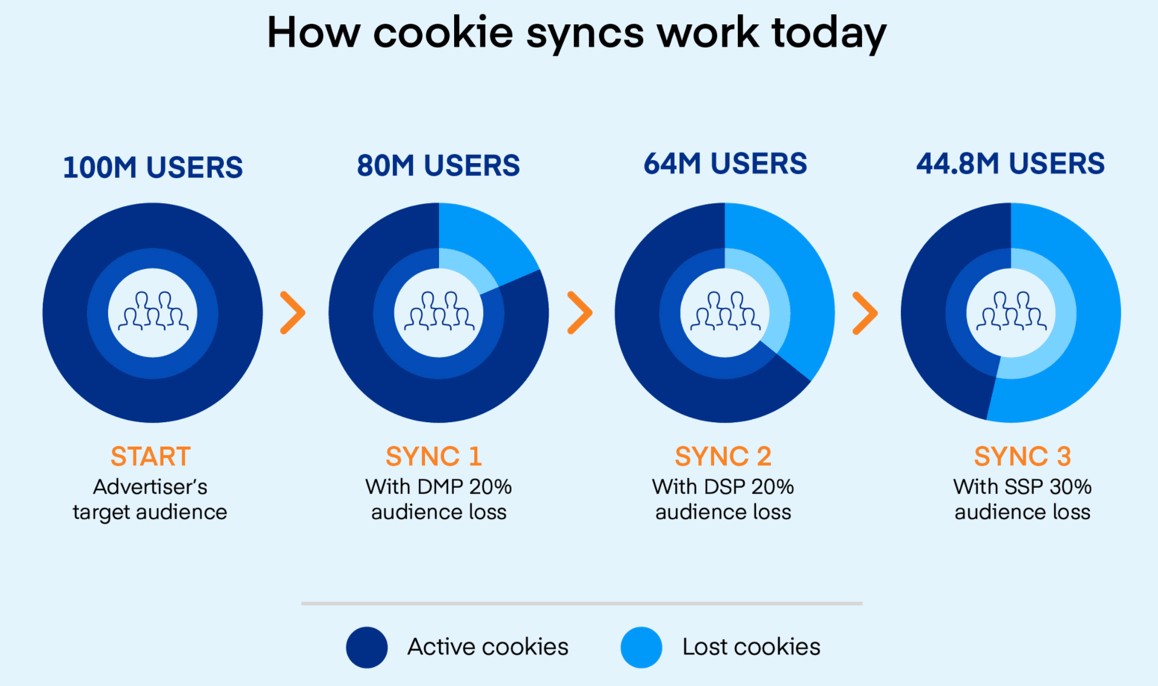

Third-party cookies are phased out because of their poor design and lack of scalability. The graphic below shows the ineffectiveness of third-party cookies. There are many versions of these cookies on the internet, and no standardized identifier exists. Consequently, loading a webpage is often a much slower process than expected. More important for advertisers is that costs rise and match rates fall. As a result, it means a lower ROI (return on investment) for advertisers.

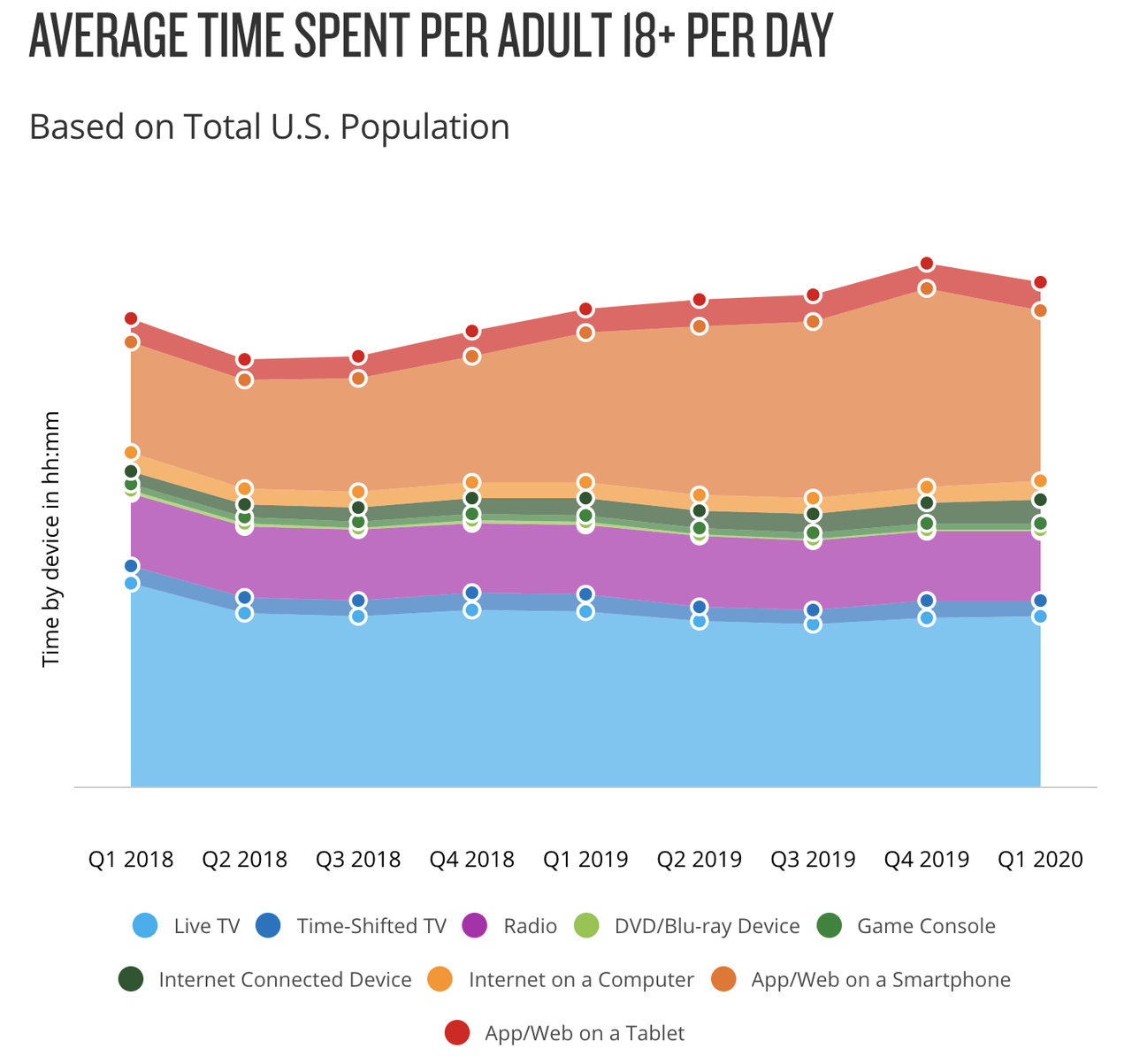

The third reason why third-party cookies will disappear is that cookies only work on browsers, which only represent 19% of digital ad spend as consumers now spend more time on videos and other mediums.

This can be demonstrated by the chart in Nielson's 2020 report. Consumers watch videos (roughly 6 hours a day) on mediums like apps, game consoles, and connected TV (‘CTV’) where third-party cookies don’t work. One thing to note is that this statistic was pre-pandemic; therefore, these numbers are likely to be much higher now.

The chart is a little hard to read, so you can start with Live TV at the bottom (in blue), going up all the way to App/Web on a Tablet (in red) at the top.

The diminishing returns of third parties on web browsers brings us to the fourth reason why Google will stop with third-party cookies. Cookies reduce the incentive for Google to spend more. Jeff Green compared Google’s decision to making a trade in a chess match.

Google is making a trade. With this announcement, Google is doubling down on its own properties, such as search and YouTube and adding bricks to the walls around those properties. The trade-off is that Google no longer values serving ads on the rest of the internet as much -- certainly not as much as they once did. (emphasis mine)

I would also like to add to Jeff Green’s comment on why Google was happy to make this trade; it’s because Google already has over 2 billion email addresses and the most potent user-level data from its search engine. It makes this chess move not at all surprising.

The fifth and final reason why Google is parting ways with third-party cookies is regulatory pressure. You might remember the Cambridge Analytica scandal at Facebook, where the personal information of 87 million users was collected without consent and misused. Facebook was fined, and regulators have since followed every company move.

Since the Facebook Cambridge Analytica scandal, governments worldwide have become very critical of big tech collecting all sorts of private data without the explicit and clear consent of the consumer. Google is facing the same pressure. It holds billions of users’ personal data.

Google’s majority share of the browser internet means that it will always be the first to be blamed for privacy on the internet. Getting rid of third-party cookies is one way for Google to release itself from some of the mounting political pressure.

To sum up, the reasons that third-party cookies are going away are

the failure to explain to consumers why they exist

the inability to scale with third-party cookies

the falling relevance as consumers spend more time outside of browsers

Google’s choice is to focus on its properties.

the increasing regulatory pressure on Google to protect users' privacy.

In the next section, we will look at why Google’s decision opens up a significant opportunity for the open internet and, importantly, why the Trade Desk is suitably positioned to be the biggest winner.

The Trade Desk’s solution

Jeff Green is a veteran and a true visionary in the Adtech space. He co-founded AdECN in 2003, the first demand-side advertising exchange platform that Microsoft acquired in 2007. After two years at Microsoft, Green left to start The Trade Desk with his Microsoft co-worker Dave Pickles, who is still the CTO of The Trade Desk today.

With this background, you shouldn’t be surprised to know that Jeff Green foresaw what was coming and had already been working on replacing the third-party cookies in 2018, before Google had made its intention known to the public in Aug 2019, and also before Safari (AAPL) and Firefox browsers announced their decision to remove third-party cookies entirely in 2019.

Jeff Green’s first attempt to create a solution was Unified ID 1.0.

At this point, he saw it was an opportunity to reinvent third-party cookies. And the key was to make it universal. As a result, Unified ID 1.0 was born as a proof of concept of an open-source universal ID that would work across devices and browsers while maintaining the quid pro quo of the internet, targeted ads for free content.

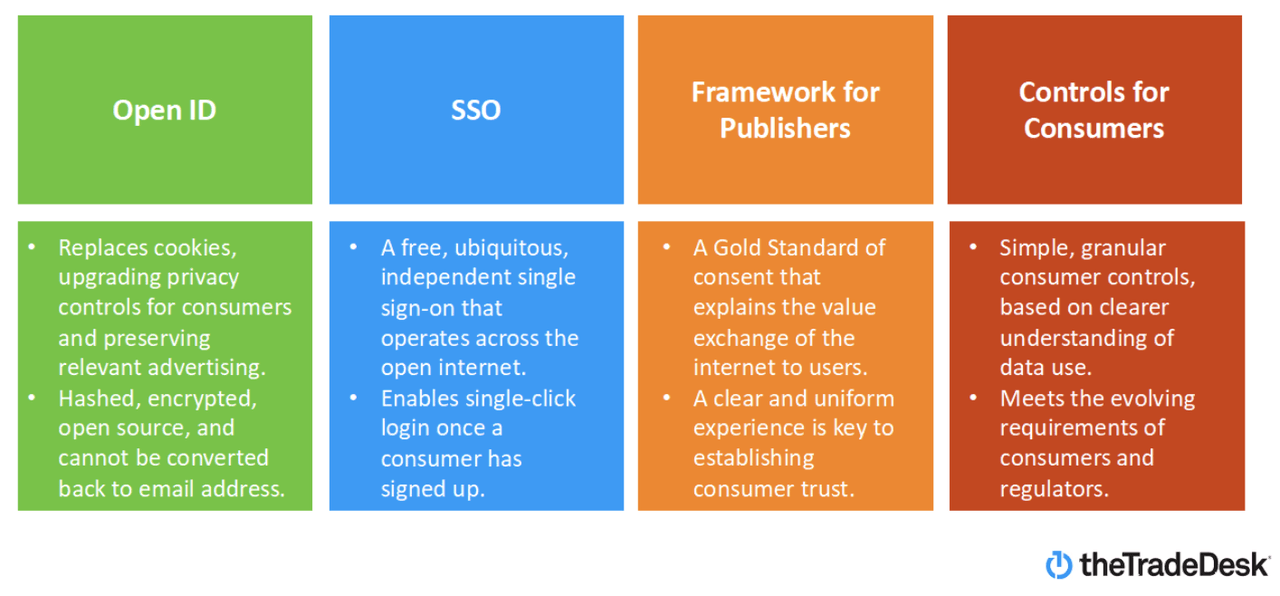

With more conversations, The Trade Desk developed an update, Unified ID 2.0. Now, the second version had more details.

First, it would use consumers’ anonymized email addresses gathered from a user logging into a website or app (mobile or connected TV).

Secondly, there were clear guidelines and reasons why it would be an upgrade to the current third-party cookies and that it has the potential to be the new common currency of the open internet. Unified 2.0 is:

-open source: ID framework is free and available for all, with full transparency

-interoperability: can be used across devices and browsers

-independently regulated: by a non-biased governing body

-scalable: lighter designed than existing third-party cookies

-more secure: the ID is encrypted and regenerates itself

-easily deployable: with one click through publishers’ and advertiser’s platforms

Jeff Green explains how these properties benefit consumers.

[…] The consumer's information is not identifiable. The consumer controls how their data is shared. And the consumer gets a simple, clear explanation of the value exchange of relevant advertising in return for free content.

Jeff Green is confident that Unified ID 2.0 is the best solution for the open Internet:

[…] Unified ID 2.0 has the best opportunity to become a new common currency of the open internet. It’s already beginning. It is a common currency that pays off the value exchange of the internet in a way that benefits publishers, advertisers and consumers. It is also one that cannot be controlled by any one company, including Apple or Google. That's great for the open internet.

I want to elaborate more on Jeff Green’s statement above because I think it sets Unified ID 2.0 apart from third-party cookies and fuels the motivation for all parties to adopt the solution when third-party cookies phase out.

He describes Unified ID 2.0 as a new common currency of the open internet and the best solution because everyone understands what it is and that it was built with everyone’s interests in mind. So, consumers know clearly why they use it, and advertisers and publishers get all the insights from their ads and inventory information to measure performance. Finally, the currency will be regulated by an unbiased and independent body.

Jeff Green contrasts this implicitly with Google by using the term 'open internet, which is the complete opposite of the walled-garden environment where only the owner - Google - has full visibility. Jeff Green explained this in the Q4 2019 conference call with his powerful tidbit: "They get to grade their homework." Here's the full context:

[...] the market has been testing the virtue of the walled garden strategy. To be clear, the term walled garden describes platforms who do not provide or enable measurement of performance of their advertising outside of their own four walls. You can only access their inventory through them and only review results as measured by them. They get to grade their own homework.

If you are interested in learning deeply about the future of the open internet and how crucial it is to level the playing field for all participants, you can watch the Identity 2020 webinar. Industry leaders also deep dive into all the properties of the Unified ID 2.0 mentioned previously. I show you the most essential webinar screenshot to get you started.

Risks

So, Unified ID 2.0 looks compelling, and if implemented successfully, it will improve the open internet and, in return, should put The Trade Desk as an undisputed leader in the field. There is a lot to win. But as always in investing, there are risks, too.

The first risk is that Unified ID 2.0 needs wide and quick adoption - the deadline isn’t far. As identification and authentication start with the publisher’s adoption, digging through the list of partnerships and collaborators, I don’t see many publisher names.

Granted, The Trade Desk has some big names, such as The Washington Post (and their Zeus technology platform powers over 100 other media publishers), MediaVine, and FuboTV on board, but I couldn’t find other big publishers like the News Corp, The New York Times, or the Daily Mail anywhere on The Trade Desk yet.

The power of Unified ID 2.0 lies in adopting the ad tech ecosystem. Big players such as Index Exchange, Magnite, PubMatic, Tremor, OpenX, SpotX, Criteo, and Neustar have adopted the standard. This page also provides other names that have already been collaborating since Unified ID 1.0.

Recently, Nielsen and LiveRamp signed up for Unified 2.0 too. These two are big wins as they provide the needed technical infrastructure and the gold standard in media measurement to enable Unified ID 2.0 to function at scale while staying true to its open-source roots.

The second risk is there are other cookieless solutions. Google itself is working on a replacement called Federated Learning of Cohorts (FLoC) technology — part of its Privacy Sandbox initiative. It claims to drive at least 95% of the conversions marketers currently see with cookies. But the claim has been met with some skepticism. The biggest criticism, in my opinion, is that data collected by FLoC will be processed in Chrome. This means Google will still hold the key to all of the data. The open internet wants transparency and a solution that is regulated by an independent body; as a result, FLoC doesn’t look as compelling and likely won’t get a welcoming adoption like Unified ID 2.0.

Overall, from my reading, the competing solutions have limitations and are not as good as Unified ID 2.0. But this is also where I appreciate your views and comments. No one knows how it will turn out 100% yet.

Despite these two risks, I think the industry understands that the biggest downfall is not adopting anything at all. So, it’s a collective problem and should incentivize everyone to work together and adopt the best available solution. Unified ID 2.0 has a great chance since it’s at the top of the list.-

Conclusion

Google’s phasing out of third-party cookies has created unnecessary confusion and fears. Deeper dives show that it was nothing surprising. Third-party cookies have failed to evolve with the internet, confusing consumers and reducing importance for advertisers. Google saw this coming, thus it decided to part way with third-party cookies and is reallocating its resources to build higher fences around its walled-garden.

However, the advent of a cookieless internet would be detrimental to all. Thus, The Trade Desk took the opportunity to take the lead and invented Unified ID 2.0. So far, it looks head and shoulders better than all other alternatives and has already gained considerable support from the industry.

Unified ID 2.0 is highly likely to be the new currency of the open internet, and The Trade Desk stands to gain the most from this situation. Investors of the Trade Desk have nothing to worry about. The future is bright.

Q2'21 results: Beat-Beat-Raise: 13% beat on revenue, 4% on EBITDA and 3% on guidance.

• Revenue grew +101% to $280M (vs. +37% Y/Y in Q1) vs. a guidance of +87%.

• Operating margin was 22% (+33pp Y/Y).

• Adjusted EBITDA margin was 42% (+32pp Y/Y).

• Cash flow from operations in H1 FY21 was $85M (vs. $149M in H1 FY20).

• Cash and short-term investments on the balance sheet was $0.7B.

• Customer retention over 95% for the past 7 years.

• Guidance for Q3 FY21 is +31% Y/Y, and an adjusted EBITDA margin of about 35%.

What I like most is the consistent beat and raise performance each quarter. TTD has beaten the expectations in all 20 quarters on both revenue and EPS. Exceptional execution. So if any investor's bear case is due to the 'lofty valuation' then they are into a big wake-up call.

Imagine that TTD keeps beating estimates by 7% each year (average of the last 20Qs) and raise guidance by another 5%...that 12% additional growth each year. So we can start with 2021 revenue at $1B, with the projected growth of 20% for the next 10 years, thats $6B in 2031, but with the additional 7% growth compounded over this period, it could be over $10B. TTD wouldn't be so expensive at just 5x EV/S and possibly 15xPE (for a SaaS-like business)

Highlights:

+The company officially launched its new trading platform Solimar.

+On CTV, the biggest driver of growth for TTD:

The big driver for the exceptional growth was CTV. Jeff Green, The Trade Desk's founder and CEO on the conference call:

"[...] Even as our overall business doubled over the second quarter last year, our CTV business significantly outpaced that growth"

[...] But now we're starting to see our CTV strategy scale more broadly around the world. For example, our CTV revenue in Europe was up more than tenfold in the second quarter.

[...] The Trade Desk has reached more households via CTV in the U.S. today than are reachable through linear TV.

[...] When compared to parallel linear TV ad campaigns, CTV delivered a 51% incremental reach and a 4x improvement when analyzing cost per household reach.

NBC estimates that the split of consumers for its digital properties and linear TV will be 50/50 at the end of 2022, from 70%/30% linear/digital today.

Founder-CEO Jeff Green explained:

“Revenue more than doubled year-over-year to $280 million in the second quarter. Our growth speaks to The Trade Desk’s position as the default DSP for the open internet. Nowhere is this more apparent than in Connected TV, as more premium streaming inventory becomes available to meet growing marketer demand for data-driven TV advertising. From a customer perspective, more of the world’s leading brands, and their agencies, joined our platform, or expanded their relationship with us. This, and our robust international growth in the second quarter, gives us tremendous optimism moving forward. We also recently launched our new trading platform, Solimar, the biggest product launch in our company’s history. Solimar allows advertisers to take advantage of many opportunities in front of them today, with features such as simple and secure onboarding of first-party data; the industry’s most advanced cross-channel measurement marketplace; and advanced, multi-level goal-setting which allows our KOA AI technology to optimize campaigns for the trader.