SWI Pick #6 - Thor Industries - RV Monopoly At The Right Price

Resilient business with 40%+ market share and integrating vertically

Hi SWI,

I am working on my next deep dive, a dominant player with a 70%+ market share in the medical industry with no worthy rivals, which should be released in a few weeks. However, in the interim, I want to bring your attention to Thor Industries, a company that also fits the Sleep Well Investments mold. I have not pulled the trigger but could do in the coming months. I’ll keep you posted.

Thor scores well in my Sleep Well Investments checklist (12/20 points) and has many qualities that I look for

+A dominant market position with defensible moats

+Incentivized management with a strong track record of capital allocation

+Survived past recessions and industry turbulences

+Ample opportunity to reinvest at high ROIC

+Trading below fair value (a bonus)

THOR Industries

THOR (NYSE: THO) was founded in 1980 and is the world's largest manufacturer of recreational vehicles (“RVs”), with a steady 40%+ market share in North America and 20% in Europe.

The Company manufactures a wide variety of RVs. It sells those vehicles and related parts and accessories primarily to 3500+ independent, non-franchise dealers throughout North America (2400 dealerships) and Europe (1100 dealerships, only two are company-owned, 45% sell EHG brands exclusively).

They produce RVs by assembling key components like chassis, windows, and frames from a limited number of suppliers and thousands of other parts from numerous suppliers. They have 400+ facilities and 32,000 employees worldwide.

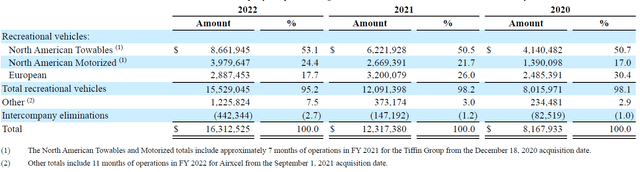

THOR has three segments: NA Towables, NA Motorized, and European.

Recent financials - Q3’23

THOR’s recent Q3’23 results show a continued challenging period for the leisure industry.

Revenue was $2.93 billion, a decrease of 37.1% YoY and 15.3% over the same quarter of the fiscal year 2021. The revenue decline continues from Q2’23 and Q1’23 declines of 39% and 22%, respectively, but is slowing down slightly.

The decline is mirrored by the steep fall of 55% in backlog orders in the largest segment, NA Towables, representing over 50% of the business.

However, positives are seen in the newly acquired segment - European, where sales increased by 20% and gross margin was 17.5%, higher than the 14% compared to the same quarter in fiscal 2022.

Overall, management sees a challenging FY2023. Hence, they have lowered the sales guidance for the year to $10.75B at the midpoint (previously $11B). However, they see a slight improvement in the gross profit margin range of 13.8% to 14.2% (previously 13.4% to 14.2%) as they continue to stick with the price hikes. Finally, earnings per share will be in the range of $5.80 to $6.50 (previously $5.50 to $6.50), representing a slight improvement.

I am more interested in looking at the business with a long-term view, and I believe THOR has many positives despite a challenging year.