Wisetech (WTC)'s Step-change Acquisition

56th Acquisition, the biggest yet. Product, Penetration and Profitability accretive?

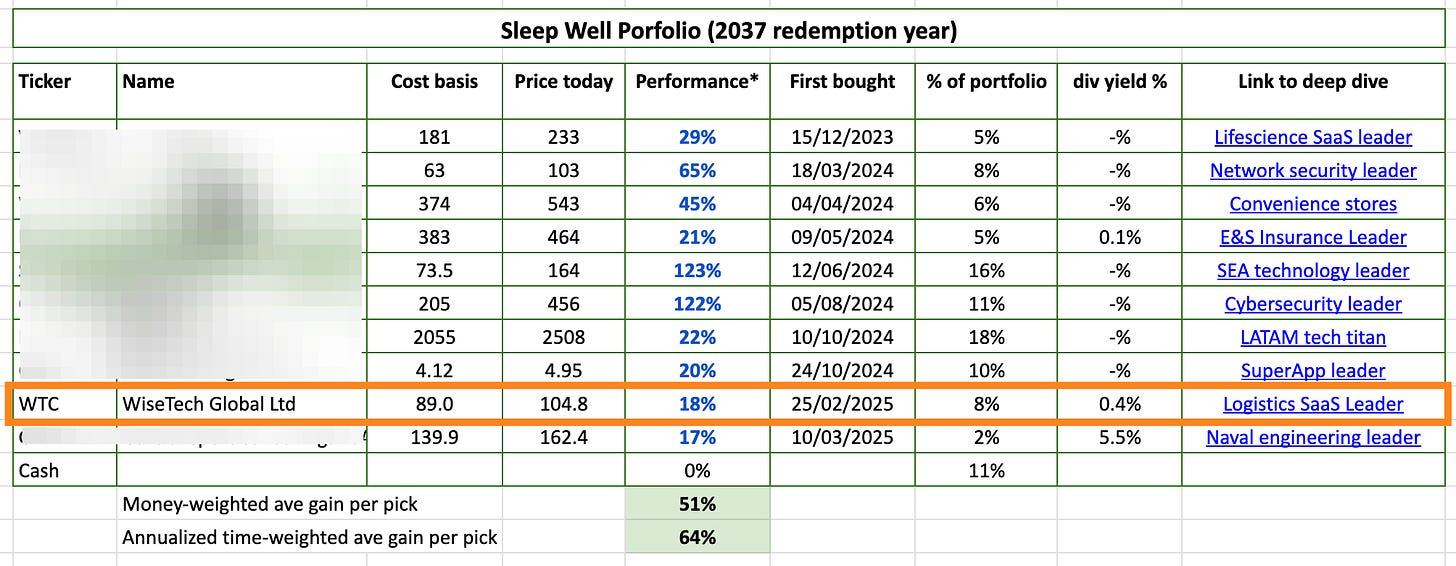

RE: Wisetech, a position acquired in February 2025, and added significantly during the tariff sell-off.

Read my deep dive, buy alert 2, buy alert 1, FY24 update, H1 FY25 update, and CEO shake-up.

Owning high-quality businesses doesn’t eliminate black swan events such as CEO personal mishaps. But there are also upside surprises that come with exceptional execution and visionary deal-making.

Wisetech CEO, Richard White, news of his scandal drove the stock down by 30% six months ago. Today, he has made amends, in my opinion, announcing the acquisition of E2open in a $2.1bn deal (fully debt-funded).

Before examining the deal, I’ll briefly go through Wisetech and E2open to give some context.

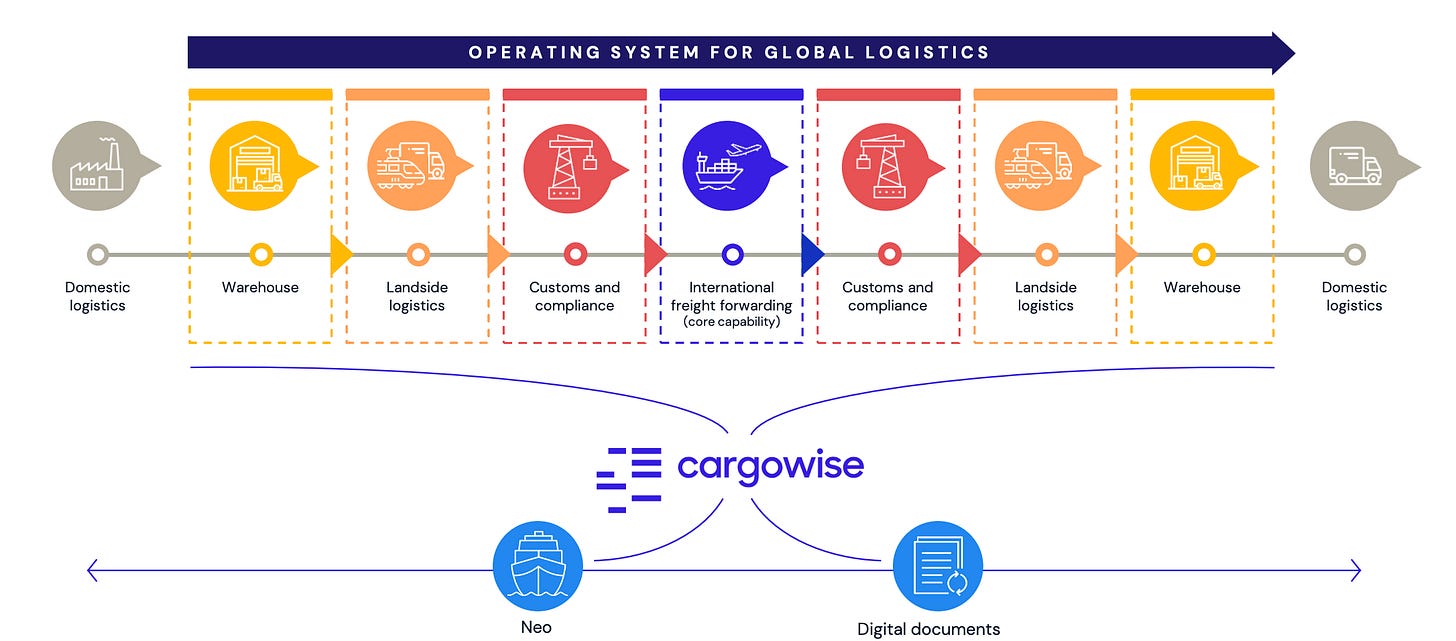

Wisetech is (or is building) the global trade and logistics operating system with 25/25 of the largest freight forwarders, and 47/50 3PL (third party logistics) as customers. No player captures a broad spectrum of logistics like Wisetech, from international customs warehousing, cross-border fulfillment, landside logistics, cross-border freight, and customs & compliance. Its strength lies in the most complex trade stage: customs & compliance, which reduces the cost, fines, and complexity of international freight forwarding.

E2open, founded in 2000, is a supply chain software platform that connects over 500,000 manufacturing, logistics, channel, and distribution partners as one multi-enterprise network and tracks over 18 billion transactions annually.

Rationale - 3P: product, penetration, profitability

Strategically, the deal aligns with WiseTech’s 3P strategy, focused on product, penetration, and profitability.