Wisetech's Unforced Errors, What Now?

One of the kind SaaS down 40% YTD. >1% attrition despite decade of price increases, but founder-exec chair's personal troubles pushes stock to oversold area. I review the business quality.

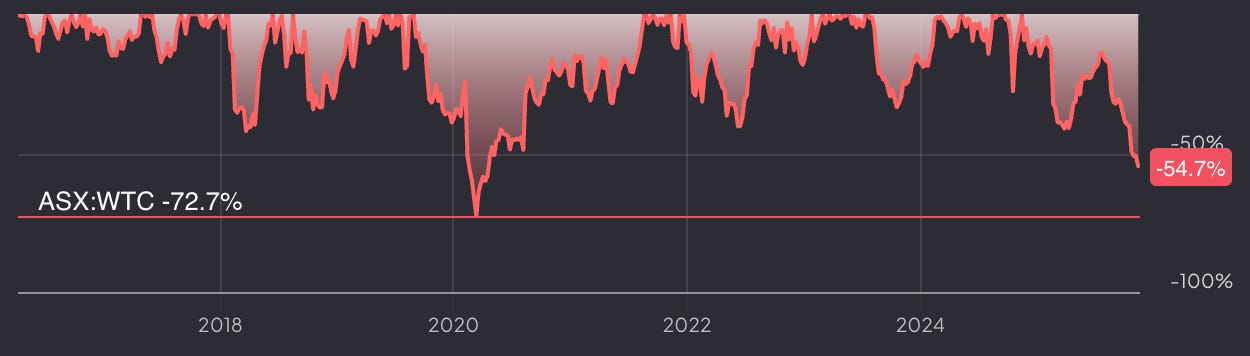

Wisetech, one of the best SaaS companies I get to own, saw shares decline 40% YTD from AUD 100s to AUD 60s, and 55% from AUD 134 peak. Was it self-inflicted?

Absolutely—founder Richard White’s power grabs, sex scandal, and share-trading probes, in my view, not only caused the 2nd most significant stock decline after the 2020 crash but, fundamentally, (i) caused significant key product delays and (ii) eroded shareholder trust.

Today, the market cap stands at AUD $21B ($13.6B), and the stock hovers in the AUD $60s.

You could say the moderating top-line growth since Q4’2024 caused the fall.

So, we’ll dig in to see why and if this situation is permanent. And if the multiple contraction to P/FCF of 41x? And 37x Proforma EV/FCF (with E2Open) attractive?

We are going to ask the same questions we asked when we deep dived in the company in January 2024, including:

Who are the customers? How do customers use CargoWise? Why do they choose it over alternatives?

Have the moats eroded or widened?

How does CargoWise + E2Open extend product and market penetration?

What free cash flow growth can we expect from here vs. what the market is expecting?

What are direct peers and top businesses trading at?

To understand the context, read my deep dive, buy alert 2, buy alert 1, FY24 update, H1 FY25 update, CEO shake-up, and E2Open acquisition.