Deck the Halls with Investment Ideas

A Christmas Collaboration from Seven Investors

As a special Christmas season release, a group of excellent investment researchers and I decided to work together for a collaboration - a series of one-pagers diving into new or previously covered companies for our collective subscribers. The investors featured in this article are:

From 0 to 1 in the Stock Market

Hopefully this joint article will provide some new investment ideas and fresh perspectives. If you’re not already, be sure to follow all the authors to keep up with their investment research! It’s a very special list of investors that we’ve gathered together for you all, and each of them produces very high quality research on their own as well - every one of them is worth the follow for in-depth investment research across a variety of investment niches.

And now, let’s get into this special collaboration edition.

Zoetis - One Pager

By From 0 to 1 in the Stock Market

Zoetis is the global leader in the animal health industry. It discovers, develops, manufactures and commercializes medicines, vaccines, diagnostic products and services. Zoetis counts with over 300 product lines, with 15 of them generating over 100M in annual sales. The latter are called blockbusters, and the company holds a third of the industry’s total.

It is important to note that the animal health industry has spectacular fundamentals for incubating long-term compounders. There is no company that competes only with generics, competitors take a rational approach to pricing and most products have an addressable market of 1M dollars or less and require to go through an FDA approval, disincentivizing competition. Furthermore, it has huge upfront and associated costs. Manufacturing plants cost hundreds of millions of dollars, it is very resource-intensive and a very large sales force is required. All of this translates into each vertical being a virtual monopoly and helps products’ have a long lifecycle. As a reference, Zoetis’ portfolio of products has an average of around 30 years.

Tied with the company’s thesis, the animal health industry is extremely resilient. The reason for the latter is largely because of the human-pet bond, alongside its past decades’ strengthening. More than 90 percent of pet owners view their pets as members of their families. Additionally, studies suggest they are willing to keep spending on their pets’ health even after a 20% income cut.

Finally, management has shown great ability to engage in M&A operations. They have successfully entered the diagnostics space, which promises double digit growth, with a large acquisition in 2018. At the same time, several acquisitions were made in the fish segment, also allowing Zoetis to enter a very promising area. Lastly, my hypothesis is that an 85M dollar acquisition the team did in 2017 drastically helped Zoetis release two products in 2021-22 with an estimated addressable market of 1 billion.

In conclusion, Zoetis is a company immersed in a very resilient industry that’s set for decent long-term growth and holds a leading position. On this front, I would like to highlight that, during their 2023 Investor Day, management guided for above-industry growth in the next five years, with improvements in the bottom line. The company’s broad portfolio of products provides proper diversification and there are some of them, such as Librela and Solensia, which make up for these two products above mentioned, that should allow the business to keep growing in the mid-term.

Find Giuliano on Twitter/X here.

Follow From 0 to 1 in the Stock Market here:

Diageo

By StockOpine

Profile

Diageo plc produces, markets, and sells alcoholic and non-alcoholic beverages. With a robust portfolio of over 200 brands, Diageo operates in 180+ countries, solidifying its status as one of the world's largest manufacturers of spirits and beer. Diageo diverse brand lineup, includes the world's bestselling Scotch whiskey, Johnnie Walker, the world’s bestselling cream liqueur, Baileys, the world’s best-selling premium distilled vodka, Smirnoff and other iconic brands such Tanqueray gin and Guinness beer.

Overview and potential growth drivers

North America, its largest market, contributes 39.5% to total net sales, followed by Europe (20.9%), Asia Pacific (18.7%), Latin America and Caribbean (10.5%), and Africa (9.9%). Favorable trends in India, China, and Latin America position Diageo for growth, leveraging its strong presence in those markets. In India, Diageo owns, 5 of the 10 fastest growing brands, showcasing its robust presence. Meanwhile, in Latin America, where Scotch comprises only 4% of total beverage alcohol (compared to 14% internationally), Diageo holds an impressive ~70% market share.

Scotch and Tequila emerge as key growth drivers, constituting 25% and 12% of net sales for FY23, respectively. Tequila, with a remarkable 19% organic net sales growth in FY23 (79% in FY21, 55% in FY22), has seen Diageo's market share in US surge from 10.2% in FY19 to 22.4% by 1H FY23. Don Julio is the #1 selling tequila brand globally in 2022 while Casamigos (#4) is the fastest growing brand. In Scotch, Diageo is the largest international whisky manufacturer, with 25% market share. The broader premiumisation trend in categories like Scotch and Tequila is poised to be a key growth driver for the overall spirits category.

Industry

In a global beverage alcohol market valued at approximately $1 trillion, Diageo aims to increase its market share from 4.7% to a targeted 6% by 2030. Within TBA, Tequila is expected to deliver over 60% of incremental growth for core spirits over the next 5 years (IWSR). The company targets organic net sales and operating profit growth between 5 and 7%, capitalizing on favorable market demographics and the trend of premiumisation.

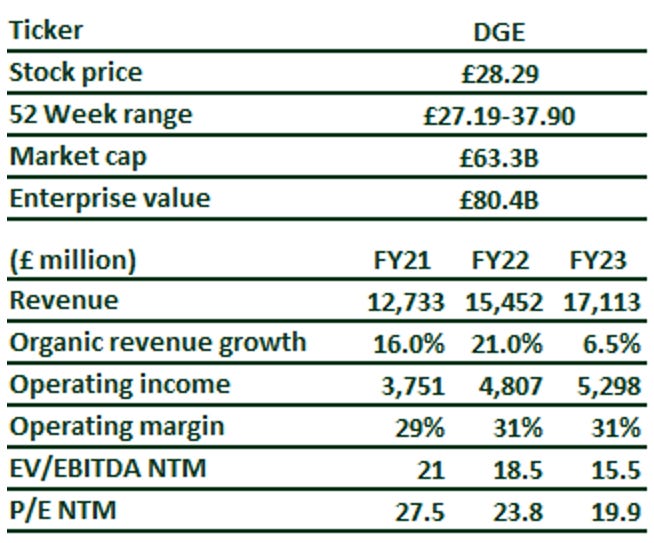

Financials and Valuation

As of FY23, Diageo reported revenues of £17.1B, representing a 4.2% CAGR from FY13 to FY23. Operating income stood at £5.3B, with a margin of 31%. Diageo has £1.6B in cash and cash equivalents compared to total debt and lease liabilities of £17.1B. Trading at a next twelve-month EV/EBITDA of 14.2x and NTM P/E of 17.9x, Diageo remains below its ten year average EV/EBITDA NTM multiple of 17.3x and its ten year average P/E NTM of 21.9x.

Strengths

Market Position: Diageo maintains best-in-class returns on capital within the industry, while it has a leading portfolio of iconic brands.

Global Scale: Operating in 180+ countries, Diageo benefits from an extensive distribution network, bulk purchasing power, and the ability to scale brands through strategic acquisitions.

Scotch whisky law protection – By law, Scotch whisky can only be made in Scotland. Diageo operates over 20% of the total whisky distilleries in the country thus it is well positioned and protected due to high barriers of entry.

Risks

Regulatory Challenges: Diageo faces risks associated with dynamic and stringent regulations, with changes potentially impacting production, distribution, and sales.

Health Conscious Consumers: Evolving consumer preferences towards reduced alcohol consumption pose challenges, even as premium offerings align with shifting trends.

Softening demand in Latin America and Caribbean observed in the first half of FY24 as a result of lower consumption and consumer down trading might be an indication that other regions could follow a similar trend as the adverse macroeconomic environment persists.

Find StockOpine on X/Twitter here.

Follow StockOpine on Substack here:

A Meta-morphic Year

BySecret Sauce - Company Write Ups

Let’s rewind to 13 months ago. In Q2 2022, user numbers and revenue growth had stagnated whilst costs were significantly up. Meta (Facebook) shares had dropped over 76%.

The narrative was one of a company burning cash in an attempt to create an unachievable metaverse, whilst the core services were ignored. When you subtracted cash, Meta traded at a single digit PE ratio.

Fast forward to December 2023 and the share price is up 258% from lows, Instagram Reels have subdued TikTok competition and Threads achieved 100 million users within the first 5 days of launch.

All of this has been achieved whilst CEO, Mark Zuckerberg, has gone about re-inventing his image to that of an MMA badass, a far cry from the pasty surfer the market previously lost confidence in.

Over the past 12 months Meta aggressively implemented cuts and layoffs;

Costs and expenses have been drastically reigned in, from $22,050B down (7)% to $20,398B in the most recent quarter.

Operating margin was 40%, up from 20% the previous year.

R&D spend down 6% YoY.

After layoffs, employees were down 7% from the first quarter to 71,400.

Revenue in the most recent quarter was $34.15 billion, growth of 23% year-over-year. This can be attributed to ad impressions that increased 31% YoY whilst the average price per ad decreased by 6%.

Core Services - Family of Apps

Meta’s core products, Facebook, Instagram, Messenger and WhatsApp are collectively referred to as the Family of Apps (FOA). As of the most recent earnings, users continued to grow;

Daily active people (DAP) – was 3.14 billion on average for September 2023, an increase of 7% year-over-year.

Monthly active people (MAP) – was 3.96 billion as of September 30, 2023, an increase of 7% YoY, the best result in six quarters.

Facebook daily active users (DAUs) – were 2.09 billion on average for September 2023, an increase of 5% year-over-year.

Lets be clear, Meta’s growth cannot go on indefinitely. The FOA services half of the global population. The apps are banned in China, so user acquisition will eventually stagnate.

Reels

What was originally viewed as a TikTok copycat now appears to be the growth factor behind user interaction. Reels views continue to drive incremental engagement. Plays exceed 200 billion per day across Facebook and Instagram over the previous quarter.

Reels annual revenue run-rate, across the FOA, now exceeds $10 billion, up from $3 billion and $1 billion in 2022 and 2021, respectively. Reels revenue has already surpassed TikTok’s 2022 generation of $9.9B.

Beyond Reels, AI is driving results through Meta Advantage, a monetisation tool to create automated ads. Meta has made significant progress with more than three quarters of advertisers now using Reels ads.

The billions of dollars the company has spent on AI infrastructure is paying-off across the ranking and recommendation systems by improving engagement and thus monetisation.

Threads

Threads launched on the 5th of July to record growth. The Twitter clone linked directly to Instagram and recorded 100 million new accounts in the first 5 days. During the company’s third-quarter earnings call, Zuckerberg said the app currently has “just under” 100 million monthly active users, and that thinks there’s a “good chance” the app could reach 1 billion users in the next couple of years.

Meta leveraged the Family of Apps to launch Threads, using the same playbook the company has employed with Facebook, Instagram, WhatsApp, Stories, Reels and more.

Usage has since compressed, but there are positives to take away. Threads was reportedly built by a team of of only 56, and proved considerably more more successful than was originally planned. Despite being a small project, Threads demonstrates the ability of Meta to leverage the exiting audience to launch new software, with relatively low investment. It’s not a foregone conclusion, but if Threads can achieve critical mass, it can act as the fifth app in the FOA to generate further revenue.

Looking Ahead

Meta is investing heavily in Reality Labs and AI. Losses for the segment are expected to increase, surpassing $40 billion in losses that will increase further in 2024. It can be argued that the company is investing in differential experiences for the future, but one of the most expensive cap-ex investments in history eventually needs to break even.

Meta still has opportunities to unlock value on existing platforms. WhatsApp has over 2 billion users and has remained largely unmonetized. $225m of revenue was attributed to the WhatsApp business platform in the most recent quarter.

On the immediate horizon Meta is investing in AI and mixed reality with the launch of Quest 3, Ray-Ban smart glasses, and AI studio. AI Studio platform enables users to create and interact with different AIs for support productivity or fun. Meta AI, is a new assistant that can be accessed across messaging services.

AI will be Meta’s largest investment area in 2024, both in engineering and compute resources. A true differentiator could be introduction of Llama 2, Meta’s large language model. Llama could be the AWS moment. Unlike the market leader, ChatGPT, Llama is open source. Llama 2 is available for free for research and commercial use and has surpassed 30 million downloads. Llama2 can be used to create AI chatbots, virtual assistants, and other applications that require natural language understanding and generation capabilities.

Although free for general users, Zuckerberg highlighted that that for the largest companies, Meta will charge.

“if you're someone like Microsoft or Amazon or Google and you're going to basically be reselling these services, that's something that we think we should get some portion of the revenue.”

The metaverse and Reality Labs will remain a long term ambition as long as cash burn allows, but Llama 2 could be the enterprise facing service that shows early promise for success.

Find Sonny on X/Twitter here.

Follow Secret Sauce Investing on Substack here:

Onfolio Holdings Inc. (NASDAQ:ONFO) - One Pager

By "From $100K to $1M" & More.

"It's either future US version of Constellation Software or a zero"

Overview

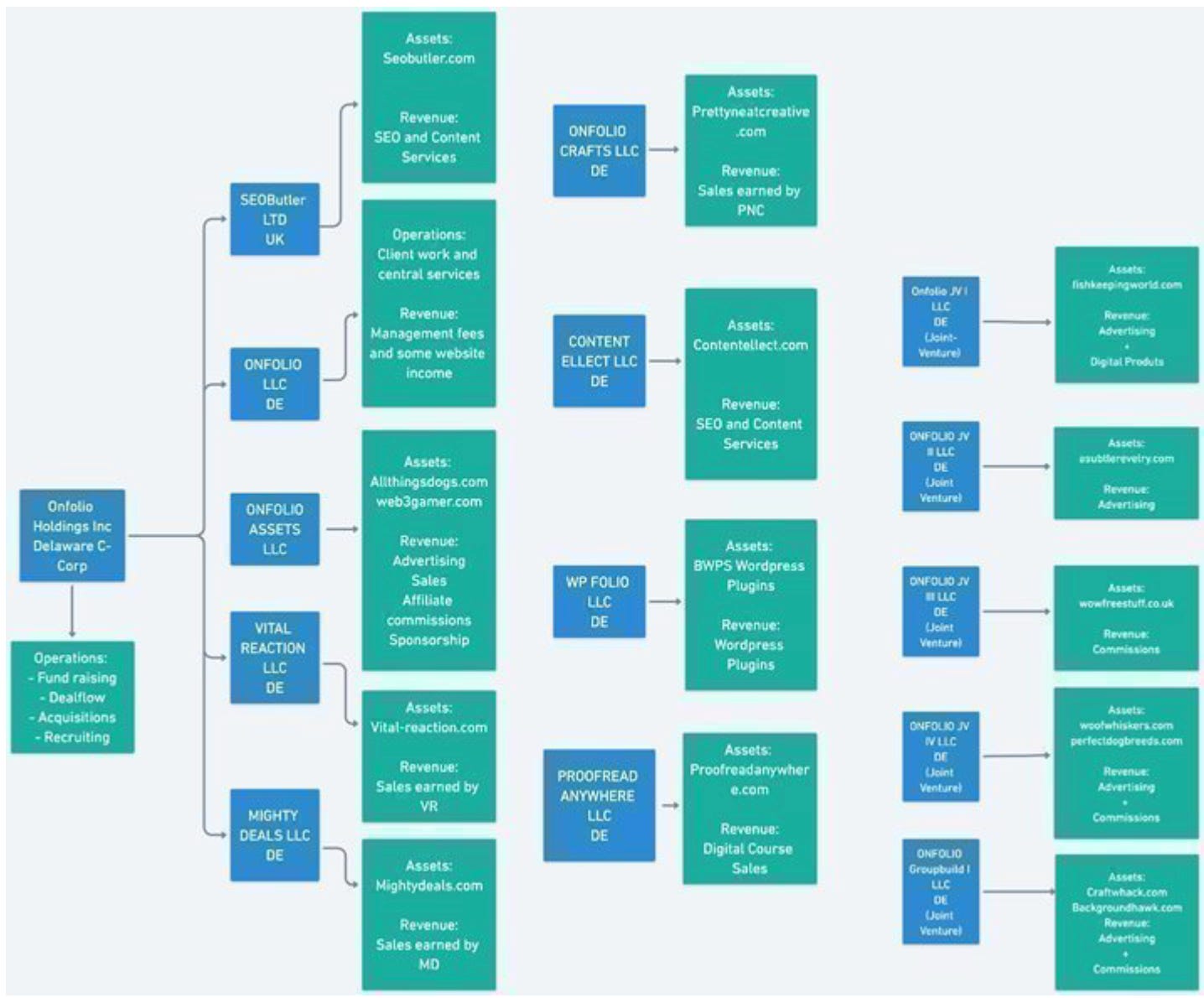

Onfolio Holdings Inc. (Onfolio, ONFO) ONFO 0.00%↑ was founded in 2019 by Dominic Wells and in 2022 completed its IPO and is listed on the NASDAQ. As of December 8th ONFO has Market Cap. of about $2.71M.

Onfolio acquires controlling interests in and manages a diversified portfolio of online businesses across a range of verticals, each with a niche content focus and brand identity. It is focused on website management, digital services, advertising and content placement on its websites, product sales, and digital product sales.

It buys businesses that are in sectors with long-term growth opportunities, have positive and stable cash flows, face minimal threats from competitors or emerging technology, and have strong management teams or can effectively be managed by the Onfolio team.

Company finds acquisition targets where the business potential is not yet maximized and adds increased value by leveraging its experience, skill-set, and the latest tools and technologies.

Management Team

Dom Wells is active on Social Media (LinkedIn, X, YouTube, etc.) to get a feel for what kind of CEO / person he is its worth checking out his LinkedIn posts and Onfolio’s YouTube channel where Mr Wells uploads videos on consistent basis on different topics, all somehow related to Onfolio.

Management owns large stake in the company:

● Dominic Wells - CEO / Founder - 22.81% or about 1.2m shares

● Esbe van Heerden - President - 4.93% or about 252.0k shares

● Yury Byalik - Director - 2.32% or about 118.8k shares

Onfolio’s Portfolio/Websites

Currently ONFO operates in the following business models: D2C eCommerce, B2B SEO and marketing services as well as B2B digital products. ONFO anticipates a combination of continuous expansion of these verticals and increasing their TAM.

ONFO’s strategy to grow their businesses involves the acquisition of websites that they expect to both complement existing verticals, existing websites, and allow them to add new verticals.

Being strong in digital marketing, company believes the key to growing online businesses is the leverage of audiences. They believe that attractive opportunities to make such acquisitions will continue to present themselves as a result of the abundance of selling founders with a limited skill-set or narrow focus.

There are opportunities to acquire “distressed” yet profitable online businesses. The opportunity is ONFO’s ability to find these online businesses, where there are leverage points and growth opportunities (Onfolio can “pull on”) that the current owners have not fully utilized.

Being public means having a few extra levers to pull for growth:

1. Issues Preferred shares

2. Issues additional common shares

3. Issues Debt

Out of the three mentioned above, ONFO has been using attractive Preferred shares to get new capital. Preferred Shares yield 12% annually and pay dividends quarterly.

Dom Wells has said multiple times that he prefers not issuing new common shares or debt.

Competition

Internet has a huge TAM but with that “TAM” comes a lot of already established competition like IAC ( IAC 0.00%↑ ) FuturePLC ( $FUTR ), and new public players like Tiny Ltd ( $TINY.V ) or the likes of Thrasio or Red Ventures just to name a few.

All the named companies (above) do about the same or similar thing but maybe in different niches or sometimes even in the same areas as Onfolio.

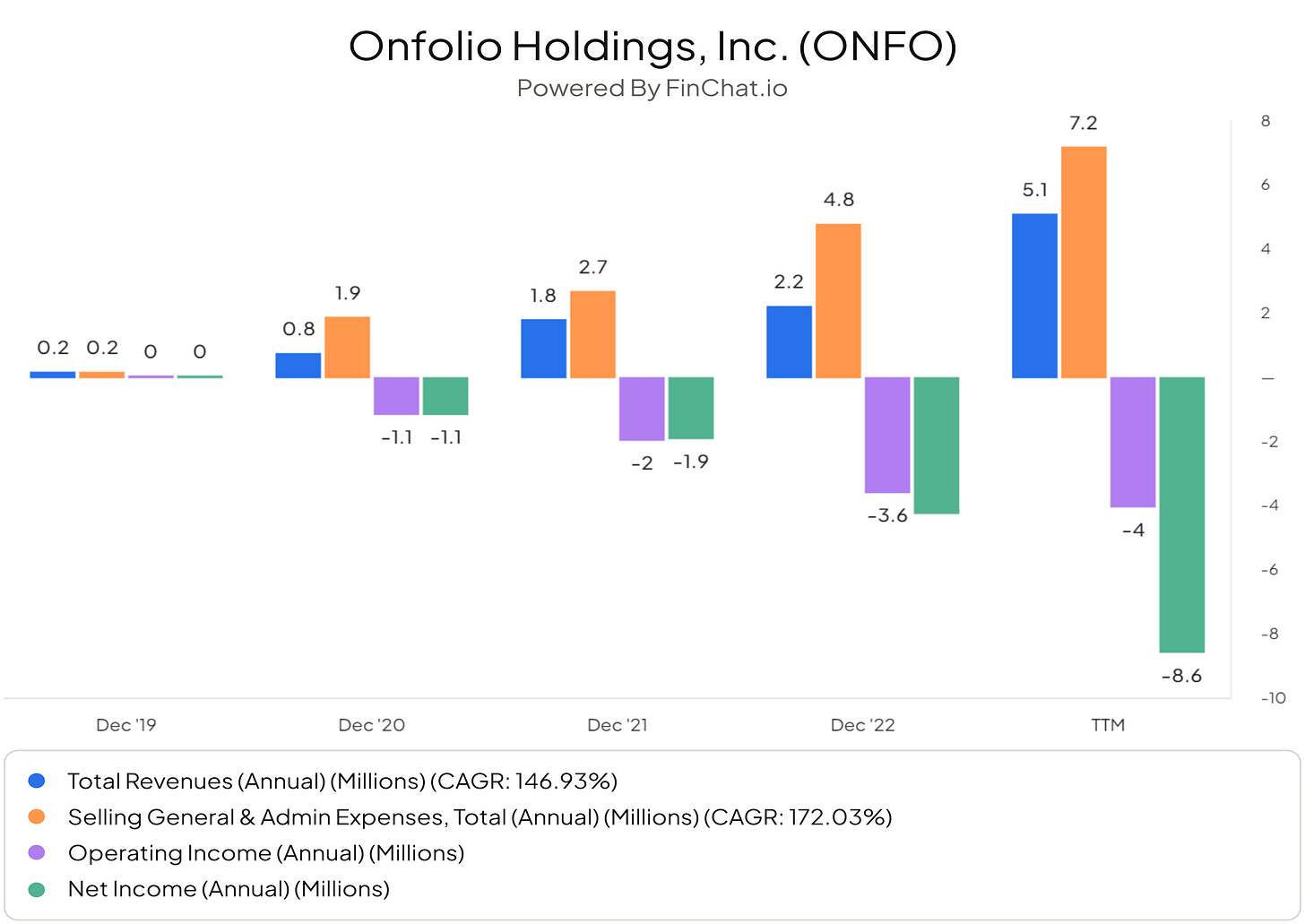

Risks

There are many risks that come with a brand new public company / nano-cap at that.

One of the biggest current risks is the fact that Onfolio is still not “profitable”. Company must get control of their overhead while at the same time keep on growing and acquiring new companies.

That is one of the big reasons why the stock of the company has been getting hammered.

Another risk is the combination of 1) that Dom Wells is working remotely from Taiwan and 2) he is (although a founder of ONFO) a first time CEO of a public company, so there is a lot that he probably does not know and will need to learn (hopefully without costing much to the shareholders).

By themselves those are not really problems but combined I think if not red then at least a yellow flag, to be cautious.

Some other risks:

Being de-listed for not complying with Nasdaq

Unable to find new companies to acquire (based on the criteria)

Failure to successfully integrate acquired companies

Warrants

Unable to meet the payments for the Preferred shares

One of the main management members quitting

Cyber-attacks

Google Traffic Changes

Many others can be found in the 10-K

Conclusion

In conclusion, Onfolio is very speculative play as there is still a lot of uncertainty and not a lot of past data/history to give us some kind of guidance. This is a bet that Dom Wells and the team can deliver on everything they are promising, that is being profitable + acquiring new companies + growing + paying out dividends on the preferred shares.

But until company gets its profitability in order, Mr Market probably wont believe anything that the management has to say…

But I guess in that lies the opportunity…

Find Yegor on Twitter/X here.

Follow "From $100K to $1M" & More. on Substack here:

Texas Instruments: A Lollapalooza in Plain Sight

By Margin of Safety Investing

Texas Instruments is a high quality business undergoing a critical capital intensive investment cycle. I believe TXN 0.00%↑ may be a beneficiary of very simple (with hindsight) Lollapalooza effects over the next decade. Markets tend to be short sighted and therefore are undervaluing the investment which is long term in nature.

"I bought the three main text books for introductory psychology and I read through them. And of course being Charlie Munger, I decided that the psychologists were doing it all wrong, and I could do it better. And one of the ideas that I came up with which wasn’t in any of the books was that the Lollapalooza effects came when 3 or 4 of the tendencies were operating at once in the same situation. I could see that it wasn’t linear, you’ve got Lollapalooza effects. But the psychology people couldn’t do experiments that were 4 or 5 things happening at once because it got too complicated for them and they couldn’t publish. So they were ignoring the most important thing in their own profession.”

- Charlie Munger

For those unfamiliar, Texas Instruments manufactures and sells analogue chips (mostly). They are essential in sensing the real world and converting this signal for use in computing, control systems, and automation processes in many end uses. They are used in a plethora of end industries such as manufacturing and automotive. They are the “old” tech compared to digital chips and are slow moving and not cutting age in comparison.

Texas Instruments is planning to reinvest heavily in new manufacturing facilities over the next 3-5 years, in addition to allocating capital to share repurchases and dividends. Some will be skeptical of such high capital expenditures but these are long lived investments that are not constant drags on future capital (as can be demonstrated by previous years operations and capital expenditures).

Lollapalooza Recipe

Pricing Power

End applications are going to become more valuable to the customer

Volume Growth

End applications will increase in quantity with automation, computing power, AI/ML increases in its effectiveness.

Operating Leverage

Expenses reduction per unit sales as replacement ordering will become more plentiful due to 1 and 2 above (more re-occurring sales over the lifetime).

Terminal Value Increases

As capex cycle comes to an end, free-cash will ramp up. Markets are too short sighted to value this properly.

Competitive Position Improvement

These changes will occur slowly enough and be costly enough to avoid an in-rush of new competition chasing returns. With the growth of the market, their competitive position should increase.

Risks

Large capital projects are inherently risky in terms of execution schedule and budget.

There is a large portion of sales (about half) in the Chinese end market geography. Geopolitics is a risk.

Valuation

Given the capital investments underway, looking at current earnings is likely not a good measure necessarily. Looking at dividend yield and p/s compared to its own history may give you some clue as to whether it is cheap here or not. The valuation doesn’t appear screaming cheap on the surface but if you believe in the above thesis to any extent and are willing to hold multiple years to allow the thesis to play out, you may end up with a very good result with limited risk along the way.

Find Simon on X/Twitter here.

Follow Margin of Safety Investing on Substack here:

Medistim One-Pager

By Sleep Well Investments

I like to own businesses that have stood the test of time. They often sell essential products with various advantages that make them difficult to compete against. As Charlie Munger famously said, "One competitor is enough to ruin a business." But what if there aren't any competitors?

Medistim (MEDI.OL) tick the boxes. It was founded 30 years ago and single-handedly created the market for measuring blood flow and intraoperative ultrasound imaging in cardiac, vascular, and transplant surgeries.

Before Medistim, surgeons relied on feeling pulse palpations with their fingertips to indicate blood flow, even though this method was clinically proven to be unreliable. Over the past 30 years, Medistim has developed four generations of devices, increasing global adoption of supporting devices from 0% to 40%. In mature markets like the Nordics, Germany, and Japan, the adoption rate is over 80%. Medistim is considered the standard of care in these developed markets, with over 80% market share, and surgeons are unwilling to switch to other solutions.

Yet, Medistim’s runway is far from complete. It is still in the early days of penetrating greenfield opportunities.

Firstly, only 30% of surgeries in the US use supporting devices. Said another way, up to 60% of the remaining cases are up for grabs, assuming the usage of supporting devices in the US matches up with Europe (80%) and Japan (90%). After the US, Medistim has much room to grow in the UK, China, and India. All are expected to expand in the future.

The second greenfield opportunity is vascular and organ transplant procedures. These are more challenging markets to crack than the core market - cardiac, especially for ultrasound imaging, as surgeons only check the image if there are abnormalities. Nevertheless, Medistim is very early, representing long-tail growth opportunities in the medium to long term.

Medistim is the smallest company in my Sleep Well Portfolio, with less than a $1 billion market cap. Still, it has life-saving implications for patients, its razor-blade business model is resilient and recurring in revenue, and its track record is impressive. Since 2012, the install base has increased by 5% CAGR to over 3300 machines in large hospitals across over 60 countries. This has translated to a 10% CAGR in revenue and an 18% CAGR in free cash flow per share. The market rewarded shareholders with a 19% CAGR return since the IPO. As competitors have not yet found a way to disrupt Medistim in the past 30 years, I doubt that Medistim's market position and value creation record will change any time soon.

Find Sleep Well Investments on X/Twitter here.

FollowSleep Well Investments on Substack here:

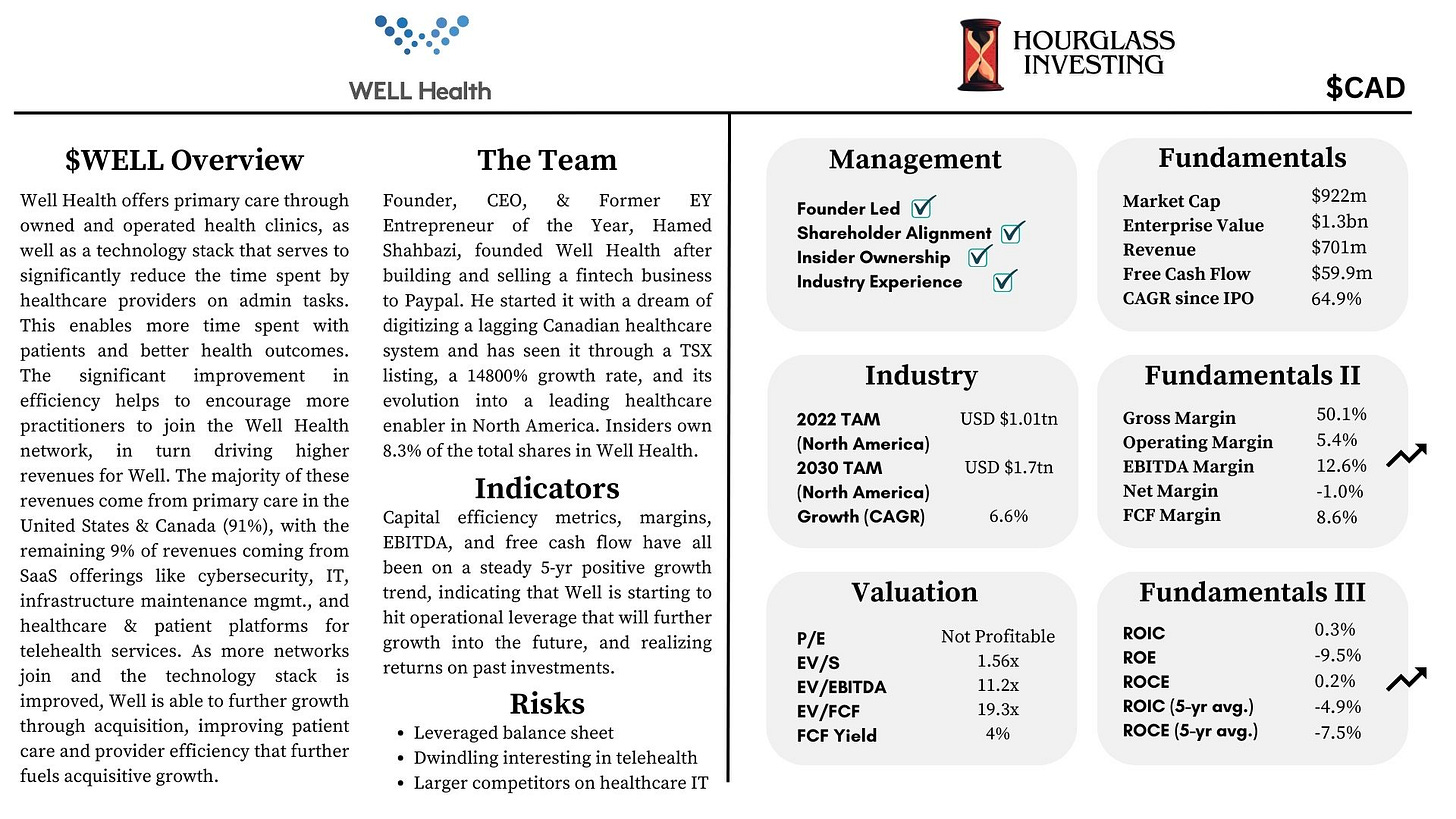

WELL Health Technologies - A Shallow Dive

By Hourglass Investing

Healthcare in Canada has a wide range of constraints that serve to limit the access to and quality of basic healthcare for Canadians. Healthcare providers are severely handcuffed by a lack of sufficient staffing, technological support, and resources - the effect is that admin work accounts for nearly 50% of a provider’s time, while interacting with and providing care for patients accounts for only 30%.

Well Health Technologies is working to break down these barriers by enabling a more efficient and effective healthcare system to deliver critical services to Canadians. More recently, they’ve expanded on this service to also deliver their patient services to the United States.

Business Model

Well’s business model revolves around three business segments: Canadian Patient Services, U.S. Patient Services, and Technology/SaaS:

Canadian Patient Services - 30% of revenues

Primary care through owned & operated clinics

Therapeutic, diagnostic, & support services

Preventative health care and assessments

U.S. Patient Services - 61% of revenues

Primary care

Specialty care

Women’s health

Anesthesia supply

SaaS/Technology - 9% of revenues

For patients:

Two-way access to health records

Online appointments and consultations

e-Prescriptions and delivery

For providers:

Billing

Maintenance management

IT support & cybersecurity

Well has largely grown through acquisition of clinics and patient services/telehealth providers, as well as individual technologies that wrap into Well’s portfolio of virtual assets. Through this strategy, Well has become a leading provider for both its patient services and tech/SaaS segments in Canada, and has acquired leading providers of niche services in the U.S. - such as Wisp, a provider of Women’s Healthcare.

Tucking in acquired clinics and providers under Well’s umbrella of efficiency-driving technologies, while continuing to bolster those offerings through additional acquisitions, allows Well to significantly ramp up revenues for acquired practices - Wisp has grown revenues by more than 85% in the two years since acquisition, while telehealth and clinic operator Circle Medical has grown revenues by 1150% since a late 2020 acquisition.

Growth

Well Health benefits from a potent flywheel that will enable efficient, scalable growth into the future:

It’s a double-pronged flywheel that lets Well benefit directly from acquiring more practices and adding to their network, but also less directly through adding more tools to their technology stack. Either way, the outcome is to drive greater revenues and cash flows and ultimately fuel growth into the future - this growth can be fuelled through three main growth levers: geographic expansion, organic growth through customer relationships, and acquisitive growth.

Capitalizing on these growth opportunities should allow Well to expand on its leadership in Canada primary care and U.S. niche services and continue growing well into the future.

Financials

Well Health has seen some incredible growth since its 2017 IPO - listed at a market cap less than $10m, the company has grown at a nearly 117% CAGR since, even after a significant drawdown post-Covid. While not profitable yet, Well is quickly progressing towards it while also expanding margins, capital efficiency metrics, cash flows, and most of its underlying metrics.

It’s showing all the signs of a promising growth company making the transition to being EBITDA & FCF positive. Revenues have grown at a 126% CAGR over the last 5 years, while EBITDA and FCF have grown from being negative metrics to $88.2m and $59.9m respectively. Capital efficiency metrics, though still low, have expanded considerably and show that Well is starting to realize returns on its initial technology and acquisitions investments.

Debt is one of very few concerns with this business - Net Debt/EBITDA sits at 3.8x and the cash ratio (comparing free cash flows to total debts) sits at just 0.3. However, given that 98% of Well’s revenues are recurring and sourced from a stable, reliable, and critical healthcare industry, this concern is somewhat lessened.

Conclusion

Despite blistering growth over the last six years, Well seems poised for continued growth into the future; it’s still in small-cap range and operating as a value-additive business in a critical and massive industry, and has improved on a number of top- and bottom-line metrics that should allow it to further feed into its business model. Despite the considerable promise it shows, Well trades at an EV/S of only 2x and EV/FCF of 25x with impressive 32.7% TTM growth in revenues - as a Canadian small-cap with lots of debt in a tough macro-economic environment, Well may represent an opportunity for the patient investor to snag a reasonable valuation on a high growth name.