Hi, I am Trung👋

I am the author of Sleep Well Investments (“SWIs”). Here, I share my knowledge and thought process on how to build a sleep-well portfolio. SWIs only focus on enduring businesses defined by their timeless purpose, adaptability, and resilience. They are the ones that you are willing to hold for the long term.

My approach to investing

I am patient and optimistic, with a keen eye for detail. I believe building a good process is everything.

There are no secrets to successful investing, and there are 100s of ways to do it. Mine is:

Invest as a part-owner of a business

Invest in anti-fragile and mundane businesses that can reinvest profitably

I own between 10-20 businesses at a time. I invest when the price is reasonable and cut when I find better opportunities.

My investment motto is:

Focus on quality

Execute with discipline

Our results so far

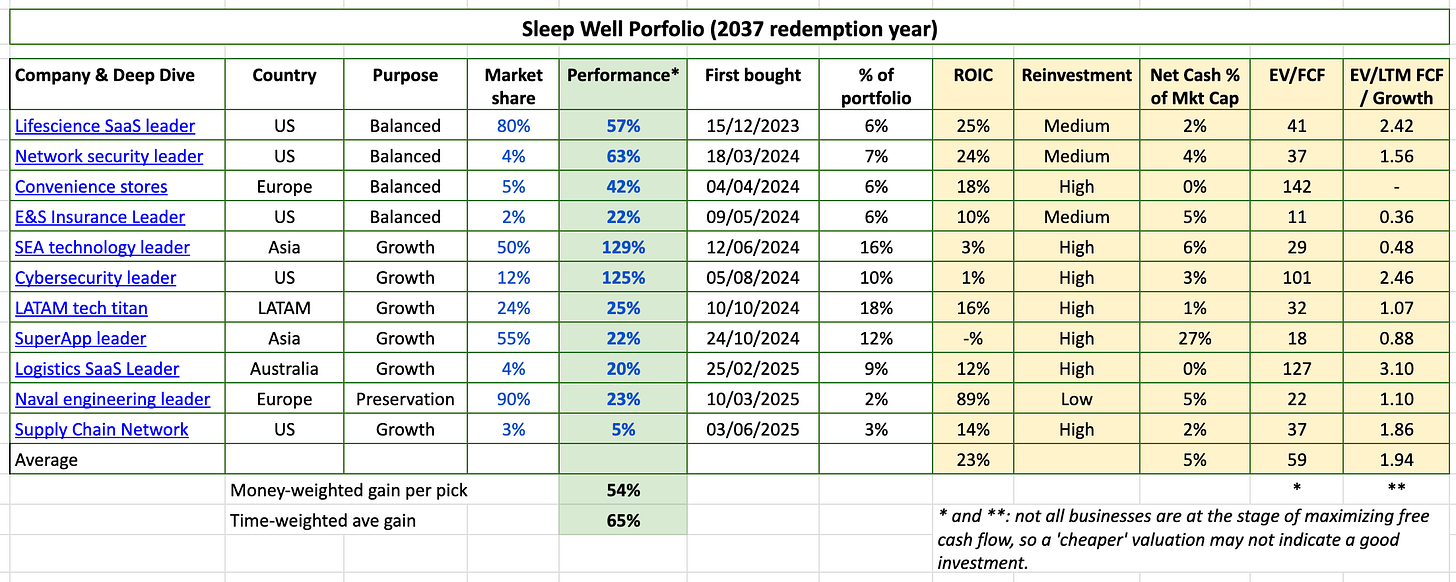

Since October 2023, 10 out of 10 stock purchases are in the money, with an average gain of 50% money-weighted (70% time-weighted).

Impressed with our results? Then consider becoming a paid subscriber to get access to the latest portfolio updates and tools to help you build your own successful portfolio.

What will you get from your SWI subscription?

I aim to provide you with all the necessary knowledge and tools to build your own sleep-well portfolio through:

1. In-depth research

2. The Sleep Well Portfolio - link

Demonstration of how I have built a portfolio from scratch using my daughter’s Junior ISA. Real-time portfolio tracker - link (available for annual subs only)

Monthly Portfolio Review - link

3. Tools

Sleep Well Investments Checklist - link

Sleep Well Investments Business Scorecard (available to paid subs only) - link

4. Ad hoc articles

Key lessons that I have learnt throughout my 15-year investing journey

Quality traps

If you are new to SWI, do check out our user manual next.

My background

I was born in Vietnam and moved to the U.K. in 2001 when I was 15.

My auditing and corporate finance experience at PwC and KPMG equipped me with the technical skills to analyze financial data. However, my investing rigour and discipline stemmed from my Doctoral research experience.

My passion for investing led me to co-host a Value Investing group in London (pre-COVID) and manage external capital for family and friends from 2015 to the present. Since 2022, I have refocused on what I enjoy most - conducting in-depth research and sharing insights on Sleep Well Investments.

I strive for simplicity and structure in my investment process because building wealth is building time for what matters most in your life.

Feel free to contact me at trung.nguyen@sleepwellinvestments.com, LinkedIn, or twitter/X@ DTF_Capital

Don’t be a stranger!

Thank you for supporting my work! Sleep Well Investing!

Sponsorships

Interested in collaborating? Sleep Well Investments is read by finance, tech, and business decision-makers, including the C-suites of public and private companies, funds, family offices, and CIOs worldwide.

We'd love to hear from you if you want to learn more. Send us a note at trung.nguyen@sleepwellinvestments.com, and we’ll respond!

Affiliate partnership

Use the ‘SWI20’ code at checkout for discounts - Quartr is a searchable database of slides, interviews, and earnings calls. It helps me to gather relevant and valuable insights efficiently.

Finchat.io, my personal Bloomberg terminal. Join Finchart.io using this link to get 20% off and support sleep-well investments.

Testimonials