✅ Buy Alert - Buying a 50% 3yr revenue CAGR platform at 15x earnings

Crucially, no direct competition, and market doesn't know this company is turning into a platform (yet). Net cash balance sheet and set to grow free cash flow by triple digits.

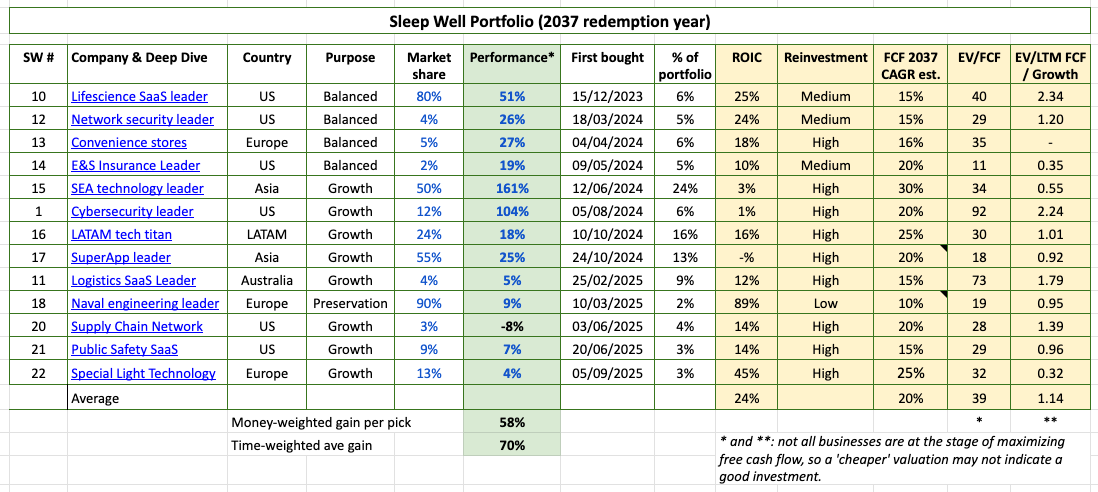

The 22nd pick has now entered the Sleep Well Portfolio, as planned in the deep dive.

The stock rose 50% while I was writing up the report, and has surged 3,000% in the last four years. But now that I understand deeply the potential and the fading risks, I am not hesitating.

You can expect:

high reinvestment opportunities with 50% returns on investments (ROIC)

aligned management with high ownership and excellent execution

mission-critical products to slow to change end-users

unfocused competition and high barriers to entry

squeaky clean balance sheet

low valuation

fading risks

If you are new, read more about us here, and our latest portfolio review here. If you are looking for an above-market return while taking low risk, you can read our Sleep Well Manual to understand our investment process.

Let’s discuss why this European technology platform improves the current Sleep Well Portfolio below. 🎯