5 Lessons From Scott Fraser

Track record: 19% over 30 years. My favourite lesson - Avoid 'lazy working capital'

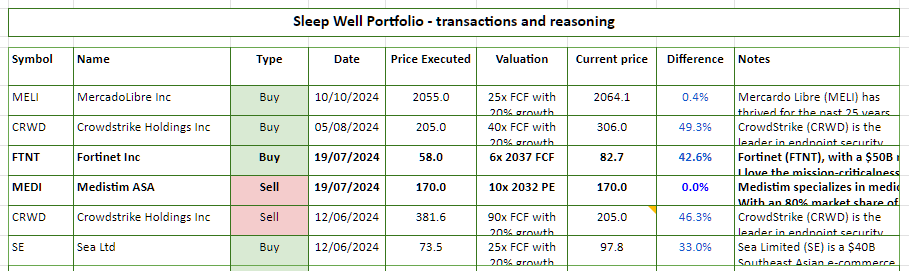

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Hi, fellow sleep well investors,

I hope you are enjoying Sleep Well’s 33% average money-weighted return (61% time-weighted) since October 2023.

Sleep Well Investments was initially built on the ideas of three wise investors:

Anti-fragility borrowed from Nassim Taleb,

Irreplaceability from Anthony Deden,

Mundanity from Matthew McLennan.

Today, I want to bring your attention to Scott Fraser, the lesser-known Canadian investor who compounded 19.5% over 30 years (1990 to 2020).

He is a fascinating man who loves salmon fishing in his free time and still enters squash tournaments in his 90s. Like Ralph Wanger, he stays out of the limelight and has plenty of investing wisdom to share.

He wrote ‘Picking Winners,’ an easy investing book with practical tips. Here are my key learnings that I apply to Sleep Well Investments:

Time in the market > timing the market.

Own good companies.

Avoid ‘lazy working capital and cash hoarding’ businesses.

Corporate governance > ROIC track record & insider ownership.

Sell the least loved investments.

1. Time in the market > timing the market

“All my life, when there’s been a crack in the market, I’ve stayed in,”

“That happened when the tech bubble burst in 2002. Stay the course.”

In a rare article profiling Scott Fraser, he reiterated the importance of staying the course during the global Coronavirus pandemic. The SP500 dropped 37% within a few weeks of China announcing the lockdown in Wuhan but then claimed new highs within a few months. Anyone who ‘sells first and asks later’ and sheltered in cash would have missed all the gains. The loss (missing the rebound) is permanent.

“[…] the whole basket of stocks went down. In previous times, people used to be able to take refuge in defensive stocks like utilities that weren’t volatile and paid a good dividend. This didn’t happen because the way most people reacted was to sell the whole index (ETFs), utilities included. Everything went down at the same time, and there was no place to hide.”

Scott Fraser compared the 2020 panic to the 2008 recession and how it left investors with long-lasting fear of the market.

In 2008 and 2009, we saw many investors lose thirty, forty, or fifty percent and then do panic selling. Once they had felt so much pain, they didn’t want to get back in, so they missed out on the rebound.

Others tried to “call the bottom” in stocks, betting that the market had reached its turnaround point, but that’s very hard to do. There are so many false bottoms and false rallies in these situations.

“This crisis is the same as 2008,” Fraser believes. “Instead of a banking crisis, we have a public health crisis.”

So, when the next crisis comes, you need some patience to wait it out, he says. If you are fortunate enough to have enough for retirement, your time horizon for investment returns can go from a few years to a decade or more, and you can be confident that, at some point, the market will come back.

2. Own good companies

In Fraser’s view, the most important thing is owning stock in good, well-managed, and solidly financed companies. Of course, they can be stressed by upheaval, but they tend to emerge in relatively good shape compared to most.

While the financial crisis in 2008 or the health crisis of 2020 profoundly impacted economies around the globe, the old rules for picking winners will still apply.

What are good companies to Scott Frasers?

3. No Lazy Cash

Scott Fraser views capital as sacred. Anthony Deden, a pillar of Sleep Well Investments, dives deep into this and will come in a separate post. Thus, he avoids companies that have lots of working capital. This often means the business model is inefficient or that the cash is not going into reinvesting in the business.

He avoids companies that build up cash or use it to pay dividends. Scott takes a drastic view on cash, but it is an excellent food for thought, as how management uses cash reflects their quality.

In one of his best-performing investments, CCL Industries, he sold the stock as soon as it started to build a significant cash position. So, in his view, look for companies that:

Miminise working capital

Reinvest excess cash

4. Corporate governance

Scott Fraser cares more about how the top management acts than their reported return on invested capital (ROIC) track record or how many shares they own. That means how these managers treat their employees, shareholders, and customers. In his view, if businesses can build and maintain a balanced ecosystem (customers, employees, suppliers, etc), then in the long term, they will attract good people and eventually become suitable investments.

Canadian National Railway and Canadian Pacific Railway are good examples in his book.

5. Sell your least loved position

I love this advice.

Most people have too many ideas but not enough cash. Myself included, I often need to sell to buy a new business.

Secondly, owning a business you don’t love wastes time and resources that could be used for the best ideas. This happened with one of our holdings—Medistim. It was sold in July to fund our purchase of Fortinet, a superior business. The result is a stellar gain of 43% vs. 0% if Medistim was kept.

Summary, Scott Fraser’s teaching in five bullets:

Time in the market > timing the market.

Own good companies.

Avoid ‘lazy working capital and cash hoarding’ businesses.

Corporate governance > ROIC track record & insider ownership.

Sell the least loved investments.

That’s it for today.

What do you think?

Some overlaps with Ralph Wanger’s Seven Lessons?

Use long-term themes to narrow down small-cap GARP picks

Extend investing horizon.

Select businesses with attributes that can withstand challenging times

Stick to your process and what you know, and ignore the fads and noise.

Buy cheap at replacement value at 2yr EPS growth.

Buy when people think it will get cheaper.

Avoid cutting flowers.

Buy great businesses and let them do the compounding.

Choose the quality of the business over the cheapness of stock.

Return on invested capital is a better value creation metric than earning per share.

A high reinvestment rate at a high ROIC is better than buyback and dividends.

Pay up for quality; it’s worth it. (hardest lesson)

In case you missed it, I shared recently:

Thank you for reading. If you have found my content value-added, subscribe and spread the word so more long-term investors can sleep well.

Reminder: How can Sleep Well Investments help?

High success rate stock picks—33% money-weighted gain per pick since Oct 2023 (61% time-weighted).

Deep research of high-quality businesses and regular tracking. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free articles on investment framework to help find quality companies and execute with discipline.

Promote yourself to 6000+ stock market investors (47% open rate) — Contact me: trung.nguyen@sleepwellinvestments.com