Sleep Well Investments Portfolio

You can see what I buy/hold/sell here. Expect periodic buys and infrequent sales (ideally never).

Hi, loyal Sleep Well Investors,

I am excited to launch the Sleep Well Portfolio. This is a long-term portfolio that I created for my 4-year-old daughter to redeem in 2037. As you know, I deep-dive into market leaders and track them to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio. I disclose the reasoning of all BUY and SELL transactions (sample: 1st, 2nd, and 3rd).

It is provided for full transparency and full disclosure. To show you that I am investing in the businesses I write about. Expect periodic buys and very infrequent sales - ideally never. I aim to own these businesses as long as they perform in my Thesis Tracker, which I update quarterly or when data is available.

Please click this LINK to see the Sleep Well Portfolio in full. It’s only available to annual paid subscribers (it’s cheaper at a 30%+ discount to the monthly price).

If you are already an annual sub, please email or DM me on Twitter/X (@DTF_Capital) for access - it will only work with your email.

Characteristics of the Sleep Well Portfolio

✔ The portfolio will eventually consist of 20 names

✔ The portfolio redemption year is 2037. We buy to own long-term

✔ No market timing. We buy at a price that offers a healthy margin of safety

✔ The portfolio only invests in deep-dived stocks that are monitored closely

✔ They are market leaders who have:

Stable / strengthening market position

Enduring competitive advantages

Management with aligned interests and a strong capital allocation track record

Anti-fragility attributes (healthy balance sheet, adaptable business model, endured competitors and past crises)

Plenty of reinvestment opportunities

Trading at a fair valuation

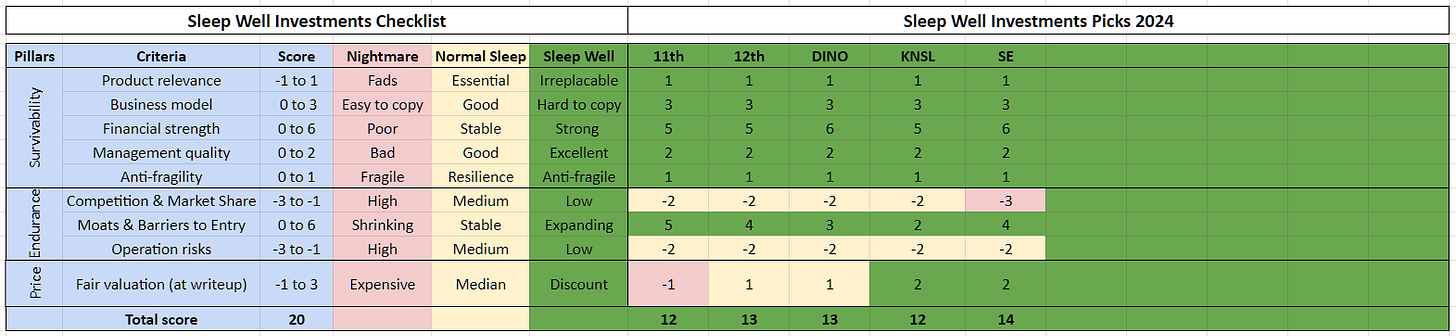

Below is the thoroughly researched current investable universe of SWI Future Portfolio. I aim to build up the list to 40-60 names and own 20.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett.

It’s important to highlight that the greatest threat to investing is yourself.

Investing is a marathon, not a sprint. That’s why the portfolio redemption year is 2037. I intend to buy to own long-term. No short-term trades. I will not trade a good night of sleep for a shot at a few extra percentage points of return.

For this reason, access to the portfolio is only available for annual paid subs who are in it for the long run. I apologize to monthly subscribers; I don’t want to mislead or tag you along for the marathon when you are looking for a sprint. You still have full access to my deep dives and thesis-tracking updates.

For annual subs, you have additional access to the following:

Research list

Slee Well Portfolio

Thesis tracking summary

Ownership status of SWIs in my family portfolio

I look forward to welcoming you and building a long-term investing community together.

*Disclaimer: Nothing on the Sleep Well Investment portfolio spreadsheet construes investment advice. It's for education purposes only, and please do your own due diligence and portfolio construction to fit your needs.

I have just made a second stock purchase for the SWI Future Portfolio (which is a portfolio for my daughter, transferable to her name in 14 years). This is a long-term portfolio that mirrors my own and my family's portfolio which I manage using the same process and philosophy. The portfolio will rebalance itself as it performs and with cash added each year. No trades and no compromise on quality. Annual Sub can check the spreadsheet for more details, link here -https://docs.google.com/spreadsheets/d/1J_g93-jHeMs3CCpQNuwGwb9wIud23aaVKE_-15ggRfE/edit?usp=sharing

I have just made the first stock purchase for the SWI Future Portfolio (which is a portfolio for my daughter, transferable to her name in 14 years). This is a long-term portfolio of businesses I aim to own and mirrors my own and my family's portfolio which I manage using the same process and philosophy. The portfolio will rebalance itself as it performs and with cash added each year. No trades and no compromise on quality.