Sleep Well Portfolio consists of only time-tested leaders. We screen them using a rigorous checklist and track their thesis regularly to buy at reasonable prices. We discuss our learning, mistakes, and actions every month here. FAQ and more about us here.

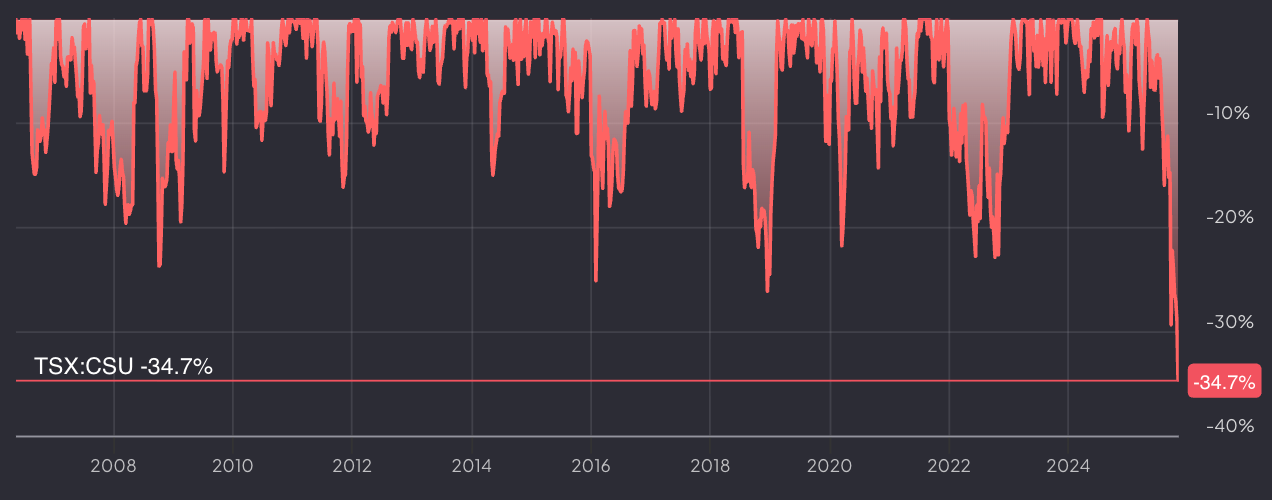

November is offering us many opportunities within the sleep-well universe. SaaS, compounders, and even Constellation Software (below) are getting hammered. On the other side is anything related to AI.

With the average ‘investors’ holding period shortened to just a few quarters, from 30 months in the 1990s, corrections are a good time to accumulate shares in good businesses. I will be adding 2 to 3 positions listed in this 2nd Best Buys edition. Just a little bit, but my investing horizon is until 2037 (when my daughter takes over the portfolio), so every add at today's prices will make a big difference.

Let’s explore what's good to add and what's good to research further.

Best buys for November 2025

Aims of best buys

The monthly best buys aim to highlight opportunities to strategically build the portfolio with a clear endgame: ‘starting capital’ for my daughters. I can not draw liquidity from this portfolio, and every dollar invested is a dollar of extra opportunity for them.

My strategy - balance preservation and growth

To achieve the endgame, I prioritize avoiding losses by adding to winners, then diversifying into growth opportunities to ensure a balanced approach across the business lifecycle. Why? Time-tested companies tend to perform well in bear markets, while younger, promising businesses tend to thrive in bull markets.

Additionally, the list is not based on the positive/negative newsflow for the following quarters. It is also not deliberately trying to beat the market (S&P 500); if it does, that’s the icing on the cake. If not, I am entirely okay with it.

Hence, best-buy lists are personal; to apply them to your needs, I encourage you to review the deep dives and updates before taking action.

Public Safety SaaS leader - 4% yield with at least 20% 3yr forward growth guided

Global logistics SaaS leader - 2.5% yield with a decade of growth runway

Commerce Infastructure in South East Asia - 5% yield with a decade of 20% growth

Commerce Infastructure in Latin America - 5% yield with a decade of 20% growth

Retail Supply Chain SaaS - 5% yield with at least 10%+ growth

Disclaimer: As a reader of Sleep Well Investments, you agree to our disclaimer. Full details here.

If you are new to SWI, check out our FAQ and Owner Manual.