SWI's Framework - Paying Up for Quality

Would you pay 70x FCF for a 20% growth software company?

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Hi friends,

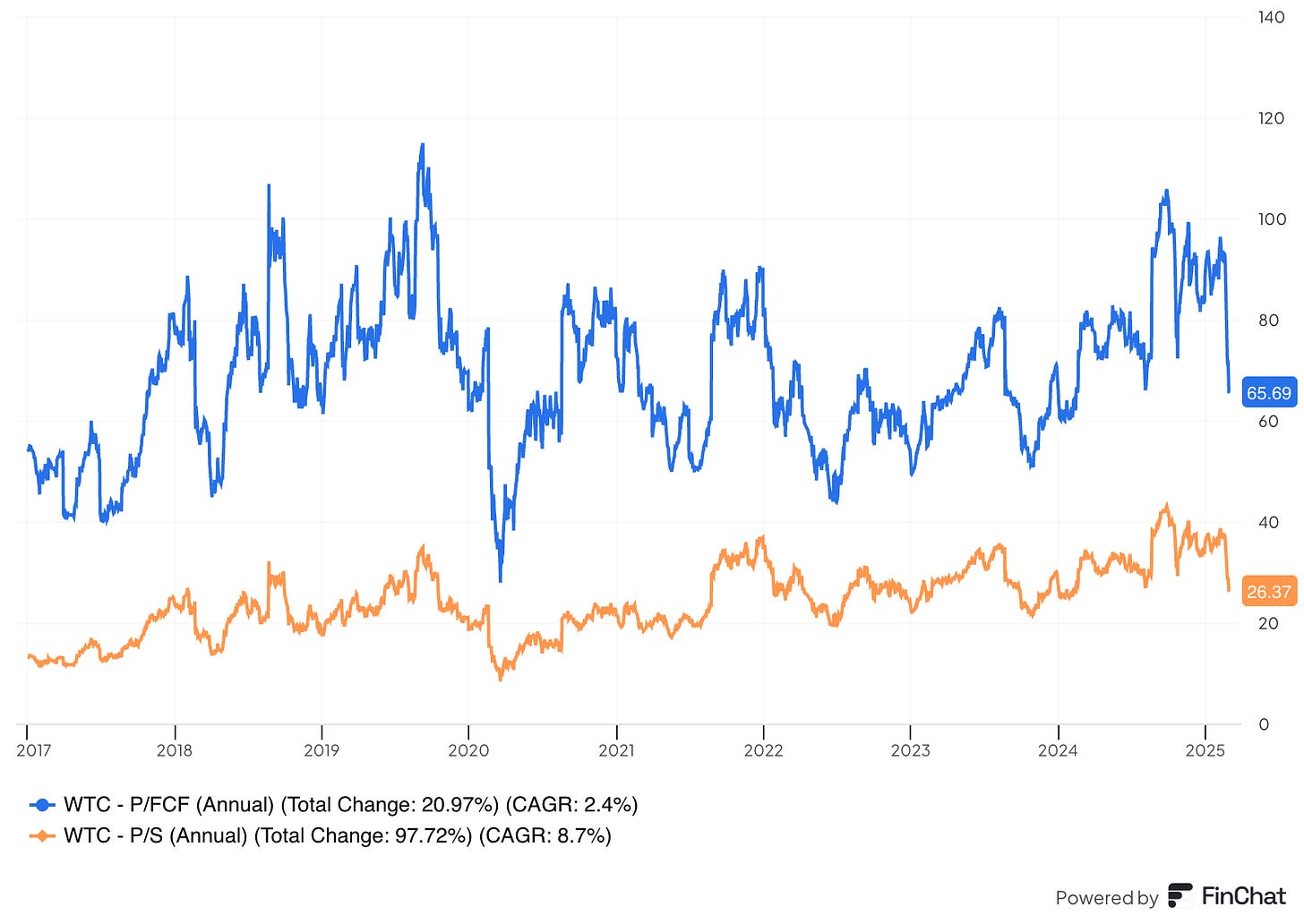

I recently bought the most expensive Australian software company, Wisetech (WTC). It’s a 3% position in the Sleep Well Portfolio, valued at 70x FCF and 26x Sales for 17% growth (15% organic and 2% inorganic) per the H1’25 report. It was a mistake not buying it last year. I am not making the same mistake this year.

Check out my Jan 2024 SWI deep dive, H1’25 update, Buy Alert, CEO update, FY24 update, for more details.

On to you, what would it take you to pay for this business?

Before I explain my reasoning, you must know that at Sleep Well Investments.

Valuation is more art than science, where I attempt to match a company's story to a rough price at a particular time.

Hence, the stronger the company, and crucially, the longer the time preference, the higher the price I am willing to pay.

As a result, what you pay today matters less.

The following 20-year study by BCG supports my reasoning above. It shows that valuation explains just 5% of the stock performance for top-quartile companies in 10 years and 46% in the next 12 months. In other words, what you pay matters less if you extend your investing horizon.

The caveat is that you must ensure you are right about the company. The findings above apply to top-quartile businesses only! Looks like Wisetech is one —one of a kind product, with 30% and 40% revenue and free cash flow CAGR 10yr growth [deep dive, H1’25 update, Buy Alert, CEO update, FY24 update].

Next, you have to conquer your worst enemy - yourself!, your price anchoring bias, and your habit of trying to price everything and make quick bucks.

Your craving for short-term gain is likely the most significant hurdle to owning companies like Wisetech.

So, if you want to protect and build your wealth (money, time, knowledge), looking at the daily price and finding reasons why it goes up or down each day (which does nothing to the business) is stressful.

I hope you find this writeup helpful.

I’ll open with this.

Wisetech is at A$90/share today, up from A$70/share at my deep dive last year.

But did you know it’s cheaper today than it was last year?

Yes, it’s valued at 66x FCF vs the previous year at 70x FCF.

Core understanding of why you and I should pay up.

I didn’t learn to pay up for quality from the start. I used to love cheap stocks! However, the concept of return on invested capital and focus on owning instead of trading paper shares for quick profit changed everything.

Terry Smith said:

Investing in a quality company requires a longer time horizon, as the company may take years or decades to realize the result of the invested capital. Even so, it may not be, so you need to understand the competitive landscape well. Moreover, you often pay for a high multiple in the first place.

Terry Smith means that if you look at a company with a view of 10-20 years, you can imagine the results of what it invests today. Similarly, you will eat the fruits of an apple tree in 5-10 years by taking care of it (invest). But you can’t if you cut (sell) it next quarter because it grows slower than expected.

So,

Think 10-20 years, ideally forever, like owning a home.

Focus on the strength of the company vs. the competition.

Learn how it reinvests in itself - durability of growth (likelihood and level)