Hi, sleep-well investors,

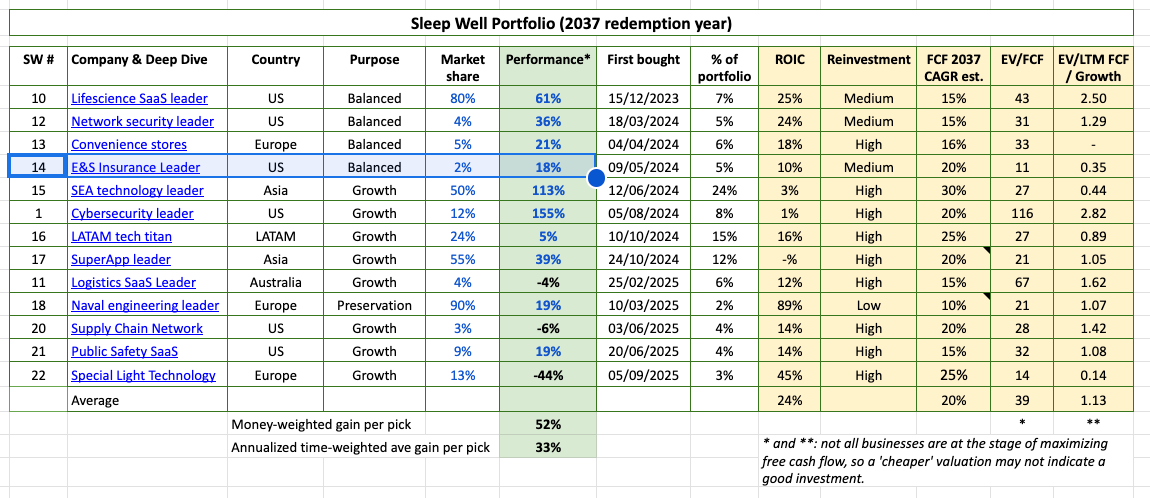

Kinsale (KNSL), a business acquired in May 2024, is a leader in Excess and Surplus (E&S) insurance.

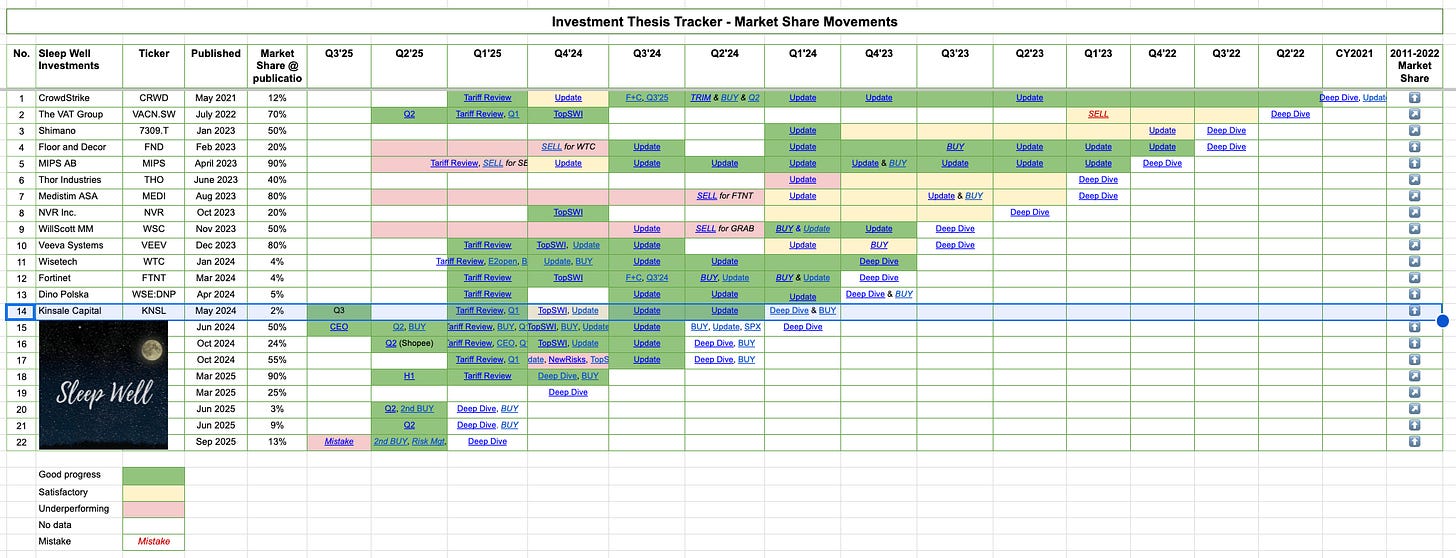

We review the latest quarterly report to see how the business has performed amidst rising competition.

Why do I own it?

KPIs (Operations, Financials, Market share)

Other highlights

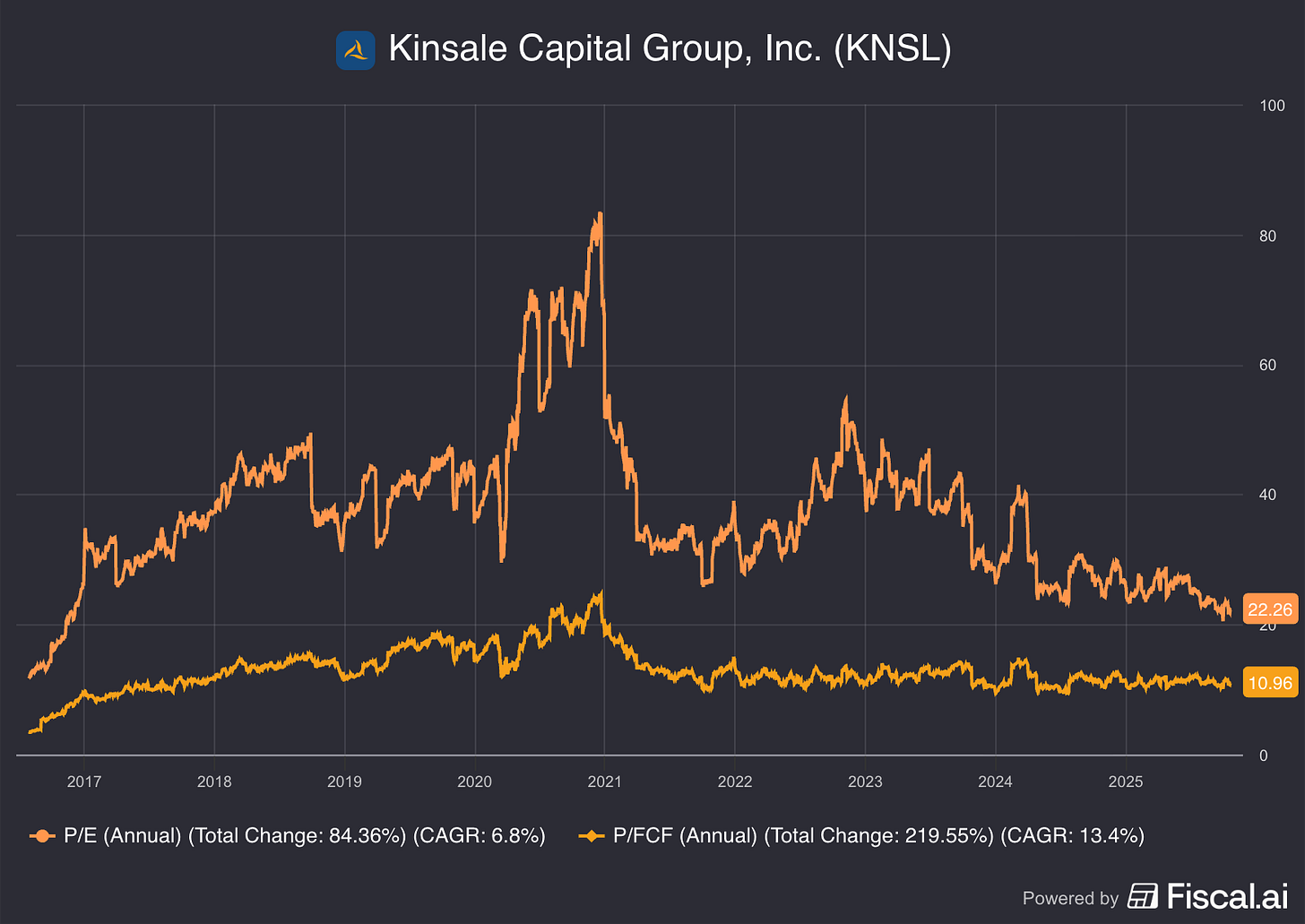

Valuation

To understand the discussion, read my deep dive, the Q4’24, Q3’24, and Q2’24 updates, and the 1st Buy alert.

Don’t miss out on the first Best Buy list.

Links to all other writeups here. Please use the FAQ alongside the SWI Manual to get the most out of your subscription.

1. Why do we own KSNL?

I own Kinsale because of (i) its disciplined and exclusive focus on just one line of insurance - E&S (a $100B TAM of hard-to-place small business and personal lines risks), (ii) the lowest-cost provider (technology-driven, one location), and (iii) total control of its underwriting and claim management processes (no middle man), which together allows it to underwrite risks at ‘high speed, accuracy, and efficiency’. [link]

The focus and advantages above explain why Kinsale has been the most efficient and fastest-growing player. It boasts an industry-leading combined ratio (loss and expense ratio) of ~75% vs. peers’ 90%+, which has contributed to an impressive 28% CAGR in free cash flow per share since 2015. The founder-CEO, Michael Kehoe, also owns 5% of the business, so we have a well-incentivized capital allocator to protect and grow our investment.

Having said the above, I have been monitoring risks, including unpredictable weather catastrophes, float allocation, and increased competition since Q3’24 (and initiated coverage since Q1’24).

Let’s review whether the business remains on the right track despite these risks, and whether the current valuation is fair.