SWI Pick #14 - Kinsale (KNSL) - Thriving From The Unpredictable

Leader in E&S insurance submarket with defensible advantages to thrive in adversity

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

Insurance is a binding business with risks and unpredictability. It’s also highly competitive. However, the business can be exceptionally resilient and rewarding if one has clear scale/cost advantages.

Today's sleep-well pick is Kinsale Capital Group (KNSL)—a US founder-led $9B market cap Excess and Surplus insurer.

Its revenue has increased at a 36% compounded annual growth rate, net income and free cash flow have increased by 30% CAGR, and the share price has increased by 50% CAGR.

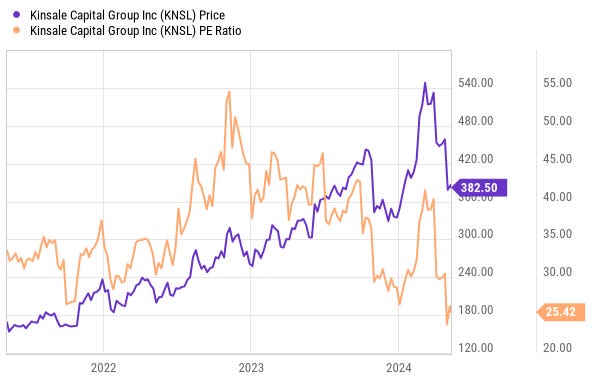

After the recent drop in share price, I feel the valuation makes it more reasonable to start a position for the Sleep Well Portfolio.

Here is what you can expect from this writeup:

$5T Insurance Market

$100B E&S Market and Key Players

Kinsale’s Defensible Advantages

Other Sleep Well Qualities

What Can Go Wrong

Simple Valuation

Sleep Well Scores

*Kinsale came to my attention last month from William, author of Fundasy (link to his write-up), and Longriver’s interview with Shree Viswanathan, founder of SVN Capital. Thank you!

1. $5Tr Insurance Market

First, a 10-second overview of how an insurance business works.

Insurers (via brokers) sell insurance products to individuals and businesses to reduce the cost of adverse events, such as poor health, natural disasters, and auto breakdowns.

Insurers profit if the premiums collected (revenue) exceed the combined claims costs (losses to insurers) and business expenses.

The premium collected / float can also be reinvested (treasury bonds, equity), adding reliable income. Fundasyinvestor did a phenomenal chart explaining the insurance business model below. 👏

In 2023, over $5 trillion of gross insurance premiums were written annually, 5% of the global GDP, split into 65% property and casualty and 35% life and annuity.