Business Update - VAT Group (VACN.SW) Q2'25 - Shares Nearing Attractive Point

Short-term uncertainties but long-term quality remains unchanged.

Hi, sleep well investors,

Q2’25 earnings have started, and I hope you are enjoying your holiday with family. As I approach my moving date to Asia, I’ll send you a quick report on the VAT Group H1’25 update.

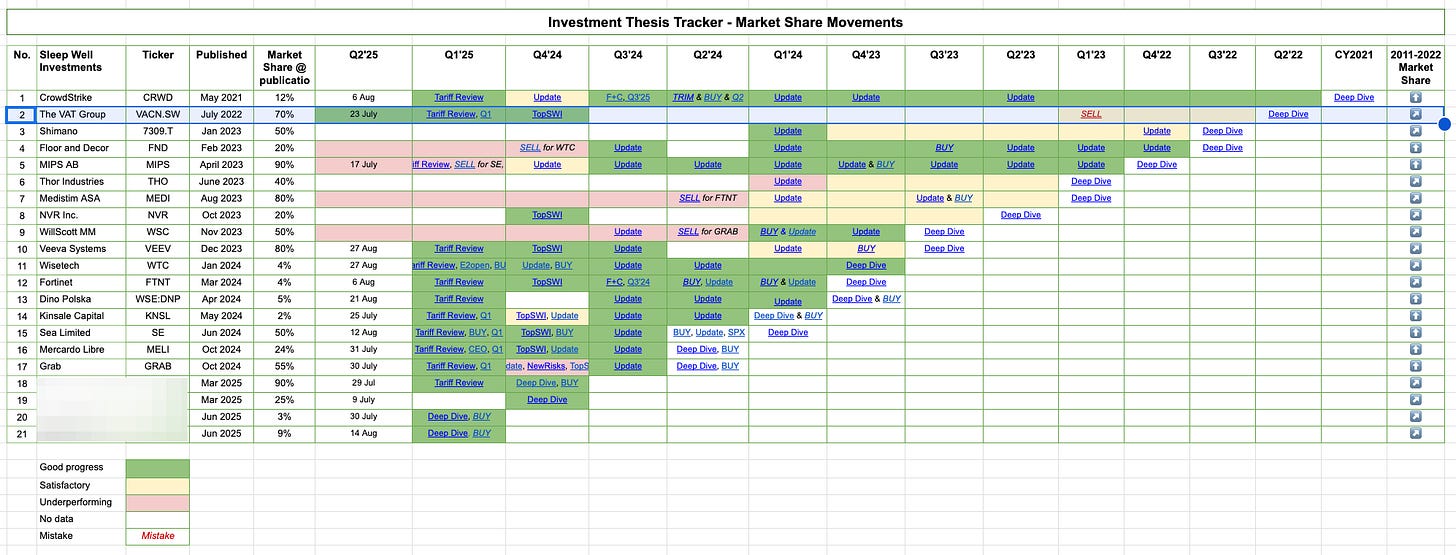

I’ll begin with my usual tracking sheet (full access to annual premium reader on this Google Spreadsheet) so you know what’s in store.

If you are new, start here:

VAT Group Q2’25 - Steady despite uncertainties

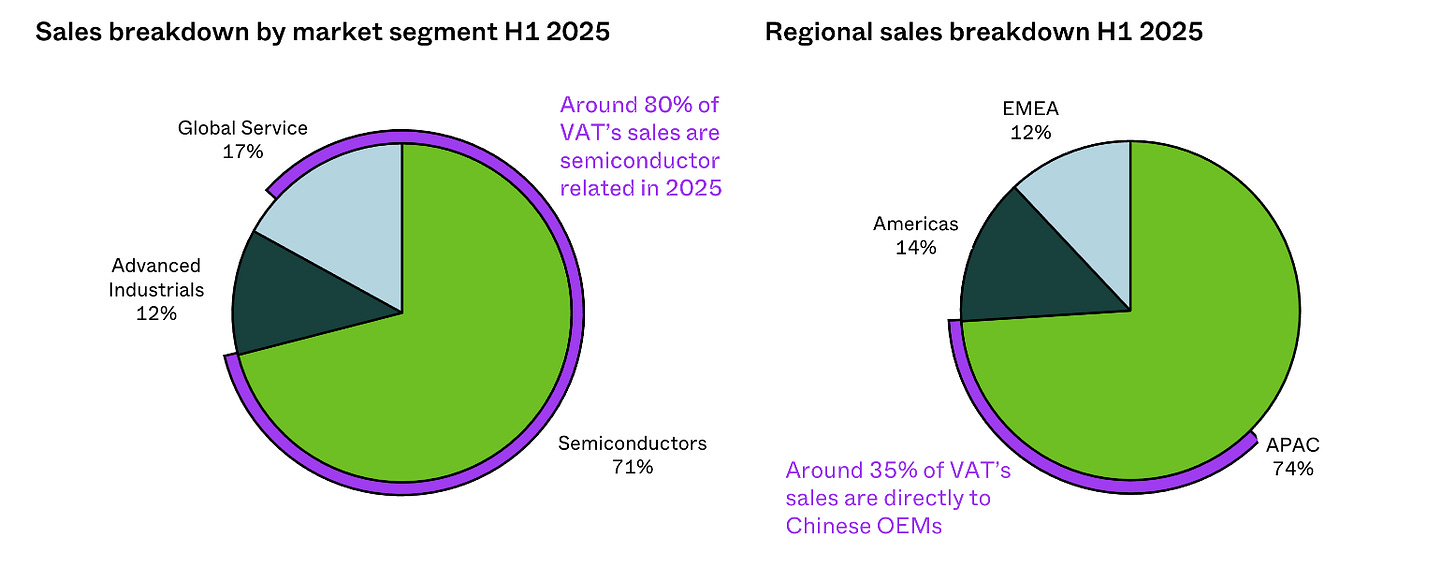

Firstly, the VAT Group (VACN.SW) is a ‘pick and shovel’ and the primary beneficiary of the megatrends in cloud computing, smart devices, the Internet of Things, and artificial intelligence.

Thanks to its superior technical know-how and scale, VAT Group owns the vacuum valve industry in multiple sectors (75%+ of the semiconductor market and 50% in others). This is an irreplaceable business with customers who have little incentive to switch to inferior alternatives.

I won’t reharsh VAT’s undisputed quality. You can read them from the links below.

VAT readings - Q1’25, Tariff review, Deep dive, Top pick beyond 2025

I previously owned in my personal account, and I have been watching it from the sidelines to initiate a position in the Sleep Well Portfolio.

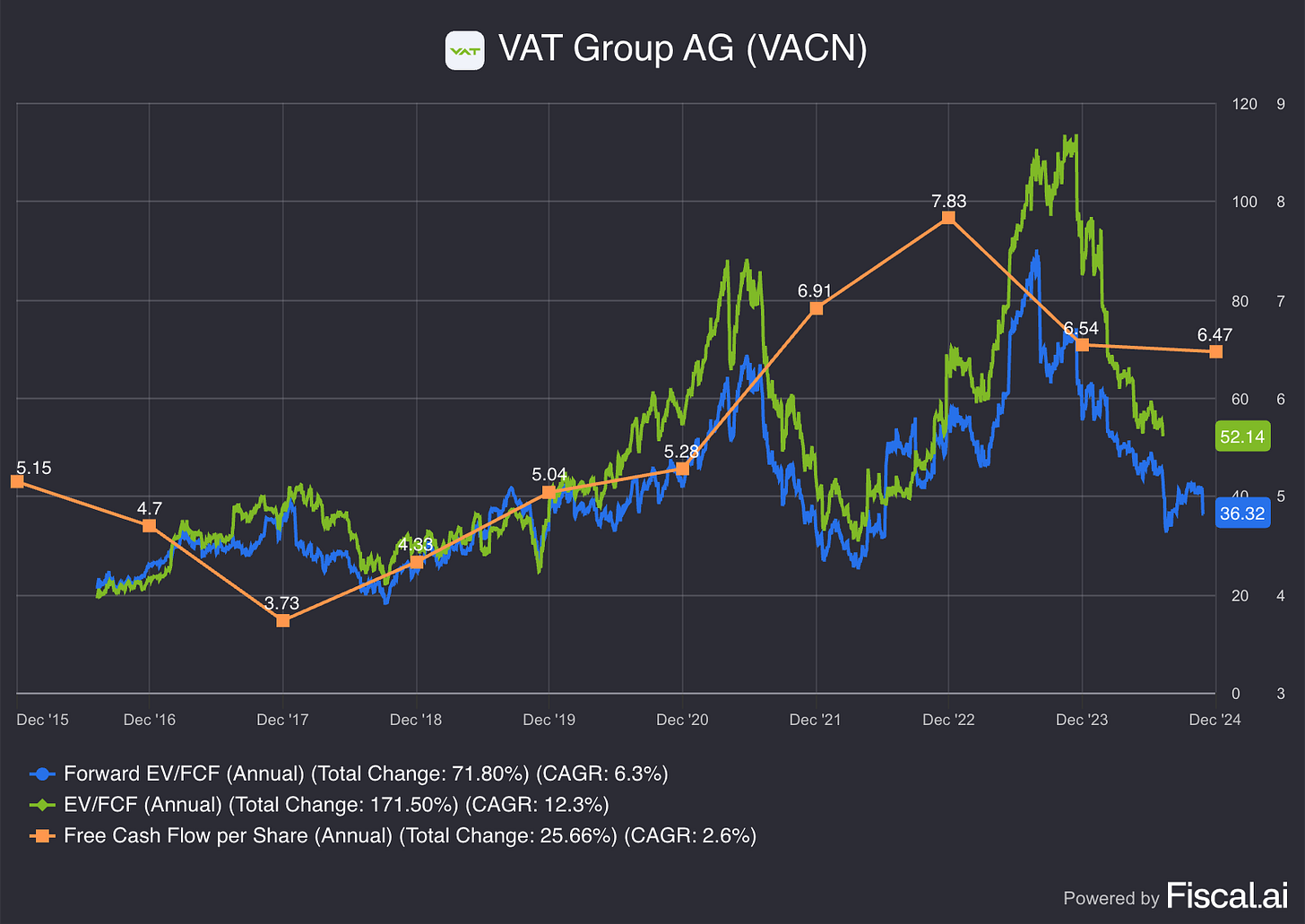

Are we there yet? With a near three-year low valuation of 52x EV/FCF and still growing free cash flow per share, it’s getting closer. But I hope 2025 will provide a better opportunity, given the 20th and 21st picks are better positioned for higher returns.

20th pick - a supply chain network leader [deep dive, first buy]

21st pick - a public safety SaaS leader [deep dive, first buy]

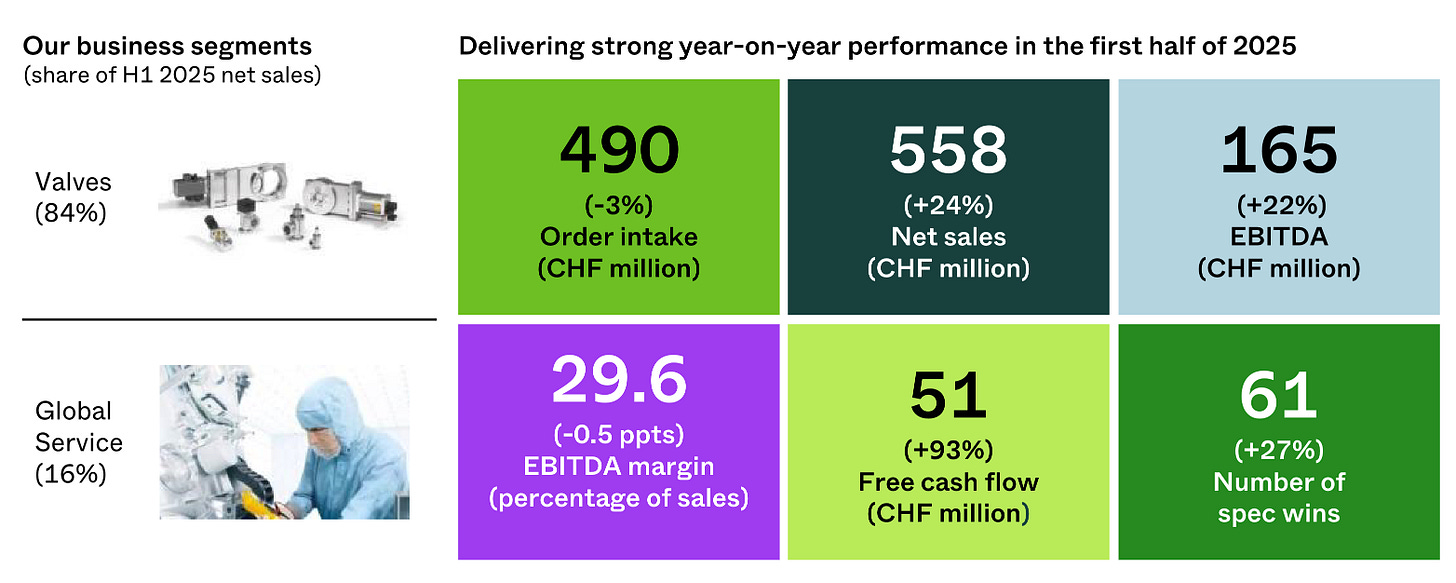

Key Q2’25 results number

The core numbers are, firstly, the spec wins, then the order intake, and the EBITDA margin.

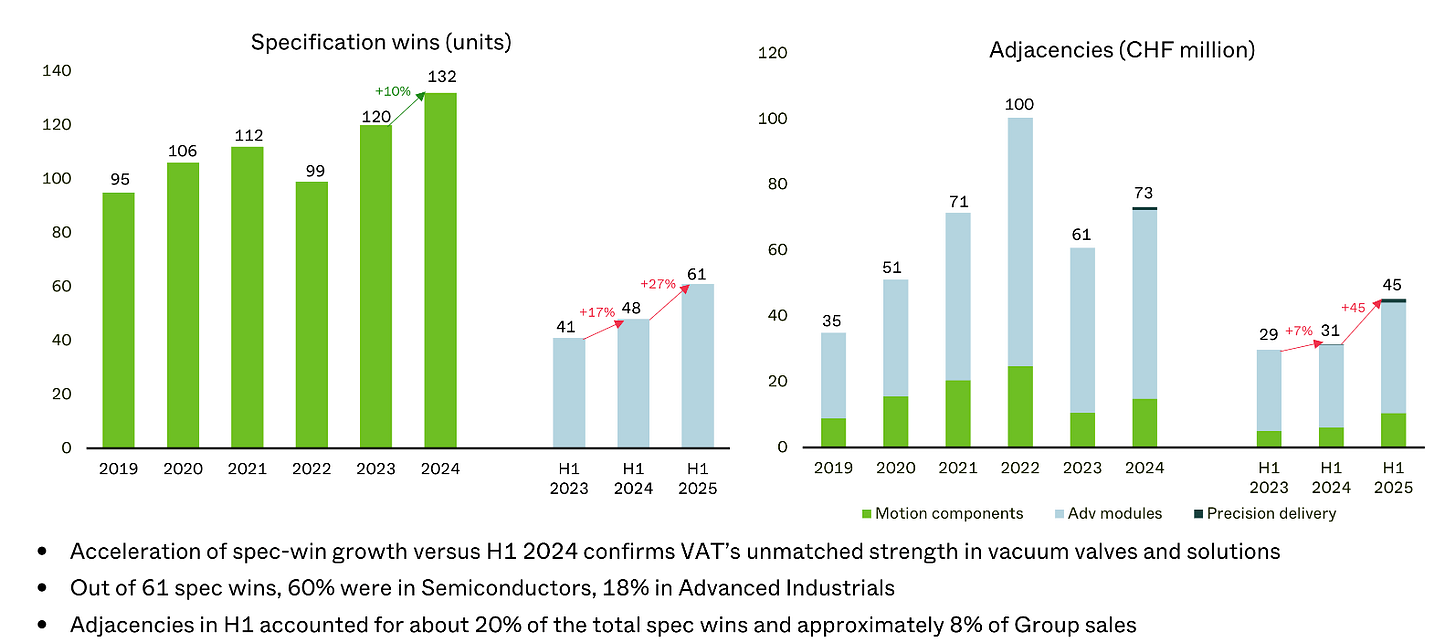

Spec win's 27% growth indicates strong forward demand, with some projects taking 3-5 years to materialize into revenue.

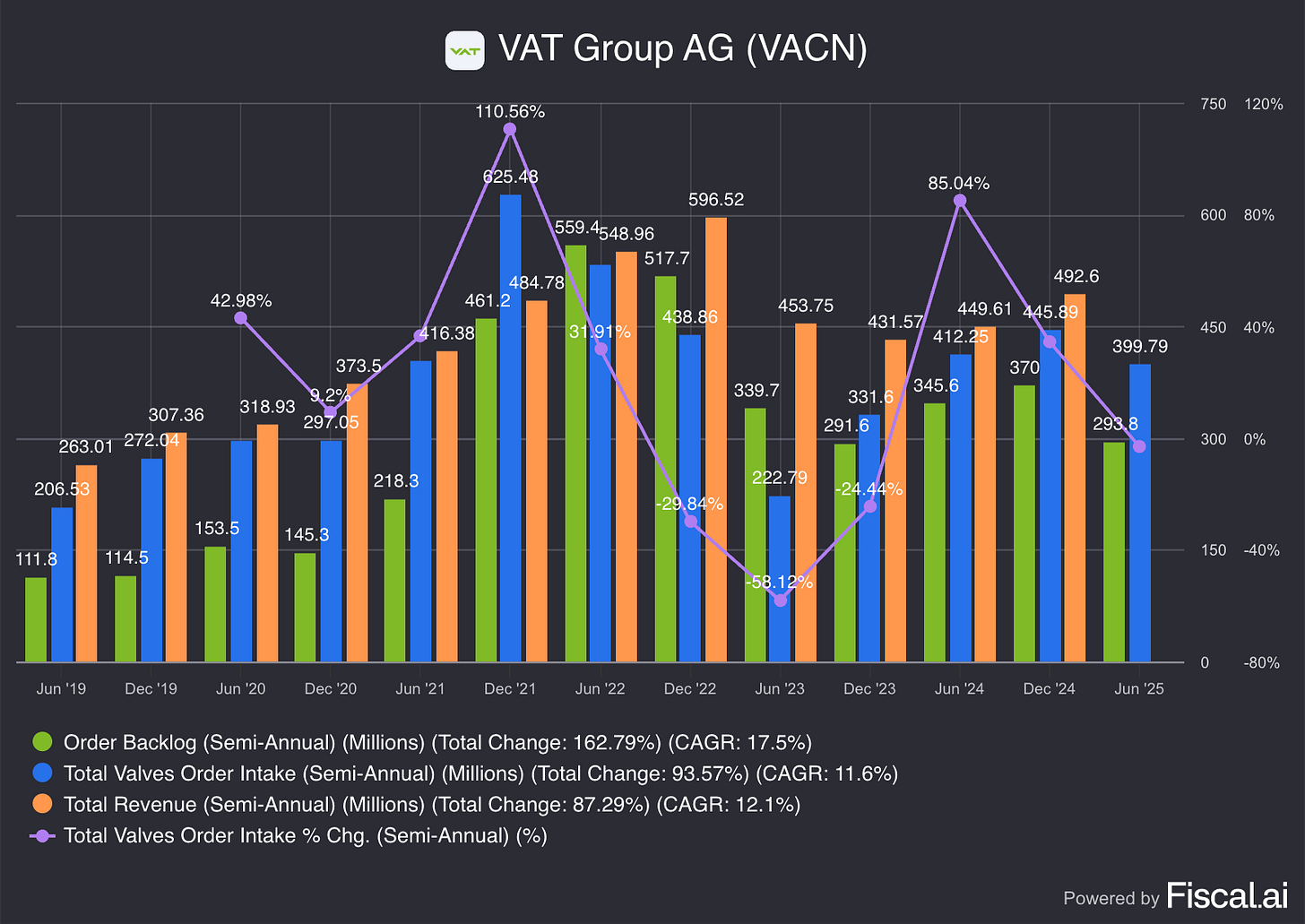

So even with a lumpy order intake growth in the past few half years, I am not concerned. The 10-year CAGR has been around 8% with the last five years rising to 11%.

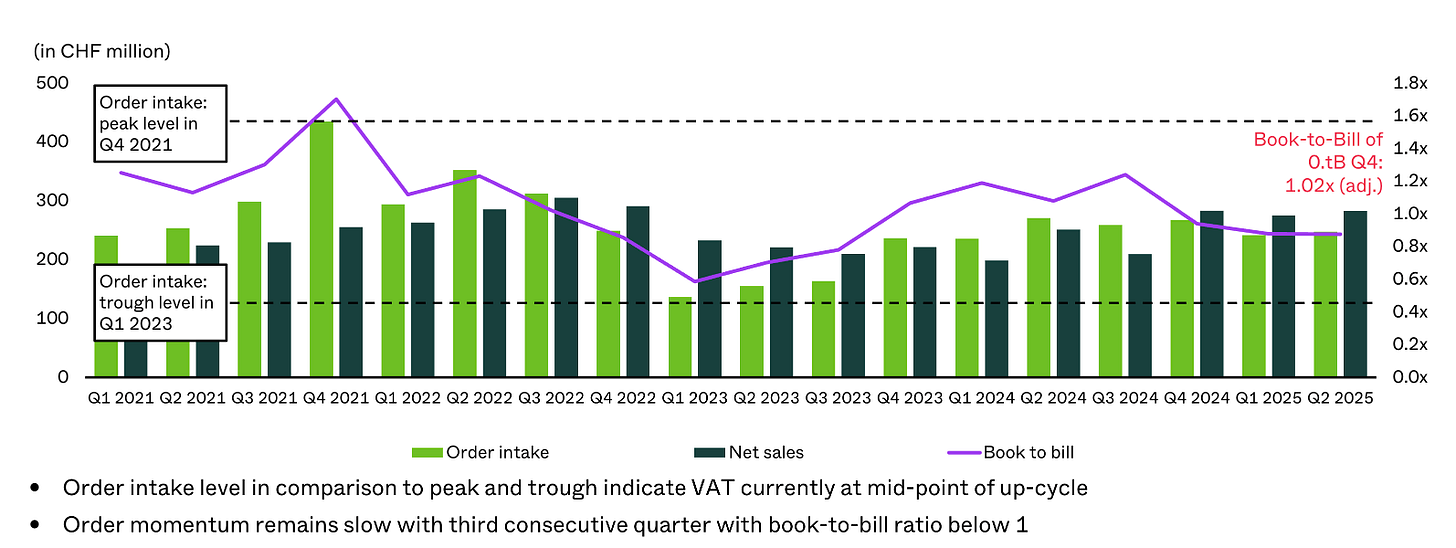

Notice that the order intake numbers for valves (below) have been lower than sales since 2023, driven by shorter order lead times as the supply chain has substantially stabilized over the last 2 years. However, management does expect a ramp-up.

The EBITDA margin is ~30% and has room to expand to the long-term range of 30-37%, which management aims for in the medium term.

Overall, VAT remains resilient in the face of tariff and geopolitical uncertainties in 2025.

Short-term uncertainties

Geopolitics is making customers more cautious.

The tariff has had a minimal financial impact, but customers have been somewhat cautious due to the geopolitical complexities involved in setting up the supply chain, including where to produce, where to ship, and all of which are outside of VAT’s control. This is partly reflected in the order intake weakness; however, there is a strong growth in spec wins, where customers remain confident of the long-term demand.

FX pressure - lower dollars

VAT reports in Swiss Francs CHF, so the lower dollar has had a material impact. Sales in Q2 were CHF 283 million, up 3% quarter-on-quarter and 13% year-on-year. But it would have been a 22% YoY growth at constant FX, exceeding the midpoint of guidance, and exceeding the ~10% wafer fab equipment (WFE) market growth in 2025.

FX impact will continue to put pressure on reported growth numbers and mask VAT’s quality. This could be a source of pessimism for the stock this year, and I look forward to lower prices.

Adjacent markets are taking a while to materialize.

The adjacent market is roughly 8% of sales. Management had aimed to reach 15%; however, it has been slow to materialize, which on the surface raises questions about the market's ability to grow in that segment. However, in reality, the Vat core has been growing strong with the help of China-based OEMs, which ordered a lot in the past few years in a bid to be self-sufficient, thereby distorting the growth of non-semiconductor and leading-edge components.

our qualified adjacencies did not yet get to the market in the last years with the leading-edge going forward. So we are very positive. I'm confident that the share of these adjacencies in the spec wins [20%] will materialize in the market. This is kind of the mechanics behind it. From a spec win to the high-volume manufacturing, it's typically the 3 to 5 years always depends on what kind of products and what kind of tools.

However, I am not concerned; VAT’s undisputed technical quality will help it cross-sell to other markets. Moreover, the 20% share of H1’25 total spec win shows it is progressing well.

Long-term growth - 2x market growth

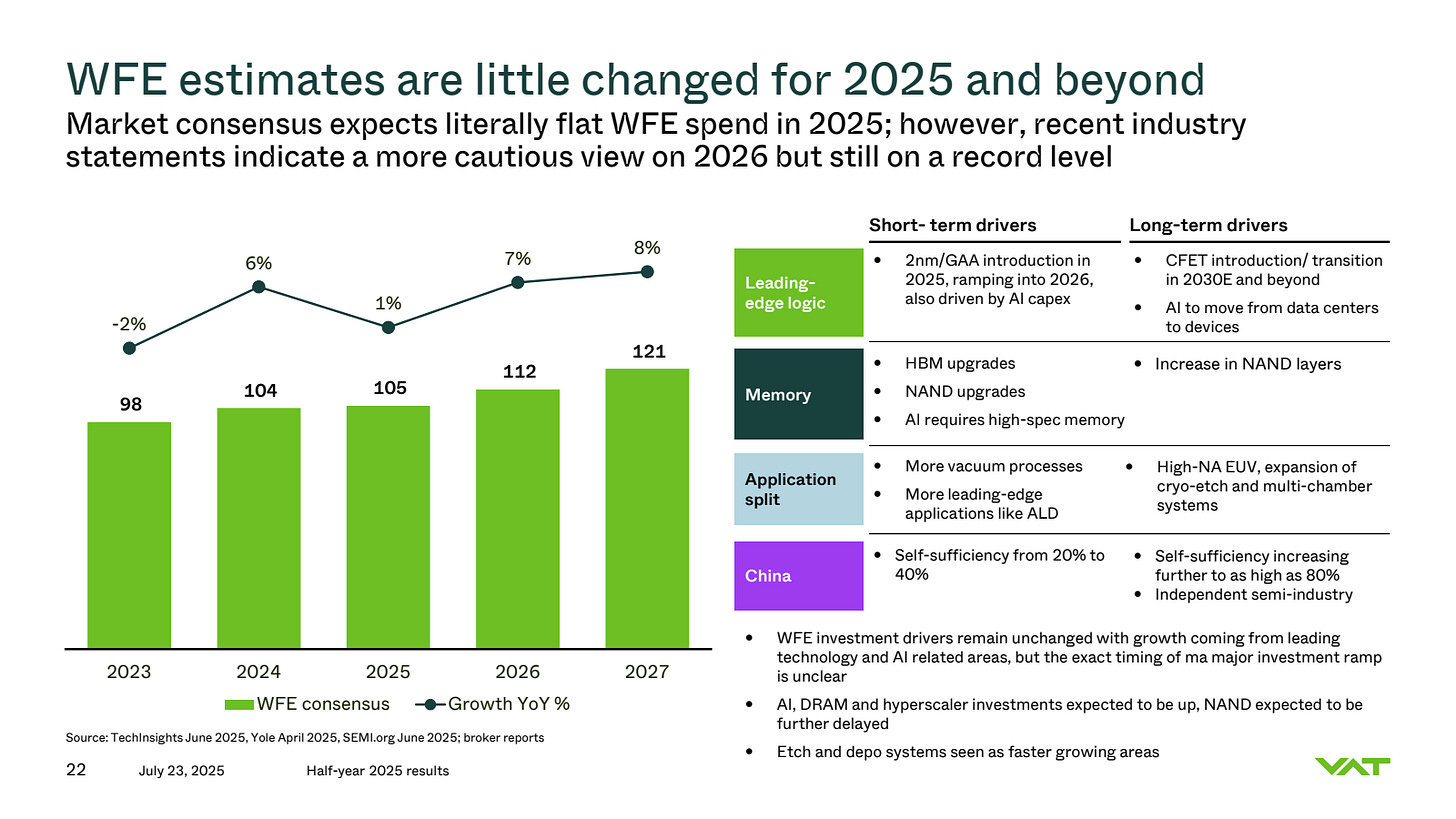

The semiconductor industry is firmly on track to reach a USD 1 trillion-plus market by 2030, as the adoption of artificial intelligence continues to require more advanced and energy-efficient chips, driven by the hyperscaler.

Consequently, wafer fab equipment spend is at record levels despite geopolitical and macroeconomic uncertainties, just north of the USD 100 billion mark. Apart from the leading foundries and IDMs, China also contributes significantly to this record wafer fab equipment spending, investing in self-sufficiency in chip manufacturing, and domestic OEMs gain a larger share.

So, demand beyond 2025 remains strong, and management expects VAT to continue growing faster than the wafer fab equipment market rate (8% in 2025), driven by its focus on vacuum and advanced equipment required for new chip technologies (such as GAA, AI-adapted fabs, and advanced memory).