FAQ

Answers to your commonly asked questions

Please use this FAQ in conjunction with the SWI Manual to get the best out of your subscription.

Section 1: SWI’s Philosophy and Framework

1 - What is Sleep Well Investments?

4 - How are you different from other newsletters?

5 - Who are you, and what's your background?

6 - What are your results so far?

7 - Do you invest with real money?

8 - Is Sleep Well Investments for me?

9 - How do you think about risk?

10 - How do you value a company?

11 - How do you screen sleep-well businesses?

12 - How do you choose which stock to buy?

13 - How do you make sure a business is still a good investment?

14 - How should I allocate capital?

15 - When is the best time to buy?

16 - When is the best time to sell?

17 - Which industry and geography do you cover?

18 - Do you short-sell stocks?

19 - Do you use leverage?

Section 2: SWI Subscription

20 - How do I subscribe? How much is a SWI subscription?

21 - What will I get from my subscription?

Section 3: Navigation

23 - Is there an owner’s manual?

24 - How do I access the Sleep Well Portfolio?

Section 4: Tools

25 - What is the SWI Checklist and Scorecard? How do I use them?

26 - What is the SWI Thesis Tracker?

Section 5: Complete beginner to investing

27 - Can you recommend helpful resources?

28 - I am a newbie to SWI. Where should I start?

29 - Can you recommend a broker?

30 - Can you recommend a financial analytics database?

31 - Which companies do you recommend buying when starting a portfolio from scratch?

32 - What if I need more specific guidance?

Section 1: SWI’s Philosophy and Framework

What is Sleep Well Investments?

Sleep Well Investments (SWI) is an investment approach and portfolio managed by Trung Nguyen, Ph.D., focused on building a long-term, resilient investment portfolio composed of market-leading, enduring businesses with strong competitive advantages. Trung shares detailed analyses, buy and sell reasoning, and portfolio updates publicly through his Sleep Well Investments platform and related channels.

SWI also offers educational content on the ‘sleep well’ investment process and analysis, aiming to equip investors with frameworks to build enduring portfolios that provide peace of mind or “sleep well” at night. The investment strategy avoids speculative trading, focusing instead on sustainable growth through fundamental research and disciplined execution.

What is your philosophy?

The SWI philosophy emphasizes investing as a part-owner of stable, adaptable businesses that can reinvest profitably and exhibit “anti-fragility” to economic cycles and crises. The Sleep Well Portfolio is designed for long-term growth with a focus on quality, discipline, and avoiding market timing by buying only when prices provide a healthy margin of safety. The portfolio aims to hold between 10 and 20 companies, monitored closely and updated regularly, with a redemption horizon extending to 2037 when his daughters take over (if they want to).

What is your framework?

The SWI framework is centered on building a risk-averse, long-term portfolio that works across macroeconomic conditions to deliver steady growth with minimal drawdowns, allowing investors to “sleep well at night.”

How are you different from other newsletters?

Sleep Well Investments stands out by focusing on a ‘no-loser’ policy, a strong risk-managed and long-term growth strategy designed to uncover anti-fragile businesses, ensuring investors can “sleep well at night” without worrying about market volatility.

This approach distinguishes it from many other newsletters that either focus on high-risk speculation or complex trading strategies. Hence, it’s not a ‘get rich quick’ strategy. And there is no shorting, no use of leverage, no speculation on macro or political changes on SWI.

Who’s the author, and what's your background?

I am Trung, the founder and author of Sleep Well Investments. I have a professional background in auditing, corporate finance, and value investing, with experience at PwC, KPMG, venture capital, and academic research (Ph.D). I previously co-led a value investing group in London from 2014 to 2019, managing external capital from HNW families in London, and now do so for my immediate family and friends.

I have invested through indiscriminate sell-offs in 2008, 2020, and 2022. As such, I felt the pain and built SWI around a disciplined, long-term investment approach to prepare for black swan events and provide peace of mind for investors.

What are your results so far?

Since sharing the Sleep Well Portfolio publicly and going paid on Substack, the portfolio has consistently produced an annualized compounded return between 40-70% per pick, and the portfolio has consistently outperformed the S&P500 (top 500 companies in the US). You can track my results in real-time (accessible to annual premium members) or monthly on my monthly portfolio update reported here.

Do you invest with real money?

Yes, I eat my own cooking. All transactions reflect my buy/sell on my Sleep Well Portfolio, built for my daughters, and my personal account (PA) that I manage for my family and friends. I win, you win, you lose, I also lose. My interest and incentive are aligned with yours.

Is Sleep Well Investments for me?

Yes, if you are looking to:

🕵️♂️ Train to think like a business owner and not just a trader of paper shares.

📝 Learn to tune out noise and focus on what matters most in business.

🦮 Be assisted alongside your investment journey

💹 Outperform the market in the long term

No, if you are looking to:

❌ Get rich quick

❌ Blindly follow someone else’s advice

❌ Outperform the market every single year

How do you think about risk?

What is risk? - It’s knowing the company less than the market. When you buy, someone is selling. So, the more you know, the lower your probability of loss.

Risk is not to be confused with the volatility of the stock price. That could be an indicator of risk, but it says nothing about the quality of the business model, the market position, or the durability of growth of the company.

Measure of risk? - I like how Howard Marks measures risk. It’s earning market type gain or above market type gain with lower losses in the downturn.

Howard Mark's framework is great - please have a listen

How do you value a company?

Over the years, my valuation work has become increasingly simpler. 90% of my investment decision is dependent on how deeply I understand the quality of the business compared to the market, and the margin of safety comes from the resiliency of the company rather than the cheapness of its valuation.

Having said that, I do provide a simple working of discounted value of future free cash flow (to 2037) of all companies (DCF), a comparison of multiples (price to earnings, price to free cash flow, etc) to peers, and a reverse DCF (where I attempt to work out how fast free cash flow growth the market is expecting at the current price).

How do you screen sleep-well businesses?

I don’t use any screeners. I consider each business one by one. I focus on the industries and products that I feel I can understand and that I can sustainably follow and update. That way, I will be motivated to track and own with interest 5, or 10 years from now.

How do you choose which business to buy?

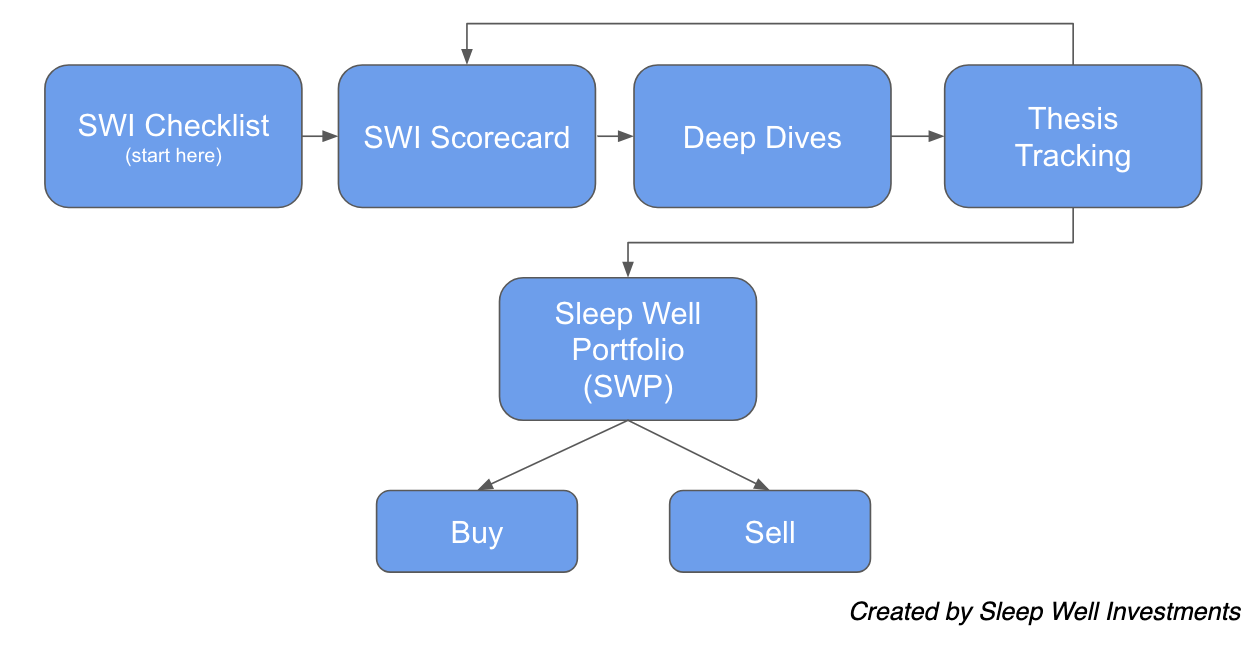

Businesses need to pass my rigorous Sleep Well Checklist (step 1), which gives out a score (step 2) to each company. Then, their resilience is ‘back tested’ and ‘stress tested’ against external adversities. I examine this in my deep dives (step 3). Next, I track their KPIs using the Sleep Well Thesis Tracker (step 4) and buy/sell if they add value to the Sleep Well Portfolio (step 5). I take a very methodical and patient approach to my portfolio construction, and I don’t let my emotions control my decisions.

I believe I have a robust checklist, and I refine it as I improve as an investor. Naturally, the more I do this ‘detective job’, the more I know what to focus on for different industry/product/business model to distinguish between a sleep-well or a nightmare business.

How do you make sure a business is still a good investment?

I keep track of all portfolio businesses, share the report, and record them on my tracking sheet (annual sub only). For companies that have yet to own, I write updates when there are significant changes so that you and I are all prepared to buy when the moment is right.

How should I allocate capital?

It’s a personal decision. You should allocate according to your understanding of the chosen business and your life circumstances. Choosing between risk and potential return, I always favour choosing one with less risk first. That doesn’t always mean less return! It just means I am more confident of the likelihood of it not going out of business.

I will endeavor to provide what I consider good buys every month in the portfolio review, but please understand that it is my personal choice, and you would need to adapt it to your goals/circumstances.

When is the best time to buy?

The best time to buy is when strong fundamentals meet with unfounded pessimism about the stock. You should see the most significant discrepancy between the business’s real value and market price.

But it’s a rare occasion.

A more typical case is that now is the best time to buy, as long as the business quality is sound and you are ready to own it for the long term, without paying an exorbitant price (paying at a reasonable and fair price is fine).

When is the best time to sell?

At SWI, the best time to sell is never! However, my capital is limited, and I don’t have a constant salary, so I often have to sell to buy something new. In that regard, I sell because I have found a better opportunity.

Next, I sell because I see more permanent deterioration of the business, for example, (i) the business is not tracking the progress it should for many quarters, (ii) it stop reinvesting in itself, (iii) changing its long-term aim and mission, (iv) a new, formidable competitor enters, or (v) management messages become more inconsistent.

Which industry and geography do you cover?

I cover a broad spectrum, including: life science, cyber security, logistics, e-commerce, technology platforms, industrial products, real estate, and construction products. I am less interested in covering cyclical consumer products (B2C), but am open to it when I see a scalable component product/platform.

I also cover globally and have no bias towards any region. Allocation is mainly based on merits and value added (growth or wealth protection) to the existing holdings.

Do you short-sell stocks?

No, we only have long positions. I don’t see unlimited losses for only 100% gain as a good deal.

Do you use leverage?

No. My goal is to limit losses first. Leverage gives more upside in good times but can be destructive in bad times.

Section 2: SWI Subscription

How do I subscribe? How much is a SWI subscription?

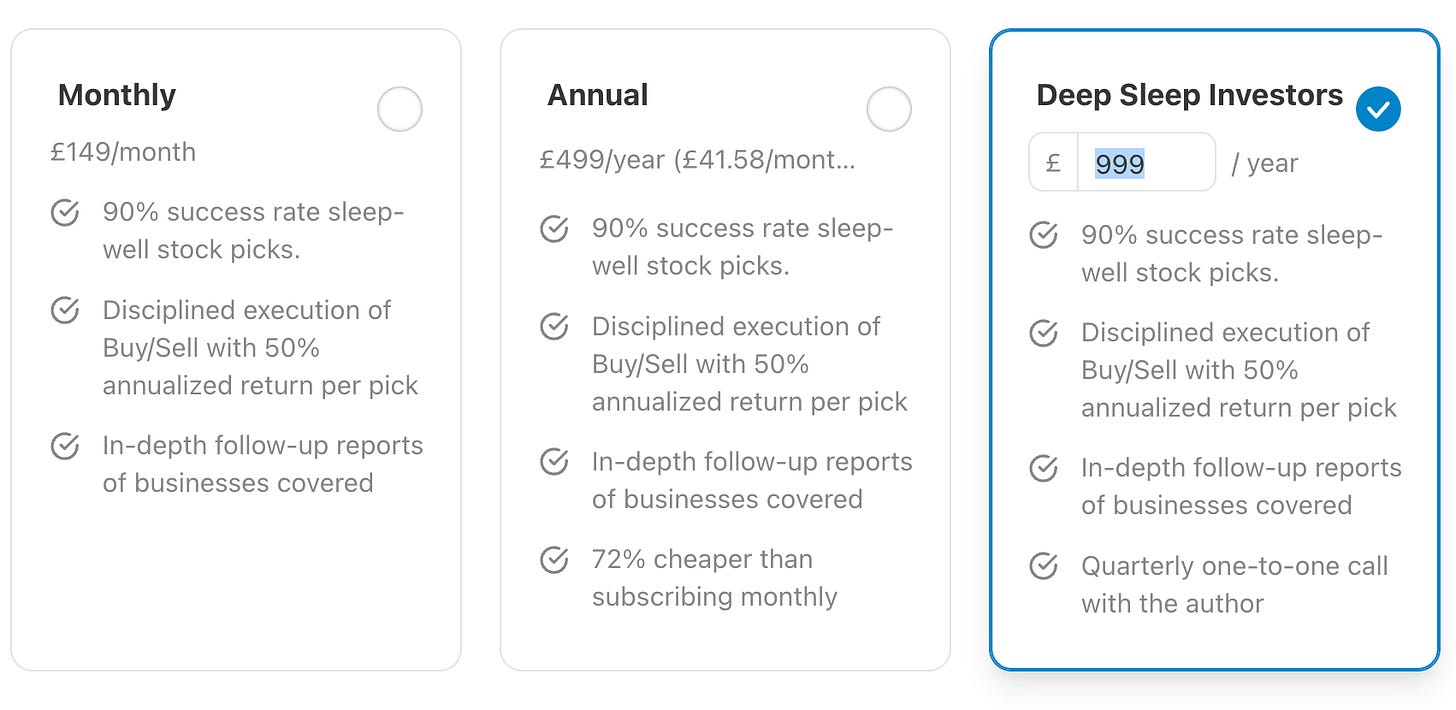

You can subscribe with this link or click the subscribe button below.

What will I get from my subscription?

Each plan gives you different things, but all will provide you with access to all of my deep dives, updates, buy/sell, monthly portfolio review, and ad-hoc reports. Annual subscribers also get access to the real-time tracking of the sleep well portfolio, research list, KPIs, and valuation of all businesses.

When will I be billed?

You will be prompted to pay at checkout, and an invoice will be sent directly from Substack.

Section 3: Navigation

Is there an owner’s manual?

Here is the link to the manual.

How do I access the Sleep Well Portfolio?

Please note that only annual subscribers have access to the portfolio (request access here). It also provides the tracking sheet, the monthly portfolio review, the research list, and the valuation tracking.

Section 4: Tools

What is the SWI Checklist and Scorecard? How do I use them?

The SWI Checklist contains a list of questions to find out the business's likelihood of surviving potential adversities and generating positive returns. An investment will receive a score against each criterion, and it’s the overall score that will determine whether it’s ‘sleep-well’ or not.

What is the SWI Thesis Tracker?

We use the SWI Thesis Tracker to make sure a business is making progress towards its goal over time. We use it to make sure a company is still worth keeping in our portfolio.

Section 5: Complete beginner to investing

Can you recommend helpful resources?

I started with reading books by Peter Lynch (my review here) and then slowly read other authors and outstanding investors, including Pulak Prasad, Scott Fraser, Ralph Wanger, and Terry Smith.

I am a newbie to SWI. Where should I start?

If you are new, I suggest checking out the manual and this page, which has links to other useful resources to get you familiarized with the SWI philosophy and stock selection process.

Can you recommend a broker?

I use Interactive Brokers, not the easiest to use, but it has all the stocks that I cover. If you open one, consider using my referral code (up to a $1000 reward for both, as of September 2025 offer).

Can you recommend a financial analytics database?

I use fiscal.ai for all my financial data crunching—my personal Bloomberg. If you use it, consider using my referral code for a 20% discount.

Which companies do you recommend buying when starting a portfolio from scratch?

I recommend reading all companies in the portfolio and having a plan to buy the ones you understand the most. However, you can also look at my current allocation as a proxy of my conviction for each business. Also, check the recent Buy/Sell report to know if all information still applies.

What if I need more specific guidance?

You can direct message me via Substack Chat or email me, and I’d recommend subscribing to the ‘deep sleep annual plan’, where I will spend an hour with you each quarter to guide you through your investing journey.