✅ Buy Alert - 3rd Buy, 35% FCF margin <1% attrition business growing at 20%, 10yr low valuation

Positive management change and continued top customer additions give me confidence amid uncertainties. Business remains top class for a 50% discount from my initial buys.

**Black Friday Special** This trade alert post is FREE to read. I appreciate your support. While prices are down this month, this is an excellent opportunity to add to future winners!

If you are new to SWI, check out our FAQ and Owner Manual.

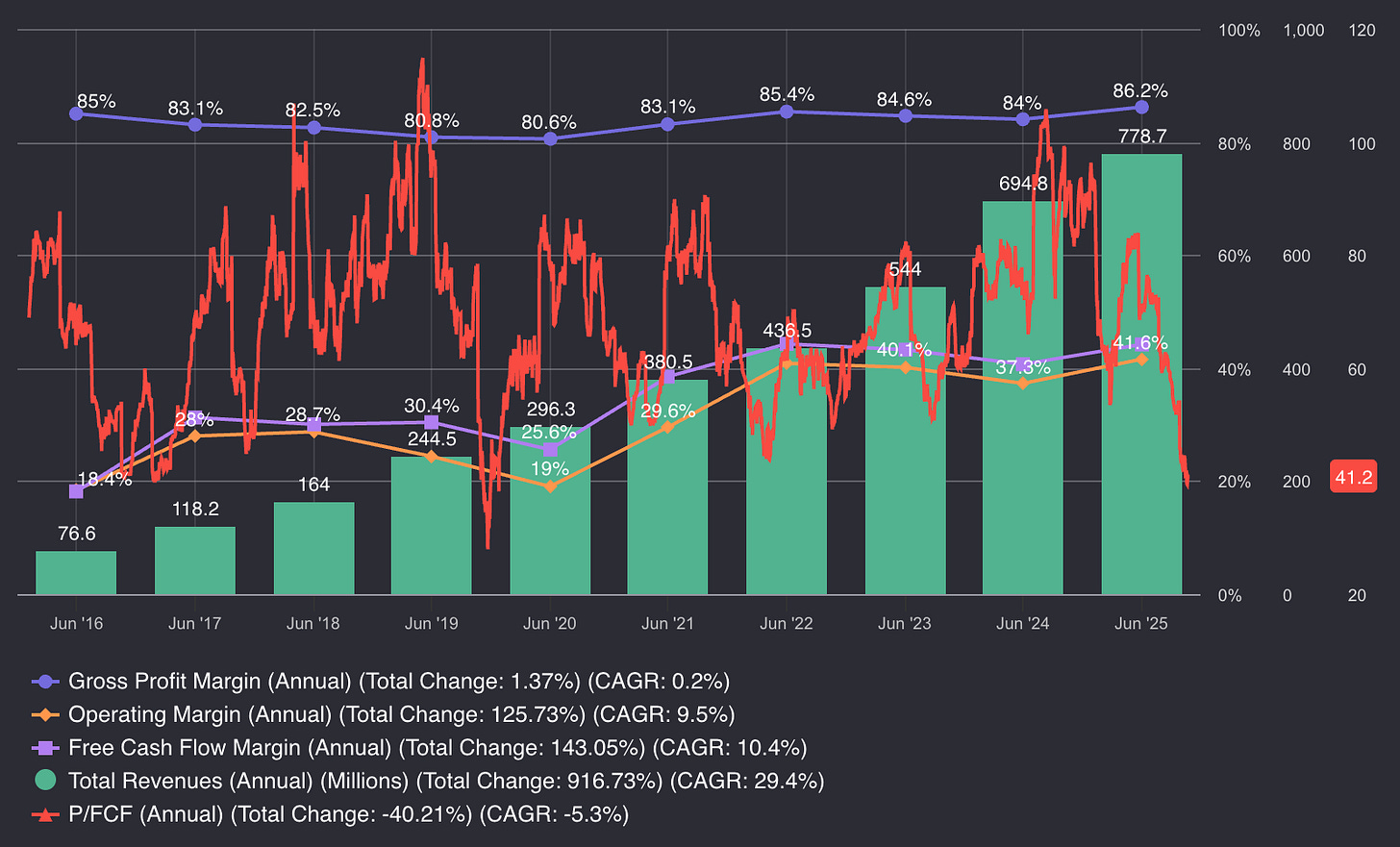

I am buying more Wisetech (WTC). Best of class business (86% gross margin, ~35% free cash flow margin, growth at ~20% expected mid-term), trading at the low end of the last 10 years p/fcf valuation at ~40x.

Read my past writeups for full context: deep dive, buy alert 2, buy alert 1, FY24 update, H1 FY25 update, CEO shake-up, E2Open acquisition, Back to basics. (tracking sheet below)

And in case you missed it, WTC was featured in my November Best Buys, and a few days before buying WTC, I also bought Sea Limited (SE) for my PA at $136/share.

What’s going on with the stock?

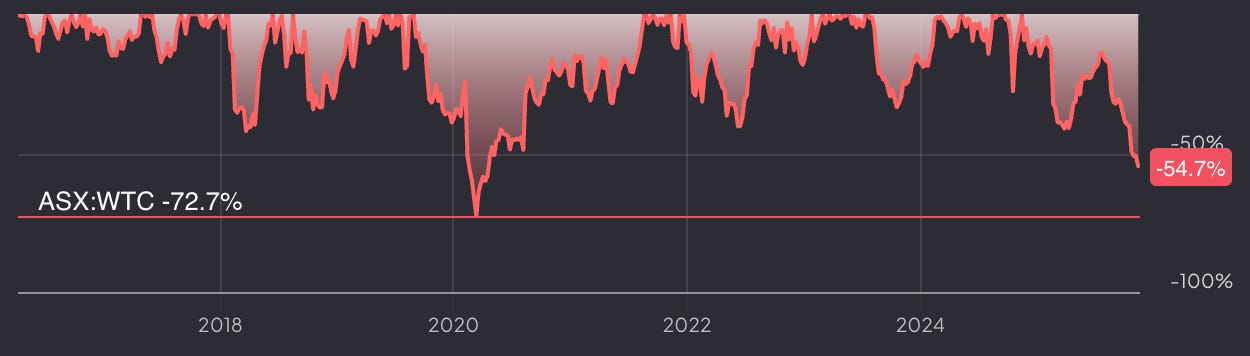

The stock has declined 55% to AUD 60 from AUD 134, primarily due to the ‘loss of focus’, to put it mildly, by the co-founder and current executive chair, Richard White (30%+ owner of shares). He has led the business for the last thirty years. Still, the sex scandal and power-grabs saga undoubtedly derailed business momentum, delayed key product releases, and slowed revenue growth.

I am a bit annoyed as it was an unforced error (more here), but as someone who wants to own the Wisetech business forever, I am a happier buyer here.

What’s going on with the underlying business?

But it’s been a year since the news broke, and I feel vindicated as I am still holding and now in a position to add more. My thesis-breaking event has always been that if a key top large freight forwarder (e.g., UPS, DHL) leaves, then something more rotten is going on, and that means I would have to reconsider my position.

Yes, growth slowed in the last 3 quarters, but instead of losing clients, WTC has continued to onboard large clients, and the last two top 25 LFF wins are going to produce 3x the wins of 2024. They are Nippon Express, a $20B revenue company and the most prominent logistics logo in Japan, which signed CargoWise due to losses from internal software failures, and LOGISTEED, a $6B revenue company with a presence in 100 countries.