Business Update - Floor and Decor: Q2'23 Thesis Tracking - Gaining Market Share Despite Further Sales Decline

Organic sales declined 6%, management lowered stores opening target and FY23 guidance, but long-term thesis is intact. FND continues to gain market share, outperforming Home Depot and Lowe's.

I am Trung. I write 10+K words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, and 3rd). Join me in building generational wealth.

Hi, sleep-well investors (SWIs),

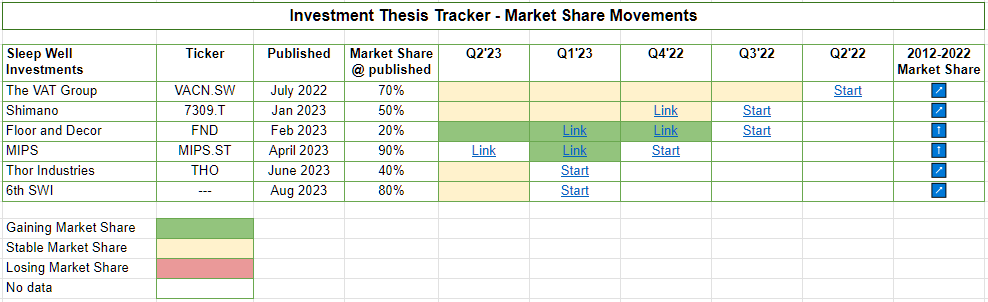

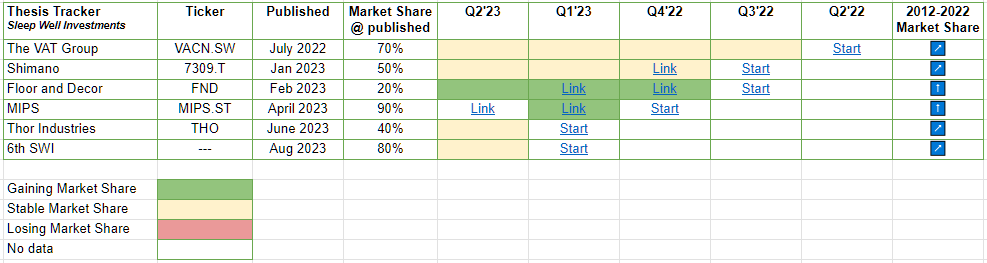

Before I review Floor and Decor’s Q2’23 results, I am excited to introduce a new feature - Thesis Tracker to the newsletter and the first portfolio change.

It tracks market share movements of all picks relative to key rivals to keep us focused on the long-term and the big picture (more about it here). That means internalizing the thesis and looking a decade ahead.

Floor and Decor is the best place for flooring solutions.

How does the company look like in 2032?

I keep things simple and effective as I focus on what matters most. So, each quarter, you will receive an update on how FND and other sleep-well businesses perform against their rivals.

While it’s only one KPI, there is much digging behind it. It’s triangulated from 3-4 sources.

Revenue generated vs. peers,

Big client wins/losses

Industry rankings

Alternative metrics

I encourage you to check out the thesis tracking updates of MIPS and CRWD to appreciate the breadth and depth of my research.

MIPS market share data, for example, is derived from three aspects:

MIPS’s revenue vs. key players.

MIPS’s appearance in teams at the Tour de France.

MIPS’s management comments at earnings calls.

In this review, you will see FND’s market share movements vs. Home Depot and Lowe’s.

1st Portfolio change and Links to all SWIs

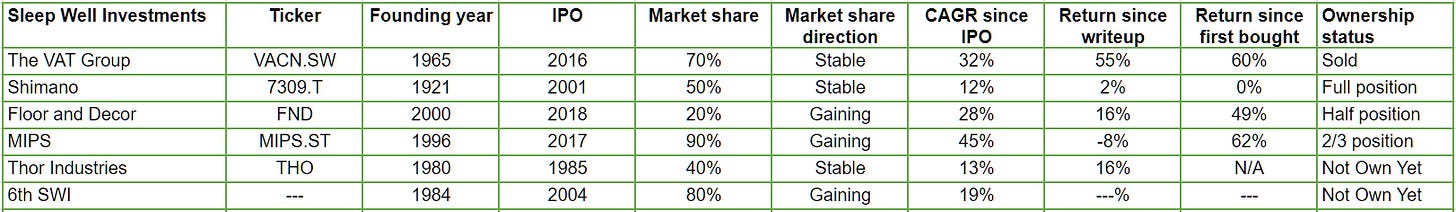

The following table shows my ownership position in all picks and their scores:

The VAT Group - Vacuum valve monopoly +32% CAGR since IPO

Shimano - Bike component monopoly +12% CAGR

Floor and Decor - Future monopoly in hard-surface flooring +30% CAGR

MIPS - Helmet safety monopoly +45% CAGR

Thor Industries - RV monopoly +14% CAGR

6th SWI - Medical Device Monopoly +17% CAGR

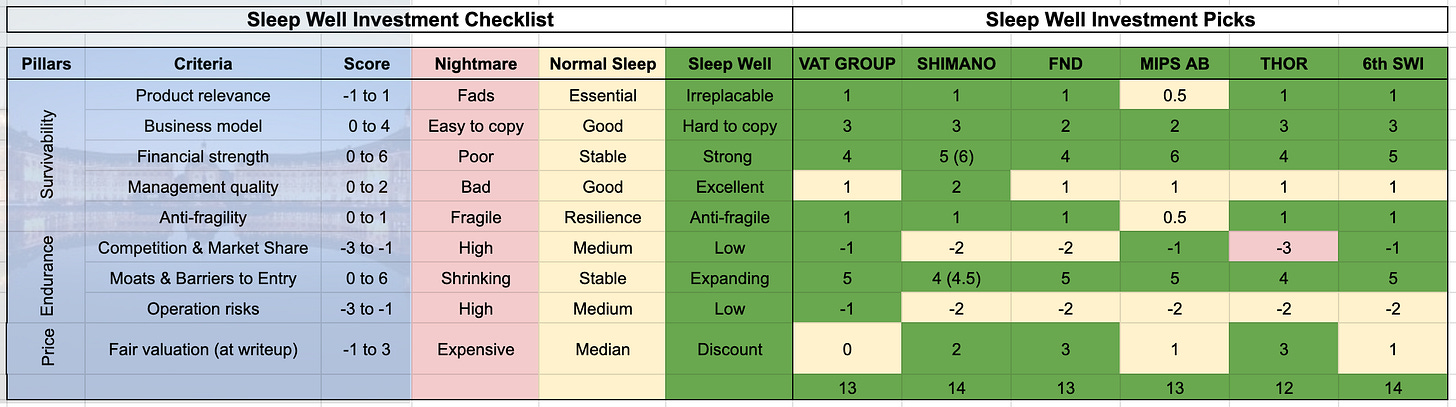

Sleep Well Investments Score (Sept 2023)

I have made the first significant portfolio change this year, selling The VAT Group for an 80% gain in only a few quarters. VAT was valued at PE 17 FY2032, making other picks’ risks and rewards ratio more attractive. For example, Floor and Decor is trading at PE 5 FY2032, a position I am still building. In this Q2’23 review, you will see that the business is doing great despite the 22 consecutive months of year-over-year declines in existing home sales from rising mortgage rates in the US. Additionally, I sold VAT because I need the cash to start a position in the 5th and 6th picks where the right price is not far away.

The combination of sleep-well business quality at a deep discount remains rare in this market environment. However, I am lining up three leading businesses in the coming months. I will meet one of the management teams to dig deep into their competition and reinvestment strategy. I am excited to share the next write-up(s) soon. So, stay tuned.

Floor & Decor - Q2’23 Thesis Tracking

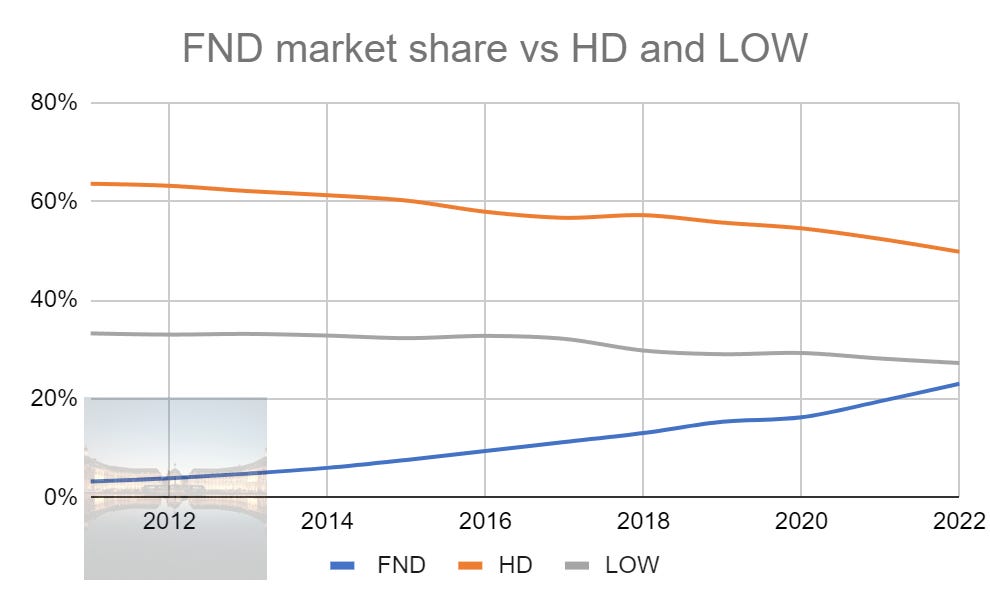

In Q2’23, Floor and Decor continued to win market share from Home Depot and Lowe’s. You can see the three consecutive green boxes on FND’s market share timeline since my deep dive in Feb 2023, a continuation of the past 10-year market share gain.

To refresh your mind about Floor and Decor, skim my thesis below and read the full write-up here.

Floor & Decor’s primer

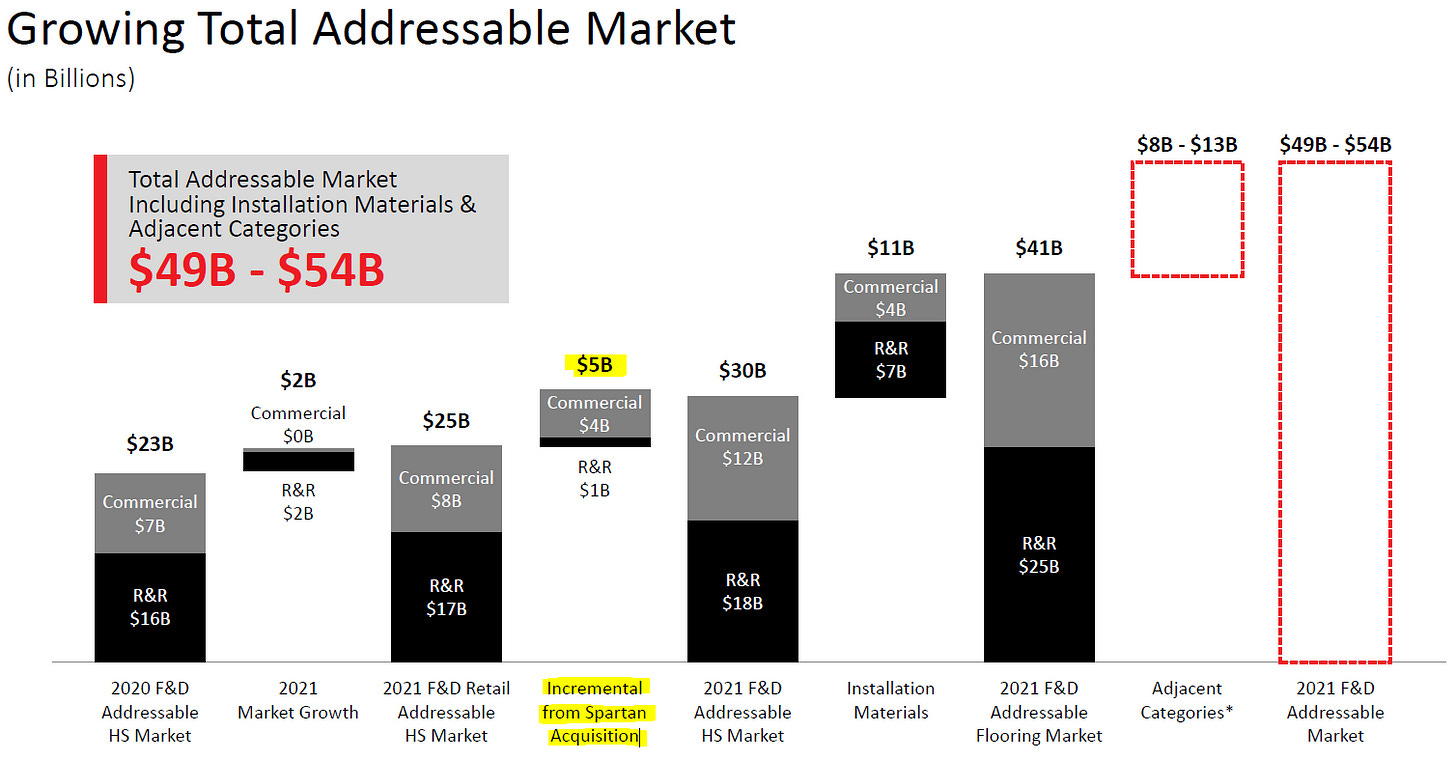

Floor & Decor (FND) is a hard-flooring warehouse retailer with a 9% market share, operating 194 stores across the US. It has a clear capital allocation plan to widen moats and win market share. At maturity (450 stores in 10 years - my base case), I estimate that FND could command a 25-30% share of the market on the basis that industry leaders Home Depot (HD) and Lowe’s (LOW) fail to keep up with FND’s scale (breadth and depth of assortments) and value prop for Pros (adapting from the Costco playbook); meanwhile, the demand for hardwood flooring will continue to support long-term industry growth. FND has clear visibility to expand revenue by 10%+ CAGR and EBIT by 15%+ CAGR in the next ten years.

Q2’23 FND Results Review:

There are two key questions to ask:

Can Floor and Decor continue to provide the best value for pro customers and take market share from Home Depot and Lowe’s?

How many stores can it open by 2032 and how will the unit economics unfold?

Everything else is secondary and perhaps noise.

1. Market share

Floor & Decor’s market share (blue line) rose consistently from 2011 to 2022, at a loss from Home Depot and Lowe’s, the top two DIY mammoths.

During this period, Floor & Decor's annual sales rose 17x from $276M to over $4B, while the two rivals saw sales increase only by 2x.

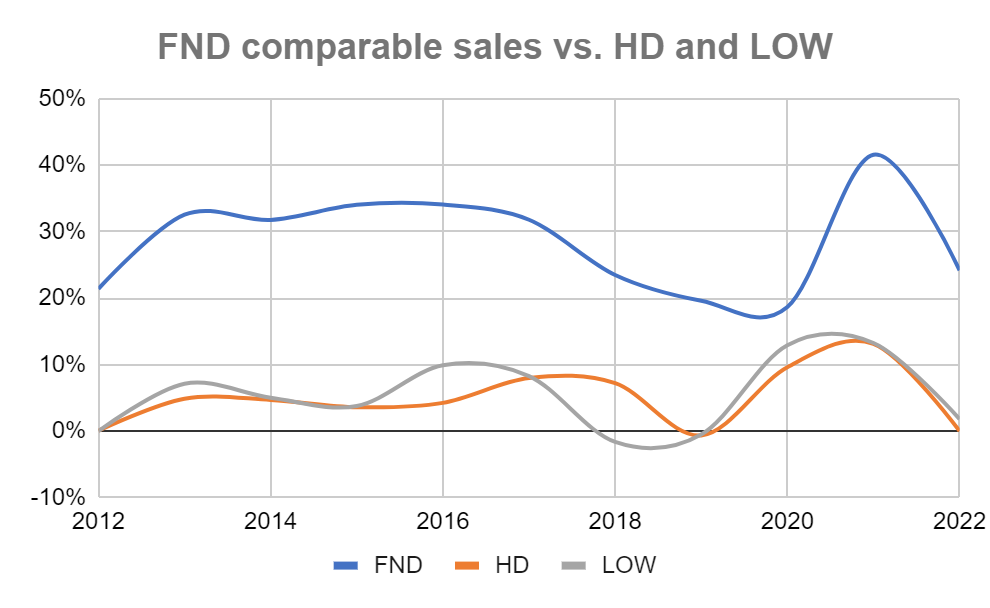

The numbers are buried in Home Depot and Lowe’s 10-K sales breakdown for all product categories (10+). Comparing the YoY growth, the picture is clear.

Floor & Decor’s average growth rate of 29% annually far surpasses the other two, at just 5%. While half is attributed to sales from new stores, the other half, or 14% organic growth, is still a significant outperformance.

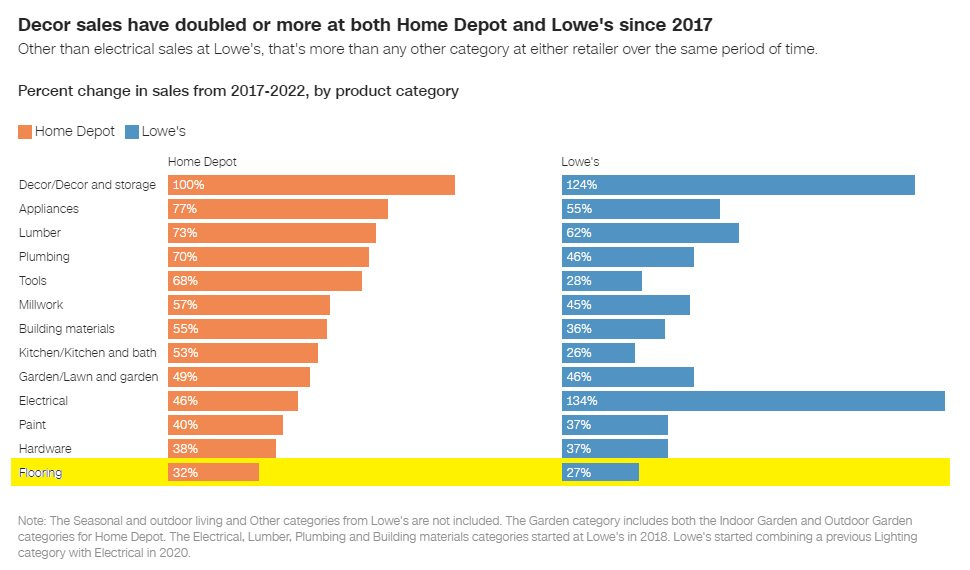

My number is consistent with the report below, showing HD and LOW’s poor performance in flooring in the last five years, growing sales only around 30% between 2017-2022.

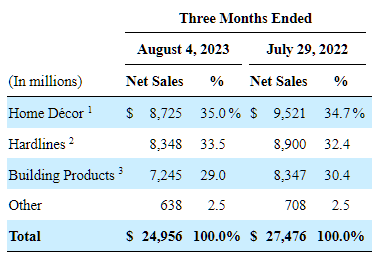

Looking at quarterly data, unfortunately, we can’t do the same like-for-like comparison. HD and LOW’s 10Qs bundle up sales. They only report three categories: Building materials, Decor, and Hardlines, and flooring is tucked under Decor.

However, I can accept it as a close proxy for ‘flooring.’

In Q2’23, HD and LOW saw a sales decline of -5.1% and -9.1% in Decor, respectively, more or less in line with the -6% decline with FND.

The decline is sharper than their overall comp sales of -2% and -1.6%, and if it was just flooring, I would guess that HD and LOW comps are even worse. This makes sense as flooring is a more expensive job than others, which consumers are delaying spending or can’t spend as they cannot afford to move into a new home with high mortgage rates.

Overall, it’s fair to conclude that Floor & Decor’s market share is still expanding against its key rivals as it continues to provide the best value for homeowners and Pros, although at a slightly slower pace in the first half of 2023.

*I haven’t mentioned the mom-and-pops or independent retailers because they are the biggest market share losers in this battle. Moreover, they have not got the ingredients to build the product’s breadth and depth to compete with these three.

2. Long-term targets - store opening and unit economics

The second most important question and focus is

How many stores can FND open by 2032, and how will stores unit economics look like?

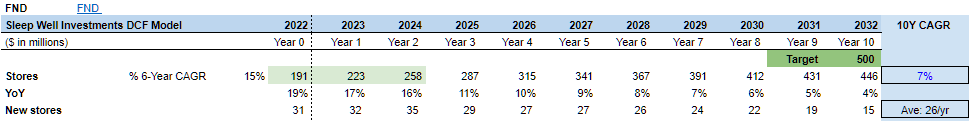

Management targets 500 by 2032, but I’d consider it a success if they reach 446 warehouses.

To get to 446 stores, FND needs to open roughly 26 stores a year or at a 7% CAGR until 2032.

For 2023, management targets 32 (35 for 2024), down from 32-35 earlier in the year.

It opened

3: in Q1’23

9: in Q2’23

So, it needs to open another 20 to meet the management target.

Given this year’s problematic outlook, low cash level at only $4M, and high borrowing rates (7% 30-year mortgage), I don’t think they would want to force it. FND’s store opening will likely disappoint in the short term.

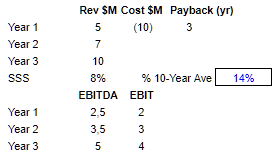

How about the unit economics of new stores? The CFO, Trevor Lang, also pointed out that new stores recently opened are doing fine.

our new store classes are still comping positive - Q2’23 CC

As such, new stores unit economics remain what they guided at FY2022

Overall, opening fewer stores this year is not a concern for me because

Larger home improvement spending will return. Homeowners can only postpone for so long,

Fewer stores opening means higher free cash flow as it spends less on Capex,

Meanwhile, existing stores continue to generate more free cash as they mature.

Moreover, I only need 26 new stores a year for my investment in FND to work. But if it doesn’t, it’s not all at a loss. The trade-off could be better free cash flow per share. You can return to my original deep dive for detailed valuation workings and assumptions.

3. Other notable mentions

Pros customers

Pros are the industry’s most knowledgeable, frequent, and high-ticket buyers. Thus, their affinity for FND’s products speaks volumes on FND’s value proposition.

In Q2’23, the pro segment grew +9.2%, decelerating from 19.1% in Q1’23, but is making up 43% of total sales, up from 41% last quarter and 35% in FY21. The positive trend shows FND’s success in catering to Pro customers.

Commercial arm

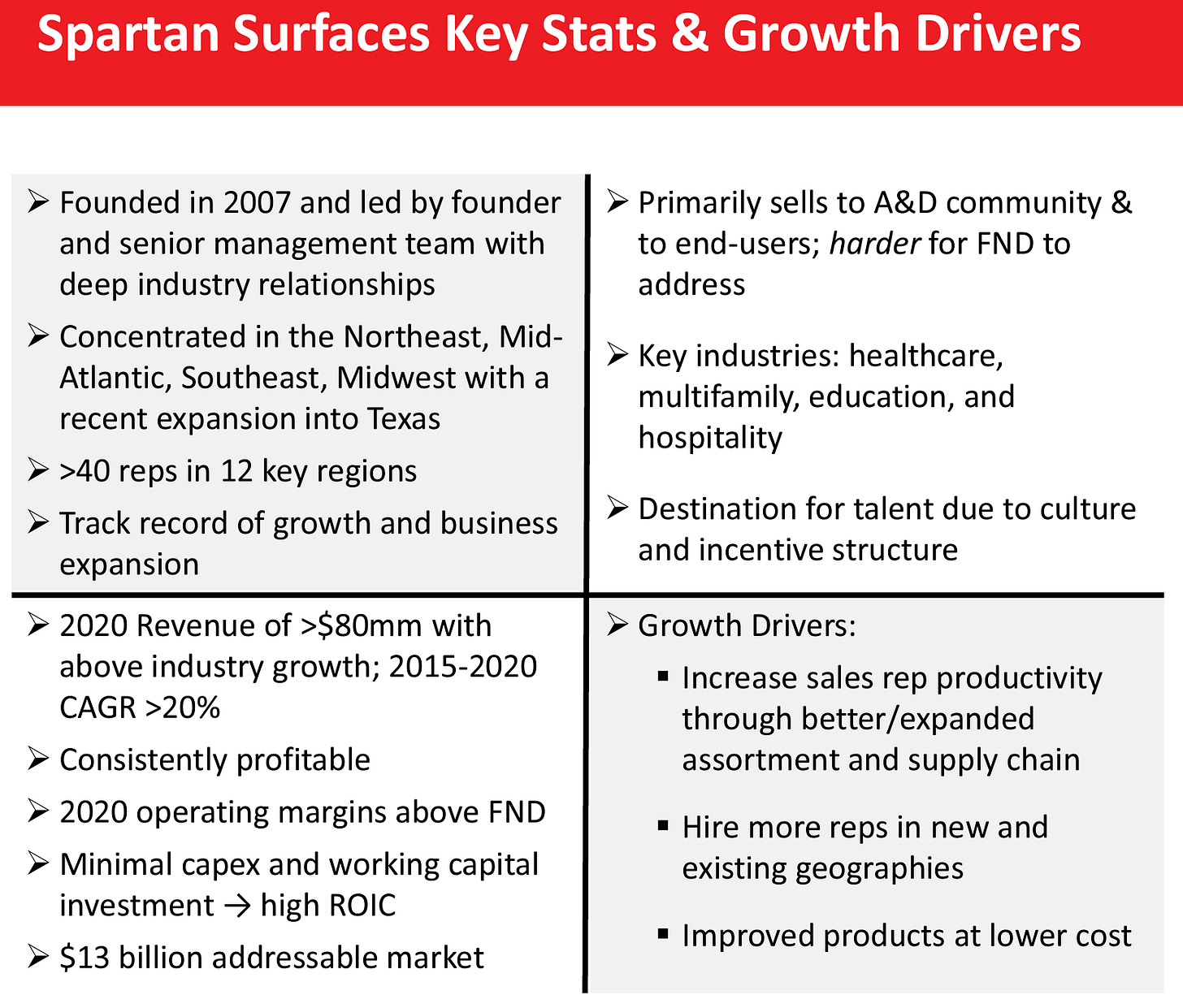

Moving on to the commercial flooring business, Spartan’s (acquired in 2021 for $77M - stats below) and RAMs (protective floor board) outperformed in the quarter.

Spartan revenue increased 40.5% YoY, accelerating from 32% YoY in Q1. Management didn’t provide precise figures, but EBIT growth remained strong (74% YoY in Q1). Spartan acquired Sales Master Flooring Solutions, a top commercial flooring distributor in New York City. With a base revenue in 2020 of $80M, strong organic growth since acquired, and the recent acquisition, FND might have grown an extra arm to attack the $5B TAM.

Meanwhile, the RAM business grew 39% YoY in Q2, decelerating from 70% YoY in Q1 and 72% YoY in Q4’22. There are no meaningful numbers from here, so I’ll check FND’s 10-K next year for further clarity.

Diversification of suppliers

Another notable mention is the progress in diversifying supplies from China to 29% of sales from 50% in 2018. I’ll track this as diversification improves FND’s business model, making it more independent from any party, which can alleviate problems in tough times, as we have seen during COVID-19.

Current market condition and outlook

Short answer: No one knows

But, I have collected a few quotes from industry experts for reference.

Ted Decker - Chair, President and Chief Executive Officer of Home Depot

when we do get through this period of moderation, we remain incredibly bullish on the sector. We couldn’t feel better about the macro for housing and home improvement and our prospects and ability to keep taking share in this huge and still largely fragmented market.

Marvin R. Ellison - Chairman and CEO of Lowe’s

it's encouraging to consider that home improvement projects are typically postponed rather than cancelled. And home improvements spend as a percentage of home equity is below the historical average, a positive indicator for medium term demand as consumer sentiment improves. The aging housing stock will also draw remodel and repairs combined with other favorable trends like millennial household formation, aging in place, and persistent remote work. All of these factors continue to make us bullish on the mid to long term outlook for our industry.

Finally,

Tom Taylor - CEO of FND

homeowners and pros are engaging in fewer projects and undertaking smaller-scale flooring projects and are very intentional in their purchase decisions.

we are operating from a position of strength and are excited about the opportunity to continue to grow our market share in fiscal 2023 and beyond. We are confident that we have the right people, strategies and business models to continue navigating this challenging macroeconomic environment successfully.

Overall, all CEOs acknowledge uncertainties in the short run as consumers spend more on services and smaller projects after COVID-19. However, they are bullish on the long-term trend as the industry is well-supported by the aging housing stock and highly fragmented markets.

4. Thesis repeat

Suppose you are struggling to see why FND is a worthy investment in these challenging times, especially when shares are whipsawing up and down 20% each quarter. The following bullet points can help. FND will win more market shares because:

FND has the most differentiated and broadest product line. It has 3x SKUs (1700+) vs HomeDepot.

It offers lower prices due to the direct and in-bulk sourcing supply chain.

It offers a better shopping experience for pros. FND has 10-15x the floor space (78K sq feet) vs. HomeDepot’s 5K sq feet, 55 flooring customer service employees per store vs. 2 in HD’s store.

Hyperfocus on Pro customers, who drive frequent and large ticket sales; to date, Pro customers account for 43% of total sales, higher than Home Depot and Lowe’s.

The multi-year thesis is intact. Q2’23 adds more data points to show that Floor and Decor continues to gain market share by

Increasing sales faster than peers by opening new stores and growing organic sales / comparable sales.

Increasing customer value by passing along its cost advantage to maintain as the lowest cost and most differentiated hard-flooring retailer.

Continue to prioritize added services to loyal pro-customers and homeowners.

I have selected a few quotes from the CEO, Tom Taylor, and President, Trevor Lang, during this challenging time - Q1’23 and Q2’23 conference calls:

On passing on benefits of economy of scales

we are building on our value proposition in 2023 by passing along some favorable supply chain costs to our customers by selectively lowering prices on specific SKUs. We intend to maintain or widen our product price gaps with our competition and are monitoring unit price elasticity to enable us to drive incremental growth. We have introduced new lower price signage in our stores and website further reinforcing our strong value message. Q1’23

Our product price gaps are as strong as ever and on like items, they sequentially widened during the second quarter. Q2’23

On focus on homeowners and pro-customers

we are intently focused on driving further engagement with our homeowner and pro customers in 2023. Q1’23

On market share

since 2020, we’d had over 500 basis points of market share gain relative to what they saw from their other people buying from specialty flooring as well. So the three – the ways we triangulate it shows in all cases, we’re gaining market share in this environment. Q1’23

our business continues to take market share is because our better and best assortment is incredible and our pricing differential versus our competition is also very high. Q2’23

Valuation - $108/share fair value ($110)

Tom Taylor, the CEO, has a ten-year target of 500 stores. As a reminder, he revised the target two times in the past, from 400 store target at IPO and 315 back in 2012.

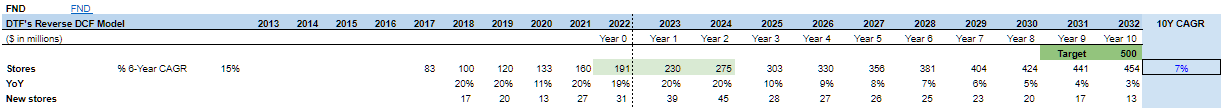

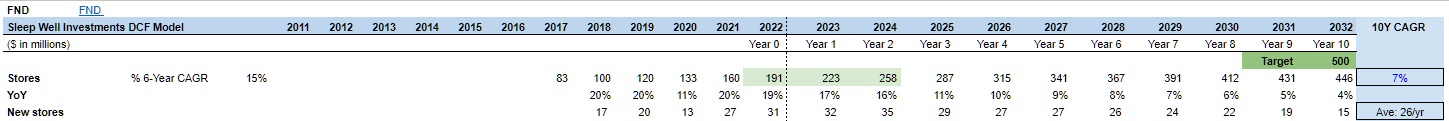

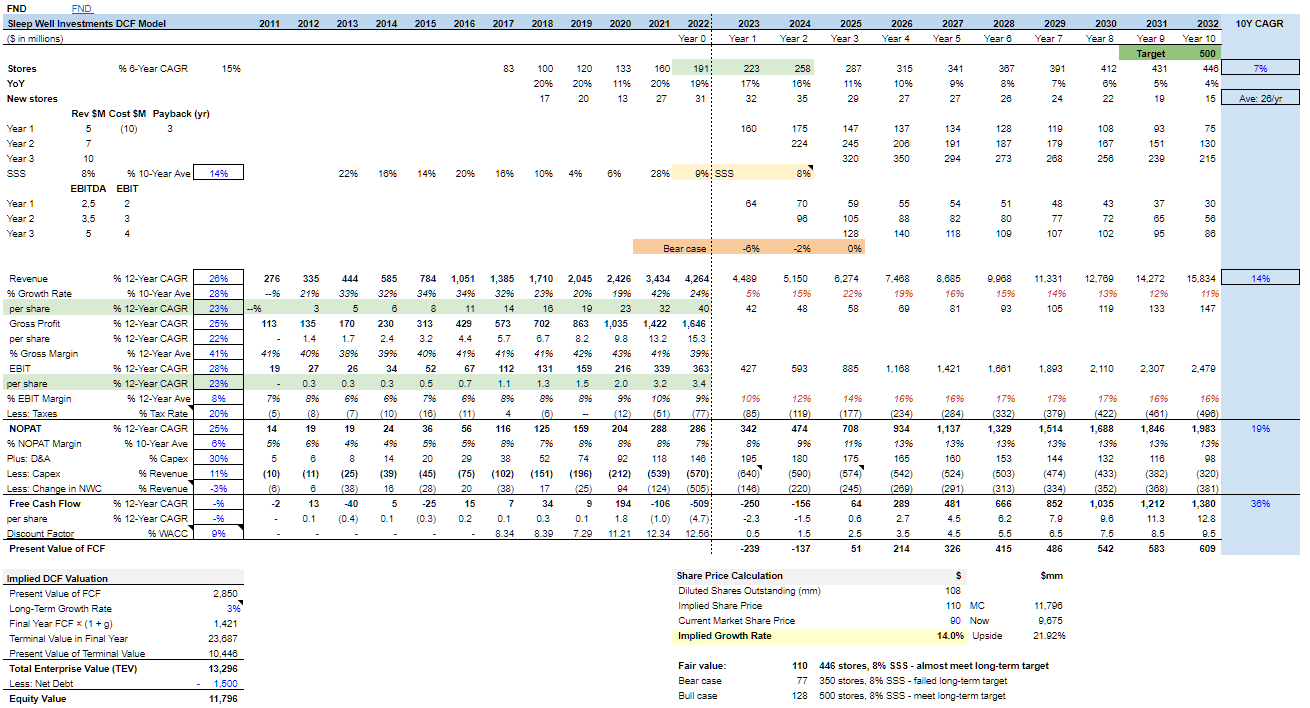

My original valuation (below) assumed FND would build new stores aggressively at a 20% CAGR for the next two years (39 stores in FY2023 and 45 stores in FY2024) and then slow down to a 7% CAGR until FY2032 to reach 450 stores (base case).

With the updated FY2023 and FY2024 new store guidance, I revised the expansion plan to grow slower in the next few years (32 in 2023, 35 in 2024) to reach 446 in 10 years (updated base case).

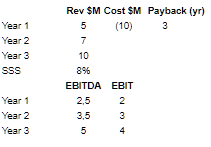

I am using the new store unit economics per the management guide,

We get to a revenue projection of $15.8B in year 10, FY2032, assuming an 8% SSS and 6% & 2% sales reduction in 2023 and 2024 to consider the impact of the housing market downturn.

With a 9% WACC and 3% terminal growth, that brings us to $1.4B in FCF by FY2032 and roughly $12B in Market Cap, or $108/share, implying an 18% upside from today’s price, $93/share.

This is $8/share lower than my original valuation, driven by fewer store openings in the next five years, pushing the impact of a higher return on invested capital (ROIC) and free cash flow generation further to the later stage.

Nevertheless, my updated DCF valuation still shows an attractive investment today.

In terms of multiples, we can work out the intrinsic value by applying 5x, 10x, and 15x to the terminal FCF, $1.4B, in the base case. You get a ~$7B, ~$14B, and ~$21B business in ten years, respectively.

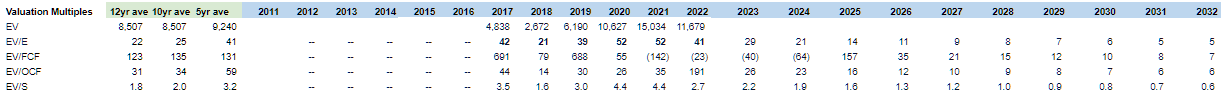

Below are the various multiples from 2017 to 2032 at the base case.

Floor & Decor’s EV/E has ranged from 21x to 52x since IPO. Thus, the stock appears cheap at the FY2023 27x. By 2032, FND could be valued at 5x Earnings and 7x FCF.

Together, both valuation methods point to an attractive price. But as my new base case valuation of $108/share doesn’t provide a 20% margin of safety (I require 30% at initiation but at 20% once I gain more confidence in the business, which is the case with FND) from today’s price at $93/share (it’s at 18%), I am happy to wait for the price to go down to around $90/share to accumulate my Floor & Decor position to 3%.

Closing thoughts

FND continues to beat peers. It may get worse in 2023, but I believe FND is resilient and prudent in balancing between expansions and managing profitability. I remain bullish on FND.

To review the full write-up, please visit this link.

Links to other writeups are:

The VAT Group - Vacuum valve monopoly +32% CAGR since IPO

Shimano - Bike component monopoly +12% CAGR

Floor and Decor - Future monopoly in hard-surface flooring +30% CAGR

MIPS - Helmet safety monopoly +45% CAGR

Thor Industries - RV monopoly +14% CAGR

6th SWI - Medical Device Monopoly +17% CAGR

I've been watching this company for a couple of years but could never justify the valuation. Thanks for the write up Trung, very informative.

$FND is set to join the S&P MidCap 400 - that should bring even more attention to the stock, but fundamentally it doesn't change much. The price increase of 8.5% today to $93/share from $84/share could be temporary. I wouldn't chase the market but stick to observing the real changes made by management i.e. number of stores opening and unit economics of it.

https://www.prnewswire.com/news-releases/floor--decor-holdings-set-to-join-sp-midcap-400-vicor-to-join-sp-smallcap-600-301959714.html