✅ Buy Alert - 3rd sleep-well ownership - MIPS

Characteristics of the Sleep Well Portfolio and the third BUY

Hi, I am Trung. I write 10+K words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, and 3rd). Join me in building generational wealth.

Hi SWIs,

Today, I'm slowly adding to my third position. The business has been deep-dived and thoroughly tracked in recent quarters. The work has been done, and the decision to buy is not rushed or half-baked. Importantly, the price is reasonable as we take a 10-year view, ideally longer.

This is the easiest part of investing - BUYING. What’s next will be more difficult. Monitor the business to own long-term.

Next week, I’ll be releasing my 9th Sleep Well Investments pick. You can expect another market leader (50% market share, multiple times larger than the 2nd) that is easy to understand and track. I promise you won’t find a deep dive into this business anywhere else on Substack or Twitter (X). If you do, I’ll give you a 3-month FREE access. (message me at trung.nguyen@sleepwellinvestments.com)

The business has survived competition and turbulence since the 1950s and benefits from the US reshoring initiatives. The price is right and deserves an initial position or a close watch. Stay tuned!

Before we go through the reasoning of the third addition to the Sleep Well Portfolio, here is a quick reminder of what it is about:

✔ The portfolio will eventually consist of 20 names

✔ The portfolio redemption year is 2037. We buy to own long-term

✔ No market timing. We buy at a price that offers a healthy margin of safety

✔ The portfolio only invests in deep-dived stocks that are monitored closely

✔ They are market leaders who have:

Stable / strengthening market position

Enduring competitive advantages

Management with aligned interests and a strong capital allocation track record

Anti-fragility attributes (healthy balance sheet, adaptable business model, endured competitors and past crises)

Plenty of reinvestment opportunities

Trading at a fair valuation

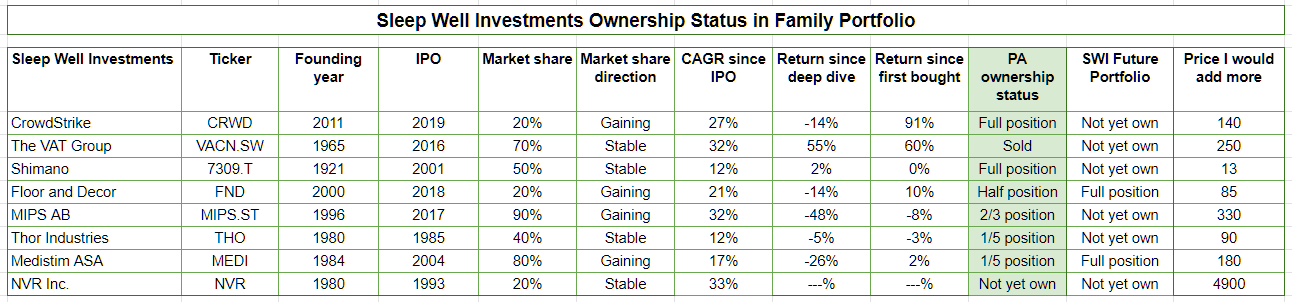

Below is the current investable universe of SWI Future Portfolio that has been thoroughly researched. I aim to build up the list to 40-60 names and own 20.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett.

It’s important to highlight that the greatest threat to investing is yourself.

Investing is a life-long journey, not a sprint. That’s why the portfolio redemption year is 2037. I intend to buy to own long-term. No short-term trades. I will not trade a good night of sleep for a shot at a few extra percentage points of return.

For this reason, access to the portfolio is only available for annual paid subs who are in it for the long run. I apologize to monthly subscribers; I don’t want to mislead or tag you along for the marathon when you are looking for a sprint. You still have full access to my deep dives and thesis-tracking updates.

For annual subs, you have additional access to the following:

Research list

Sleep Well Portfolio

Thesis tracking summary

Ownership status of SWIs in my family portfolio

Important note: I do not provide ownership details in absolute $ value as it doesn’t matter if you manage a $50K or a $50M portfolio; if you can’t manage the small amount responsibly, then managing $50M will magnify your mistakes.

The purpose of showing how I manage my daughter’s and my family's portfolio is to encourage long-term ownership, showing I eat my own cooking and, for your reference, that it is possible to have a lasting investment process over multiple cycles. Please don’t copy it blindly; your saving is finite; treat it responsibly. We also likely have very different financial goals and circumstances.

Finally, I will only reveal new Sleep Well Portfolio positions after publishing my deep dive. I believe an investor should only consider an investment after thoroughly researching it.

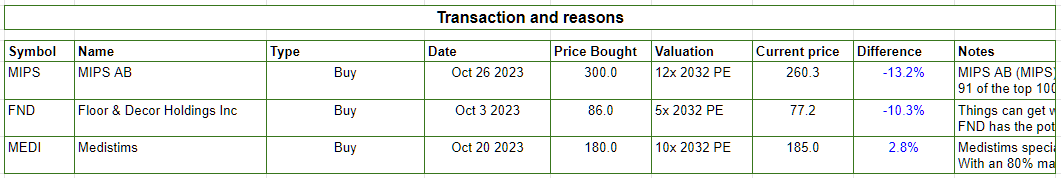

Let’s look at the third BUY in the Sleep Well Portfolio. The first two BUYS were reported here.

Today, I bought MIPS AB (MIPS), deep dived in April 2023, at 300 SEK/share for the Sleep Well Portfolio (a portfolio for my daughter, transferable to her name in 14 years, 2037). This long-term portfolio mirrors my and my family's portfolios, which I manage using the same process and philosophy. In the family portfolio, the MIPS AB position is 2/3 complete, so I am leaving one more time to add.

MIPS AB (MIPS), is a pioneer and market leader in helmet safety systems for bicycles and adventurous sports, including skiing and equestrian. It is the most recognizable brand in the industry. The small yellow dot logo on the outside of the helmet and the yellow liner MIPS represents ‘increased safety’ and are considered the standard for the industry.

91 of the top 100 highest-rated helmets use MIPS technology. The first non-MIPS position is at 30th place (!). Over 200 brands, including 9 of the top 10 bike brands and 6 of 6 biggest snow sports brands, are MIPS customers. For example, Specialized, Alpina, Fox, and Poc. The next competitor has just two brands as customers (!). In the most recent Tour de France, 18/22 teams used MIPS helmets, including 9 in the top 10. It’s a good indication MIPS is likely a clear leader in the future.

As shown, competition risk is limited. What’s more, customers (helmet makers) are not incentivized to compete as the cost of the component is low, and the technology barrier to entry is high.

Valuation is more attractive today at 12x PE 2032, while you get at least 10-15% FCF per share growth. In normal times, MIPS should be valued at 30x PE with little competition risks. I am aware that MIPS’s stock price can still go lower, especially with the uncertainties that the market is pumping every day. Still, I have confidence in the business and its relevance in the future, so I am investing today for my family and my daughter’s Sleep Well Portfolio.

The bottom line is that you are investing in an industry leader (monopoly, practically) who is already cash-rich, highly profitable, and expected to grow its revenue and earnings at high double digits in a conservative scenario. Please review my deep dive in April 2023 for detailed valuation and risks.

You can also review my thesis tracking updates Q3’23, Q2’23, and Q1’23 to see the evolution of the business market share and moats. They will help you understand the business and industry deeply before taking any action. The advantage of buying a great business is you can buy it next year, the next five years, or five years before; it would still make sense (as long as you keep tracking and remain confident the business isn’t disrupted, of course).

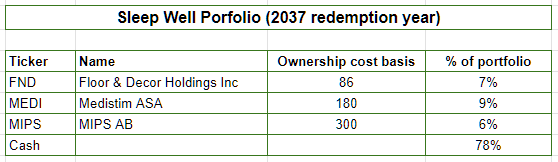

Following is the current status of the Sleep Well Portfolio.

This is the current ownership status of all picks for my family portfolio, highlighted in green (PA - short for personal account).

The portfolio will rebalance itself as each business performs and with cash added each year. There are no trades and no compromises on quality. Annual subscribers can check the spreadsheet for more details. Link here. I'll add more features as we go along.

Finally, remember that investing is a life-long journey, not a sprint.

Let me know in Chat/Email if you have any questions.

Sleep Well Investing,

Regards, Trung

Right here with you Trung. Will be adding to my position, even more if the stock continues to decrease.