Thesis Tracking Q2'24 - Dino Polska, Wisetech, Fortinet, Kinsale, Sea Ltd

Dino winning, WTC's share returned 30x since 2016, Fortinet's safest bet, KNSL execution, and SE's logistics advantage.

Hi, sleep well investors,

Premium members have benefited from my high-quality research and disciplined portfolio execution. Since going paid last summer,

13 out of 15 picks have had an average return of 36%.

Of 9 stocks bought from the list, 8 returned an average of 28%, with one loser -12%.

Quality > Quantity.

You can track the deep dive performance below - average return since publication is 26%.

This post is an update for 5 of the 15 sleep-well picks:

Dino Polska (DNP.WA) - H2’24 results - down 15% from picked (Apr 24)

Wisetech (WTC) - FY2024 results - shares up 72% from picked (Jan 24)

Fortinet (FTNT) - Q2’24 results - shares up 12% from picked (Mar 24)

Kinsale (KNSL) - Q2’24 results - shares up 27% from picked (May 24)

Sea Limited (SE) - SPX in-house logistics and SeaMoney’s durability (Jun 24)

Link to previous Q2’24 updates below; all thesis tracking here:

Sea Limited (SE) - Q2’24 solid results, shares up +15% from picked (Jun 24)

MIPS (MIPS) - Q2’24 strong recovery, shares up +70% from bought (Oct 24)

Next, if there are substantial changes, you will receive reviews on the following:

The VAT Group (VAT) - Q2’24 results, up +110% from picked (July 2022)

Veeva Systems (VEEV) - Q2-24 results, up +16% from picked (Dec 2023)

CrowdStrike (CRWD) - Q2’25 results, up 36% from picked (May 2021)

For all sleep-well writeups, please click this link.

Finchat.io, my personal Bloomberg terminal, sponsors this post; join Finchart.io using this link to get 20% off and support sleep-well investments.

Dino Polska (DNP.WA) - Q2’24 results - Winning the price war, slower store opening isn’t a concern.

Dino Polska (deep dive), Poland's third-largest convenience store chain, reported challenging Q2’24 results on first look.

The stock dropped -10% on the following headlines (I presume):

Revenue increased 10% YoY to PLN 7.2B ($1.8B), a significant decrease from the 20-50% growth in the previous ten quarters.

The significant slowdown was driven by higher pricing investment from Biedronka, lower store openings (32 in Q1’24 and 66 in Q2’24 vs 54 in Q1’23 and 62 in Q2’23), and lower food inflation (2.3% vs 10-20% in the past two years). Moreover, EBITDA also fell slightly (-1.6% EBITDA YoY), primarily due to the 20% increase in the national minimum wage in Poland and slightly higher sales and market spending.

However, given all of the above, Dino did great. What I care about most is how it performs against the competition and plans for growth. Macro-wise, Poland is a favorable environment for Dino Polska; food and wage inflation are out of Dino’s control.

Superior like-for-like sales

Dino’s main competitor is Biedronka (owned by Jeromino Martins - JMT), in this case, Dino’s stores outperform by a mile.

In H1'24, Dino’s like-for-like sales were +6.4%, a deceleration from 12.4% in H2’23, but still +4.1% higher than food inflation, better than the last two quarters.

Meanwhile, Biedroka's like-for-like sales were negative -4.6% in Q2 and +4.6% in Q1. With food inflation of 2.3%, that’s a negative -2% real like-for-like sales.

Source: JerominoMartins JMT’s H1’24 report

In addition, while Dino closed no store over the same period, Biedronka closed nine and plans to revamp approximately 275 stores this year. This is roughly 2% of its annualized store number compared to the 3.5K stores it operates and 10% within 5 years—a drag on both the top and bottom lines.

Although JMT’s higher leveraged balance sheet and lower unit economics are sustainable, I can see Dino continuing to take market share.

Dino’s shares are down 8% from the H1’24 announcement and 12% from my first buy.

Why am I not concerned and likely do nothing here?

Of all my picks, I believe Dino is in the most cut-throat industry. Supermarkets compete on razor-thin margins (20s gross margins, 5s operating margins). But Dino operates in a position of strength, and I made a case for owning the niche convenience chain because:

Dino is structurally most efficient and independent of external forces because it builds and owns 90% of its stores with the most standardized store design and has in-house meat production. This means total control from laying out the 5000 stock-keeping units (SKUs) to solar panels to the consistent 400m2 store area and fresh meat quality. Few appreciate it, but control over the location, construction, maintenance, supplies, and operation ensures the most convenient location possible, lowering setup, running, and maintenance costs. As a result, Dino operates with the highest profit margins in the industry.

The excess profit and self-sufficiency allow Dino to reinvest 100% of its profit at a 20%+ return on investment (ROI) with no debt/equity raise, complex franchise models, or M&As. It is well capitalized, with 0.6x net debts/EBITDA (vs. JMT's 2x net debt/EBITDA). It gives me comfort to project a store count of 4600 by 2034. Further upside is possible by adding petrol / EV charging points to existing locations and opening another 2,000 stores in the Czech Republic, Slovakia, and East Germany.

Results are not visible now as management focuses on playing the long-term game. Elevated store openings in the past few years will take time to scale to profitability. Meanwhile, as the competitive environment remains challenging, lower store openings lead to better free cash flow, which is a win-win situation. I am not worried about short-term food price deflation, price competition, or lower store openings.

Time is a friend to Dino and an enemy to peers who pursue aggressive and less financially prudent store expansion. Management has voiced continued investments in new stores in the next few years. I’ll track whether they will execute efficiently. Stay tuned.

Wisetech (WTC) - FY24 results

First, well done to investors who bought Wisetech on my recommendation in January 2024; you are up a cool 70%. Moreover, a member said his first shares were purchased in 2017, and he’s up 20x on that lot. I am happy for you!

This sort of return is life-changing and is possible by holding on to unique businesses run by competent and incentivized founders. Richard White created WiseTech Global, Australia’s biggest tech company and the global leader in logistics SaaS tech, which logistics giants cannot live without. (deep dive here)

All the details from my deep dive remain relevant.

The first pick of 2024 is one of the best lesser-known global leaders I have encountered. I see a lot of similarities in this business’s platform approach, difficult-to-replicate moats, and barriers to entry with Veeva Systems and CrowdStrike. Both started with one key capability and have now expanded successfully into a full suite of others. They also performed incredibly, returning 48% and 27% CAGR since IPO in 2017 and 2019, respectively.

[…] founded three decades ago and was profitable from day 1. It has become the backbone of the global supply chain execution market, managing over half of the global manufactured trade flow. Its key product is a unified SaaS platform facilitating the delivery of goods and documents from manufacturers to the consumer and everything in between, such as warehousing, fulfillment, landside logistics, cross-border freight, and customs & compliance. It solves the most complex logistic problems in a highly regulated industry. And the reward for being the pioneer and leader is reflected in its achievements below:

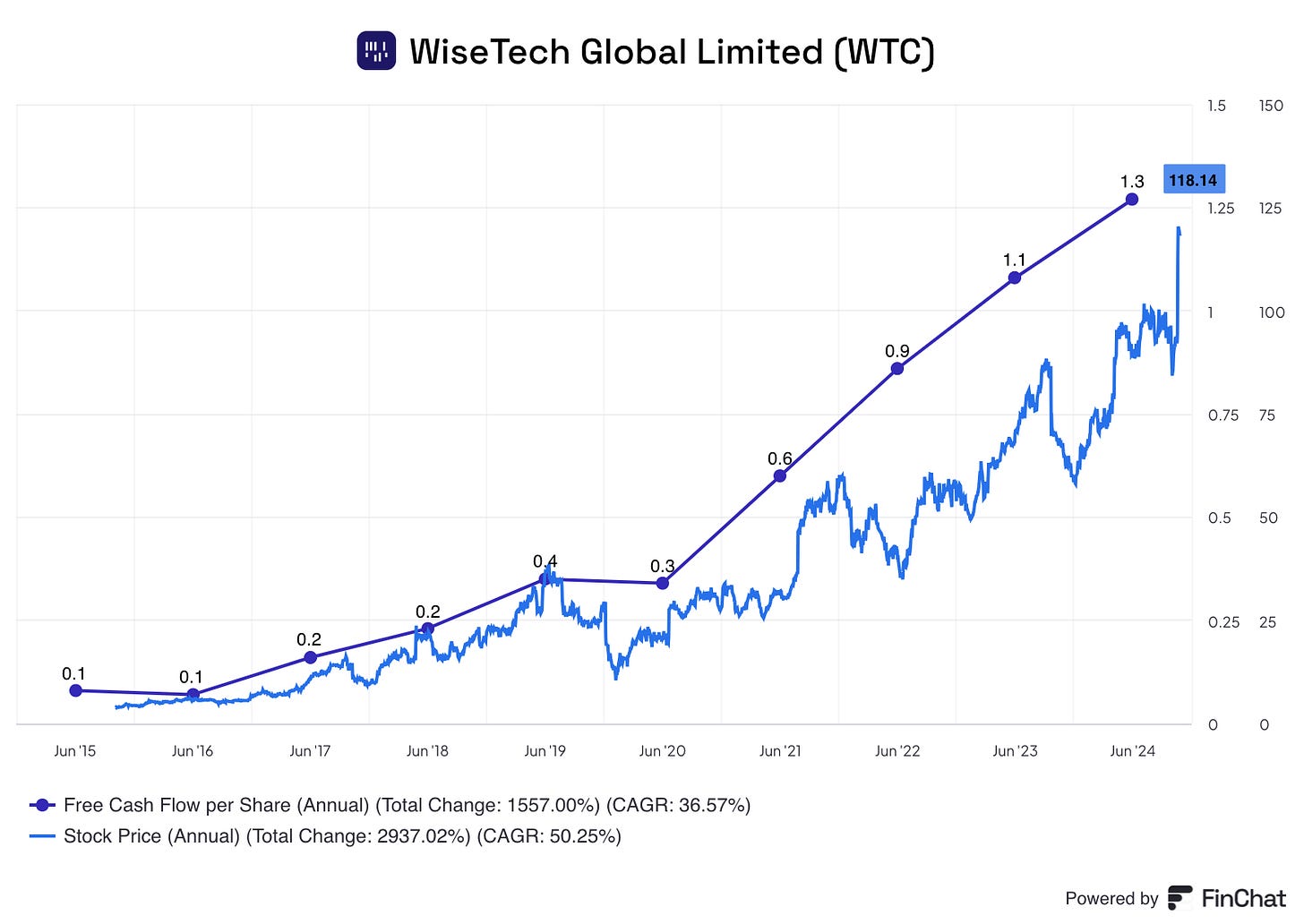

+25% revenue per share CAGR since IPO

+48% free cash flow per share CAGR

85%+ gross margin and 40%+ EBIT margin

>90% of the top players in the industry are its customer

manages over half of the global manufactured trade flow

close to 0% attrition for the past 12 years

- Jan 2024 SWI deep dive

Premium valuation

Wisetech is at its highest level since 2016 at 38x EV/S and 144x EV/FCF. It was expensive in my Jan 2024 deep dive at 30x and 100x, respectively, but it was my mistake not to buy it then, as the stock has increased 70%+.

How long will the premium price continue? It depends on whether Wisetech can deliver a high return on investment and expand its investment runway.

Let’s review the FY24 results.

Return on invested capital (ROIC)

Continued strong fundamentals and capital allocations drive ROIC.

That’s organic and inorganic revenue growth, profitability, and free cash flow per share.

Revenue growth and margins

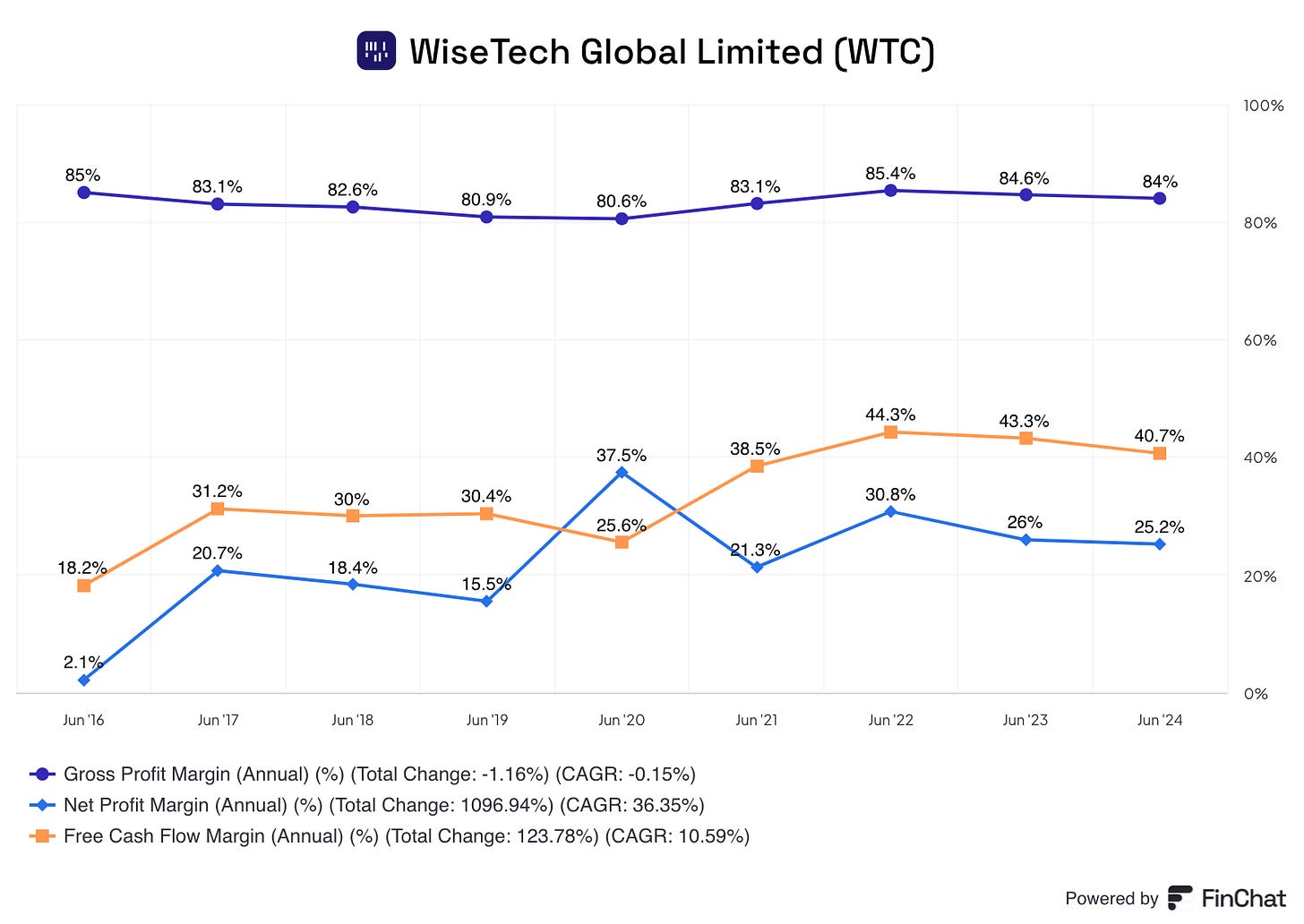

Revenue ended FY24 on a 28% growth to $1.05B (15% organic, 13% inorganic), of which 97% is recurring revenue of ‘on-demand license,’ and all geographies (US, EU, and APAC) grew.

Gross, net, and free cash flow margins remained consistently strong at 84%, 25%, and 40.7%, respectively.

Notably, the free cash flow margin has more than doubled from 18% in 2016 and is still 5-10% higher than that of Descartes (76%, 20%, 35%), the second largest peer.

Value driver - Top 51 LGFF customers

Incredible growth was driven by price increases, M&As, and the global rollout of CargoWise's largest customers. The company now has 51 LGFF (large global freight forwarders) as customers (50 in FY2023).

In particular, of the 51 LGFF, 38 LGFF are ‘in production’, so Customers who are operationally live on the CargoWise application suite and are using the platform on a production database, having rolled out in 10 or more countries and 400 or more registered users on the CargoWise application suite. This cohort has grown at a 37% CAGR since 2016.

13 LGFF are ‘contracted and in progress’ to roll out the CargoWise application suite in 10 or more countries and for 400 or more registered users who have fewer than 75% of expected registered users operationally live. This cohort has grown at a 260% CAGR since 2020.

What this means is that the runway for organic growth is incredible!

Attritions

CargoWise customer attrition has remained extremely low, at less than 1% every year for the last 12 years, demonstrating the platform's ‘stickiness’ and the significant long-term value generated for customers. This is the best of SaaS; even The Trade Desk has a 5% attrition annually.

Long reinvestment runway

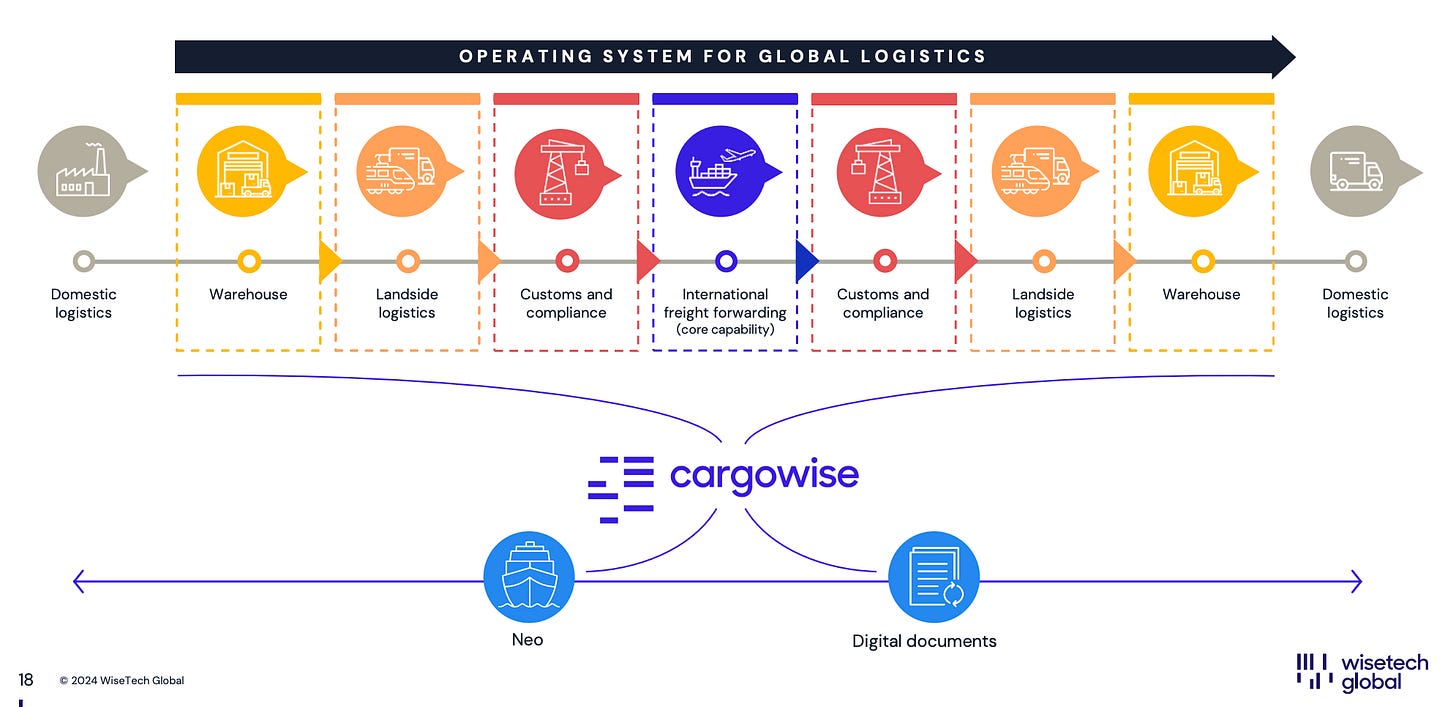

Below, we see six main capabilities integrated into one platform—CargoWise.

It helps simplify and reduce the cost of moving goods from point A to B, by cutting fixed (IT and labor costs) and variable (fines and freight costs) costs.

Warehouse A

Landside logistics

Customs and Compliance

International freight forwarding

Landside logistics (again)

Warehouse B

We will be seeing an upgrade of the platform with three major product additions:

The first two, Cargowise Next and Container Transport Optimization, mostly update new features to improve user experience.

I am most interested in the improvements to ComplianceWise, as 44% of customers find navigating customs the toughest challenge due to increasingly complex trade laws and higher fines and penalties. Recall that traditionally, global freight forwarders use individual vendors in each country to comply with local laws, so the cost isn’t just about avoiding the fines but the complexity and inefficiencies of navigating across multiple products and countries, in particular when there are changes in local laws, trade agreements, embargoes, or wars break out.

Product updates such as these make the CargoWise platform indispensable once customers are locked in. Imagine the first few years of integration; costs are reduced through fewer fines and streamlining of compliance work. A few years after that, a complete integration may mean a significant cut of headcount in the customer compliance team as Cargowise automates essential functions. We have seen the same story in other SaaS verticals, such as accounting, finance, sales, cybersecurity, and life science.

Apart from upgrading products, future revenue growth will come from

• Large Global Freight Forwarder rollouts and further contract wins

• Potential strategically significant and tuck-in acquisition opportunities (M&As)

Management guided FY2025 will be another year of

25-30% growth in topline to AUD 1.3B

51-52% EBITDA margin

It’s impressive to see how Wisetech can keep improving its profitability. Since 2016, EBITDA has grown by 41% CAGR, and Free cash flow has grown by 49% CAGR.

The question is, how many more years can Wisetech keep up with the 40% EBITDA and 49% FCF growth? 2 years? 5 years?

I have no idea, but I think I can be comfortable saying that:

There isn’t a complete logistic platform like Wisetech.

The runway is long due to Wisetech’s ability to grow organically (75%) and organically (25%).

Growth is mostly within Wisetech's control because 30% comes from large customers simply rolling out Cargowise to new functions and countries, 20% from new products/price increases, and only 5% from industry growth, which WiseTech can’t control.

So, I would be comfortable factoring in a 20% growth rate for the next 20 years, making Wisetech stock just a little overvalued at the current price of AUD 118/share, where the market expects Wisetech to grow free cash flow per share by 24% for the next ten years.

It was a mistake not to start a position in Wisetech when I finished my deep dive. I will likely start dollar-cost-average into the position soon. I’ll keep you posted.

Fortinet (FTNT) - Q2’24 solid results

We have had an excellent Q2'24; in addition to MIPS's +70% since our buy, Fortinet was up +27% from the announcement, and Kinsale (KNSL) was up +20% recently. Since my recommendation, Wisetech and VAT have quietly been up 30% and over 100%.