SWI Pick #11 - A Leader In Logistics Cloud Software [Part 1]

$10B+ market cap, 48% FCF CAGR, 34% TSR CAGR, one of its kind, abundant expansion opportunities

Hi, I am Trung. I write 10K+ words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Join me in building generational wealth.

Happy 2024 sleep-well investors,

In my 2023 annual review - 100% success rate, I promised quality > quantity.

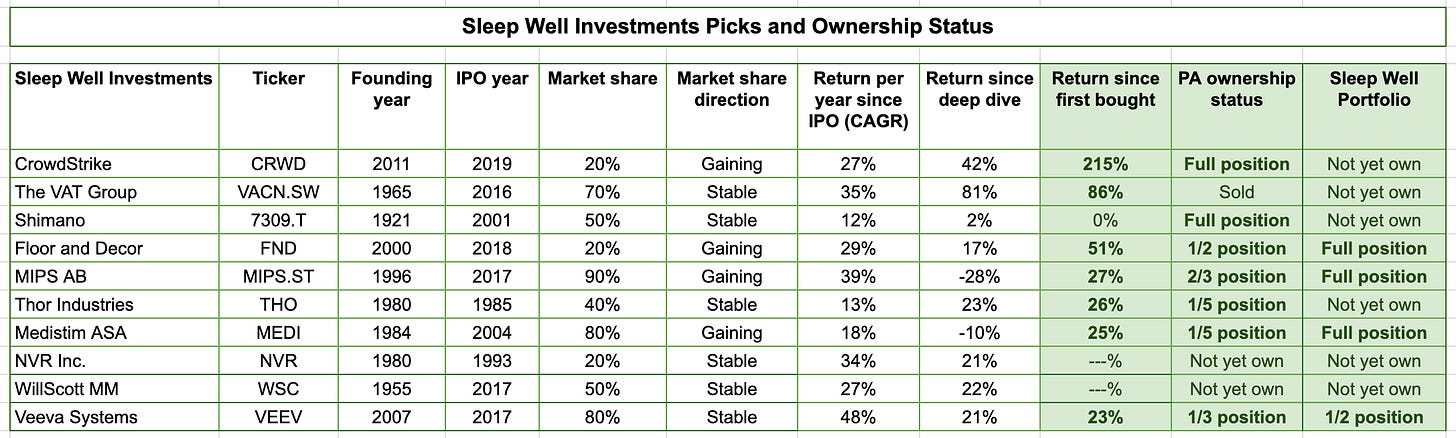

The first pick of 2024 is one of the best lesser-known global leaders I have encountered. I see a lot of similarities in this business’s platform approach, difficult-to-replicate moats, and barriers to entry with Veeva Systems and CrowdStrike. Both started with one key capability and have now expanded successfully into a full suite of others. They also performed incredibly, returning 48% and 27% CAGR since IPO in 2017 and 2019, respectively.

The first pick of 2024 was founded three decades ago and was profitable from day 1. It has become the backbone of the global supply chain execution market, managing over half of the global manufactured trade flow. Its key product is a unified SaaS platform facilitating the delivery of goods and documents from manufacturers to the consumer and everything in between, such as warehousing, fulfillment, landside logistics, cross-border freight, and customs & compliance. It solves the most complex logistic problems in a highly regulated industry. And the reward for being the pioneer and leader is reflected in its achievements below:

+25% revenue per share CAGR since IPO

+48% free cash flow per share CAGR

85%+ gross margin and 40%+ EBIT margin

>90% of the top players in the industry are its customer

manages over half of the global manufactured trade flow

close to 0% attrition for the past 12 years

After spending several months understanding the complex logistical problems it solves. I became a believer in the business and think opportunities for further growth are still abundant.

The share price has only returned 31% CAGR in the past five years vs. the 48% FCF CAGR, showing the market still underappreciated the company's future despite the premium valuation.

Then, like Veeva Systems, another global leader in a vertical-specific SaaS market that I deep dived (and bought) into last December 2023, I see a well-protected moat around the business and a heightened barrier to entry due to the complex cross-border nature of the transactions and idiosyncratic custom standards, which should help the business grow at a 20%+ rate over the next 5-10 years.

Additionally, like CrowdStrike, the largest customers are expanding to the full arrays of apps available in the platform, underscores that customers are increasingly relying on the company to provide all of the logistics backbone -- as opposed to using disparate products and services from several vendors or building it in-house.

Impressively, the company has proven it can also grow inorganically. In the last five years, all 45+ acquisitions have been accretive and contribute to around 1/3 of total revenue growth.

For such a wonderful business, I am inclined to hit the BUY button today, but I will wait until you have received both parts of my writeup to start DCAing (dollar-cost averaging) into a full position over the next 6-12 months.

Be warned, this is the most expensive stock I will be buying.

Knowing errors of omission due to valuation is my biggest mistake. The last few ‘overvalued’ businesses returned the most since publication - look at CRWD, VAT Group, and NVR below, which produced 42%, 81%, and 21%, respectively. I don’t want to miss owning another winner.

Below are the scores of these businesses and valuations at publication.

Now, let’s dive into the 11th idea of Sleep Well Investments, the first idea for 2024.

This is part 1. [Part 2]

What makes it a sleep-well business? [Part 1]

Emerging leader

Outdated alternatives

Gaining market share

Durable growth

Widening moats / High barriers to entry

Management track record and ownership

Anti-fragility

Risks [Part 2]

Valuation

What to track

Sleep Well Scorecard