Intellego's no fraud; it's mispriced.

Using facts, removing emotion, extending my time preference and controlled capital allocation, Intellego can improve SW portfolio returns.

Intellego (INT.ST, INT) is priced for zero growth, thanks to the recent live event and controversies.

Intellego is an easy pass, if you invest to profit next year, focus on the stock volatility, and don’t look beyond its past issues.

SWI’s approach is different.

We take into account the (i) context the business is running—country/industry/life cycle. We assess the investment by its (ii) future value creation.

And through that lens, we see the issues as temporary. As such, the stock is highly mispriced at 8x FY2025 EBIT.

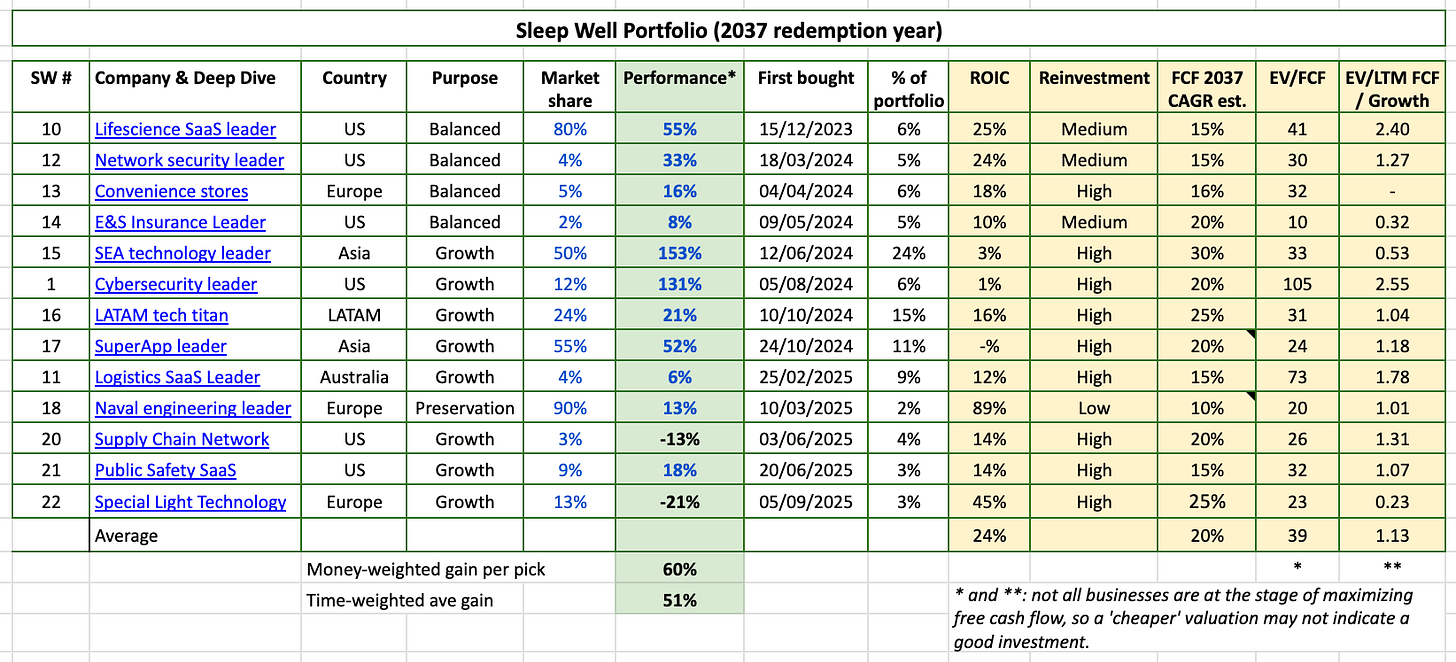

As the current Sleep Well Portfolio primarily consists of proven businesses with a high degree of certainty, Intellego can enhance the return profile if our assessment is correct.

But investing is not simple. There is an admission price. No success comes without learning. And no high return comes without understanding risks.

The good news is:

Risk is inversely correlated with knowledge. Risk can be lowered if you extend your time horizon, leave emotion out of your investment process and allocate capital with discipline. - Understanding Risk

If you can do the above, in my opinion, Intellego is a low-risk, high-return investment.

Let me expand:

Know the business better than the average market participant. With the material provided [deep dive, 1st buy, 2nd buy, risk management, 1st live event], you and I have done more work than 99% of investors, both on the negative and positive sides, and have gained sufficient insight to engage constructively with the CEO [details].

Focus on facts - I have shut off the stock screen and spent more time speaking with early investors (including a family office who invested at SEK 10/share), exchanging questions and answers with the CEO, digging into third-party sources on the product, the current deal with Henkel and Likang (interesting link), as well as academic research papers and local knowledge of the management team (CEO, Claes has grit but is inexperience at this scale), the stage of the company (either take more sales for lower cash flow or higher cash flow for slower growth), and the ‘logum’ context (be good but not too good) around running a successful business in Sweden.

Facts with local contexts are key, in my opinion, which explains why Intellego has temporary flaws and was an easy target for ‘bears’.

Extend your investing horizon - A key factor in becoming an owner of businesses, rather than holding paper shares, is to extend your time preference. A nice byproduct is that you also become immune to the volatility of the stock price (Mr. Market is a maniac).

My time horizon is 12 years. In 2037, my daughters will start using the fund for their university (or whatever they choose). I don’t need to set short-term targets for any of my ownership. The business doesn’t need to revolutionize the industry or drastically transform the structure by 2026.

The market doesn’t have patience for mistakes, miscommunications, or incremental changes.

Let’s use it to our advantage.

Facts have shown that Claes has already achieved a miracle in bringing Intellego to an MSEK 700 business, despite failures after failures in his many start-up attempts. Now, running a company at a new scale, serving industrial giants, in the public eye, and achieving triple-digit growth requires a very different skill set and business structure.

The most significant misunderstanding around Intellego is its high receivables. If you were the CEO, would you accept more sales with longer payment terms now, or would you negotiate to receive cash quicker but with smaller sales orders?

Extending my time horizon enables me to see how this dynamic unfolds. As Intellego earns more trust from customers, customers will be more willing to accept shorter payment terms. Additionally, I will have more time to witness the improvement that Claes and co will make, or even see a more appropriate leadership to take over the day-to-day operation. Whatever it is, Intellego has a good foundation to change positively. And allowing more time, I will collect higher rewards.

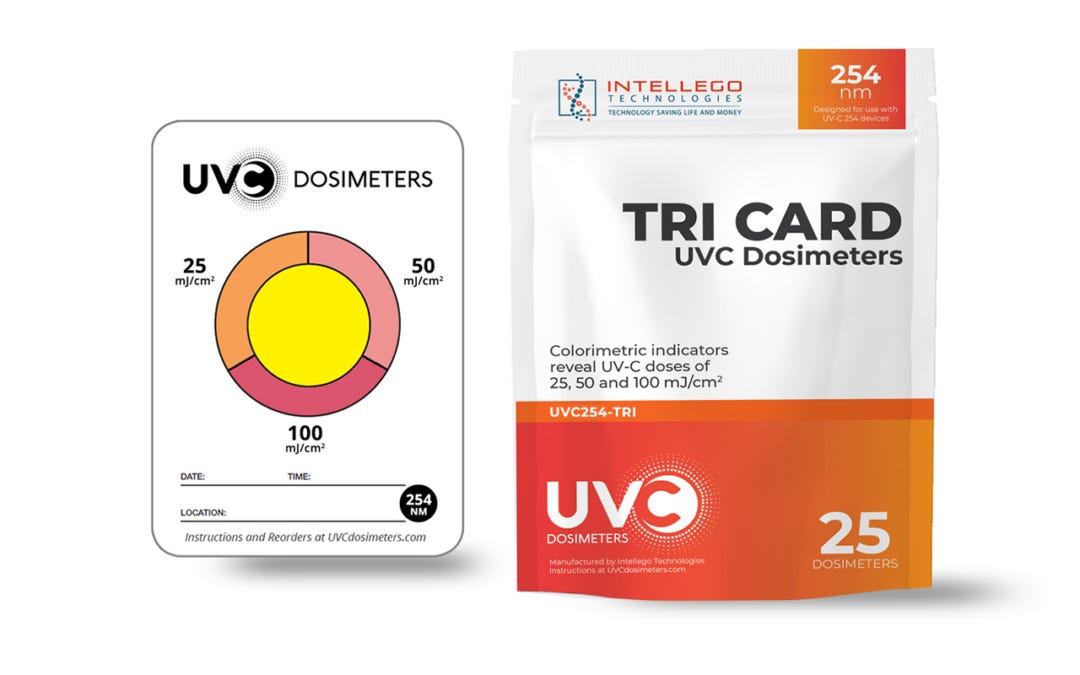

Allocate with discipline - risk is lowered with the level of knowledge and time I have allocated for Intellego. With the initial 5% allocation, I am positioned to lose less than 5% if I am wrong, but I win multiple times my capital if I am right. There is a triple-digit fundamental improvement [100% free cash flow per share growth] + multiple expansion opportunity [8x EBIT] on offer here. The more I search for reasons and the likelihood Intellego could be overstating its sales, the more I see that the product is genuine, and customers are getting value from it. How durable is the positive trajectory? A more intelligent investor prompted me to consider this question.

“As Henkel reports higher production quality while reducing costs from integrating Intellego’s technology, how long will Henkel’s competitors stand on the sidelines before they ‘google’ the name?

So, either I am wrong and cause limited damage, or I am right and rewarded with outsized returns.

Why is Intellego not fraudulent?

Everything is predicated on determining the likelihood that Intellego is not fraudulent. My arguments are, in order of importance: