SWI's Framework - Understanding Risk and Taking Risk

Preserving capital vs. growing capital.

When it comes to risk management and capital preservation, investor giants Seth Klarman and Howard Marks are the first names that come to mind.

‘Playing safe wins matches’

Howard Marks’ four questions when entering a trade are gold:

How much money can I make if things go well?

What will happen if events don’t go as planned?

How much could I lose if things get bad?

And how bad would things have to get?

He compares investing to tennis and says playing safe wins. In most amateur tennis games and even professional tennis, the play style that minimizes errors (instead of going for winners - riskier shots) often wins Grand Slams (the biggest prize in tennis). Risk control wins.

However, investing is different.

Both Seth Klarman and Howard Marks' recent 10-year returns are less impressive (-10% and +200%, respectively), given their ultra-focus on risk management.

Hence, playing it safe doesn’t always win.

SWI’s approach - balanced

We also focus on protecting wealth, but we also want to position ourselves to participate in above-market gains.

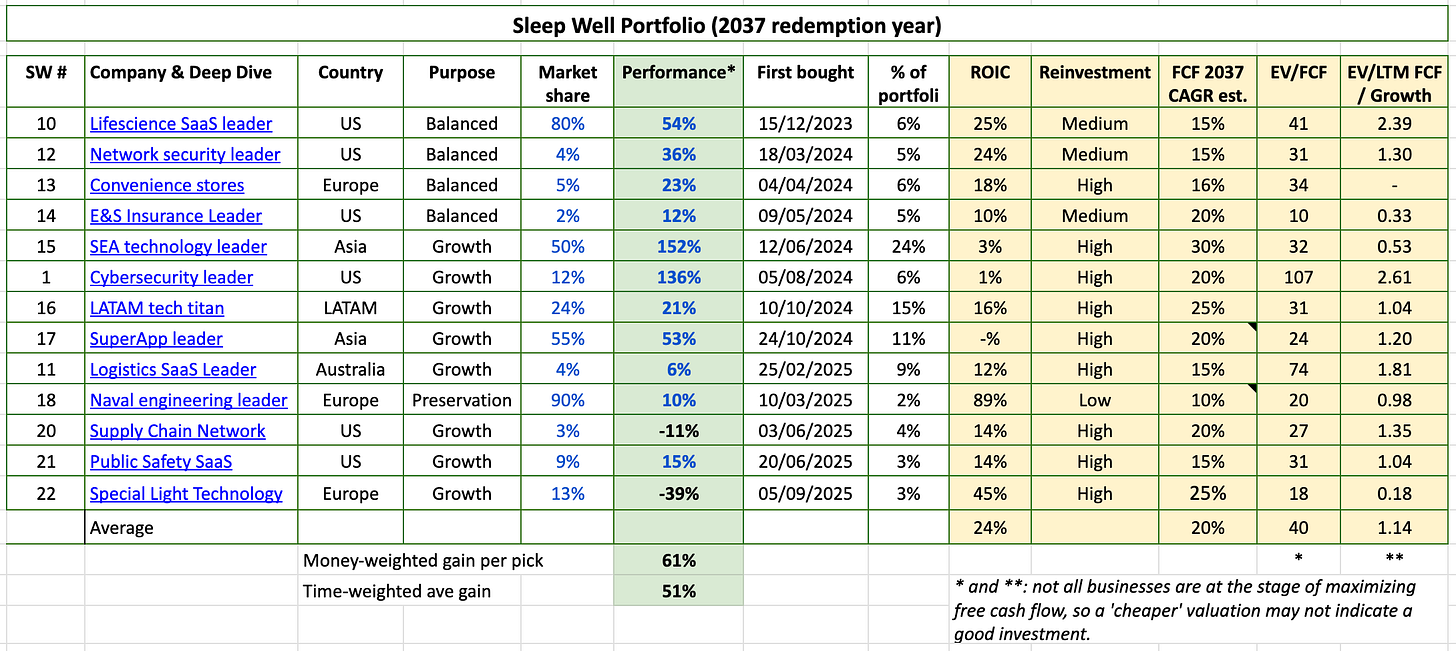

Our 13 holdings have an average annualized return of 51% (ranging from 40% - 60% depending on the month). That didn’t come from playing ultra safe. It comes with buying enduring niche leaders, averaging up, paying up, and having a buying plan.

The latest one, Intellego, a niche leader in UV disinfection and curing validation [deep dive, 1st buy, 2nd buy, risk management, 1st live event], however, is down 39% after just 2 weeks of buying. But we are not panicking at all.

This is an excellent case study to help you understand why Intellego’s share decline/volatility doesn’t mean it’s risky (yet) and how we are positioned to win big.

Of course, we are ready to admit our mistake, but losses will be limited to a 5% position. For now, the facts suggest that we are not [1st live event]. Let me explain.

What is risk, and why does it matter?

Investing horizon

Focus on facts

Allocation

What is risk?

Risk is the permanent loss of your capital (locking in losses). Risk is not understanding the business you own as well as the market.

If you buy, why are others selling? If you sell, why are others buying? Can you make your case and provide factual evidence?

Why does it matter?

Gauging the level of your understanding of the business is a direct measure of the level of risk you are taking.

The above helps you determine the right amount of risk to take.

Not taking risks at all means you are not gaining anything (financially or intellectually). Taking too much risk means not understanding why your holdings are rising or falling in value.

Balancing it is key to learning, protecting, and growing wealth.

To help you, consider the following aspects to determine how much risk to take.

Investing horizon

When do you need the money?

If it’s 10-15 years, buy stocks of great companies; valuation today matters very little. No one could have accounted for the value AWS created for Amazon 15 years ago, nor the value Advertising brought in since 2015. An extended time preference allows your chosen business to build on its economic model, and for you to understand the business and take advantage of opportunities that arise from dips/volatilities.

If it’s just 1-3 years, I’d put my money in ultra-safe companies/index funds/interest-paying bonds. You won’t gain much, but you most likely preserve your capital.

Anything in between, and you can employ a mix of both. And the rule of thumb is, the longer the time preference, the higher the amount of risk you can take.

Focus on facts

Volatility of the stock can indicate risk or uncertainties, but it is not risk. Importantly, it can be significantly different from the volatility of business performance (sales, profit, cash flow, product value, customer stickiness, competitor actions, and industry trends).

If you focus on the stock price, your thesis will be wrong one day and right the next. You become a slave to the market.

If you focus on facts, you will know the trajectory of the business, what value it is creating, and crucially, which business is not. Hopefully, as a result, you become a better investor.

Allocation

Allocate the ownership according to the level of your knowledge of the business and the likelihood of you being wrong.

For example, 24% of the SW portfolio is in Sea Limited, 15% in Mercado Libre, 11% in Grab, 9% in Wisetech, and 6-9% in Veeva, CrowdStrike, and Fortinet. Meanwhile, 3% is in the 21st pick and 5% in the 22nd pick, Intellego.

I know the top allocation very well, and I am comfortable letting them run and add more in dips. However, I need time for the more recent picks to prove themselves. When given the chance and it can’t, I will cut with no regret. The lower allocation and buying in stages will limit my financial losses.

To summarise, risk is inversely correlated with knowledge. If you are confident in your research on the business and can extend your time horizon, take the emotion out of your investment process and allocate capital with discipline. You can take more risks.

**Current performance means little. I’m learning and appreciate your feedback and advice. Please leave a comment by clicking the button below.**

If the SWI approach aligns with you, read more about us here, and our latest portfolio review here. We aim for above-market returns while taking low risk. You can read our Sleep Well Manual to gain a deeper understanding of our investment process.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain