Business Update - Mercado Libre (MELI) Q4'24 - 25 Year Anniversary of Compounding Investments

Reinvestments in users UX/UI, logistics and fintech accelerate. Shares +8% making an new all time high. I am patiently waiting to add more shares.

Important notice: prices have been updated to £399/yearly and £79/monthly as pre-announced in December and reminded in January. The ‘pay rise’ will help me maintain a 100% success rate (50% average return per pick). Check the latest Sleep Well Portfolio performance here.

Mercado Libre (MELI), the 16th sleep-well pick, reported fantastic Q4’24 earnings. The company's messages and actions ooze owner-operator execution. It also marks the 25 years of democratizing trade and financial services to the region.

They walk the talk, focus on the long term, and emphasize reinvesting in the business to improve customer value, fortify the ecosystem, deter competition, and put their best foot forward to capture the enormous opportunity ahead in Latin America.

I love owning businesses like this.

How enormous is the opportunity for Meli?

Only 15% of commerce in the region is online, a decade behind the US/EU/China, which is at 30-40%. In fintech, Meli has an opportunity to capture 125 million unbanked people, half of whom are in Mexico. Leveraging the growing ecosystem and following the proven Amazon playbook, Meli’s advertising execution has already reached the $1B run rate, growing at over 50% for the last eight quarters (41% in Q4’24, 37% in Q3’24). It won’t be linear, but Amazon has achieved a 40% CAGR since reaching the $1B mark in 2014 to reach $51B annually today.

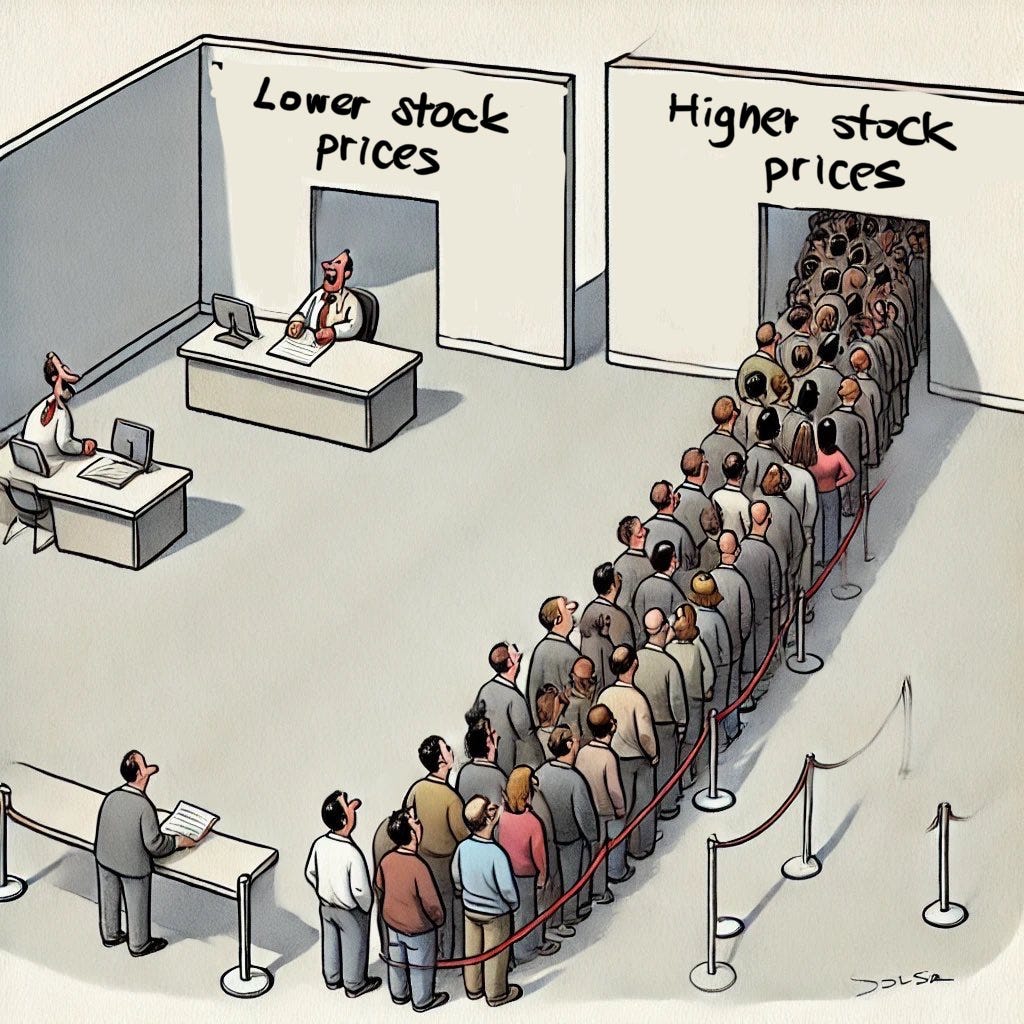

As an owner, I am always excited to digest Meli’s reports. Unfortunately, unlike the 16% drop in shares after business-as-usual Q3’24, shares are up 8%. Yes, I want the share price to stay low to keep adding with every penny I find.

Charlie Munger would also add to ‘invert, always invert.’

I’ll wait in the left queue for better days. If I don’t get it, fine. I already have ~20% of the Sleep Well Portfolio and over 20% in my portfolio. But if you hadn’t owned Meli, I’d read on.

Before we begin digesting Mel’s Q4, please do me a favor. I put enormous research and portfolio management discipline behind the results, which premium members have benefited from. Please help me spread the word to improve the quality even further.

Since going paid in the summer of 2023,

We have had no loser in the Sleep Well Portfolio. The average gain reached 50% per pick money-weighted and 72% time-weighted.

Seventeen picks have had an average return of 36% since publication. You buy when I publish a deep dive and still achieve positive returns.

Quality > Quantity.

How?

I track all my picks thoroughly and individually (no boilerplate analysis; I don’t aim to pump out content quickly). None are ChatGPT generated.

I compile all thesis tracking here and link it in the Sleep Well Portfolio spreadsheet (annual sub only). You can also access all buy-and-sell and deep dives.

Meli’s writeups: The Most Sleep Well Investment Of LATAM, Top pick for 2025, Q3’24 update, and Buy Alert.

For all sleep-well writeups, please click this link.

Meli Q4’24 and FY2024 results

I remain laser-focused on what Meli says and acts to achieve its goals in 10-20 years, 2037, to be precise, the year I hand over the Sleep Well Portfolio to my daughters. So, Wall Street’s ‘beat & misses’ record means very little to me.

With that investing horizon, what makes Meli or any of my picks successful depends on four points: