Business Update - Mercado Libre Q1'25: Strong Start, Are Shares Still Cheap To Buy?

Meli reported exceptional Q1’25, despite tariff uncertainties and the perennial geopolitical risks investors have worried about since its founding.

Meli reported exceptional Q1’25, despite tariff uncertainties and the perennial geopolitical risks investors have worried about since its founding.

Last year was Meli’s 25th anniversary, and one can see how impressively Meli outperformed every investor’s imagination.

Even the founder CEO, Marcos Galperin, was impressed, posting a tweet on X the following chart.

Meli’s 55% revenue growth in the last five years is only matched by PDD and Nvidia. This is even faster than the previous 10-year CAGR growth, which was 44%.

Marcos Galperin, founder and CEO, added in his 25th anniversary podcast:

There's still so much to do, there's still so many opportunities, and the fact that we're willing to take risks and make big bets to continue growing and the fact that we're growing at the same rates that we were growing 25 years ago is amazing.

And about those geopolitical risks? After Q1’25 results, the CFO, Martín de los Santos said in an interview with Yahoo Finance.

I think if you look at the history of Mercado Libre for the past 25 years, you know, we started the company back in 99. We became from being a startup in the garage. We became the, the most valuable company today in Latin America. And a lot of, you know, throughout the years, we've seen all type of macro situations, not only in Mexico, but in Argentina, Brazil. So we are very used to dealing with macro complex conditions, even more difficult than the conditions that we see today. I think the most important thing is people moving online. If you look at Latin America, the penetration of commerce continues to be very low at 15%. So there's plenty of room to continue growing by bringing people online, by improving the user experience, continue to working on our product, our platform, bringing more merchants to our platform, delivering faster to our users, you know, increasing our logistic infrastructure.

Meli’s writeups: The Most Sleep Well Investment Of LATAM, Top pick for 2025, Q4’24, Q3’24 update, and Buy Alert.

Q1’25 Operating KPIs

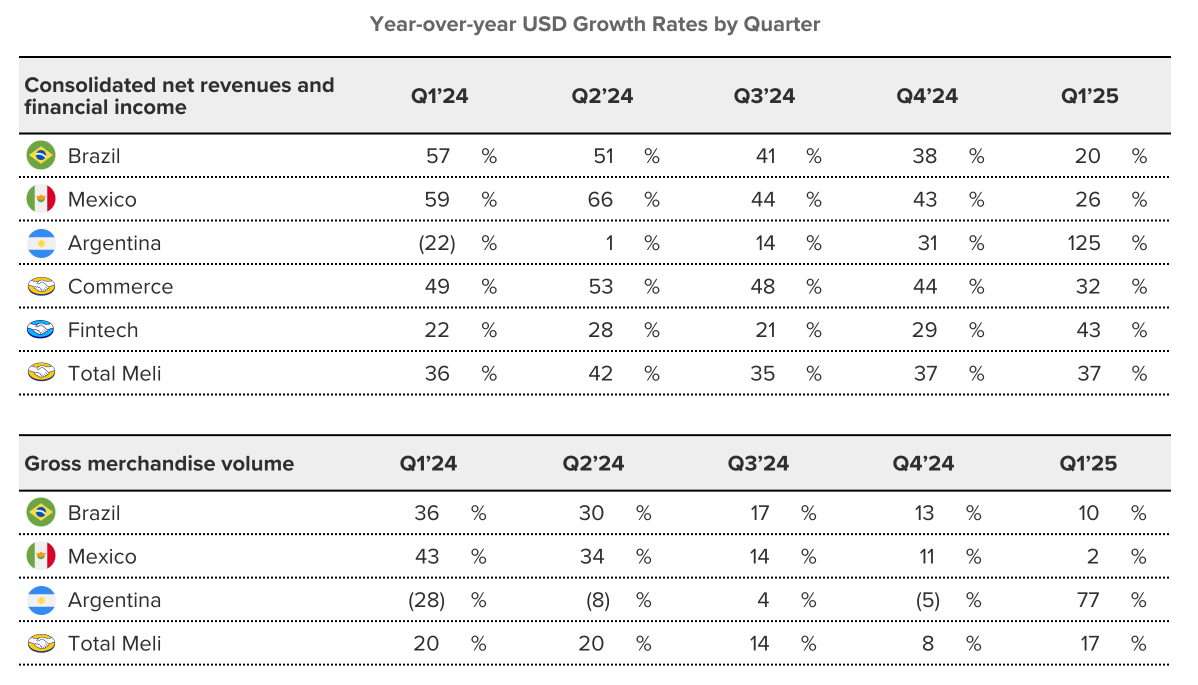

The Commerce and Fintech segment grew by 32% and 43%, respectively, driven by consistent operating KPIs growth compared to the past 12 quarters (post-COVID) and 12 years.

Particularly:

GMV (gross merchandise value) grew 40% FXN, or 17% in USD, vs. 20% CAGR in the past 12 quarters and 20% in the past 12 years.

Total payment value grew 43% in USD, vs. 39% CAGR in the past 12 quarters and 48% in the past 12 years.

Deliveries by Meli are ~95%.

Unique active buyers reached 66.6M, up by 24.5%.

Unique fintech monthly active users reached 64.3M, up 31%.

Financials

Total revenue grew by 43% to nearly $6B in Q1, which means Meli’s growth has accelerated from the 37% CAGR it achieved since 2012. Meli is one of a kind indeed!

In Q1, Argentina was the star performer. GMV, revenue, and profitability have returned to rapid growth, helped by a stabilizing macroeconomic environment, a growing credit asset base, a strong supermarket segment (up 65% in items sold YoY), a growing market share, and a weak Q1 of 2024.

Argentina’s revenue (purple bar) has substantially recovered over the last four quarters. As the macroeconomic environment improves, it will regain the second-largest market for Meli.

More on Argentina:

The credit business grew very nicely. I mentioned it before, and improved profitability, interest rates coming down in Argentina helping us also with the credit business not only because of more adoption of credit because it's more affordable to people but also by lowering the cost of funding, it improves our margins on that particular product. So I think for the most part, we've seen the recoveries and as Ariel mentioned earlier, in commerce, items always growing at 50-plus percent year-on-year. So I think it's throughout the business. Margins have improved and this is the reason why not only because of comp from last year, but also genuine and sustainable improvements in profitability we're seeing in Argentina so far.

As a group:

Operating margin has remained remarkably consistent and is steadily growing. I use the annual number on the chart below to remove the quarterly lumpiness. Gross margin has declined but that is due to Meli selling their own products (1P), it will stablise or improve as it penetrates more into higher-margin products (Pago, Advertising, etc.).

So, as a quick look through, everything is on the right track.

Let’s examine the details to see if Meli is still reinvesting appropriately, and I’ll share whether shares are still cheap to buy today.