SWI Pick #10 - Veeva Systems (VEEV) - A Leader In Life Science With Seven Critical Risks [Part 1]

Once touted as the next Salesforce, the CRM and R&D cloud platform leader in life science is trading at record low valuation 25xFCF. Is it still a wonderful business?

Hi, I am Trung. I write 10+K words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, and 3rd). Join me in building generational wealth.

We have found in a long life that one competitor is frequently enough to ruin a business.

— Charlie Munger (1924-2023)

Veeva Systems VEEV 0.00%↑ (VEEV), $27B market cap, is a leader in CRM and R&D cloud platforms for Life Sciences with 19 out of 20 top pharma companies as customers and an 80%+ and 30%+ share of the penetrated market, respectively, in terms of seats. Clinical operations from drug study design and manufacturing to commercialization desperately need a unified platform for applications and high-fidelity data, playing into Veeva's architecture strength. Inherent regulatory entry barriers, a slow-moving, risk-averse industry, and high switching costs protect this unique SaaS business. At a $2.2B revenue run rate, plenty of growth is left in a $20B+ total addressable market (TAM).

What’s more, Veeva is

Founder-led by Peter Gassner, an ex-Salesforce exec who still owns 9% of the company.

Mission-critical to pharma and biotech as Veeva reduces 25% of the time and cost for new drug/device development. Once integrated into their workflow, most are locked in with a <4% churn rate.

Durable business model with 80% recurring revenue, 20%+ net margin, 40% free cash low margin, debt-free, and 10%+ forward growth for at least a decade.

Veeva has compounded free cash flow per share by 38% CAGR since its IPO in 2013, yet the stock has only returned 16% CAGR.

You will be pleased to see that Veeva’s valuation is also at 25x EV/FCF vs 40x pre-COVID, the lowest level since its IPO. At the $170/share level, Veeva provides a 3.5% FCF yield with 10%+ forward growth.

However, diving deeper, I find seven critical risks that can threaten Veeva's future:

IQVIA, a $40B elephant, is the most significant risk to Veeva’s Commerical (CRM) and Data Cloud (particularly Compass and Crossix). As Veeva modernizes the data design and application structure, does it have the edge over IQVIA’s offering?

IQVIA’s decade-long lawsuit against Veeva for data misuse remains unsettled, restricting Veeva’s customers from integrating IQVIA’s third-party data into Veeva’s multiple applications, including Network Customer Master and Nitro. Which other applications are negatively impacted?

Salesforce (CRM), the leader in generic CRM platforms, has created Healthcare to enter life science. But after recruiting Frank Defesche, the former General Manager of Veeva’s Vault, in November 2023, will that change the competition dynamics?

Meanwhile, Veeva is migrating its CRM capabilities to Veeva Vault from Salesforce. Management lauded the long-term gains, but the disruption will increase churn.

Medidata’s Rave and Oracle’s Phase Forward are formidable competitors in specific applications, namely electronic data capture (EDC) and clinical data management. But can they go beyond these functions to disrupt Veeva?

AI - What is Veeva doing to ensure it becomes an opportunity, not a risk?

Loss of exclusivity (LoEs) and the biopharma funding cycle are cyclical risks as R&D and CRM funding cuts worsen, reducing drug development activities. But, could it motivate biopharma to improve efficiency and increase investment in R&D solutions?

I intend to look at Veeva with The Bear Cave mentality (extreme skepticism) because Veeva is widely accepted as a high-quality business. I have made mistakes by believing in a good story. Thus, contrarian and objective research is required.

Importantly, I only want to own enduring businesses in my daughter’s Sleep Well Portfolio. If I get Veeva wrong, I’d want plenty of margin of safety.

You can expect a thorough analysis of the following:

Veeva Systems business [Part 1]

Who are the customers?

What does Veeva do that others can’t?

Seven critical risks

IQVIA vs. Data Cloud

IQVIA vs. Veeva decade-long lawsuit

Salesforce CRM Healthcare

Migration to Vault from Salesforce

Medidata and Oracle

AI - an opportunity or a risk?

Loss of exclusivity (LoEs) and the biopharma funding cycle

Why is it a sleep-well business? [Part 2]

How critical is the product?

How enduring is the business model?

What is the growth potential and outlook?

What competitive advantages does Veeva have over peers?

How anti-fragile is the business?

Management’s alignment

What’s a fair price?

bear case

base case

Sleep Well Scorecard

How do you track Veeva?

If you enjoy my deep analysis, please spread the love, hit the ❤ button, and leave a review. Your kindness fuels my work. Special thanks to Keong, Carl and Alwyn, for your feedback.

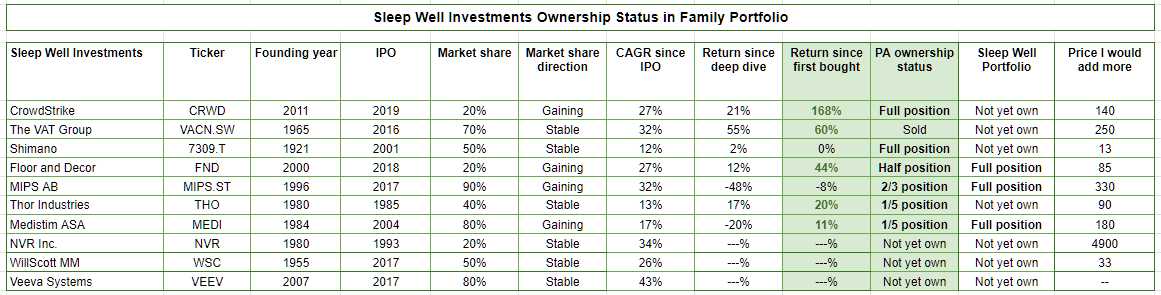

I scored all of my Sleep Well Investments (05 Nov 2023)

And I track their thesis here

And I buy for my daughter’s portfolio when the price is right

I also own some of them in my portfolio.

1. Veeva Systems Overview

Veeva offers software-as-a-service (SaaS) solutions in customer relationship management (CRM) and research and development (R&D) for the life sciences industry. Founded in 2007 by Peter Gassner (ex-Salesforce CRM) and Matt Wallach (ex-Siebel Systems, leading pharm CRM and Clinical Trial Management System, which were sold to Oracle), the duo has led Veeva to become an integral part of drugs and medical devices development processes.

What does it do?

Veeva’s 40+ cloud applications in CRM solutions and R&D solutions help life sciences companies develop and bring products to market faster and more efficiently while maintaining compliance with government regulations.

More specifically, Veeva’s CRM solutions, introduced in 2007 and built on the Salesforce platform, help life sciences companies engage with healthcare professionals and healthcare organizations seamlessly across multiple communication channels and plan and execute more effective media and marketing campaigns. In other words, CRM helps biopharma to navigate the complex healthcare system to sell and market drugs more effectively. According to Veeva, 83% of approved US drugs are launched with Veeva CRM. The core applications are Veeva CRM, Veeva Vault PromoMats (make sure promotional content is compliant), Vault Medical, and Vault Crossix (acquired). The core data offerings are OpenData, Link (platform of deep data), and Compass (patient and prescriber), which were introduced in 2020 and will likely become a new segment - Data Cloud.

Then, Veeva’s R&D solutions, introduced in 2012, focus on the client’s clinical operations, clinical data management, and regulatory, quality, and safety functions. In particular, applications help streamline end-to-end drug/medical device development processes from study startup, data collection, and site design to site inspection. Applications also help collaboration across stakeholders securely and outsource partners/vendors to increase operational efficiency and maintain regulatory compliance from clinical research to manufacturing. The core applications are Vault Clinical (eTMF, CTMS, EDC), Vault RIM (Registration, Submission), Vault Safety, and Vault Quality (QMS).

What are Veeva’s segments?

Currently, there are two reporting segments - Commercial (CRM) and R&D Solutions.

In FY2023, Veeva’s revenue was $2.2B. 80% of Veeva's revenue ($1.7B) was subscription-based (85% gross margin), of which 54% was from CRM solutions. Notice all the 14 functions in the slide below are on the Vault Platform (orange bar) - the technology platform for both CRM and R&D applications. Currently, the CRM applications are mostly run on Salesforce, where it pays a licensing fee per seat. However, Veeva isn’t renewing its contract with Salesforce, which expires in 2025.

The other 46% of subscription revenue comes from R&D solutions, which extends the service's life cycle and relationship with clients from clinical startup (study design) to manufacturing. As of Q2 FY24, it has 26 R&D applications.

Interestingly, six applications (CRM, PromoMats, eTMF, EDC, QualityDocs, and Regulatory Submissions) drive the bulk of revenue with Compass and Link the following applications to contribute substantial revenue in the future.

There are many application names and functions, but it will get easier, and perhaps if you remember anything from this section, it's the next paragraph.

Since 2014, the number of average products per customer has grown to four for CRM and three applications for R&D, and the net dollar-based retention rate (NDBRR) leveled to 120%, which means every year, existing customers spend 20% more on the platform, including churn (c4%). Veeva demonstrates the ability to innovate new products and lock in customers.

The remaining 20% of revenue ($422M) is from consulting and professional services, with a 30% gross margin. It is low but essential as it helps clients maximize the value of Veeva’s technologies and ongoing maintenance.

Geographically, 58% of revenue is from North America, 27% is from Europe, and the remaining is from Asia, MENA, and Latin America.

Who are the customers?

Veeva has over 1388+ customers, including 50+ largest global pharmaceutical and thousands of biotechnology companies such as Bayer AG, Boehringer Ingelheim GmbH, Eli Lilly and Company, Gilead Sciences, Merck Sharp & Dohme Corp., Novartis Pharma AG, and emerging growth pharmaceutical and biotechnology companies, including Alkermes Inc., Alnylam Pharmaceuticals, Inc., bluebird bio, Inc., Idorsia Pharmaceuticals Ltd, and Moderna Therapeutics Inc.

We can break it down to CRM and R&D customers. We can see that the R&D segment has acquired more customers than CRM, despite starting in 2012, five years after CRM. One thing we might see in the future is a third segment for the Data Cloud, which is part of CRM right now, but with two (Compass and Link) out of four applications (other 2: OpenData, and Pulse) touted as the next growth drivers, Veeva may start to break up the sales numbers.

In FY2023, 95% of revenue came from biopharmaceuticals, and the remaining came from medical devices (medtech). As Veeva is migrating from the Salesforce CRM platform to its own Vault Cloud (effective from 2025 for new customers), it can market its CRM solutions to non-life science companies. So Veeva has marketed solutions to consumer packaging and chemical companies - the box on the right.

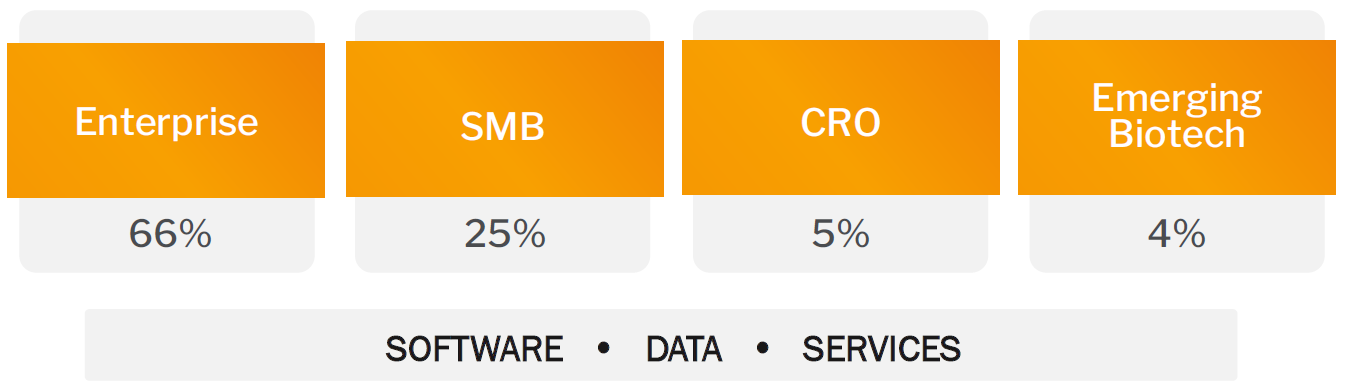

Within biopharma, 66% of revenue comes from enterprises or the top 50 customers. Small-medium-sized businesses (SMBs) represent 25% of Veeva's revenue across 700+ customers, with less than 1,000 employees and less than $1B of revenue. Contract research organizations, or CROs, represent 5% of revenue. Finally, emerging biotech customers represent 4% of total biopharma revenue across c300 customers.

These customers spend about $20 billion annually (total addressable market - TAM) on industry-specific software and data, growing at 6%. Veeva’s revenue of $2.3B (FY2024 estimates) is still just 12% of the total addressable market despite being the leader with roughly 80% market share of the 500K sales pharma representatives.

More than 50% of Veeva’s TAM is from announced products covering primarily commercial and clinical functions, and the remainder is from areas of future opportunity.

What does Veeva do that others can’t?

Customers have four choices for CRM, R&D, and data analytics applications. They are purpose-built platform solutions for life science on the cloud, on-premise, generic, or application-specific.