✅ Buy Alert - 4th sleep-well ownership

Characteristics of the Sleep Well Portfolio and the reasons behind the fourth BUY

Hi, I am Trung. I write 10+K words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, and 3rd). Join me in building generational wealth.

Hi SWIs,

Today, I'm slowly adding to my fourth position. The business has been deep-dived and thoroughly observed for critical risks; I will keep track of crucial KPIs and report to you in the next few quarters. The work has been done, and the decision to buy is not rushed or half-baked. Notably, the price is reasonable as we take a 10-year view, ideally longer.

This is the easiest part of investing - BUYING. What’s next will be more difficult. Monitor the business to own long-term.

Before we go through the reasoning behind the addition to the Sleep Well Portfolio, here is a quick reminder of what it is about:

✔ The portfolio will eventually consist of 20 names

✔ The portfolio redemption year is 2037. We buy to own long-term

✔ No market timing. We buy at a price that offers a healthy margin of safety

✔ The portfolio only invests in deep-dived stocks that are monitored closely

✔ They are market leaders who have:

Stable / strengthening market position

Enduring competitive advantages

Management with aligned interests and a strong capital allocation track record

Anti-fragility attributes (healthy balance sheet, adaptable business model, endured competitors and past crises)

Plenty of reinvestment opportunities

Trading at a fair valuation

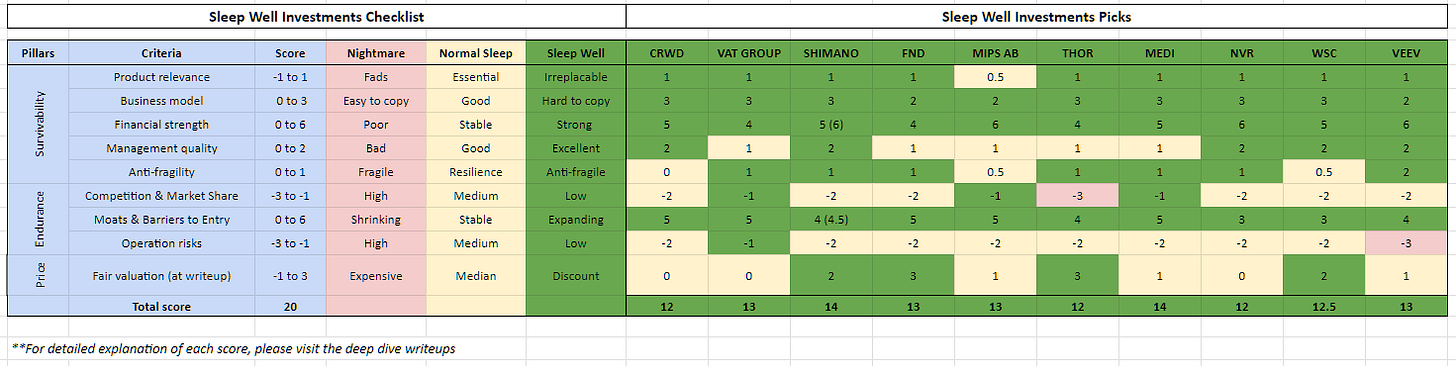

Below is the current investable universe of SWI Future Portfolio that has been thoroughly researched. I aim to build up the list to 40-60 names and own 20.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett.

It’s important to highlight that the greatest threat to investing is yourself.

Investing is a life-long journey, not a sprint. That’s why the portfolio redemption year is 2037. I intend to buy to own long-term—no short-term trades. I will not trade a good night of sleep for a shot at a few extra percentage points of return.

For this reason, access to the portfolio is only available for annual paid subs who are in it for the long run. I apologize to monthly subscribers; I don’t want to mislead or tag you along for the marathon when you are looking for a sprint. You still have full access to my deep dives and thesis-tracking updates.

For annual subs, you have additional access to the following:

Research list

Sleep Well Portfolio

Thesis tracking summary

Ownership status of SWIs in my family portfolio

Important note: I do not provide ownership details in absolute $ value as it doesn’t matter if you manage a $50K or a $50M portfolio; if you can’t manage the small amount responsibly, then managing $50M will magnify your mistakes.

The purpose of showing how I manage my daughter’s and my family's portfolio is to encourage long-term ownership, showing I eat my own cooking and, for your reference, that it is possible to have a lasting investment process over multiple cycles. Please don’t copy it blindly; your saving is finite; treat it responsibly. We also likely have very different financial goals and circumstances.

Finally, I will only reveal new Sleep Well Portfolio positions after publishing my deep dive. I believe an investor should only consider an investment after thoroughly researching it.

Let’s look at the fourth BUY in the Sleep Well Portfolio. The first three BUYS were reported here.

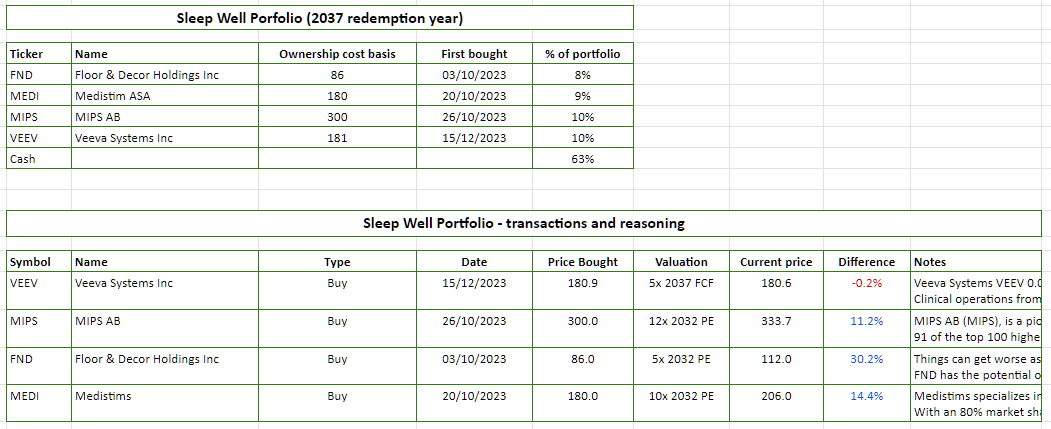

Today, I bought Veeva Systems (VEEV), deep-dived recently [Part 1, Part 2], on 08 Dec 2023, at $180.86/share for the Sleep Well Portfolio (a portfolio for my daughter, transferable to her name in 14 years, 2037). This long-term portfolio mirrors my and my family's portfolios, which I manage using the same process and philosophy. The Veeva Systems position is 1/3 complete in the family portfolio, so I am leaving two more times to add as I observe the progress of the migration to Vault and the development of Compass vs IQVIA, among other risks.

Veeva Systems VEEV 0.00%↑ (VEEV), $27B market cap, is a leader in CRM and R&D cloud platforms for Life Sciences with 19 out of 20 top pharma companies and 47 out of top 50 as customers and an 80%+ and 30%+ share of the penetrated market, respectively, in terms of seats. Veeva practically carved out its market and became the dominant player since its founding in 2007.

It has deep domain knowledge and understands that clinical operations from drug study design and manufacturing to commercialization desperately need a unified platform for applications and high-fidelity data, playing into Veeva's architecture strength. Inherent regulatory entry barriers, a slow-moving, risk-averse industry, and high switching costs protect Veeva’s unique SaaS business. At a $2.2B revenue run rate, 15%+ FCF per share growth for the following decades, plenty of growth is left in a $20B+ total addressable market (TAM).

As we have seen in Part 1, there are seven critical risks to Veeva’s existence. The biggest is IQVIA, with its acquired CRM and monopoly (gatekeeper) position of life science data.

However, my research found that IQVIA only impacts three applications within the Data Cloud.

I cross-check with management’s calls and confirm that Network, Nitro, Andi, and OpenData are impacted, while the core CRM is not directly affected, and R&D has no impact. The 2023 Investor Presentation slide summarizes the impact.

The second risk comes from the Salesforce generic CRM solution. However, I also found that it isn’t good enough for life science. Thus, we are left with minor risks, including migration to Vault from Salesforce. The main thing to focus on is that Vault has been running with R&D solutions without problems for over a decade, so it can also take on CRM.

You can revisit the seven risks here:

Valuation is reasonable today at 27x FCF or 5x FCF in 2037, while you get at least 10-15% FCF per share growth for the next decade. As the leader with a nearly 40% FCF margin, 80%+ of which is recurring, Veeva should be valued at 30x FCF at exit. This means we could see the investment today becoming 5x-10x in 14 years. For detailed valuation work, please visit part 2. However, please remember that valuation is highly subjective; understanding why Veeva is better than others and how it can remain the leader should be the key driver to investing in the business.

I am aware that Veeva’s stock price can still go lower, especially with the uncertainties that the market is pumping every day. Still, I have confidence in the business and its likelihood of staying as the leader in the future, so I am investing today for my family and my daughter’s Sleep Well Portfolio.

The advantage of buying a great business with manageable competition risk is that you can buy it next year, the next five years, or five years before; it would still make sense (as long as you keep tracking and remain confident the business isn’t disrupted, of course).

Following is the current status of the Sleep Well Portfolio.

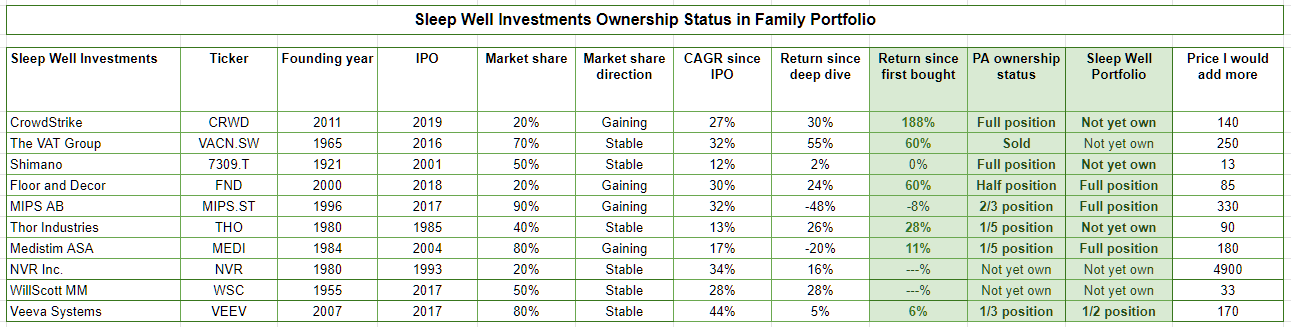

This is the current ownership status of all picks for my family portfolio, highlighted in green (PA - short for personal account).

The portfolio will rebalance itself by merit—business performance and with cash added each year. There are no trades and no compromises on quality. Annual subscribers can check the spreadsheet for more details. Link here. I'll add more features as we go along.

Finally, remember that investing is a life-long journey, not a sprint.

Let me know in Chat/Email if you have any questions.

Sleep Well Investing,

Regards, Trung

![Veeva Systems (VEEV) - A Leader In Life Science With Seven Critical Risks [Part 1]](https://substackcdn.com/image/fetch/$s_!a0mx!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa83b5815-bdb9-4b52-bfa4-4a5474be67f5_356x205.png)

just subscribed and looking forward too learning more. our long term goal seem alligned