✅ Buy Alert - 7th sleep-well ownership

We are buying this unique business with products yielding 25%+ IRR over a 30yr asset life span, counter-cyclical capex and working capital, management proactive on value creation.

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

I bought a unique business to the Sleep Well Portfolio, adding counter-cyclical characteristics, positive environmental impact, and a 30-year asset life.

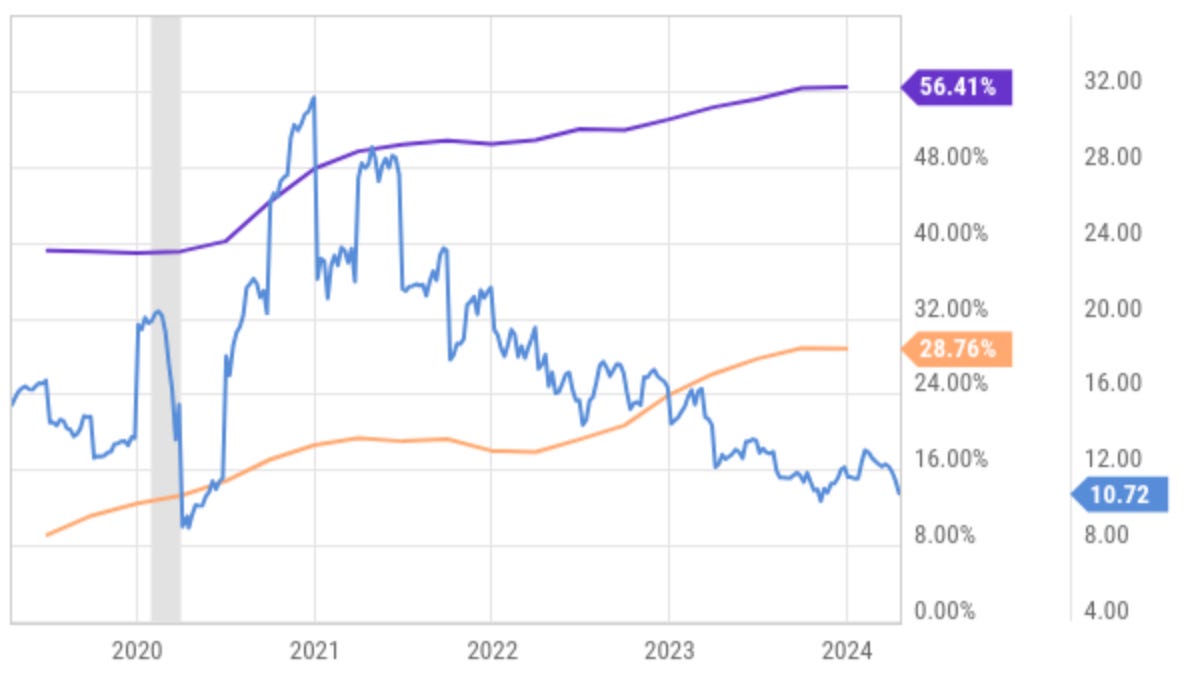

It’s also trading at a 5-year low valuation while the fundamentals outlook is strong as we advance.

10x EV/EBITDA

25% margin (increased from 10%)

30% ROE

40% Reinvestment rate

55% on share buyback

My latest deep dive is:

Free subscribers can read all my FREE and previews of paid research here.