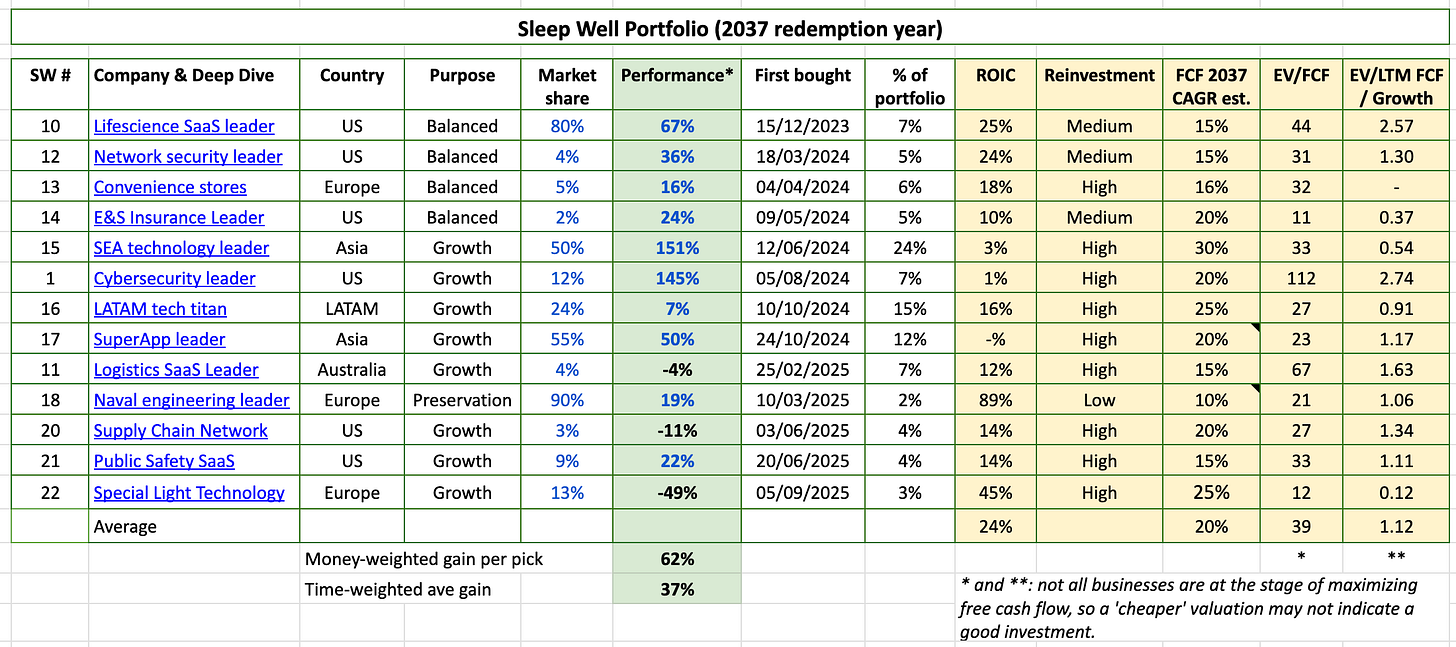

Sleep Well Portfolio consists of only time-tested leaders. We screen them through a rigorous checklist and track their thesis regularly to buy at reasonable prices. We discuss our learning and actions every month here. FAQ and more about us here.

The average ‘investors’ now hold shares for just a few quarters, cut from 30 months in the 1990s. This time frame means very little for most businesses; therefore, to profit, you must be the first to receive newsflow and analyze the impact correctly faster than others.

I can’t do both, so my only solution is to extend my holding period.

Easy said than done, so when building the sleep well portfolio, I think of it like I am creating my dream home for my family, where:

Location is the core. They are the top positions of my portfolio that I don’t want to get wrong. [SE, MELI, GRAB, WTC, VEEV, FTNT+CRWD]

Designs are pieces that we take longer to earn a permanent role. They are smaller positions that I gain conviction over time. [DNP, 18th, KNSL, 20th, 21st, 22nd]

To ensure I continue to keep my house in order. Every month, I’ll highlight any positions that are worth reviewing for possible additions or trims.

This is a new format designed to help new readers understand and implement the SWI approach to investing.

Let’s explore.

Best buys for Oct 2025

Aims of best buys

The monthly best buys aim to highlight opportunities to strategically build the portfolio with a clear endgame, which is ‘starting capital’ for my daughters. Hence, I can not draw liquidity from this portfolio.

My strategy - balance preservation and growth

To achieve the endgame, I prioritize avoiding losses by adding to winners (as long as cash flow increases), then diversifying into growth opportunities to ensure a balanced approach across the business lifecycle. Why? Time-tested companies tend to perform well in bear markets, while younger, promising businesses tend to thrive in bull markets.

Additionally, the list is not based on the positive/negative newsflow for the following quarters. It is also not deliberately trying to beat the market (S&P 500); if it does, that’s the icing on the cake. If not, I am entirely okay with it.

Hence, best-buy lists are personal; to apply them to your needs, I encourage you to review the deep dives and updates so you know what to do/not to do when the market swings.

1. Mercado Libre - most impressive execution amid political uncertainties.

Scored 15/20 points on my sleep well checklist.

Possesses all four moats: scale/cost, network effects, switching costs, and brand.

Beaten the best competition you can think of to compound FCF at 44% since IPO.

On track to grow 20%+ for 5-10 years and available at >14x OCF with a net cash balance sheet.

The current situation in Argentina, headlines about Amazon investing more aggressively, or the rapid growth of Nu Bank and Shopee, are not new. Meli is structurally more advantaged and should maintain its dominant market share. Any significant dip in MELI’s valuation has historically been a good time to add.

[deep dive, Q2’25 & Shopee, CEO transition, Tariff Review, Top pick for 2025, Q4’24, Q3’24, 1st Buy]

My original thesis for the company to triple in size is still valid:

In 10 years, I believe the additional value will come from

Advertising, which Meli hasn’t monetized to its full potential. Using Amazon as the north star, Meli’s Ads can reach $20B in revenue (40% CAGR for ten years). I showed my work in the deep dive to conclude that Ads could bring in an additional $6B in revenue or $3B of free cash flow, even at a conservative estimate. That’s a $90B if you value it at 30x FCF multiple, nearly the same size as Meli today.

Pago, Mexico alone, 50% of the unpenetrated market in Latin America, can bring in another $4B of revenue. Mexico is also where Pago has a high chance of success, with Libre already strong there. $4B revenue should equate to another $2B free cash flow. If Pago expands in the remaining 50% of the underpenetrated market, we should have $8B in revenue and $4B in free cash flow from Pago. That’s another $100B+ business in 10 years if we apply a 30x FCF multiple.

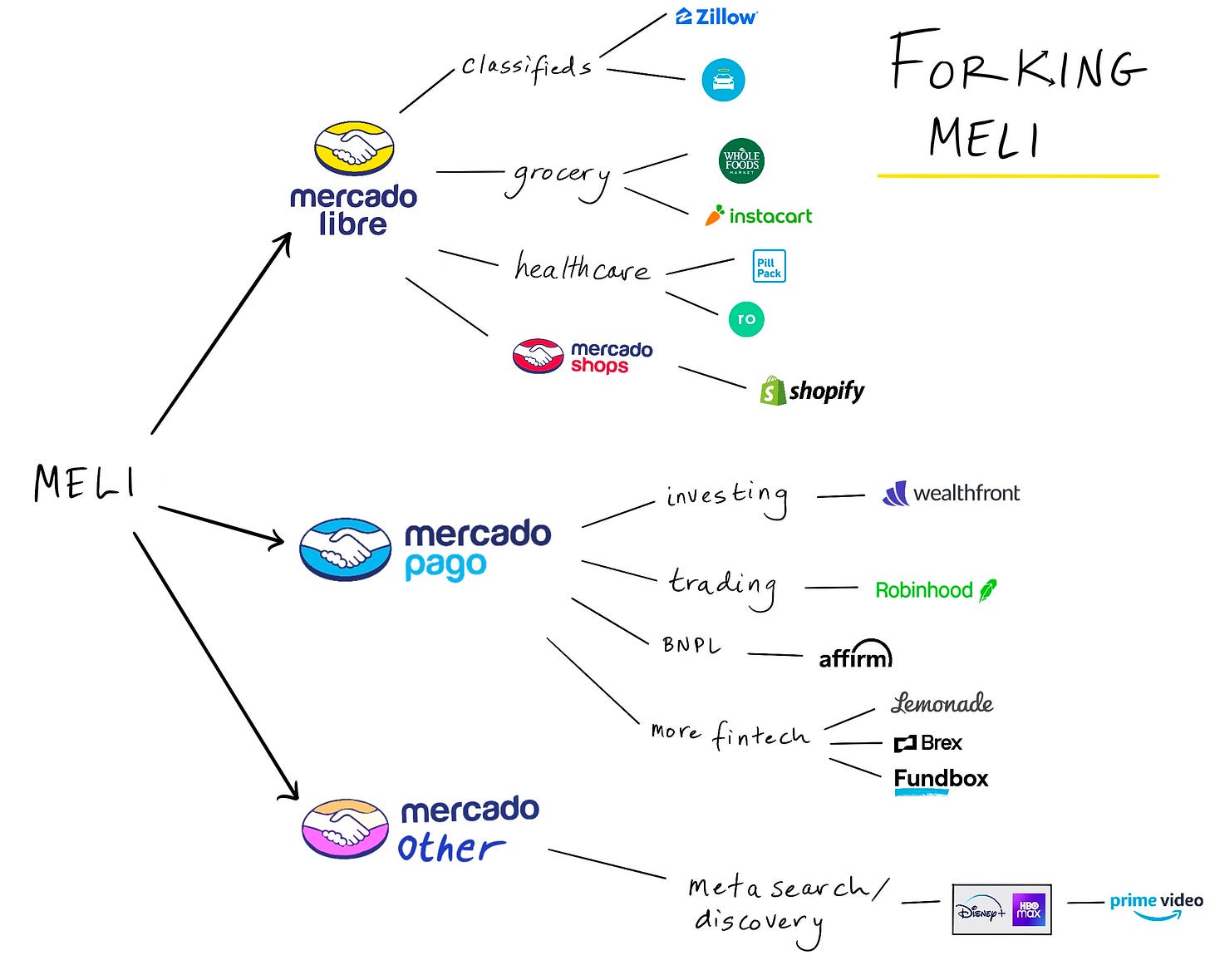

Everything else should continue to grow, making Meli’s ecosystem stickier and more essential to consumers, merchants, and the region’s commerce infrastructure. For example, Envios—logistics (grocery, classified), Credito (loans, investments, buy now pay later, trading, crypto), and Shops (online shop front). See the diagram below by the Generalist.

The probability of Meli tripling in size in 10 years is high, in my humble opinion. Because Meli has proven that it can defend its ability to generate profit (moats) for 25 years against:

Amazon

Local competitors (Amercianas, Magazine Luiza, etc..)

Emerging competitors (NU, Temu, Shein, TikTok, Shopee, etc..)

Perennial economic and political uncertainties, especially in Argentina

I also have confidence in the current management's ability to execute successfully.

After 26 years at the helm, Founder and CEO Marcos Galperin is stepping down. Commerce head, Ariel Szarfsztejn, will start as the new CEO on January 1, 2026 (SEC filings).

As Ariel Szarfsztejn has already been at the company for 8 years, Meli’s culture, values, and capital allocation framework will remain. He led the logistics expansion between 2018 and 2021, then Commerce since 2022, which I think was the key engine and enabler of growth in the past and will be in the future.

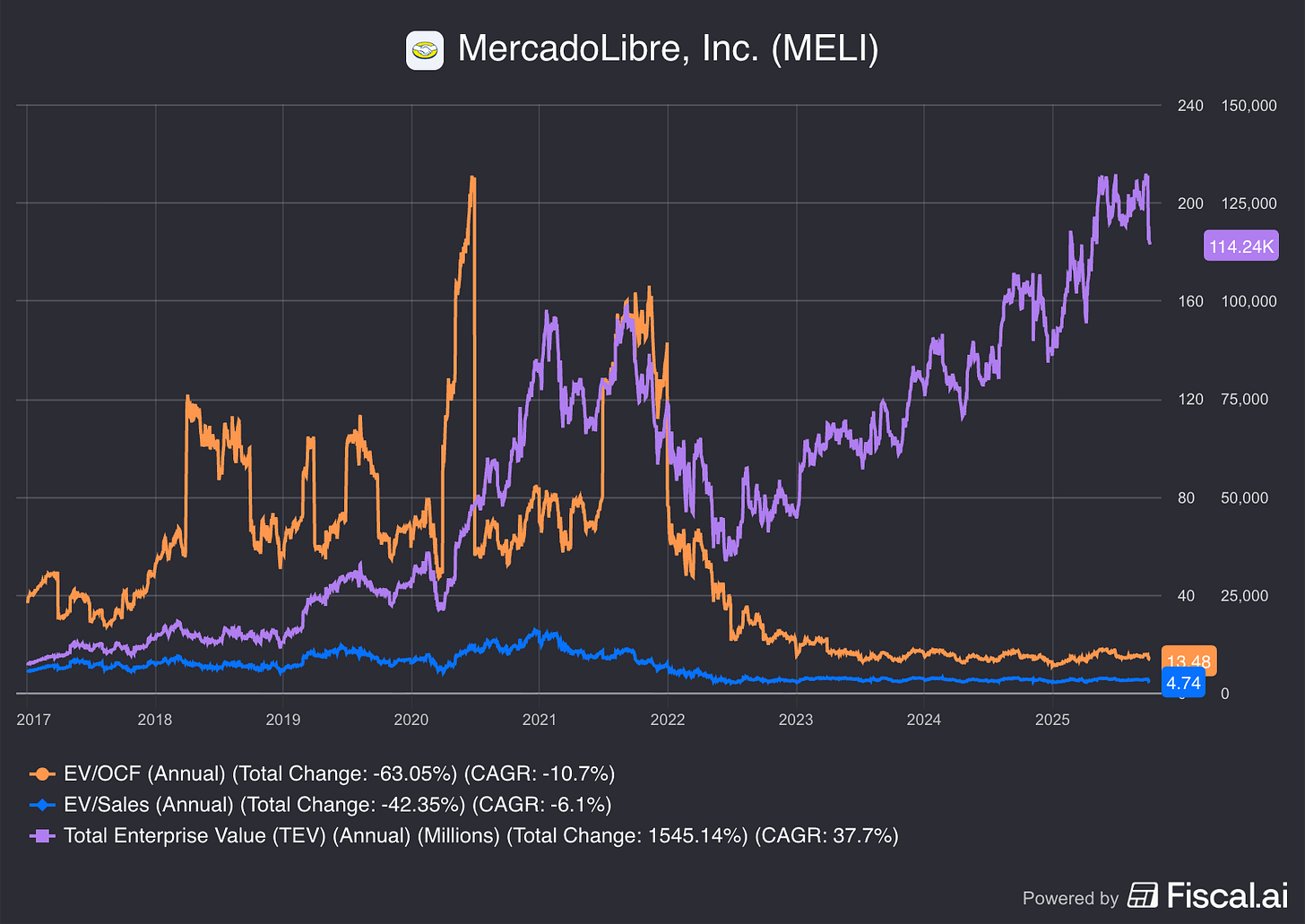

Meli currently trades at ~14x EV/Operating Cash Flow and 5x EV/Sales. It’s not extended at all. Before COVID, Meli was already trading at 20-40x EV/OCF, and during the pandemic, it was trading between 60-120x EV/OCF.

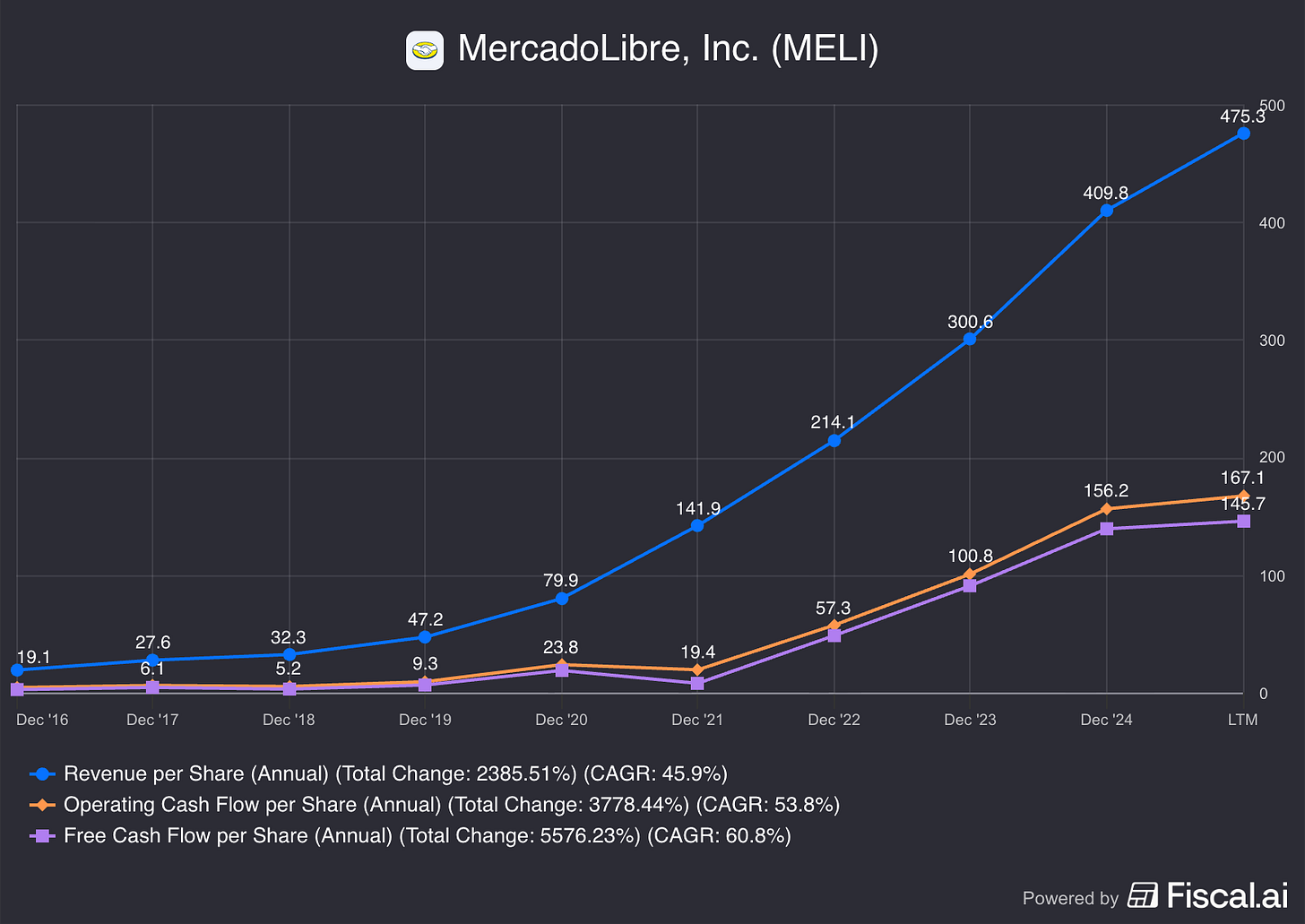

Meli’s value (enterprise value) has grown at a 37% CAGR over the last 10 years. It is reasonable given that revenue, operating cash flow, and free cash flow have grown at 46%, 54%, and 60% CAGR, respectively. That means the stock's performance has been driven purely by exceptional fundamentals, despite experiencing multiple contractions.

Fair?

I don’t think so. Meli’s stock return is lagging significantly behind the underlying fundamentals. Additionally, a BCG study has shown that the valuation multiple accounts for only 5% of stock performance over a 10-year period. The rest is explained by revenue and free cash flow growth.

Hence, my conservative assumption for Meli’s free cash flow expansion by 20% or more per year for 5-10 years [1st buy alert], coupled with a lagging stock performance, supports a strong future stock performance.