✅ Buy Alert - 3rd Buy - Shorts increased their position; I bought more, 9x EBIT

Third and final purchase of this highly misunderstood UV disinfection validation business, expanding to other industrial applications.

Intellego, the 22nd pick, is now back at a 5% allocation after falling by over 30% after just a month of ownership. The first two purchases were planned after the deep dive was published. However, after dissecting the business even further for risks of permanent capital losses (article here), I found the odds of the company, the product, and its partnerships to be more real than ‘fraud’.

To understand why I made a third purchase today, please read the required readings below: [deep dive, 1st buy, 2nd buy, risk management, 1st live event, mispriced]

The latest one is most interesting.

This is a company that exhibits multiple ways to win through fundamental performance and potential multiple expansion (and at this valuation, even being acquired by its partner).

high reinvestment opportunities with 50% returns on investments (ROIC)

aligned management with high ownership and excellent execution

mission-critical products to slow to change end-users

unfocused competition and high barriers to entry

squeaky clean balance sheet

low valuation

fading risks

If you are new, read more about us here, and our latest portfolio review here.

If you are looking for an above-market return while taking low risk, you can read our Sleep Well Manual to understand our investment process.

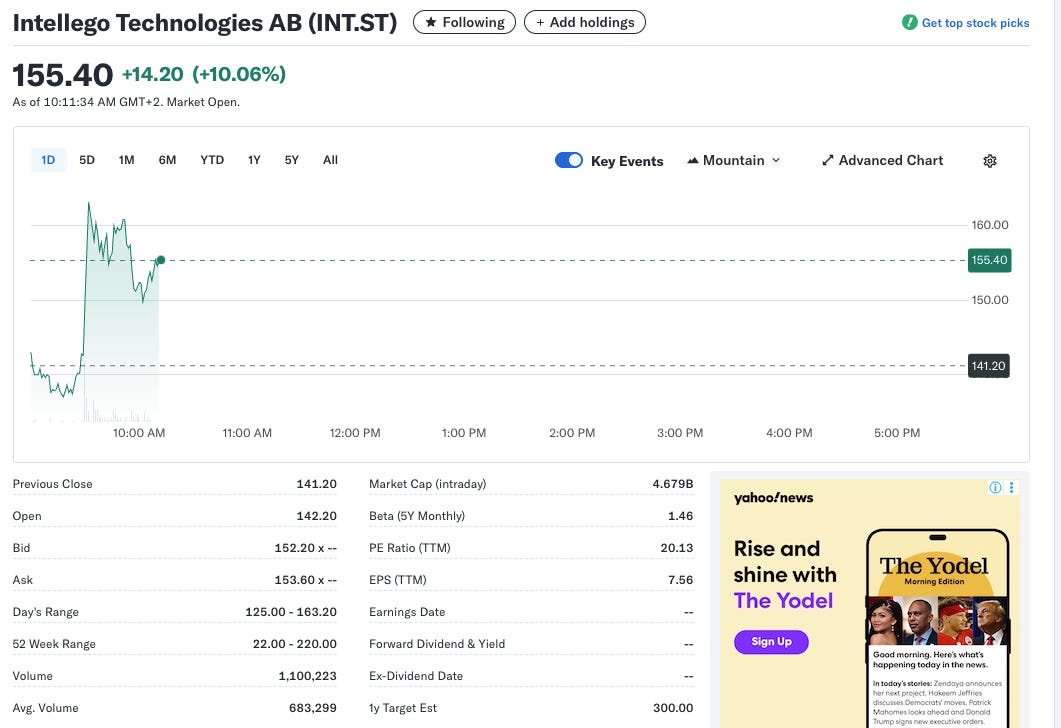

For our records, I purchased an additional 2% position at SEK128/share. To my surprise, the stock fell to these levels before shooting up to SEK 160/share after the anticipated Q3’25 preliminary results were announced.

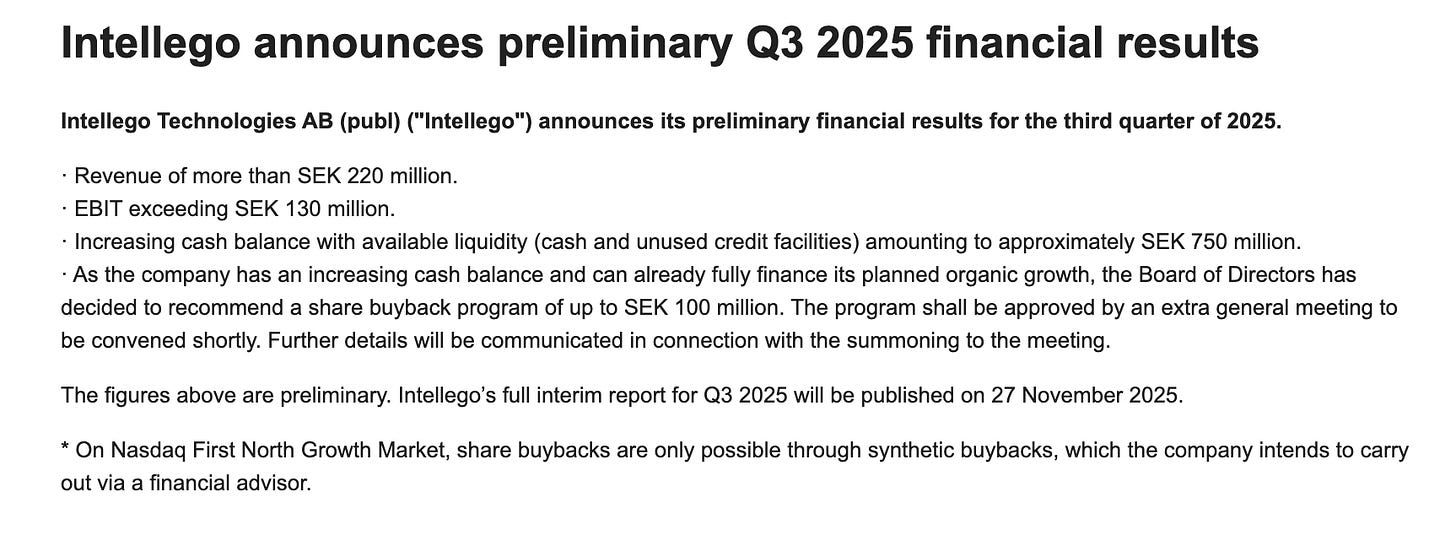

Here are the Q3’25 preliminary results:

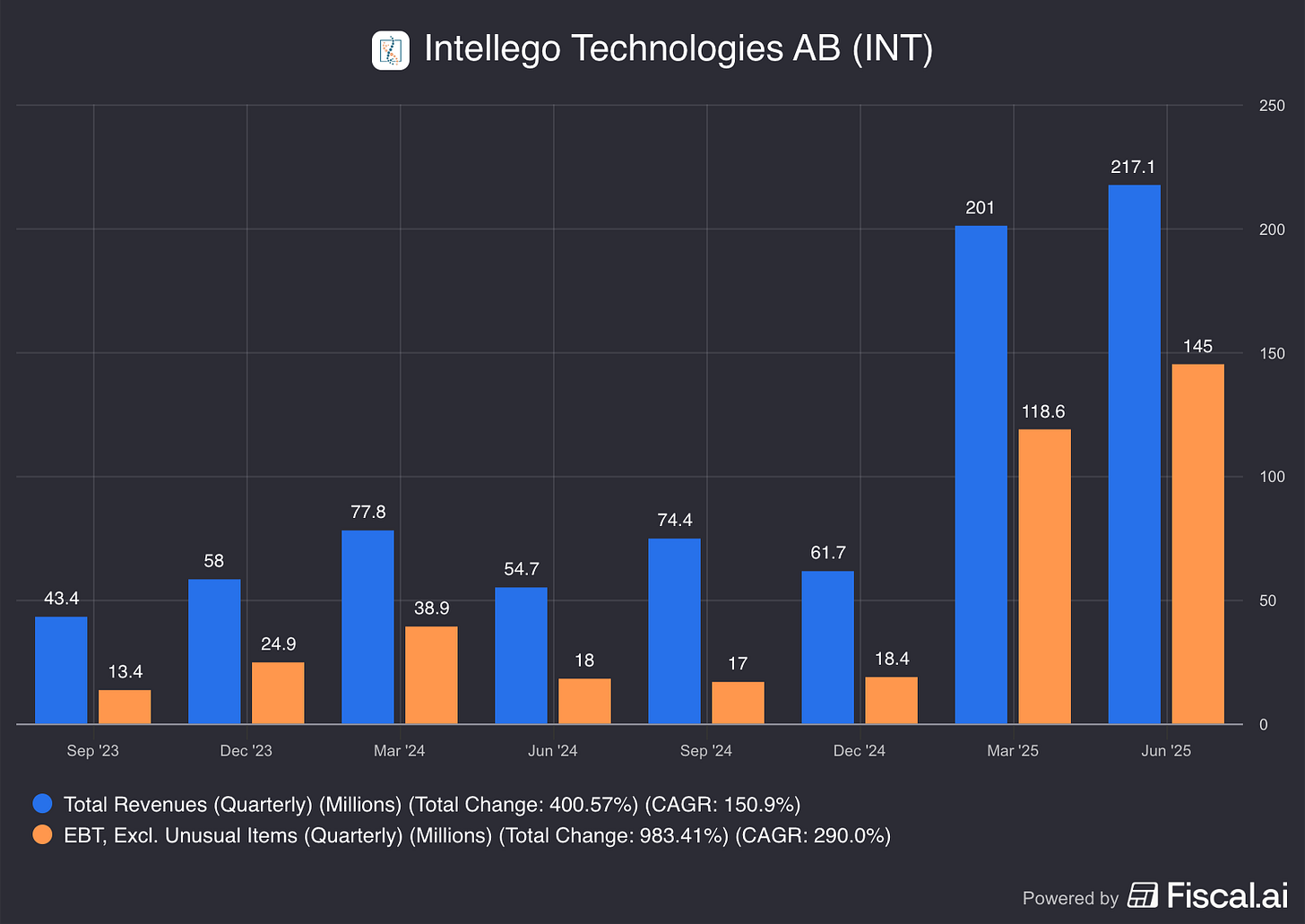

Q3 revenue of more than SEK 220M, EBIT exceeding SEK 130M.

Q2 revenue was 217M, EBIT was 145M

Q1 revenue was 201M, EBIT was 118M

Hence,

FY2025 revenue is likely to be SEK 800-900M, if the trend continues.

And EBIT is likely SEK 500-600M.

The Q3’25 preliminary results imply the year-end numbers will far surpass the last guidance of SEK 700 and SEK 400 for revenue and EBIT.

Even better, liquidity stood at SEK 750 million (in the form of cash of SEK 243 million and unused credit facilities of SEK 507 million), a ~SEK 550 million improvement from SEK 200 million (100 million in cash and 100 million in unused credit facilities). So I guess more receivables have been paid and converted to cash in Q3.

Additionally, management has indicated a SEK 100M allocation for buybacks, which is greater than 2% of the company's value. If they do so, I don’t think there are any doubts by bears that Intellego is all made up!

As a result, I still firmly believe that the quality of the business has improved significantly, and the future cash flow is poised to grow by triple digits over the next few years.

The investment risk isn’t that the share price has surged or declined sharply; the risk is that we don’t understand the product and evolution of the business deep enough to know where it will be in 5 or 10 years.

Please read my deep dive for a comprehensive understanding of the product, alternatives, and why the business model is highly defensible.

The reasons I bought Intellego for the third time are:

Disinfection using UV light is an emerging but superior solution to existing alternatives. It’s a safer, more cost-effective, and easier-to-validate alternative to chemical sprays in medical settings, which are responsible for ~40 million hospital-associated infection cases in the US annually.

Intellego’s UVC dosimeter product is a more cost-effective and versatile solution than radiometers for validating disinfection procedures/runs in medical settings (e.g. Veteran Affairs SEK 30-50M hospitals deal in 2024, cost per UVGI robot). In particular, if you see curing (drying) machines at an industrial scale (for semiconductors, adhesives, etc), there is just no space for a radiometer to fit in. Hence, the new curing market is for Intellego to take.

Intellego has expertly navigated through major roadblocks in setting up a go-to-market strategy that aligns incentives for all parties. It created Yuvio and acquired Daro, both of which sell UV disinfection devices. Hence, distributors are more willing to sell high-value devices and lower-value dosimeters as a bundle.

The results have immensely changed the face of its business model (consumer to business pre 2022, transactional to recurring post Daro/Yuvio, and vertical integration post Daro/Yuvio). By selling both the disinfection devices (robot lamps) and the UVC dosimeters, they can also guide clients on the proper usage of UVC disinfection.

Transformational collaborations with Likang (both dosimeter and disinfection devices) and Henkel (utilized internally and for sales) are already covering most of the current guided FY2025 revenue, approximately $ 80 million.

Guidance for FY2025 was raised every quarter this year and is highly likely to be raised again in the official Q3, as well as the 3-5 year guidance of SEK 2 billion. Q1’25 revenue was as much as the whole 2024 financial year. But even if management doesn’t raise the 3-5-year guidance, revenue would still be growing at 45% per annum for three years with the existing guide (SEK 2B). The valuation appears reasonable at 9x EBIT this year and single digits for 2026 (SEK 4.5B market cap).

In detail, valuation does not account for (i) business model generating more recurring revenue and stronger cash conversion, (ii) favourable regulation mandating businesses and hospitals to validate their disinfection procedure, (iii) expanding application of the technology into the larger curing market (hardening of adhesive, coatings, paint, dental, and industrial usage), and white space in agriculture (plant cultivation). The likelihood of the above materializing is high in the medium term. And a ‘technology platform of UV solutions’ will demand a different multiple.

Meanwhile, new entrances will have to go through patent hoops that expire in 2029, 2041, and 2042. One interesting snippet is that Henkel attempted to create a similar solution in the past but opted for Intellego instead (after a 2-year discussion behind the scenes). As for existing competition, radiometers are only competing within the disinfection market and are showing signs of losing out, as UV disinfection using dosimeters for validation is growing much faster.

This is how the Sleep Well Portfolio looks after the transaction: 13 SW businesses, 2 losers.