Business Update - CrowdStrike Q2'25 - IT Outage A '1%' Problem, what's next at 60x FCF?

We trimmed shares at $381/share, rebought at $205, stock trading at 60x FCF knowing the true cost, the churn, the elongated sales and the benefits to S1 and PANW?

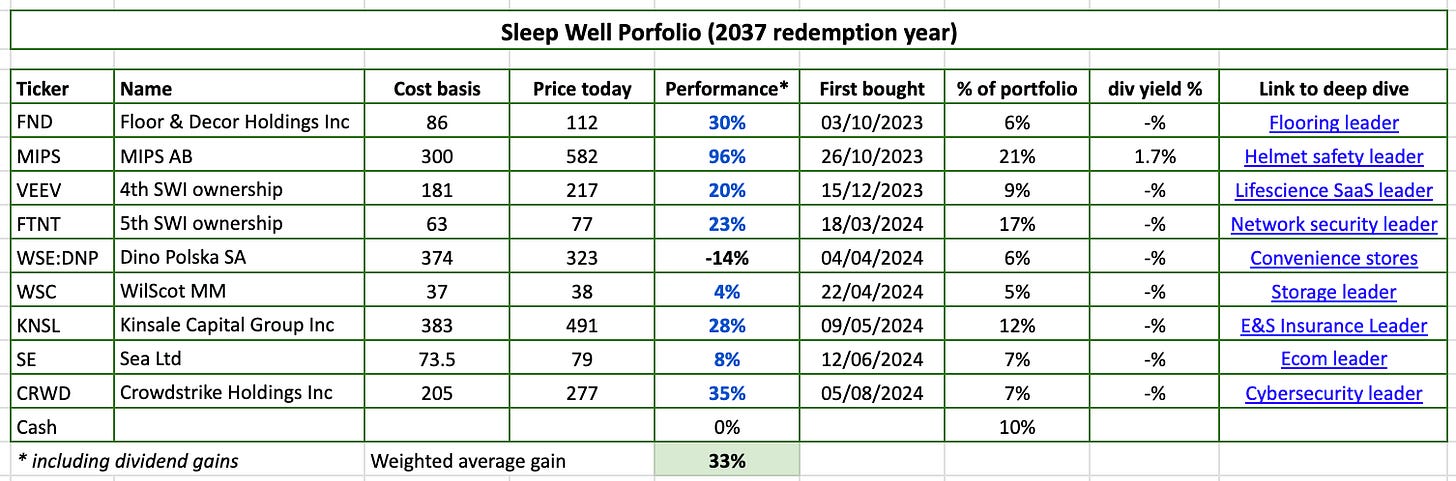

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Hi, sleep-well investors,

We will review the crucial CrowdStrike Q2’25 results. We have extensive information about the cost of the IT outage, well-handled apology, remedial work, and, importantly, the switching costs, the churn, forward sales, and the benefits to SentinelOne and Palo Alto Networks.

Before we start, I want to highlight Sleep Well Investments' high success rate and encourage more investors to take advantage of it.

Since going paid, we have been correct 8 out of 9 times, and I believe we have the right mindset and framework to maintain this rate.

More importantly, we have been right where it matters. When CrowdStrike caused the global IT outage, having done thorough work on Fortinet [deep dive], we bought it as a hedge and made it the second largest position (15%, up 30%) in the portfolio. When MIPS was on the way to recovery last year, we made it the largest (21%, up 91%).

Moreover, we trimmed CrowdStrike shares at $381/share in June to buy Sea Limited at $73.5/share. After my initial analysis of the IT outage, I waited two weeks to gather more information before adding CrowdStrike at $205/share.

As Q2-25 results were announced, it is turning out to be our most successful roll of events. Luck played a part, but to be correct, 11 transactions out of 13 required disciplined execution and a deep understanding of what we own. That’s what we aim to deliver at Sleep Well Investments.

CrowdStrike Q2-25 review

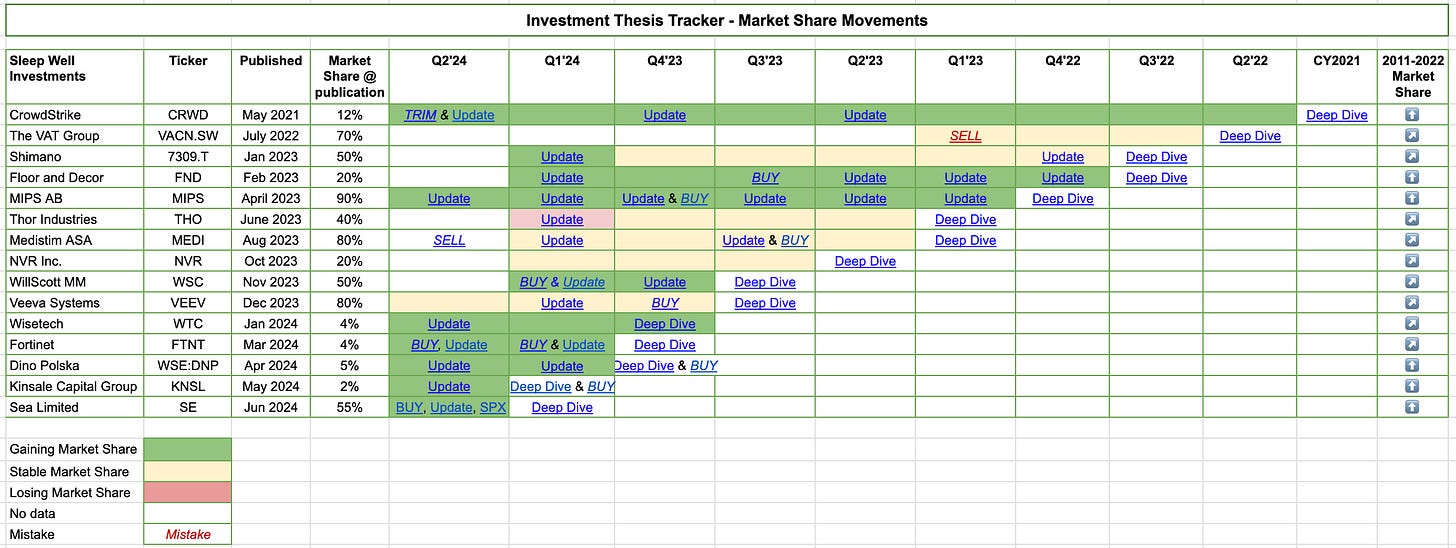

For a complete view of CrowdStrike, below is what was covered and sorted chronologically.

Deeper review of the IT outage damages, purchase note at $205/share, Aug 2024

Initial review of IT outage, bought Fortinet as a hedge, July 2024

Lofty valuation, trimmed Crowdstrike, Jun 2024

Q1’25 review, Mar 2024

Fal.con review, Oct 2023

Deep-dive in 2021 (pre-sleep-well framework).

First note in 2020

**The table above has all the links to thesis updates, buy-and-sell, and deep dives—all in the Sleep Well Portfolio spreadsheet.

Free subscribers can read all my FREE and previews of paid research here.

Brief financials - Q2’25

Q2 ’25 results saw 32% revenue growth and a 28% free cash flow margin, matching SentinelOne's speed and Palo Alto Network's profitability.

Non-endpoint modules saw incredible growth, surpassing $1B ARR, demonstrating successful leverage of EDR base to upsell to other products — platformization at work. In particular, Cloud security is now over $515M ARR, growing at 80% YoY, larger and growing faster than Palo Alto (500M ARR at 30% growth), and catching up with Wiz ($500M ARR at 100% growth).

The IT outage occurred only at the end of Q2 ’25; the solid financials don’t reflect what’s to come.

In my second review of the IT outage, I discussed

(i) Can CrowdStrike adapt and improve? - Yes, based on initial evidence

(ii) Can we trust the management? - Yes, based on the track record, incentives, and how they owned the problem.

As we advance, the FIVE most important discussion points are: