✅ 🚫 Buy/Sell Alert - *9th sleep-well ownership* - Sea Limited (SE), Trimmed CrowdStrike (CRWD)

Sea overcame a perfect storm to reemerge as the most dominant tech titan in SEA, execution risks reduced, undervalued at 25xFCF with 20% durable growth.

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

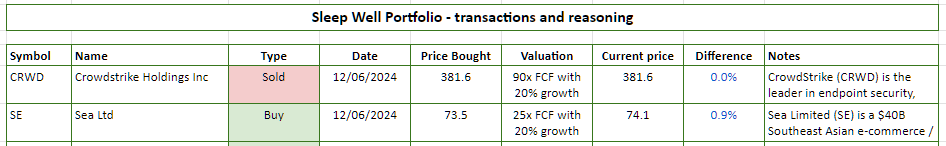

Today, I bought Sea Limited (SE) ‘Sea’ at $73.50/share and trimmed CrowdStrike (CRWD) at 381.64. I am adding a resilient business with durable growth that can help the Sleep Well Portfolio thrive from unpredictability while reducing my largest holding, CrowdStrike, as its valuation has approached nearly 90x free cash flow.

Arguably, CrowdStrike is perceived as higher quality with durable 20-30% growth for the next 5-10 years. However, Sea is trading at just 25x FCF for a similar growth profile. Importantly, to justify Crowdstrike’s current stock price of $381/share, it needs to grow FCF by 25% for the next ten years. Things need to be perfect. Compared to Sea, it’s a beatable 7% CAGR.

Additionally, Sea’s 55% market share in Southeast Asia is more dominant than Amazon's (AMZN) 38% share in the US or Mercado Libre’s (MELI) 30% in Latin America. This is also a high-quality business.

As we advance, Sea seems like a better risk/reward for me.

25x FCF ($38B EV)

20%+ forward growth

$4B net cash balance sheet

55% market share in E-commerce, $1B free cash generative in Gaming, and $500M free cash generative in Fintech.

Read my deep-dive yesterday, 11 June 2024, for complete details about the Sea’s business. For more details on CrowdStrike, please read my Q1’24 review, Fal.con review, first note in 2020, and deep-dive in 2021 (pre-sleep-well framework).

Free subscribers can read all my FREE and previews of paid research here.

What’s Sea Limited?

Sea Limited (SE) is a $40B Southeast Asian e-commerce/fintech/gaming success story.

Sea’s growth is nothing short of phenomenal. From humble beginnings, Forrest Li and Gang Ye founded Garena, a gaming platform that ignited a global phenomenon with Free Fire, enjoyed by half a billion players with its fast-paced action and freemium model. Garena’s success blossomed into Sea Limited / ‘Sea,’ a digital empire encompassing e-commerce (vertically integrated with its own logistics and advertising) and fintech.

Shopee, Sea's e-commerce arm, conquered Southeast Asia's burgeoning internet market with 50%+ market share thanks to its mobile-friendly interface, broad SKUs, strategic integration with social media, and competitive pricing. SeaMoney, the company's financial services arm, is seamlessly integrated with Shopee, offering users an intuitive and convenient one-stop shop for digital payments and financial solutions.

Since 2014, sales have compounded 62% annually and are expected to generate at least $1.5B in free cash flow annually.

I have owned Sea since 2020 and feel comfortable sharing my thesis with you yesterday and adding it to the Sleep Well Portfolio today.

Why own Sea Limited now?

I love this quote; it fits well with Sea’s journey.

Do not judge me by my successes, judge me by how many times I fell down and got back up again. - Nelson Mandela

Sea’s phenomenal success was followed by crushing depths post-COVID (FY2022 cash burn of $2B). The fall culminated in several internal and external pressures from

(i) economic headwinds, which saw its Gross Merchandise Value (GMV) growth slowing from 85% in 2021 to a mere 28% in 2023,

(ii) Free Fire's sharp decline as user downloads dropped from 240 million in 2021 to 150 million in 2023, with revenue dipping proportionally, casting doubts over its durability.

(iii) Overambitious, cultural, and local competition miscalculation, leading to ineffective global expansion plans into India, Europe, and Latin America, drained resources from Sea's core markets.

(iv) Sea’s aggressive marketing and promotional campaigns at the expense of long-term profitability were deemed unsustainable. Coupled with geopolitical turbulence in the war in Ukraine, it further disrupted supply chains and compounded Sea’s existing challenges, fueling the $2B cash burn fire in 2022.

Sea’s sharp slowdown saw its market capitalization fall 80%+ from $370/share in 2021 to $33/share in October 2023. This translates to a staggering $170 billion wiped off the company's market value, leaving me questioning its future.

But this wasn’t the end of Sea. It marked a new beginning. What comes next impressed me enough to label the business ‘sleep-well’.

Sea used the challenge to devise a balanced formula for growing sustainably. Shopee broke-even and has built the most extensive logistic networks in the region, Garena returned to growth, and SeaMoney keeps on printing money.

Sea will have three durable cash-generating businesses at the current run rate of over $1.5B free cash flow as we advance. Importantly, Sea shows clear evidence of reinvestment opportunities that will expand the empire's resiliency.

It has proven it has the grit to overcome the ‘sea change’ challenges above and has worked on building defensive qualities to fence off more resourceful competition. The achievement is a testament to its visionary leadership and ability to adapt and capitalize on the region's rapid digital transformation.

Best of all, the market has not given enough credit, valuing it at just 25 times free cash flow for a tech titan with multiple years of 20% growth and margin expansions. Together with future multiple expansions, Sea’s value is well-positioned for outsized long-term gains.

Here is a quick overview of the segments and how they make Sea a sleep-well pick.

Garena, the gaming segment / Digital Entertainment, owns Free Fire, the most successful battle royal game in the past seven years; it attracts nearly 900B views on TikTok, 300B (!) more views than the next most popular games (Roblox and Fortnite), has 595M quarterly active players and 49M paying. After a roller coaster post-COVID, Garena has stabilized and is en route to generating $1B of free cash flow annually for the near future. Adding to the $4B net cash, Sea can redirect this excess cash to fortify Shopee and SeaMoney.

Shopee, with a $85B gross merchandise value (trailing 12-month GMV), commands over 50% market share in Southeast Asia. Shopee is more dominant than Amazon's (AMZN) 38% share in the US or Mercado Libre’s (MELI) 30% in Latin America. The monopoly-like share is a testament to Forrest Li’s leadership and superior local knowledge compared to competitors. Since the last few quarters, Shopee has been breakeven in the core market - South East Asia. Future success is supported by 15%+ e-retail growth, improving logistics and unit economics in live-commerce business thanks to more rational competitive behaviors following Tiktok's merger with Tokopedia.

SeaMoney / Digital Financial Services, the fast-growing and high-margin fintech segment, offers credit services to Shopee sellers (SME loans) and buyers (buy-now-pay-later and short-term cash loans). SeaMoney empowered 18 million Southeast Asians to participate in the digital economy, bridging the gap between traditional finance and the world of mobile transactions. It is a direct benefactor of Shopee’s success. SeaMoney generated $500M of free cash flow in the last 12 months and has durable 20%+ growth thanks to Shopee integration, disciplined risk management (decreasing non-performing loan ratio of 1.4%), and growing monetization in insurance and mobile wallet services.

My simple and conservative sum-of-part valuation of Sea indicates an undervalued enterprise of $44B compared to the current market cap of $40B. I value:

Garena at $12B (12x EBITDA, low range of industry 12-20x EBITDA),

Shopee at $25B (2.5x EV/Revenue, lower than peers at 3x), and

SeaMoney at $7B (15x EBITDA).

My reverse DCF also see that to justify Sea’s current stock price of $73/share, it needs to grow FCF by just 7% for the next 14 years. Things don’t need to be perfect.

I believe the market hasn’t appreciated the value in

(i) Garena’s durability, especially if Free Fire is relaunched in India (a 40M user potential), and

(ii) Shopee’s scale advantage and defensive quality in SPX, its own logistics, the most extensive in Southeast Asia, and

(iii) a higher advertising take rate towards the end of FY2024, a 0.5% increase, leads to $400M of ad revenue alone ($200-300M free cash flow).

(iv) a higher multiple as time will show Sea is an enduring enterprise.

Lastly, Jeff Bezos often says that free cash flow per share is the ultimate financial measure. Sea’s free cash flow per share is only starting to move upwards.

Sea Limited (SE) is in the Sleep Well Portfolio. Please do your due diligence and consider becoming a premium member for more wealth-creating content.

Since I started, Sleep Well purchases have been ‘in the money’; I attribute this to a combination of deep understanding of the business, disciplined execution, and luck. I hope the results continue to help you and the Sleep Well Portfolio.

If my content has had a positive impact 🎯 please help me grow by spreading the word. Thank you 🙏

The current ownership status of all picks in the Sleep Well Portfolio and my family portfolio are below (*PA - short for personal account).

The portfolio will rebalance itself by merit—business performance and with cash added each year. There are no trades and no compromises on quality. Annual subscribers can check the spreadsheet for more details. Link here. I'll add more features as we go along.

Finally, remember that investing is a life-long journey, not a sprint.

Let me know in Chat/Email if you have any questions.

Sleep Well Investing,

Regards, Trung

Stock Tags: NVR 0.00%↑ CRWD 0.00%↑ WSC 0.00%↑ VEEV 0.00%↑ FND 0.00%↑ $MIPS.ST $SMNNY THO 0.00%↑ MEDI 0.00%↑ $VAT $DNP.WA FTNT 0.00%↑ PANW 0.00%↑KNSL 0.00%↑ SE 0.00%↑

Incredibly lucky, of course, that I trimmed $CRWD for $SE.

Bad news for CRWD today.

It's Falcon Sensor and Microsoft online services crashed, causing global IT problems. In the US, 911 outages across several US states and disruptions in international airlines, banks, and media outlets.

CRWD stock is down -14%, due to the news and probably also due to the sky-high valuation.