Business Update - Grab (GRAB) - Local Competition and Autonomous Driving

A new local competition with 80K cars and bikes in Vietnam and the fast evolving robot-taxi in the US, how will they disrupt Grab and Uber?

Hi friends,

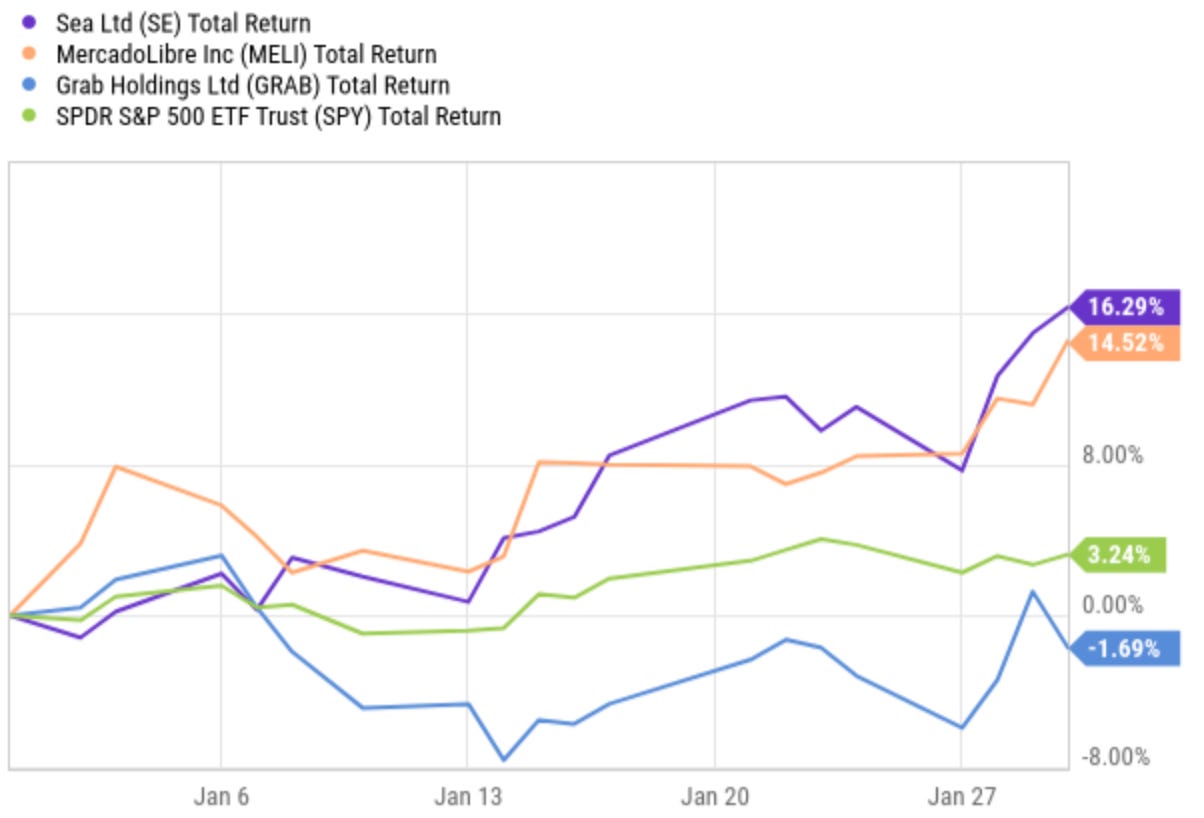

The basket of Sea Limited, Mercado Libre, and Grab that I proposed earlier in the year returned 16%, 15%, and -2%, respectively, compared to the S&P500 at 3%. That’s great, given the uncertainties in a new political environment.

The other four resilient businesses discussed are well-positioned to endure this seemingly uncertain year. Read more here.

In my Grab’s deep dive and updates, I have circled four key risks: local competition, key man, regulatory, and currency.

Grab readings - deep dive, buy alert, Q3’24 update

In this post, I want to discuss new findings on Vietnam's rapidly growing local competition. I also want to add a mid-long-term risk to Grab — robot-taxi / autonomous driving in Southeast Asia. This comes after studying how the rapid development of Robotaxi in the US by Tesla is forcing Uber to partner with Waymo.

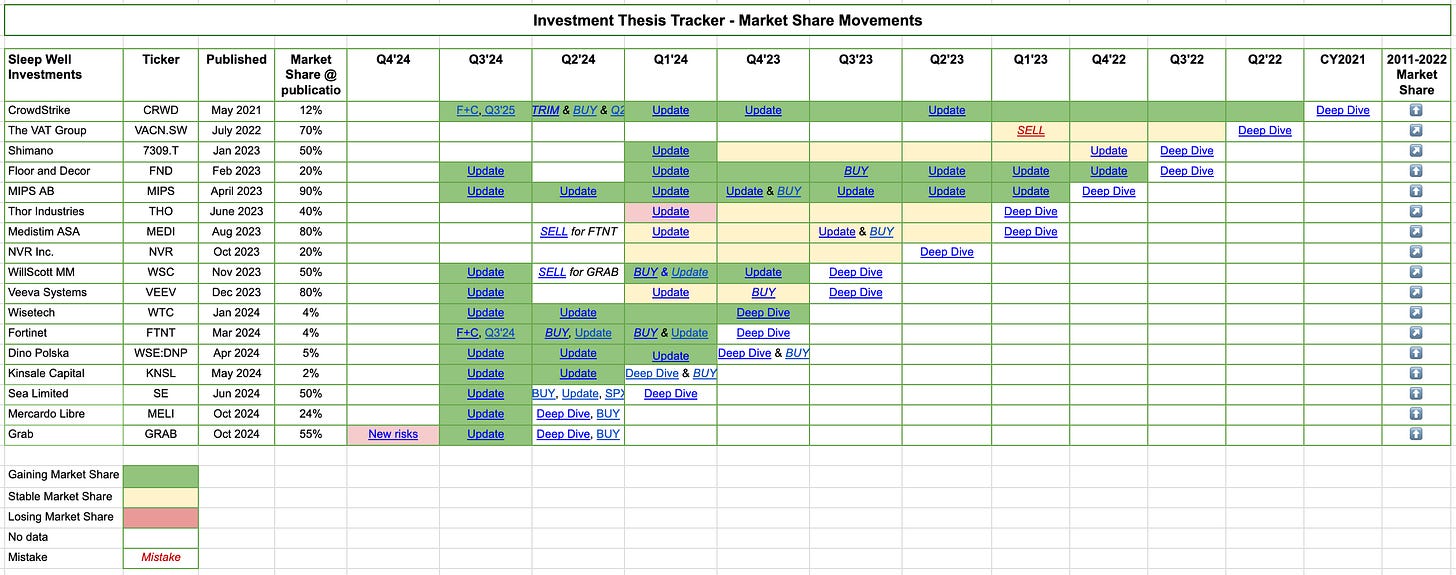

Given Grab’s new risks, I have added a pink box in the thesis tracking table to indicate its potentially declining market share.

**Links to thesis updates, buy-and-sell, and deep dives are all in the Sleep Well Portfolio spreadsheet.

In case you missed my FY2024 performance review, it’s here.

For all other writeups:

1. Local competition - GSM in Vietnam

While I was in Vietnam for Christmas, I couldn’t help but notice the sea of cyan EV taxis on the road. They came with well-spoken drivers, new cars, and the loss-art of opening doors for passengers. For what price? It was cheaper than Grab. Wait time? It was on par or just a minute or two longer.

Enter GSM or Xanh (Green) in Vietnamese — a platform solution like Grab, but without the Fintech division (yet).

VinGroup, the biggest conglomerate in Vietnam, owns 90% of it. If there were one competition that could topple Grab, it would be this company. Vingroup is also the sole manufacturer of EVs in Vietnam - VinFast, the supermarket chain VinMart, the luxury resort chain VinPearl, and many other leading businesses in the country.

I tried over ten trips with Xanh, both long and short distances, and talked to all the drivers to get an idea of how it provided a better ride experience at a lower price! And why drivers switched from other platforms to Xanh.

All sorts of numbers were mentioned, but roughly, Xanh operates 30K cars (20K in 2023) and 60K motorbikes in Vietnam (FY2024). After just 1.5 years of operation (since summer 2023), it reportedly holds ~30% of the Vietnamese market and trails Grab's ~35% market share (60% in 2023) per Decision Lab. I think the actual number is likely ~20% for Xanh and ~60% for Grab, given that Xanh grew only 2% in 2024, and Grab grew ~20% in the country, and a different source reported ~60% share for Grab in 2023.

In my last update, Xanh / GSM lost $200M in 2023, trying to establish a foothold, while Grab generated a $100M profit for the first time in Vietnam. It could be a few more years before Xanh’s numbers turn positive.

However, for the first time, I felt Grab’s position could be challenged in Vietnam, a rapidly growing market, with a $800M total addressable market in ride-hailing alone in 2023 and projected to grow 20% CAGR until 2029. If Xanh could topple Grab, local competitors like VinGroup in other countries would pose a similar risk.

Why is Xanh a near-term risk?

Superior experience on lux rides:

Drivers receive a week of formal training, including meet-and-greet standards and thorough car maintenance practices. VinFast subsidized charging costs for the first two years, so drivers from other platforms flocked to Xanh. Most were ex-traditional taxi drivers, Be (the third-largest platform in Vietnam, with a 10% market share), Xanh staff, and even ex-Grab drivers. In contrast, Grab drivers receive just one day of training. In my estimation, they might have lost 5-10% of the drivers since Xanh’s emergence, and Grab’s drivers’ income declined up to 30% (per conversation with 20 car drivers, bike drivers were minimally impacted).

New cars—all the cars were new and electric, so the rides were markedly more comfortable compared with Grab's lux option. Rumors have it that VinFast was not selling its EVs well, so Xanh was a solution to get more Vietnamese to try out its EV cars.

Cheaper prices on most occasions:

Thanks to promotions, Xanh’s prices are still cheaper or at least on par. The price war can last a while as VinGroup has abundant resources from other established businesses.