🎯 2024 Sleep Well Portfolio Review - 92% win-rate 🎯

46 institutional-grade research, 7 new picks, 30 follow-up reports, 9 stocks BUY/SELL alerts, 92% win rate, It's Day 1 mentality again.

Happy holidays to 5000+ sleep-well investors,

I am honored that you find my work impactful. Sleep Well Investments is built on a foundation of a rigorous stock selection process and practices Jeff Bezos’s ‘Day 1’ mentality for continuous improvements.

2024 was near perfect, with a 92% win rate, after 100% in 2023.

🎯 11 buy & sell decisions were correct out of 12 compared to 4 out of 4 in 2023

🕵️ 7 sleep-well picks yielded 33% return on average

☑ 30 thesis tracking reports that deepen knowledge of our 17 picks

📚 learned from Peter Lynch, Scott Fraser, Ralph Wanger, and Terry Smith.

I am incredibly proud of this result. Despite the current bull market, all 3 of my sales decisions were correct. On top of this, 8 out of 9 buy decisions were on the money, keeping up with 4 out of 4 in 2023. Quality > quantity.

Then, for four months, my 5-year-old daughter was hospitalized (and is still recovering) due to a complicated bone fracture, which turned our family upside down. But that didn’t stop me from publishing 46 writeups and delivering excellent results this year - a testament to my sleep-well system for investing and managing our daily lives.

Yes, luck struck twice after last year’s success. So, I will continue refining and executing with discipline to ensure it rolls on. I am grateful for your kindness. Without your support, our lives would have been a lot more challenging. Thank you 🥰.

Let’s look at our 2024 performance and the key lessons to achieve good results in 2025 and beyond.

FY2024 Performance 😴 sleeping well

Caveat emptor: Our finish line is in 2037, not 2024. Judge my performance in a few years, not today. That said, let’s celebrate crossing our second year together!

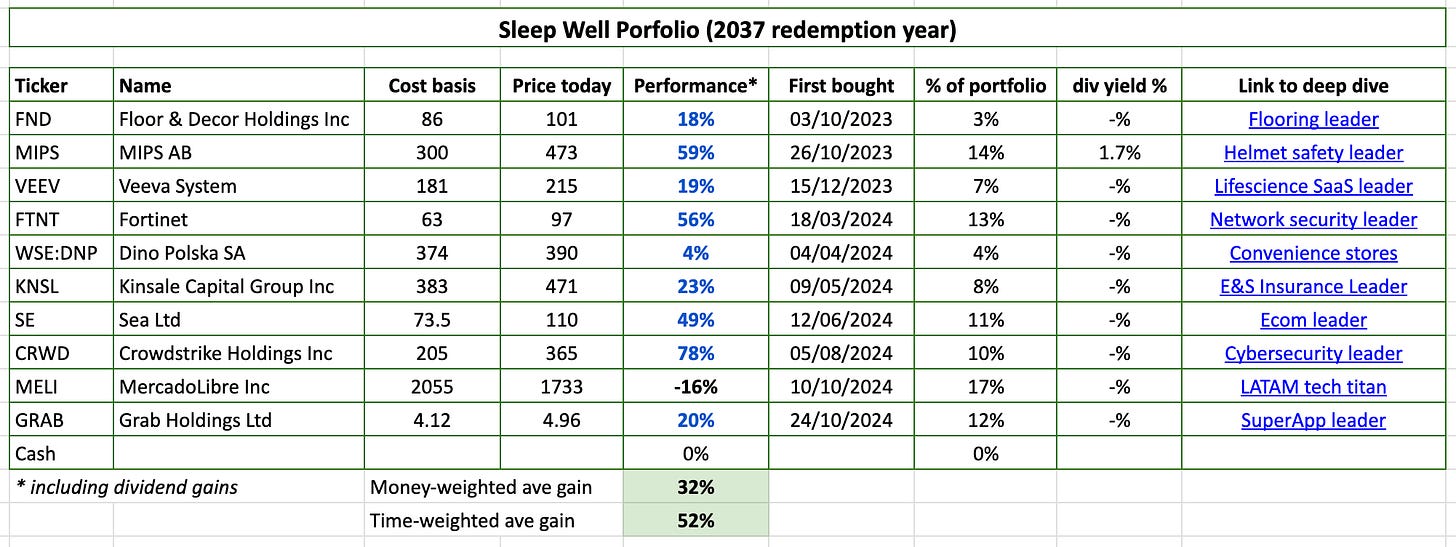

Since inception (October 2023), my self-reported result is 32% money-weighted per pick.

From 2024, I will start reporting the Sleep Well Portfolio and my personal portfolio (PA) directly from my broker, Interactive Brokers.

However, I could only pull the results for the Sleep Well Portfolio from March 2024, when my daughter's account was migrated. Hence, the following results are for reference only and are not meant to be precise but are approximately correct with the transaction reported in my Sleep Well Portfolio spreadsheet (only for the annual sub).

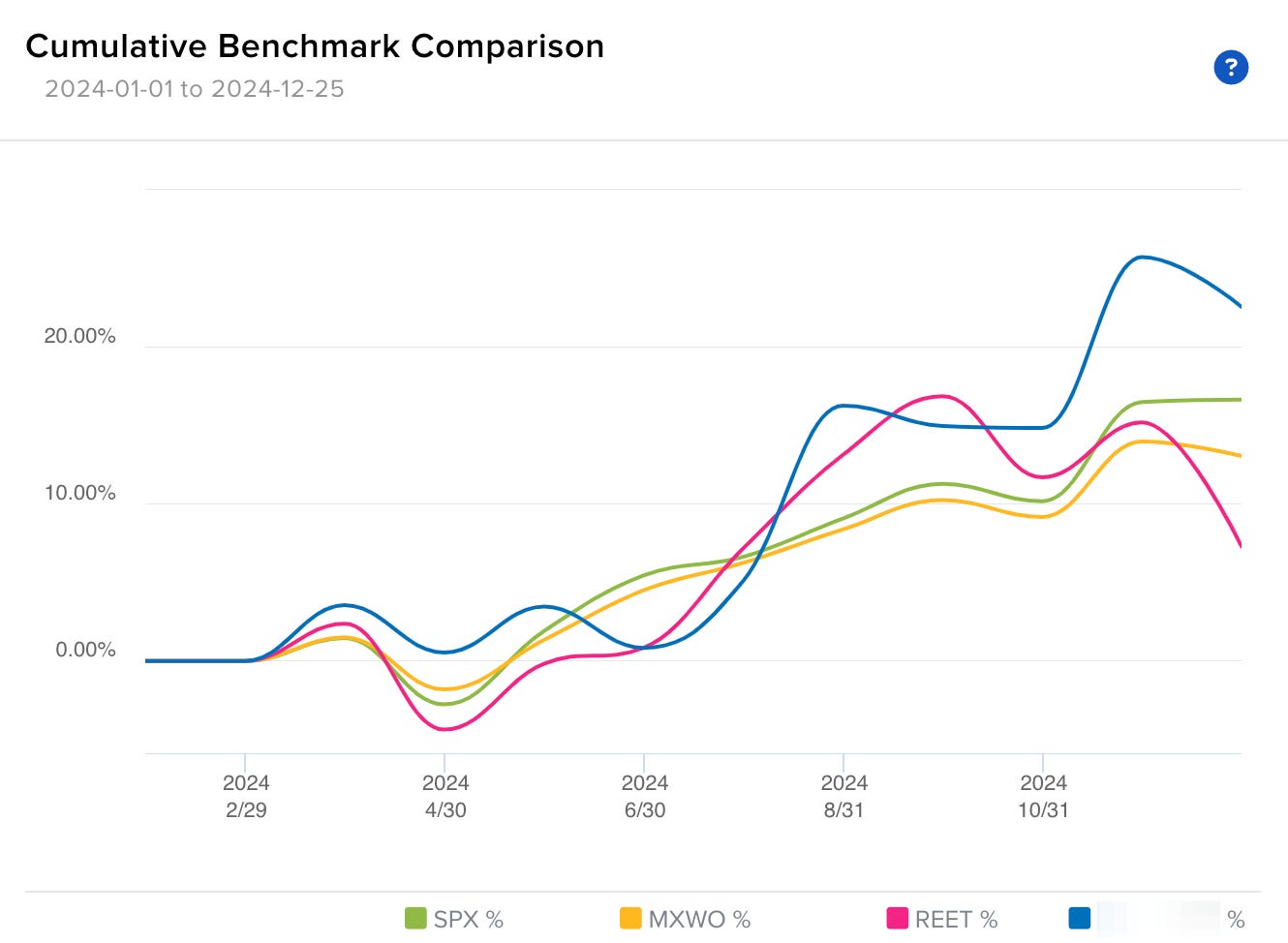

The Sleep Well Portfolio (blue) returned 22.5%, compared to 16.6% for the S&P 500 (01 March 2024 - 24 December 2024).

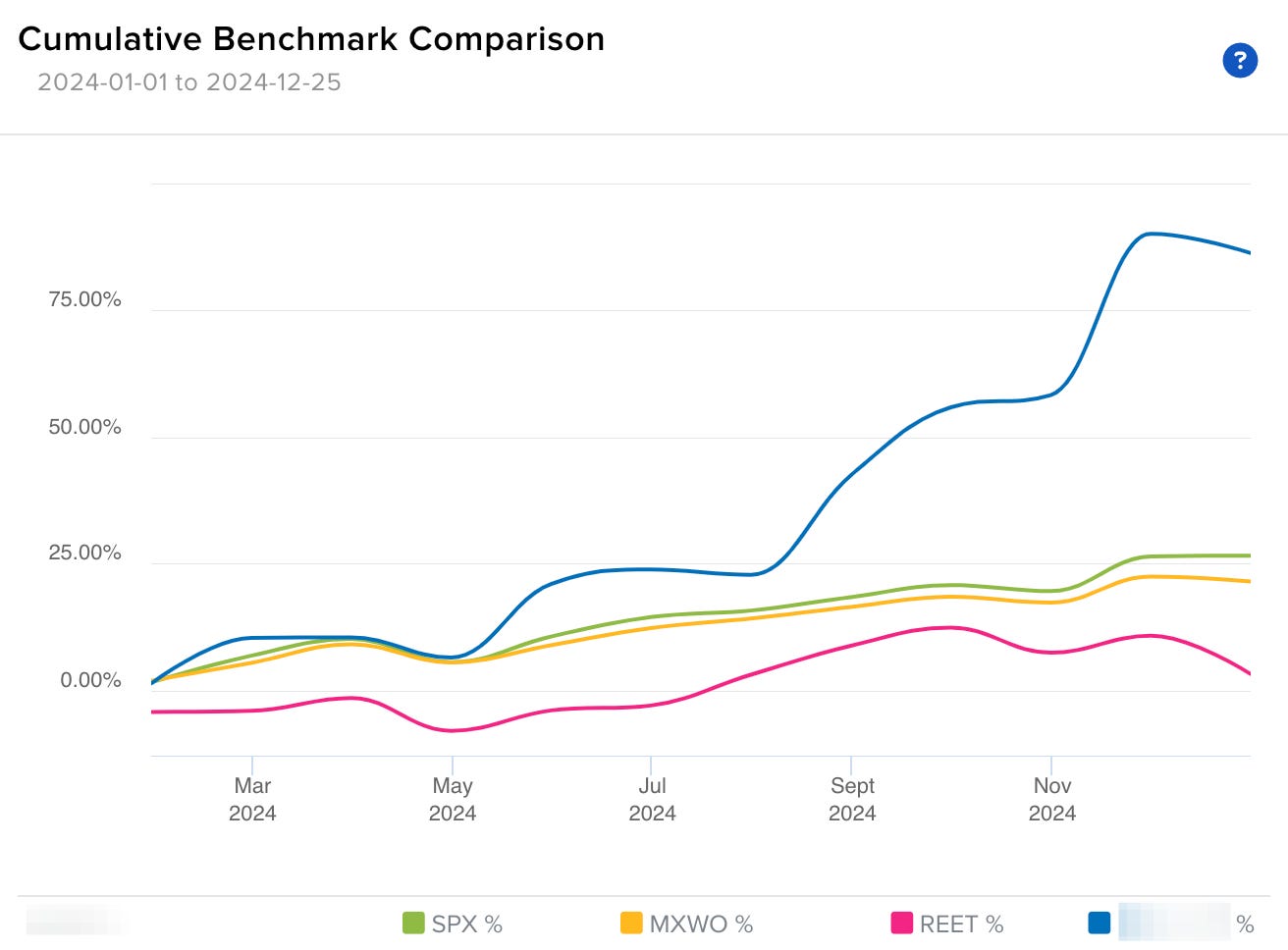

My Personal Portfolio (PA) returned 86%, compared to 26% for the S&P500 (01 January 2024 - 24 December 2024).

My PA's superior performance is explained by owning much larger positions in CrowdStrike, Sea Limited, Mercado Libre, and Grab, four of which I have owned for over five years.

But 2024 is already past. What is most important is the health of the portfolios beyond 2025, and I will dedicate a separate write-up to laying out my top picks.

Transaction performance 🎯 11 out of 12

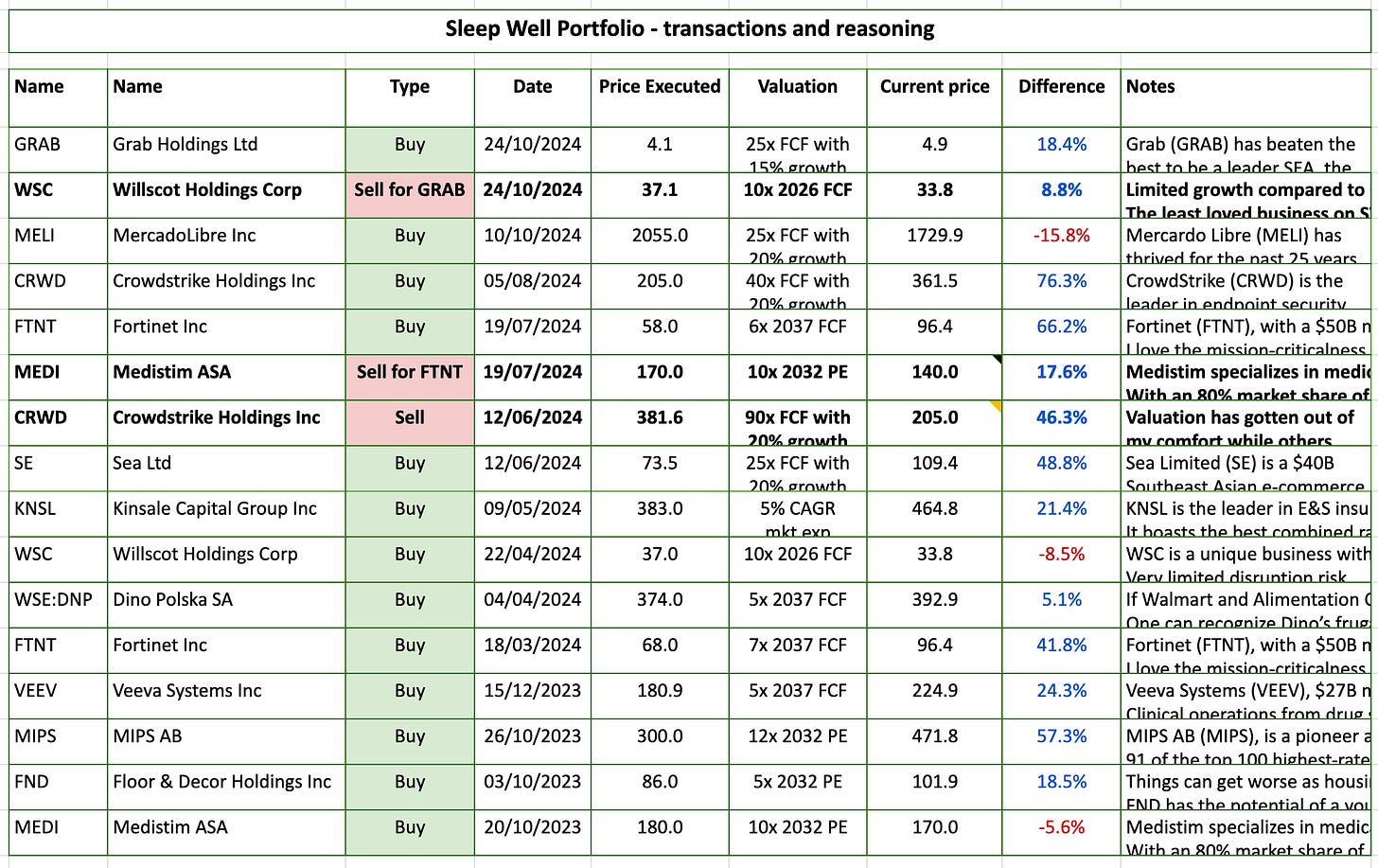

I made 12 transactions (9 buys and 3 sells) in 2024, 11 of which were correct.

I am incredibly proud of the three profitable sell decisions, particularly in a bull market.

Selling Willscot MM yielded a 9% gain (selling at $37 while the stock slid to $34 since selling) plus a 20% gain from using the proceeds to buy Grab in October.

Similarly, selling Medistims at NOK 170 while the stock slid to NOK 140 yielded a 17% gain plus a 66% gain in using the proceeds to buy Fortinet in July.

Selling Crowdstrike at $381 due to valuation (90x FCF) concerns to buy Sea Limited (25x FCF) and rebuying CrowdStrike after the IT outage sell-off (40x FCF) has also proved to be correct (so far).

Only the purchase of Mecardo Libre on October 10 remains a negative result. But I have zero concern as Meli is Latin America's most sleep-well business (anti-fragile with a long reinvestment runway at a high return on investment).

Sleep Well Picks performance.

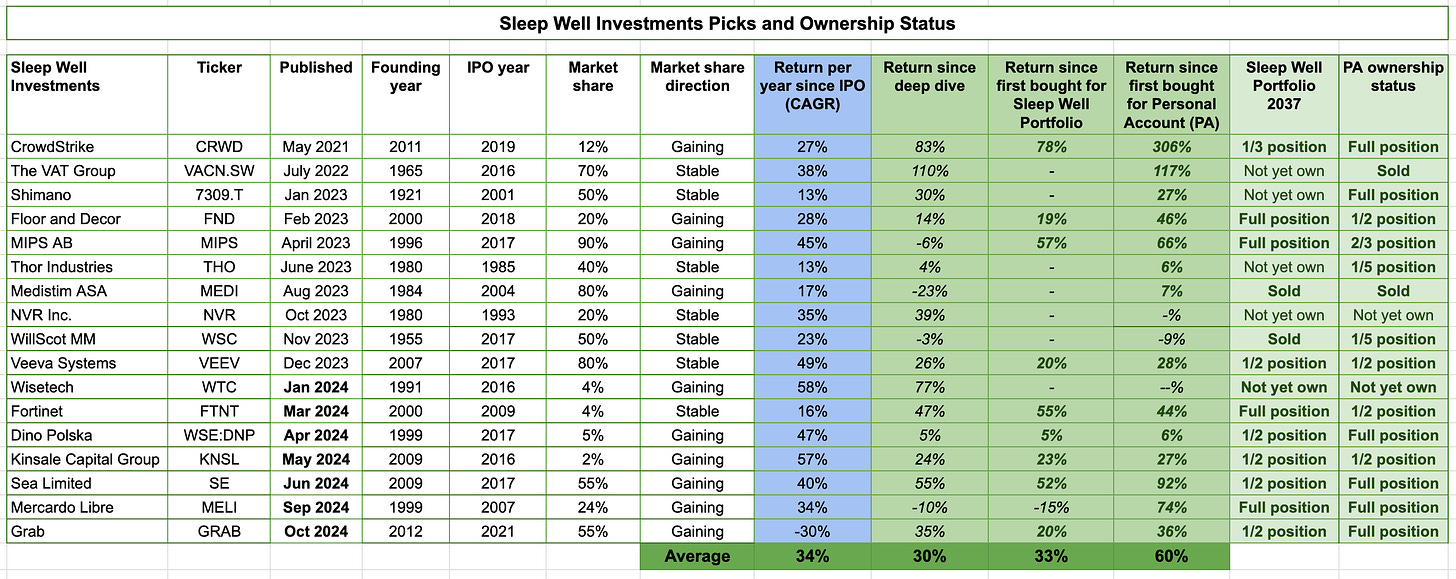

We recommended 7 new picks in 2024. You can see the performance since publication in the table below.

Links to the 7 deep dives in 2024:

WiseTech - Global logistics software leader [Part 1, Part 2] +31% CAGR

Fortinet - Sleep Well In Network Security [Part 1, Part 2] +13% CAGR

Mercado Libre - The Most Sleep Well Business in LATAM +33% CAGR

Grab - SuperApp Monopoly (-36%) CAGR

Key lessons

I take every win and loss as a lesson to improve. Let’s go through three, then discuss Jeff Bezos’ ‘day 1’ mentality.

Sell least-loved position first (Medistims and WillScot) - Scott Fraser.

Owning companies you don’t love drains valuable resources and enjoyment that can be invested in others. I learned this from reading Scott Fraser’s Picking Winners book [review here]. Moreover, companies must be sold if they perform poorly relative to others or have become more challenging to track. That was the case with Medistims, which had proven less attractive than my other picks (Fortinet) and also confused me when they changed how they reported segment data.

WillScot, on the other hand, was a less productive business than initially thought, given that it already owned 50% of a slower-growing market (5% growth) compared to Grab (12%+). The low visibility of the merger with the second-largest player, McGrath, also reduced my confidence in the current management's execution.

Any year you don’t destroy one of your best-loved ideas is probably a wasted year (CrowdStrike) - Charlie Munger.

I first wrote about CrowdStrike in 2020 and owned it shortly after its IPO in 2019. It was my biggest winner and, at a point, was over 30% of my portfolio. But this year, I sold it at $381/share and re-purchased it at $205/share (today: $365/share). Luck? Certainly. But, no matter how much in love I was with CrowdStrike’s execution and expanding competitive advantages, I couldn’t see how the business could grow at 25% for the next 14 years to justify the 90x FCF valuation. Make no mistake, CrowdStrike was the best endpoint solution, but cyber security has formidable peers, namely Microsoft, Palo Alto, and Fortinet. Having a good knowledge of all three, I know they have a leading position in their core segment, and their superior scale and distribution will allow them to encroach on CrowdStrike’s share. At 90x FCF and with that competition risks, there was minimal margin of safety. Moreover, historically, only 6% of businesses can grow organically over 10% for 10 years (McKinsey study between 2009 and 2019); CrowdStrike’s 25% required annual growth is a long stretch. However, at 40x FCF and little impact from the IT outage it caused in July, I was a happy buyer again, with a much smaller position.

Bet big when the odds are in your favor - Charlie Munger

I used to limit my allocation to 5% of the portfolio for any given stock. However, that would be a waste of my deep understanding of a few stocks I cover. Thus, I have become more concentrated when encountering a business that ticks more boxes on the sleep-well checklist and when I know it well. I have tested this strategy more aggressively in my personal portfolio and started doing the same for the Sleep Well Portfolio (MIPS, FTNT, MELI, SE, GRAB with a 10%+ allocation).

Time will tell if it will work; everyone must do what suits their circumstance best. At Sleep Well Investments, we dive deep into fewer stocks and track them rigorously, so staying concentrated fits well.

See our tracking sheet below.

**Links to thesis updates, buy-and-sell, and deep dives are all in the Sleep Well Portfolio spreadsheet.

The ‘Day 1’ mentality continues.

I created Sleep Well Investments to hold myself accountable for my family’s future and safeguard what we have saved for decades. Now that over 5,000 of you have trusted me, I feel more grateful and motivated to continue refining my investment process and building discipline to allocate capital wisely.

That’s my ‘Day 1’ mentality.

What’s Day 2, you ask? In Jeff Bezos’ words:

Day 2 means stasis, followed by irrelevance, followed by an excruciating, painful decline, followed by death.

It’s not quite dramatic, but you get the vibe. Like my father, who’s especially old-schooled, I want a solid safety net for my family. So, it will always be ‘Day 1’ for me. I will repeat this section until it grows in my bones.

So in 2025, you can again expect:

Quality > quantity

High win-rate

We will continue to compound capital by being highly selective of what we own and knowing deeply why we own them. I believe this is the most ‘sleep-well’ and proven way to succeed.

Stay tuned for my subsequent write-up, where I will discuss the sleep-wellness of my picks for the next 5-10 years.

Don’t hesitate to comment, help me improve, and contact me through trung.nguyen@sleepwellinvestments.com, LinkedIn, or twitter/X@DTF_Capital.

Happy holidays with your loved ones!

Awesome performance!!!

Congrats! Wish you more of the same next year! That's a useful thesis tracker.