Grab Q3'25: Few Less Impressive Prints, Hold.

Stocks were red hot into earnings, I'll point straight to four areas that requires some attentions. The rest performed as expected.

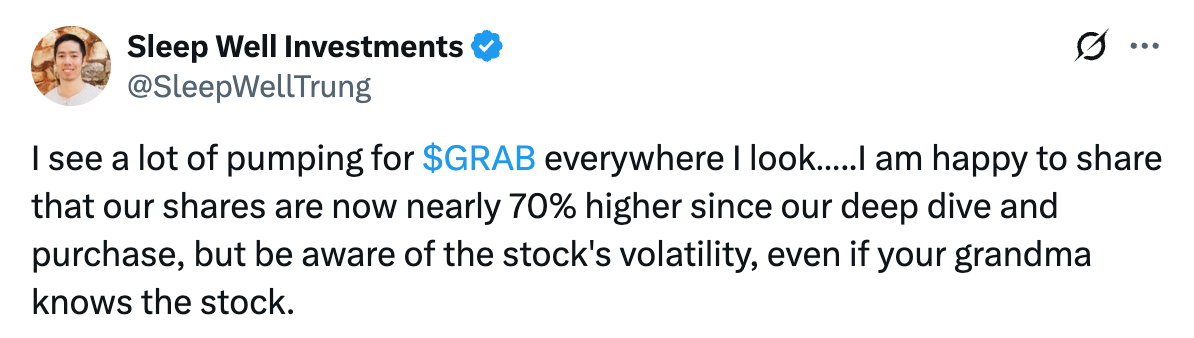

GRAB, a position acquired in October 2024, reported good Q3’25.

However, the stock felt red hot into the earnings.

In this report, I dive straight into four underlying growth drivers that require owners’ attention.

On Q3’25. I invite you to skim the overall headlines (Q3’25 presentation here) — I won’t discuss the obvious. Then focus on:

Drivers and customers’ incentives

Financial services growth is not so remarkable

$5.5B cash position, $250M wasted.

Velocity of product release, and advertising’s growth.

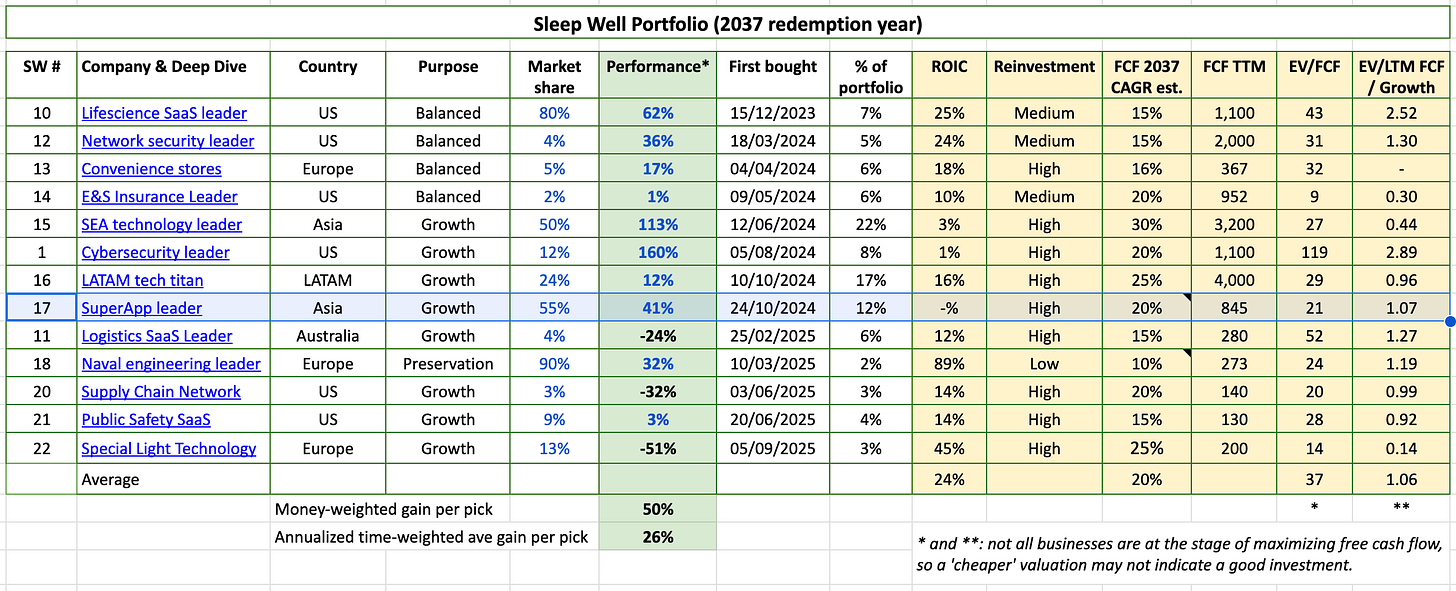

Then we’ll revisit why Sleep Well owns Grab and whether a ~24x free cash flow valuation is attractive/unattractive for the Sleep Well Portfolio.

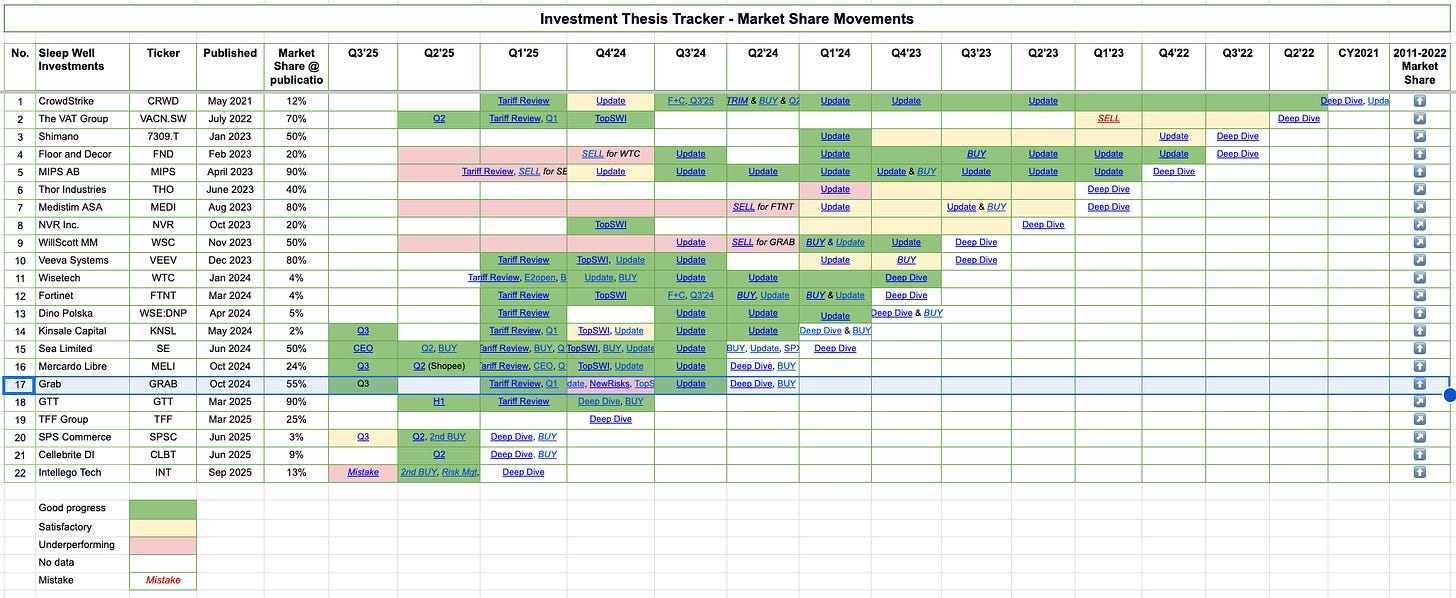

Read our previous write-up on Grab for more context.

Q1’25 - Tariff Review, Q1 Update

Q3’24 - Update

Disclaimer

As a reader of Sleep Well Investments, you agree to our disclaimer. Full details here.

If you are new to SWI, check out our FAQ and Owner Manual.