Business Update - Medistim: Q3-23 Thesis Tracking - No News Is Good News

Undisputed market leader with 80%+ market share, Q3'23 showed non-conclusive evidence of peers encroaching on Medistim's dominance.

Hi, I am Trung. I write 10+K words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, and 3rd). Join me in building generational wealth.

My most recent deep dive on WillScot Mobile Mini - A Leader In Space Solutions WSC 0.00%↑ is FREE if you missed it.

My next one is another 80%+ market share leader in the life science industry - Veeva (VEEV); however, with Salesforce (CRM) eyeing to enter the market and IQVIA’s multi-year lawsuit, there are lots to unpack before I get comfortable owning a piece of the business - stay tuned.

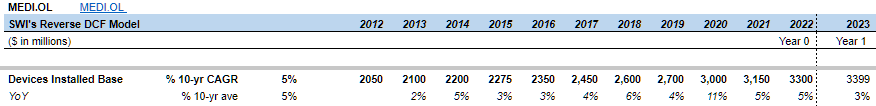

Medistim ($MEDI.OL) specializes in medical devices that measure blood flow and intraoperative ultrasound imaging for cardiac, vascular, and transplant surgeries. Surgeons use Medistim’s devices to check the blood vessels' condition (function and abnormalities) and operating area to ensure the quality of surgeries. While over 60% of surgeries do not use assisted technologies such as Medistim, of the remaining 40% of surgeries, 80% of cases adopt Medistim devices. It is the standard of care for Europe and Japan, and plenty of growth is left, particularly in the US market and the BRIC countries.

I published the initiation report in August 2023 when the share price was at NOK 240/share, and although I concluded that it’s a phenomenal business, I would only buy at a price below NOK 190/share.

Recently, shares were exchanged at NOK 180 after Q3 earnings. I saw little signs of worry and was happy to notify paid subs that I started a position for the Sleep Well Portfolio. Read my detailed reasoning below:

I rate Medistism highly as it has the strongest moats and financial strength out of the nine sleep-well picks. I score all businesses' survivability, endurance, and valuation and track them over the long run. See the scores below:

In the medical device industry, there are often high risks of not being recognized by various health organizations or not getting enough adoption by practitioners. Medistims have quashed both concerns:

There are approximately:

700,000 cardiac procedures (CABG) annually worldwide, 200,000 in the US,

600,000 vascular procedures, and

150,000 organ transplants.

These segments are valued at 2B NOK / $200M, 1.5B NOK / $150M, 1B NOK / $100M, or 4.5B NOK / $450M total.

Globally, of the 700,000 CABG procedures, roughly 60% do not use quality assurance (i.e., surgeons’ fingertips). In the 40% of cases that use supporting devices, Medistim accounts for 33% (82.5% market share), while other players have just 7%.

In Northern Europe and Japan, Medistim is used in 8 out of 10 CAGB procedures or an 82.5% market share of the penetrated market (Northern Europe: 70%+ and Japan: 90%+). Ten years ago, Medistim was used in 7 out of 10 CABG procedures. Thus, it has taken an extra 1% of the market share each year in the past decade.

Meanwhile, Medistim’s competitor market share shrunk to 18% in 2019 from 23% in FY2012.

Let’s see how Medistim performed in Q3’23 and why it offers a good entry point.

Q3’23 results highlight - Nothing surprising

Medistim’s Q3’23 topline grew 6.5% YoY, but the YTD growth looks fine with 11.6% growth, driven mainly by higher procedure volume, strong sales of the flow systems and flow probes (for blood flow measurement) but offset by a slight decrease in imaging systems and probe sales. Meanwhile, 3rd party sales remain steady and reliable, with 5% growth YTD. Since 2012, it has maintained a 2% CAGR growth.

Quick notes on the two immediate growth areas:

Imaging systems are now 30% of total sales, which has grown at around 25% CAGR since 2012, doubling total sales growth. The rapid growth is a testament to the shrewd move from the management as they combined flow and imaging capabilities into the MiraQs and VeriQs, helping sales conversion.

However, Q3’23 highlights how difficult it can be because surgeons only use imaging when they feel an abnormality. When the patient's operating area is acting as expected and healthy, imaging is often nice to have. Thus, when budgets are tight, imaging will most likely be cut first.

If you are a surgeon, please comment below or email me your thoughts; I would love to hear them.

Vascular is another growth segment, posting 13% CAGR growth since 2017. It’s becoming an increasing part of sales of own products, making up 17.6% YTD, compared to 16.7% for the full year 2022. YTD growth was 15%, so it is progressing well.

Moving down the bottom line, the profit margin has decreased due to heightened expenses in converting the sales channel from a distributor model to direct-to-customer (the latest conversions have been in China and Canada).

This is a short-term trade-off for the long-term gain in higher margins and more control/independence from distributors.

The other reason is atypical, which management blames the hospitals’ tighter funds available to adopt innovative medical technologies due to the escalating inflation and interest rates. This can lead to prolonged sales cycles and an inclination for customers to opt for more budget-conscious Flow-only alternatives rather than the premium-priced Flow-and-Imaging systems. It makes sense.

The 2% drop in EBIT margin (27% from 29.2%) isn’t a concern. Nothing was surprising or disappointing. The macro impact was industry-wide. What’s more important is how it compares with competitors and uses excess profit.

Market share

There are two metrics I track with Medistim

The number of procedures globally that adopt Medistim devices.

The number of procedures globally that adopt competitor devices.

How about system sales? I don’t need to track the system sales so much because Medistim is at a stage where system sales will be stable and won’t grow out of the 3-7% range. Additionally, 2/3 of sales now come from consumables; thus, tracking procedures volume is the most potent—minimizing information overload.

Q3’23 - Medistim was used in 35% of the total bypass surgeries globally. In Q1'23 - it was 37% - indicating a loss in market share.

At the same time, equipment from competitors was used in about 5% of the procedures performed in Q3’23, no change from Q1’23 figures.

So, if there is a loss of market share, it’s a mild one, or it’s more of the case that more fingers were used to check blood flow than using assisted technologies - which is highly likely as a way to save costs. This is a quarterly figure, so let’s check back in Q4'23 for the annual one.

It’s not conclusive that Medistim lost market share, so I won’t put a red box in Medistim’s row until I see more conclusive data. So, for Q3’23, I’ll keep it as a stable market share.

Future Growth

In the past ten years, Medistim accumulated about 526M NOK in free cash flow, which it allocates into

156M NOK in Capex

372M NOK in Dividend

Zero NOK in Buyback

Medistim is at a stage where it has already built out the core technology and system. Thus, it doesn’t require a lot of reinvestment to grow. Depreciation at 166M NOK is even higher than CAPEX.

That can be a negative for some investors, but I believe the business is incredibly capital-light, and the unchallenged market position allows it to ‘under-invest.’ It hasn’t stopped the company from growing earnings at 16% CAGR since 2012.

Returns on invested capital (ROIC) averaged about 34% in the past five years and 29% in the past ten. The high ROIC ratio comes from operating a high-margin strategy comparable to a mature software business.

Everything is in place, and now it just needs to sell.

Management set four key growth areas to double its revenue to NOK 1B by the mid-term.

The most obvious growth remains the 60% of CABG surgeries in the US (1/3 of the global market), where surgeons still use fingertips. Management is offering both sales and leases to keep it flexible for hospitals, making it easier for hospitals to manage cash flows and Medistim to lock in new surgeons using the technology. Market share growth has compounded 12% in the past ten years.

Then, we have the long-tail growth in Russia, China, and India, where Medistim is relatively new. Finally, Vascular is an area where growth has achieved 13%+ CAGR since 2017.

The general trend in surgery is moving towards minimally invasive and keyhole procedures, which gives the surgeon less workspace and the ability to verify using fingertips. There is, therefore, an increased need to verify the desired result.

Anti-fragile checks

I own Medistim because it possesses anti-fragility attributes to thrive/counter future challenges. They are:

Abundant cash (net of debts)

Stable/agile business model - with recurring revenue, diversified geographically, limited dependence on supply chain

Preparedness for challenges is strong.

As of Q3’23, it has NOK 126M in cash and NOK 4M of long-term debt. Medistim has never needed external capital to grow or dilute shareholders in the past ten years.

Over 2/3 of total sales are recurring from consumables sales while the installed systems base continues to expand.

Sales are also diversified among regions (US and non-US), lease and sales, and prices (lower entry price in BRIC countries).

Medistim assembles and manufactures its devices and probes in Horten, Norway, some probes are also produced in the US (Sound Technology - FY2013), and third parties make only imaging probes. The supply chain ensures limited quality and IP theft risks. During Covid, the business suffered no significant backlog or production issues.

Finally, Medistim has a clean track record since it was founded 30 years ago. I haven’t seen any significant threat to its business yet - check out my deep dive for more details.

Valuation - no change

My long-term assumption is that Medistim will continue to drive 10% revenue growth for the next ten years. That might raise eyebrows if you are new to Medistims. But let’s break it down.

US segment growth is the CAGB (cardiac) procedure volume x price per procedure. Historical volume growth has been at 10%, and price growth has been at 20%. I am modeling for a 15% combo between volume (5%) and price increase (10%), which I think is reasonable given the US market penetration is only at around 30%, lower than the world at 37% and saturated markets at 70%+ (Europe, Japan)

Non-US segment growth is expected to lower at 8%, driven by 4% volume and a 4% price increase, leaving room for upside as Medistim’s penetration in India (1% penetration) is at the first inning of growth.

I still believe that fair value is north of NOK 220/share and that prices at NOK 180/share provide a good entry opportunity to own a piece of the business.

Read why I started a position for the Sleep Well Portfolio below:

Your support 🥰 in spreading the word allows me to do what I do best—sifting through the haystack for market leaders, saving you time from turning over your portfolio.

Check out my other sleep-well investments writeups below:

CrowdStrike - Cloud security leader +27% CAGR since IPO

The VAT Group - Vacuum valve leader +32% CAGR

Shimano - Bike component leader +12% CAGR

Floor and Decor - Future leader in hard-surface flooring +30% CAGR

MIPS - Helmet safety leader +45% CAGR

Thor Industries - RV leader +14% CAGR

Medical device leader +17% CAGR

NVR - Top US East Coast Hombuilder +30% CAGR

Circle Business Leader [Part 1, Part 2] +24% CAGR

Sleep Well Investments Score (05 Nov 2023)

Check out the thesis tracker section for follow-up updates if anything interests you.

![WillScot Mobile Mini - A Circle Economy Leader [Part 1]](https://substackcdn.com/image/fetch/$s_!bCJa!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F7958afa3-d43f-4398-b92f-14b09ea0f1f6_1050x982.png)

slow and steady wins the race :)

Aren't you concerned that the organic growth was negative and only FX gains leading to the +6.5% in Q3? Furthermore, the number of CBAG surgeries are slightly declining due to the increased use of stents.