SWI Pick #9 - WillScot Mobile Mini - A Circle Economy Leader [Part 1]

Five times the size of the next competitor in a $10B+ market, products with 25%+ IRR over a 30yr asset life span, counter-cyclical capex and working capital, management proactive on value creation.

*The full write-up is a 50-minute read. This one is Part 1. Part 2 will arrive in your mailbox tomorrow, Nov 5th. I also recommend reading the web version - click here.

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

Today is the 9th Sleep Well Investments pick. It’s a business that has everlasting qualities, from providing evergreen products to running a well-oiled business model recurring in revenue, expanding organically and inorganically. The business also has anti-fragile elements with its counter-cyclical capex profile. One will be comforted that these companies will overcome future adversities— investors are not required to check stock prices, events, or interest rate decisions 24/7, leaving you more time to enjoy life.

Before we start with the write-up, I want to say a big THANK YOU to the 1000+ subscribers who have joined Sleep Well Investments. Over a fifth of you are from hedge funds or are actively managing your family offices! It’s a huge vouch of confidence! Also, thanks to Jared at Hourglass Network for a congratulatory shoutout in his recent post and Steven at Time In The Market Podcast for a podcast interview. I shared my journey as a writer and investor, why I preserve after making so many mistakes, and finally, what drove me to create Sleep Well Investments.”

In a nutshell, I am building a portfolio for my daughter (and soon her sibling next year 🤞) and their children. So, my goal at Sleep Well Investments is to own businesses that will last for several lifetimes (hopefully) and resonate best with their generations.

So, how does the WillScott Mobile Mini ($WSC) help us sleep well?

It has been around for nearly eight decades, providing essential solutions to 15+ key markets with no concentration risk. This business is a ‘circular economy’ investment whereby its products are designed to be reused, refurbished, and relocated to prolong their useful life, reducing waste—Yes! ESG compliant. The business faces minimal disruption risk, and alternatives are time and cost-consuming—the product demand/relevance also benefits from the US reshoring manufacturing and decarbonization initiatives. I am confident this business will be around when I transfer the portfolio to my daughter.

The market-leading position is five times bigger than the second in a $10B+ market. Its scale/cost and network partnership advantages make it difficult to catch up.

The business model is easy to understand. Revenue is predictable, as most of it is recurring, and the average contract is almost three years. The unit economics are also compelling, given that the resale value is up to 50% of the cost, and the path to organic growth is clear.

In the case of challenging macroeconomics, the business has defensive attributes to buffer the downturn, notably the counter-cyclical CAPEX and flexible working capital profile.

Management’s incentives, attitude, and capital allocation framework align with shareholders' goals. They target spending 50% of available capital to buy back shares yearly, and they have bought back 9% in the last twelve months.

The business's intrinsic value is moderately undervalued in the base case and slightly overvalued in the 2008 recession scenario. It deserves my full attention today, and I will initiate a half position when the share price drops another 10%—leaving room to add more if the market sentiment deteriorates.

This is the most ‘boring’ and environmentally impactful business I have followed this year. I can see myself joyfully following the business KPIs, and you’d indeed receive regular thesis-tracking updates.

Enjoy your first part of the research write-up. The second part will be delivered tomorrow, Nov 5th, 2023.

You can expect a thorough analysis of the following:

Why is it a Sleep Well Business?

Over half-century product

Evergreen product needs

Limited alternatives

Secular runway for growth

M&A platform

Market leader today and likely tomorrow

Market share

Direct and future competitors [End of Part 1]

Moats [Part 2 starts]

No-frill products

Scale/cost advantage

M&A platform

Easy to understand and predictable business model

Simple operation

Flexible capex profile

A clear path to growth

Mid-term targets

Aligned capital allocation framework

Anti-fragile attributes

Reasonable valuation

Base case

Bear case

Sleep Well Scorecard

What to track

Let’s dive right in → why should you know about WillScot Mobile Mini, and why is it a sleep-well investment?

Why is WSC a sleep-well investment?

1. Over half-century products with limited alternatives

WillScot Mobile Mini (Ticker: WSC, $6.8B market cap) provides temporary space solutions for construction / industrial / energy and government infrastructure agencies to learn, live, recover, work, and play. They have been doing this job since 1955 under various local and regional brands you might recognize.

Pictures speak a thousand words. The slide below illustrates their solutions.

The two main products offered are the lease of modular work space and storage facility. The other ancillary offerings to support the lease of the two products are the logistics of delivering, installing, and removing after the lease ends and value-added products and services (VAPS), which are the rentals of furniture, appliances, insurance, and maintenance during the lease. In many cases, if the customers want to own these temporary spaces permanently, WSC also sells the units.

I provide a quick summary of the business's financials and then explain the solutions in detail.

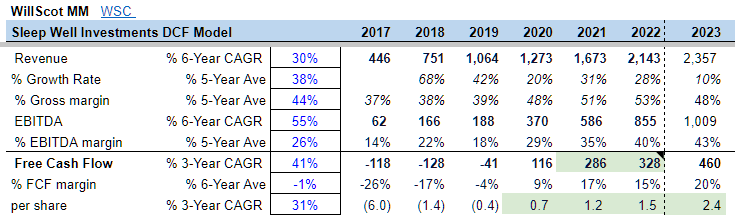

Since its IPO in 2017, revenue has grown 30% CAGR to $2.1B with a $2.3B revenue guided for 2023. EBITDA and FCF margins have consistently improved to 40% and 20%, respectively. There is clear evidence of growth, operating leverage, and strong capital allocation as free cash flow per share has also grown to $2.4, on track to meet management's 2026 target of $4+.

The chart below shows that 95% of revenue comes from reoccurring leasing and servicing revenue.

Modular Units

Refer back to Exhibit 1; the middle structure is a modular unit. It is typically made of steel and aluminum frames and traditional building materials. It ranges from standalone portable units as small as 24 square feet to large complex units that can be coupled or stacked to create versatile workspaces up to 10,000 square feet. The aim is to equip a customer with all the necessities to be ‘Ready for Work’ - the slogan of WSC’s solution. One unit's acquisition and build-out cost is $50,000 and has a useful life of about 20-30 years.

The following slide shows the quarterly revenue from modular solutions, which was $388M in Q3’23 (64% of total revenue) and is a function of the number of modular units on rent (UOR) times the average monthly rental rates (AMR).

Storage Units

The unit on the right of Exhibit 1 is a standard portable storage container. They are ISO containers (shipping/intermodal containers) made from weather‑resistant corrugated steel, thus making them easy to maintain and can last up to 30 years. They are available in lengths ranging from 5 to 48 feet, widths of either 8 or 10 feet, and various configuration options. After they are bought, they are remanufactured (cleaning, removing rust and dents, repairing floors and sidewalls, painting, adding logos, etc.) and modified to the customer’s requirements. Interestingly, the acquisition cost is about $6,000/unit, but even after 30 years of useful life, average residual values are over 50% of the cost.

The following slide shows the quarterly revenue from storage solutions, which was $217M in Q3’23 (36% of total revenue) and is a function of the number of storage units on rent (UOR) times the average monthly rental rates (AMR).

Value-Added Products and Services (VAPS)

On top of leasing the units above, WSC offers value-added products and services or VAPS (revenue included in the leasing revenue of the modular and storage segments above). They include equipping the units with essentials such as air conditioning, heating, filtration, electrical and Ethernet ports, plumbing and utility hookups, and furnishings and appliances.

Exhibit 2 shows a range of VAPS's essential products and services, including leasing furniture, steps, ramps, essential appliances, internet connectivity devices, integral tool racking, heavy-duty capacity shelving, workstations, electrical and lighting products, and other items to make these units more productive, comfortable, secure, and “Ready to Work.”

What’s more? VAPS also offers a damage waiver program that protects customers if the leased unit is damaged. For customers who do not select the damage waiver program, WSC bills them for repairs above and beyond normal wear and tear. As you know, with insurance, it pays to have peace of mind.

Logistics - Delivery, Installation, and Removal

Lastly, the truck on the left of Exhibit 1 refers to disassembling, unhooking, and removing services once a lease expires. This is an additional charge for all the products and services above.

That’s a lot of services around the modular and storage containers. However, the breadth and depth of WSC’s logistics and service capabilities make it convenient for customers and unrivaled in the industry. The combination differentiates them as customers can start their projects quickly and cost-effectively with minimal environmental waste (ESG highlights).

Alternatives - few disruption risks

One of the first risks to WSC's business is the alternatives/substitutes.

Fortunately, the alternatives to WSC are building permanent structures or renting off-site offices nearby. Their disadvantages are that they take longer to set up, often cost more, are further away from job sites, and, importantly, take time away from the actual work that they are there to do. It’s only suitable for long-term projects (5-10 years). For short-term projects (<5 years), I don’t think customers would want to build a temporary workspace themselves.

The more significant risk to WSC is if/when large industrial equipment rental/leasing companies decide to offer temporary office and storage solutions. I have been watching the key ones. We have United Rentals, Ashtead, and Herc Rentals in order of threat level. They have been around for many decades, 30 years, 80 years, and 70 years, respectively. Until now, they haven’t stopped WSC from working its way to the top yet, but we’ll go over this in more detail later.

WSC’s value prop is attractive and durable. The proof is in the numbers.

Key stats - as of Q3’23 earnings, WSC has

85K customers (35K in 2017), no one >3% of revenue

366K units deployed, 154K modular (67% on rent), 210K storage (70% on rent). A massive increase from 95K in 2017, and is worth $3.3B at net book value.

20K+ units refurbished or converted annually (50K total)

880 trucks owned

128M+ square feet of relocatable space (46M square feet in 2017) - equivalent to 45 Empire State buildings

240+ branches across North America (100+ in 2017)

90% of leases are over 32 months (FY2022)

40% of customers require both modular and storage solutions

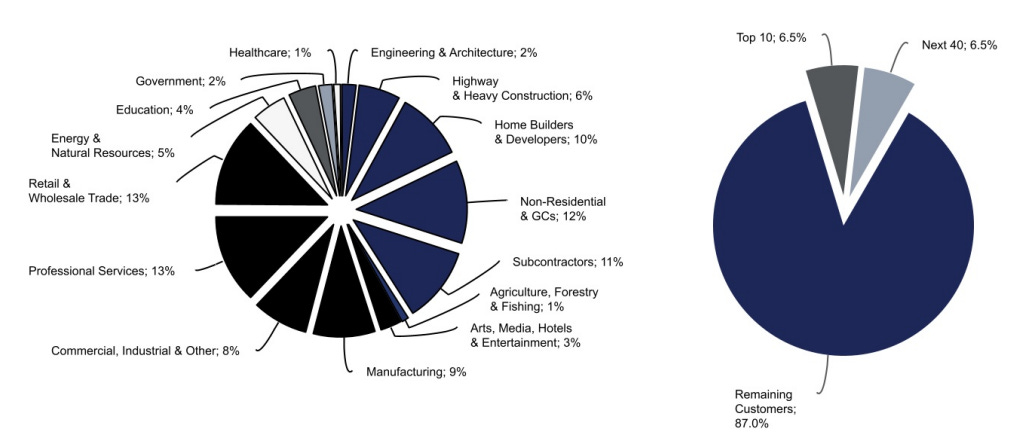

I like that WSC spreads its sales far and wide, with no customer accounting for more than 3% of total sales, and the top 10 has just 6.5%. This also explains why the average cost of leasing WSC products is just 0.5% of the total costs of the customers’ projects. Since it’s small, it gives WSC more leeway in future price increases and, importantly, disincentivizes customers to build the products themselves - lowering disruption risks.

Additionally, although WSC is an industrial player, its end market includes manufacturing, commercial / retail, energy, education, and event-driven projects. Many of them are maintenance projects that have provided consistent revenue throughout the years. Additionally, the seasonality of each industry counterbalances each other. For example, a terrible period for retail and event projects during COVID-19 was met with very resilient heavy construction, healthcare (COVID-19 vaccine facilities), and homebuilding segments.

Below, you can see the revenue share from each submarket and customer concentration.

Secular growth runway

So far, we know that WSC has existed since the 1950s and has few disruption risks, but the key question is whether it is needed in the future.

In short, I conclude that the need for WSC’s modular and storage solutions is long-lasting.

Circular by design, WSC’s lease and renew (reuse/refurbish) business model helps all stakeholders reduce material usage and costs while helping the environment.

Then, the government’s initiative to on-shoring / re-shoring infrastructure building will provide growth for many decades.

United Rentals, the bellwether of industrials, shared a slide in their 2023 Investor Day showing some of the largest and most important industries are bringing back their manufacturing operations to the US, including:

Technology companies, many benefitting from the CHIPs Act of 2022, are bringing $200B of R&D and semiconductor manufacturing home, led by corporations like Intel, Micron, Rockwell Automation, Eaton, and Nextracker.

Renewable energy manufacturing, including PV solar panels and wind turbine producers, continues to see a $300B investment.

Specialty chemical companies like RPM International are also ramping up domestic production to support pharmaceutical, food, and energy sector clients.

More than a third of manufacturers plan to add capacity in the US, while retail giant Walmart has committed to spending $350 million over the next decade to source supplies domestically.

The US is investing heavily because the National Association of Manufacturers (NAM) calculates that every $1 spent in manufacturing adds $2.60 to the broader economy.

Additionally, the effort will decouple the US’s reliance on China and minimize the geopolitical risks of manufacturing abroad. It will support the long-term trend for construction spending in the US, which has been growing at 9% CAGR to $2T/year, even measured from peak-to-peak (2016 to today). That will also support a rise in both the price and volume of modular rentals - helping WSC’s long-term organic growth.

Business growth and M&A platform

The environment-impactful business and tailwinds from the US reshoring manufacturing initiative will provide growth for many decades. I believe WillScot Mobile Mini has the right structure to capture this opportunity.

Looking back to the history of WSC, it has a strong record of growing inorganically. Their pace of acquisition in the past few years has been impressive.

We will work our way back to 1955, but let’s start with the most recent deal, the merger of WilScott and Mobile Mini in 2020. The move combined the leader in modular space - Willscot, and the leader in portable storage solutions - Mobile Mini, to create a ‘space solution’ specialty leasing platform, the most significant player in the US, 5x the next competitor. This was a bold move. It is a move that makes a ton of sense since 80% of the end market from the two companies and 40% of the combined customers require both modular and storage solutions. There is plenty of opportunity to cross-sell.

But if you trace through the years, mergers and acquisitions run deep in the company’s history.

Since 1955, the combined entity has had over 75 legacy acquisitions. Since the IPO in 2017, 25 deals have been made costing $1.8B to acquire a total of $4.8 billion in cumulative enterprise value, including Acton Mobile in 2017 ($235 million and founded in 1968) and Tyson Onsite (as a tuck-in acquisition to expand to the MidWest).

And in 2022 alone, WSC acquired 13 regional and local players. They cost only $220.6M in total, with assets of 14,100 storage units and 4,400 modular units. So, it’s not huge compared to WSC’s current $3.3B book cost of assets comprising 366K modular and storage units. However, it demonstrates that WSC has an M&A platform to expand products and services to increase revenue and cost synergies. It would be exciting if WSC could keep up the acquisition pace. This is an excellent area to keep track of in the future.

Out of all the recent deals, I want to highlight ModSpace. It was a $1.1B deal ($1B cash and 6M shares, and at 10x Adjusted EBITDA or 6.6x including $60M cost synergies) completed in Aug 2018 (commercial starts Nov 2018).

ModSpace is the biggest acquisition and a good case study of what’s to come. We’ll look at the individual business before acquisitions, the timeline, and the value created.

First, you can see the overlaps of services. The combination nearly doubled the number of branches and fleet size. Management expected to roughly double revenue, and Adj. EBITDA after full integration.

They targeted to realize 80% of the cost synergies in the fourth quarter of 2019. But as I look at Q4’2019 earnings, about 1.5 years from completion. They have missed the target by a quarter and moved the goalposts to another year. It was a slight miss and still demonstrates good execution, given Covid-19 would start just after the result announcement.

Shifting to ModSpace, we have realized approximately 75% of the associated cost synergies in our run-rate in the fourth quarter 2019, $31 million of which are in our LTM results.

Our initial estimates indicate that we should capture approximately 80% of these synergies in our run-rate by year two post deal close with approximately 30% captured in our run-rate one year post close. - Brad Soultz, CEO, Q4’19

Reviewing Modspace allows us to get a sense of the price that WSC targets. ModSpace was acquired for 10x Adj. EBITDA, which doesn’t seem overpriced because WSC's median EV/EBITDA from 2017 to today is around 18x. It would be at just 6.6x EV/EBITDA if cost synergies of $60M were fully captured. ModSpace also provides growth opportunities in VAPS; while that is still in the works, any gains from that make the acquisition of ModSpace even cheaper.

We also understand the motivation and strategic plans behind the acquisition. On Investor Day in 2021, WSC explained why it acquired ModSpace and was looking for similar deals:

First, to consolidate the No. 1 position in the modular office.

Secondly, to realize a $60M cost synergy on $106M of EBITDA, given both companies had duplicated brands, corporate structure, and logistics.

Third, WSC could improve growth in VAPS and cash conversion by improving ModSpace’s working capital, fleet optimization, and sourcing and procurement.

All three have played out as I think ModSpace has been accretive to the bottom line, the future opportunities in VAPS (we’ll dive into this later), and helped WSC consolidate as the market leader.

Overall, WSC has a working M&A platform that can create value through:

Back office integrations

Logistics optimization

Cross-selling

VAPS

Before moving into the next section, ‘Market leader today and likely a leader tomorrow,’ I want to highlight that WSC is not shy of selling non-value-added units.

In Sept 2022, WSC completed the sale of its former Tank and Pump Solutions segment; in January 2023, it completed the sale of its UK Storage Solutions segment.

It shows management is laser-focused and disciplined in creating a scalable M&A platform, streamlining the business to a pure space leasing business, and not afraid to cut losses/mistakes.

2. Market leader today and likely a leader tomorrow

Market share

WillScot Mobile Mini (WSC) is the market leader in North American modular workplace solutions (around 50% market share) and portable storage solutions (around 25% market share), five times bigger than the next competitor - McGrath, in terms of revenue and total fleet size.

Compared to the average regional competitors, WSC is 5-10x its size in modular and 20-10x in storage.

Compared to peers, WSC’s fleet size is 2x the size of the largest modular provider - McGrath (and 5x revenue), and nearly 3x the size of the second largest storage provider - United Rentals.

Both modular and storage markets are highly fragmented. WSC estimates that regional and local competitors supply approximately 55% of the modular market and about 70% of the portable storage market in North America. And that WSC has a 200+ acquisition (sub $100M) pipeline. Hence, there is still much room to capture market share by acquiring or growing organically.

As mentioned, since the IPO in 2017, WSC spent $1.8B on acquiring 25 competitors, totaling $4.8 billion in cumulative enterprise value, including Acton Mobile in 2017 ($235 million and founded in 1968) and Tyson Onsite (as a tuck-in acquisition to expand to the MidWest). And in 2022 alone, WSC acquired 13 regional and local players. The rapid pace is necessary because although WSC is a pure play on modular and storage, I see competitors coming from adjacent markets, too. Let’s explore.

Direct and Future Competitors

WSC competes on customer relationships, price, service, delivery speed, breadth and quality of equipment, and additional services offered.

The service is heavily local/regional, so local knowledge is essential. It is also time-pressed, so delivery, installation, and cleanup have to be on time. Luckily, price isn’t the priority as the cost of leasing WSC’s product is only 0.5% (2021 figures) of the customer's total project cost, so the next important thing is the breadth and quality of equipment - i.e., VAPS.

As you go through the criteria, WSC is highly competitive and demonstrates wide moats in some; we’ll review if they are enduring. But first, let’s look at the competition.

Today, WSC’s competitors are:

The most direct one is McGrath, a $2.3B market cap and $3B enterprise value player trading around 11x EV/EBITDA. It has $461M in revenue from leasing modular space, which makes up 60% of the total business (1/5 of WSC's total revenue). The remaining 40% is in communication testing equipment rentals - some examples below - which is considered a market leader in North America. If you know this segment, you should check out Keys Insights (KEYS), a leading producer of this equipment.

While the modular and storage business and communication equipment have moderate customer overlaps, they detract McGrath from the modular and storage business. Good for WSC.

That said, McGrath is considered the number 2 player. It also covers nationally, with modular in 35 states and storage in 28 states. It claims to be a leader in California, Texas, Florida, and Mid-Atlantic education markets. It has about 83K units for rent with about $1.4B in asset value at cost.

Comparing asset value at cost would be misleading as WSC benefits from cheaper acquisition of units. But, generally, WSC is roughly 4.4x the fleet size (366K vs 83K) and 5x the revenue.

Going through McGrath, I also see a well-run modular and storage division that benefited from rising utilization rates (70-80%) and rent prices. The company also sees a positive outlook into 2024 despite economic uncertainties.

Is McGrath a worry to WSC?

Yes, McGrath deeply understands the unit economics of renting out container units. And it is shifting gears to grow inorganically, too. However, I believe United Rentals and Ashtead are more significant worries. Let’s dive into the details.

McGrath understands that Modular leasing is a high-margin and recurring revenue business with a favorable demand trend. Their strategy is to grow revenue from this segment to 80% of the business from 60% today. That could mean a more competitive environment regarding pricing, value-added services, and acquisition targets. We are already witnessing a change in the latter.

McGrath has been actively acquiring regional players and competing for M&A opportunities for the last three years, having done none in the years prior.

Notably, in 2021, it acquired Design Space for $260M at 8x EBITDA, then in 2022, it acquired Titan, a Texan Storage Container, for an undisclosed amount, and in early 2023, it acquired Vesta for $400M at 10x EBITDA.

That’s a lot of acquisitions for a $2.3B company. WSC only spent $266M in acquisitions (13 tuck-ins) in the last 12 months. Maybe the grim macroeconomics played a role, or there aren’t as many compelling opportunities. However, we can see that McGrath’s acquisitions opened opportunities to expand its Portable Storage business into new geographies. Together, they would add $72M of EBITDA ($32M from Design Space and $40M from Vesta) to McGrath (full integration in 2024).

McGrath's purchase price pre-synergy is in the same range as what WSC paid for its recent acquisitions, at 10x EBITDA. Thus, on the surface, WSC has little ‘acquisition’ bargaining power vs McGrath.

However, WSC deals provided more value. Synergies numbers of Vesta ($8M, no record for Design Space) aren’t nearly as impressive as ModSpace to WSC at $60M. Modspace, at $1.1B, is a much bigger player in the industry and can add substantial future growth to WSC in the shape of VAPS - this is one of the core pillars of growth for WSC. As a result, WSC has paid a lower price at just 6.6x EBITDA post synergy - so WSC does have stronger bargaining power than McGrath.

In summary, McGrath makes a sticky 2nd rival to WSC. I’d likely track McGrath’s M&A and operating performance in my Thesis Tracking updates. I will cover metrics like utilization rate, rental prices, and fleet size movements. For now, WSC has an edge over price, value, and size regarding acquisitions.

Direct competitions are usually the focus for management, but for me, I want to know 10-20-30 years down the line where else competition can emerge from. Thus, we review reputable businesses that might have their head focused on one industry but their eyes looking at others - the adjacent industries. They are:

United Rentals

Ashtead

Herc Rentals

ATCO Structures

I order the list on the threat level. We will focus on the first three as ATCO poses the least risk, mainly in container ships already acquired (FYI, in 2022 for $10B EV, 7x EBITDA).

As McGrath shows, you can operate modular and storage leasing with equipment leasing. United Rentals, Ashtead, and Herc Holdings are top dogs of the industrial equipment rental business with 17%, 13%, and 4% market share, respectively. And they would not stand by the sideline for long if they also see money to be made, given barriers to entry fall in the future.

Let’s see how these equipment rental companies will likely challenge WSC’s market position.

United Rentals

United Rentals was founded in 1997 by Bradley Jacobs and was IPOed on the New York Stock Exchange in the same year. The company was formed to consolidate the equipment rental industry through an acquisition strategy.

They are the most leveraged player with $12B net debt on the balance sheet and a 3x Debt/EBITDA ratio. However, they have recently entered WSC’s market through an acquisition of General Finance, and their leading position in industrial equipment rental poses a risk in cross-selling. Let me explain.

They operate 1,465 rental locations in North America, 14 in Europe, 27 in Australia, and 19 in New Zealand. In North America, the company operates in 49 states and every Canadian province. The company offers approximately 4,600 classes of equipment for rent with a total original cost of $20 billion. Their breadth of product overlaps with WSC’s VAPS offerings, and their equipment costs are over five times WSC’s ($3.7B).

Through the acquisition, United Rentals has 71K units in the mobile storage and office market (vs. 366K units at WSC), which accounts for 2% of their total revenue. That, in conjunction with their on-site service business, offers many solutions for customers to prepare the job site before starting their construction projects.

For example, their Trench and Safety business offers excavation works and safety solutions to customers’ employees. This is a key way for United Rentals to interact with their customers when they are first on-site. Then, their Power HVAC and Temperature Control business supplies temporary power heating or air conditioning. Their Fluid Solutions business is a complete end-to-end from containment, transfer, and treatment. United Rental has multiple entry points to provide customers with additional service regardless of what level they need.

United Rentals acquired General Finance for $1B at roughly 10.5x EBITDA in 2021. Through General Finance, United Rentals controls Pac-Van, Container King, and Lone Star Tank Rentals businesses in the US and Canada and Royal Wolf in Australia and New Zealand.

Matt Flannery, President and CEO of United Rentals, said:

We see strong growth potential from this combination, including our ability cross-sell mobile storage and office solutions to our customers. Our expansion into this space comfortably checks all three boxes of our M&A criteria — strategic rationale, financial impact and cultural fit.”

I have checked through their offering and came away less impressed. The $1B price tag seems hefty for a $94M EBITDA business because the rental fleet comprises only 78,000 portable storage containers, 4,200 tanks, 13,600 office containers, and 4,200 mobile site offices, of which over 1/3 is in Australia and New Zeland. That’s small compared to WSC’s US asset base of 154K mobile office units and 207K storage units that generated nearly $500M of EBITDA in FY2022.

What’s more, General Finance was making losses in 4 out of 5 years before getting acquired by United Rentals. Their growth and margins were also tepid (mid-single digits) compared to WSC and McGrath (15-25%). It just doesn’t seem like a great company.

However, United Rentals sounds determined. Dale Asplund, Executive VP & COO of United Rentals, said:

So we don't really talk about too much openly for competitive reasons of what they're going to be, but I can tell you that we looked at the mobile storage business for quite a while before we found the right partner. And once we find it, we're going to move, execute quickly and then grow the heck out of it. And that's how we look at how we'll use M&A in the future.

Investor Day 2023 - Source: Quartr (an affiliate of SWI, please, use ‘SWI20’ for discounts)

I am not convinced from what I see (yet), so United Rental is not a near-term risk and should not pose as big of a threat as McGrath right now. I’ll check back once United Rental has integrated General Finance into the business, and I expect completion in 2024.

Next, Ashtead.

Ashtead

It is the second-largest industrial equipment leasing in the US under Sunbelt Rentals. Founded in 1947 in the UK and IPOed in the London Stock Exchange in 1986. Its customer and equipment profiles are similar to United Rentals; however, Ashtead isn’t big on storage and mobile office yet. Its Sunbelt product page has just three products.

Its focus and largest market positions are on large equipment leasing such as power, climate, and pump businesses.

When we look under the Ashtead brand, the closest product to WSC is the temporary structures in the graphic below; however, the drawing is just as much information as you can get on the website.

The rest of the 10-Ks or IR’s transcripts rarely mention storage or mobile office solutions. It’s fair to say Ashtead / Sunbelt Rentals are not immediate threats to WSC.

However, in the last decade, Ashtead had acquired 103 entities in North America with an average EBITDA multiple of 5.2x for 96 acquisitions (under $100M deals) and 6.1x for seven acquisitions (above $100M deals). Like United Rentals, they have the resources to compete with WSC.

I’ll track them periodically for any sign of investment within WSC’s space.

Herc Rentals

Herc is the smallest equipment leasing company with a 4% market share, a $6B fleet size (at cost), and $1.2B EBITDA. Upon looking at the fleet composition and the growth strategy, WSC has little to worry about.

Herc doesn’t have a storage or mobile office solution (yet), and its growth strategy doesn’t point towards expanding to this segment either. But we will check back on Herc as they are very active with acquisitions. As it shows with United Rentals, one significant acquisition can change the competitive landscape drastically.

Learning about Herc gives an additional point of view about the underlying markets. They are seeing resilient industrial spending (top right) and non-residential building starts (bottom right) despite an exceptional FY2022.

Moats to defend market position

We learned that McGrath poses immediate threats, and United Rentals poses the most significant future threat to WSC.

So, what defensible attributes does WSC have to protect its business position and longevity?

This is the end of Part 1. I will post Part 2 tomorrow, which covers the question above - moats, business model, the unit economics of modular and storage assets over the 20-30 years life span, capital allocation attitude and framework, valuation, and lastly, we will see how the business performs under the Sleep Well Investments Checklist.

Thank you for reading!

Your support 🥰 in spreading the word allows me to do what I do best—sifting through the haystack for market leaders, saving you time from turning over your portfolio.

Check out my other sleep-well investments writeups below:

CrowdStrike - Cloud security leader +27% CAGR since IPO

The VAT Group - Vacuum valve leader +32% CAGR

Shimano - Bike component leader +12% CAGR

Floor and Decor - Future leader in hard-surface flooring +30% CAGR

MIPS - Helmet safety leader +45% CAGR

Thor Industries - RV leader +14% CAGR

Medical device leader +17% CAGR

NVR - Top US East Coast Hombuilder +30% CAGR

Circle Business Leader [Part 1, Part 2] +24% CAGR

If any interests you, check out the thesis tracker section for follow-up updates.

"However, WSC deals provided more value. Synergies numbers of Vesta ($8M, no record for Design Space) aren’t nearly as impressive as ModSpace to WSC at $60M. Modspace, at $1.1B, is a much bigger player in the industry and can add substantial future growth to WSC in the shape of VAPS - this is one of the core pillars of growth for WSC. As a result, WSC has paid a lower price at just 6.6x EBITDA post synergy - so WSC does, in fact, have stronger bargaining power than McGrath."

1.1bn less 100m of working capital capture less 100m released real estate = 900m

900/160 = 5.6x. so possibly even better than you suggested above... bargain, really!

Hi Trung,

What do you think about this recent short-seller research: https://dfresearch.substack.com/p/willscots-overlevered-fleet-with ??