Veeva System (VEEV) Q4'25: Sticky and Independent

Veeva posted great Q4'25 results, migration with slight delay but product positioning remains strong against IQVIA and Salesforce. Position up 33% since acquired.

Hi all,

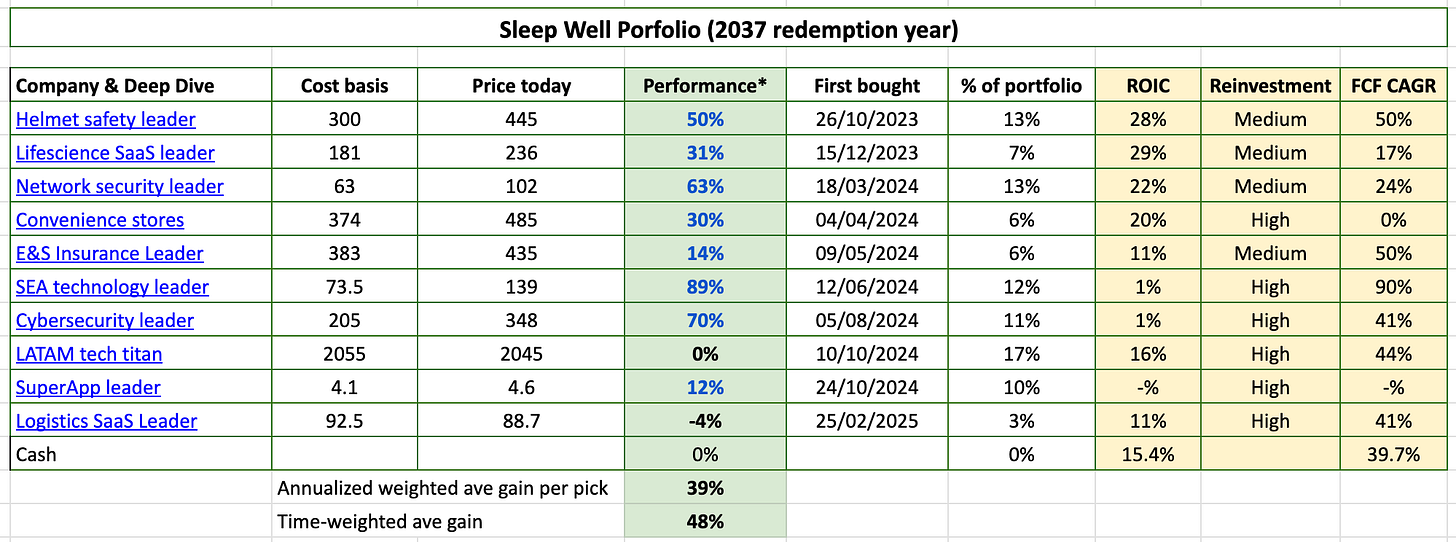

This report updates on Veeva Systems, the life science software leader, a business we acquired last Dec 2023, a top pick for 2025+, and is currently sitting on a 31% gain amid a sea of red in the market.

No action is required, but Veeva's owners must watch the two critical aspects.

The first is the migration to Veeva Vault from Salesforce CRM, and the second is the progress of the IQVIA + Salesforce copycat version of Veeva Vault.

🎯 New sleep-well pick this weekend 🎯

The company featured is exceptional and the prime beneficiary of the multi-decade green energy transition.

there is NO viable alternative, NO AI risk,

95%+ gross 40%+ free cash flow margin, asset-light business,

customers pay in advance and can’t withdraw from the multi-year contract.

net cash position, acquisition opportunities,

5-year backlog and growing steadily,

I am confident we won’t lose money and could make a market-beating return. You won’t find in-depth research on this company anywhere on Substack (there are 400 investment newsletters). If you do, I’ll give you a refund.

Veeva Systems Q4’25 business update

Veeva Systems’ CEO, Peter Gassner, said:

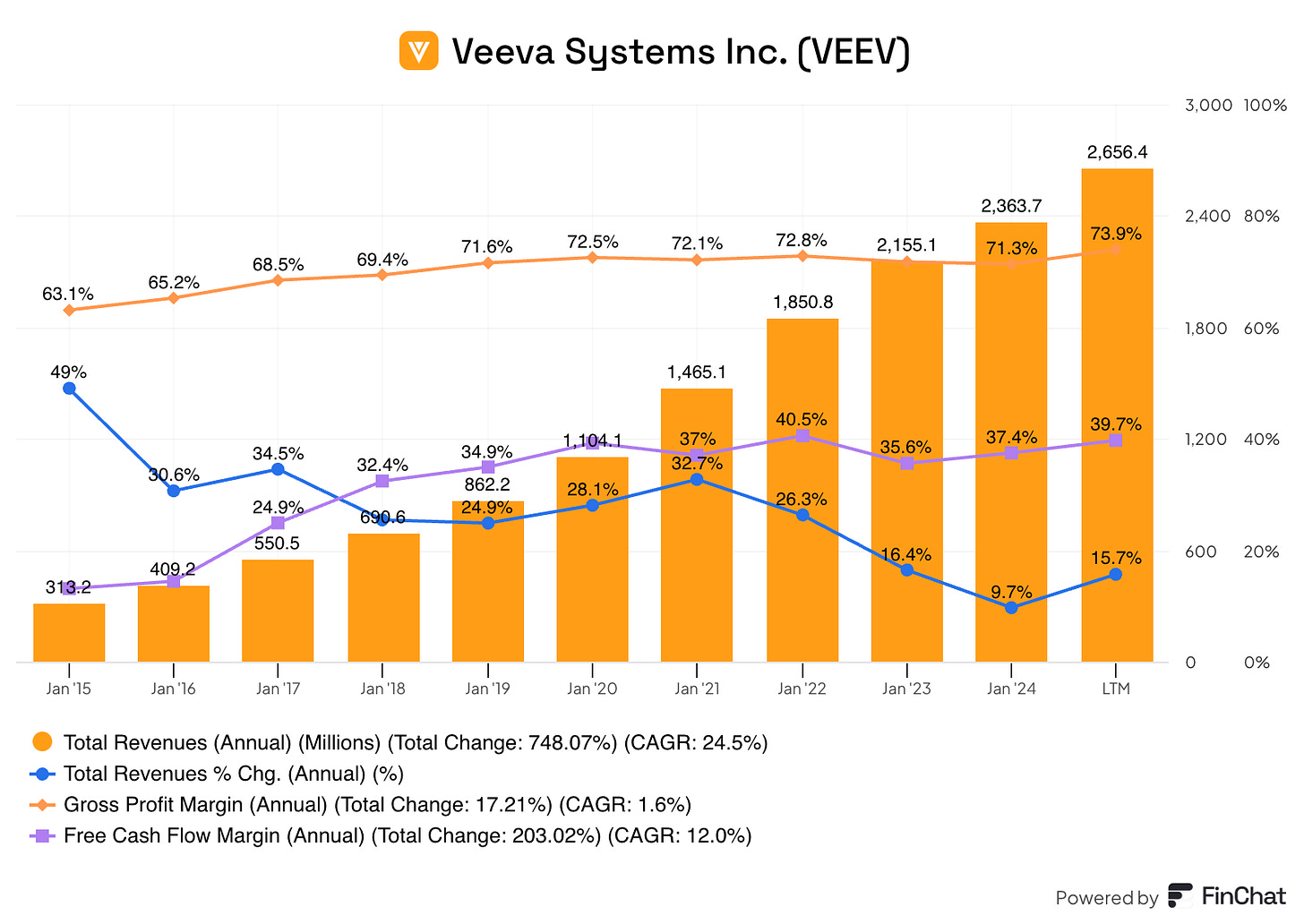

"Our 2025 goal a little more than 5 years ago has been to be a $3 billion revenue run rate company this year. So we're on track to do that. And the 2030 goal that we announced at our Investor Day in November is to be a $6 billion revenue run rate company in 2030."

Peter Gasser’s target of $6B revenue in 2030 would translate to ~$2.5B of free cash flow. That means Veeva can be ‘fairly’ valued at $75B then, or over a double from here and ~15% pa return.

It's not hugely exciting, but I concentrate on 2037, and the most important thing to remember is that Veeva is increasingly stickier and independent.

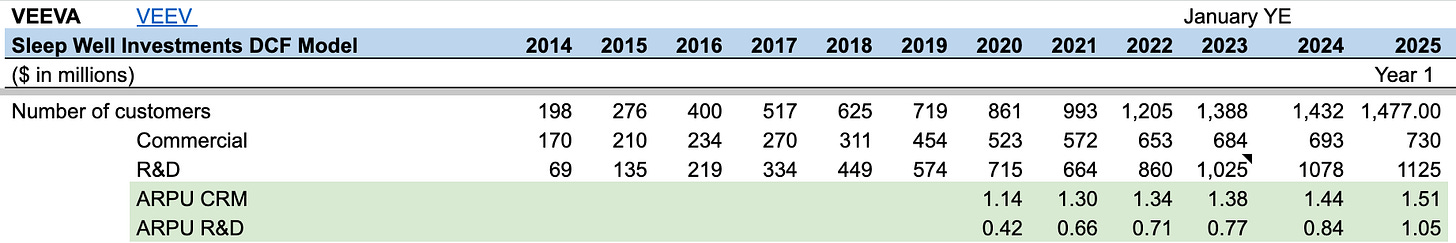

What I mean above is partly conveyed in the increasing revenue per user (ARPU - green highlight) for both CRM and R&D (Development) Cloud suite, despite the higher number of customers acquired each year.

The platform's stickiness and independence from external forces will provide downside protection for decades. In a few years, we will see that Veeva will no longer rely on Salesforce (it currently still provides the platform for Veeva’s CRM customers while they migrate to Veeva Vault). Hopefully, in a year or two (max), all three suites - CRM, Development, and Data Cloud will be on one unified platform. In the next 5-10 years, I think Veeva can also be independent from IQVIA. When that happens, Veeva will be like the Microsoft of PC operating systems. Regulators won’t like it, but owners of shares will be rewarded.

I won’t rehash why Veeva is a sleep-well business here, so please read my in-depth reports: [deep dive part 1, part 2, BUY, Q3’24 migration accelerates, CRM+ IQVIA]