20 Sleep-Well Businesses You Have Never Heard Of

Phenomenal businesses with a long history of operation, wide moats, high return on invested capital, and long runway for growth.

Hi, Sleep Well Investors!

I am Trung. I write 10+K words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, and 3rd). Join me in building generational wealth.

What is the best thing about investing long-term?

It changes your thought process and rewires your brain.

We start to think like owners.

We start to understand the business so profoundly that we can question management.

We forget about the noise, the promotion of the stock, the daily changes in the stock price, or what the Fed will do.

We start to think about the why. Why do we invest? Why do we own this business? The awareness of why helps us persevere in tough times and build wealth.

In this article, you’ll find a list of 20 market leaders that could help you build wealth and change your investing process.

Sleep Well Investments has deep-dived into some of these businesses and is patiently waiting for the right price to own more; we recently bought three businesses (1st, 2nd, and 3rd).

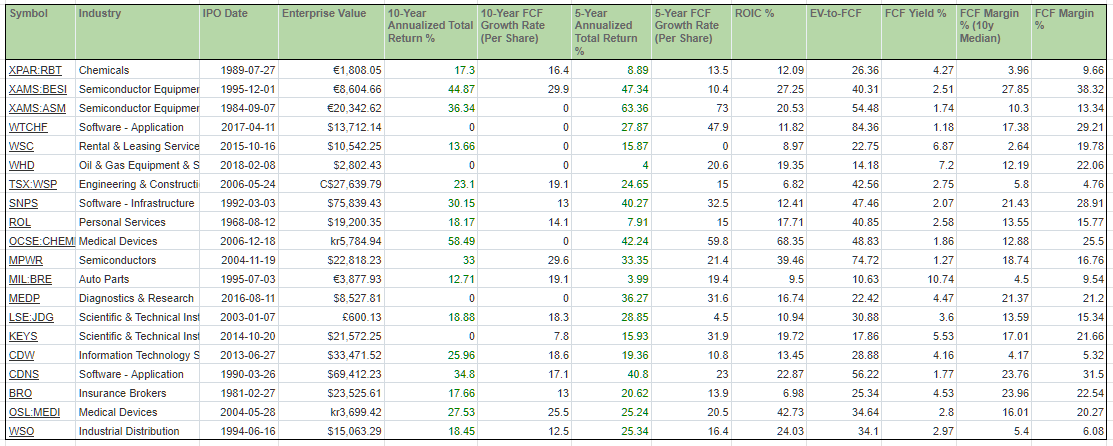

Robertet SA RBT 0.00%↑ ($RBT)

Robertet, founded in 1850, is a French fragrance and flavor manufacturer specializing in natural raw materials. It’s a world leader and a fully integrated company from source to final fragrance or ‘seed to scent.’ Business Breakdowns does a great job of breaking down the business, a long-term holding of Edelweiss Holdings.

FCF margin: 10%

FCF yield: 4.3%

10-yr FCF/share CAGR: 16.4%

ROIC: 12%

10-yr return CAGR: 17%

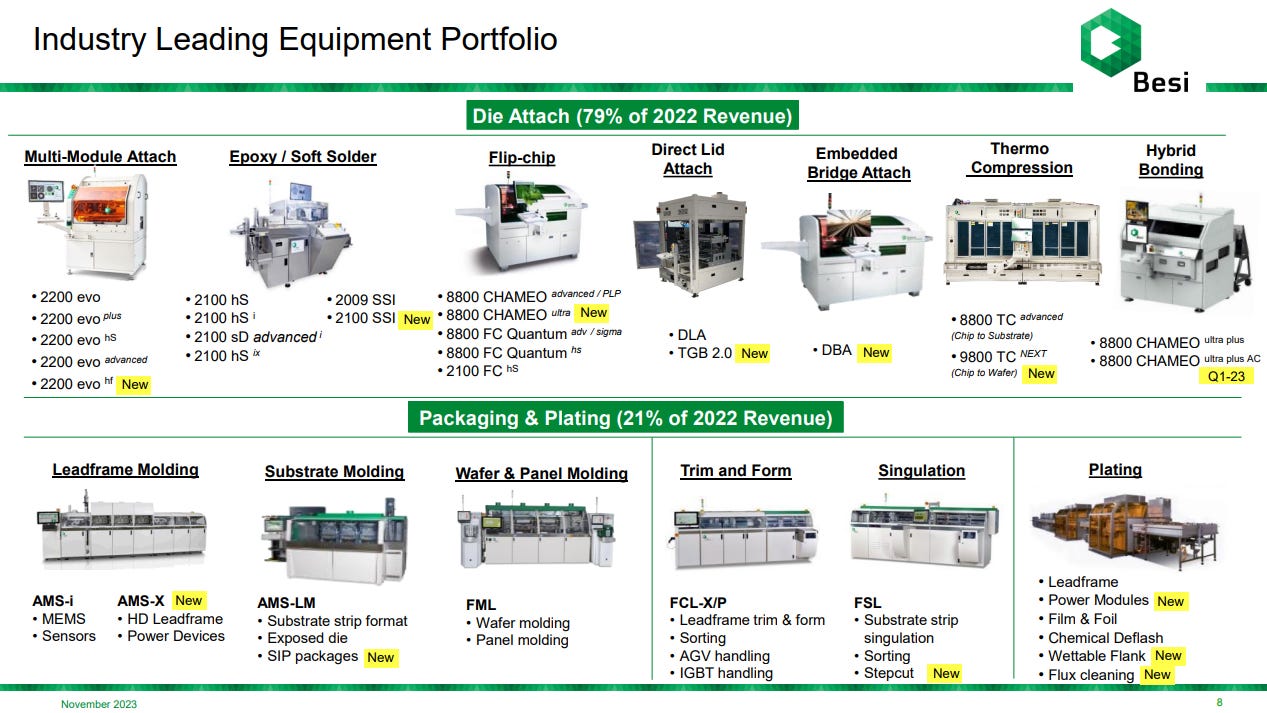

Besi Semiconductor $BESI

Besi, founded in 1995, is a Dutch company that provides equipment for the semiconductor assembly and packaging market (the back-end). Besi is one of the market leaders with a focused portfolio and flexible business operations, which allow it to maintain leading gross and operating margins. Besi's main clients are the world's largest foundries (TSMC, Samsung, and Intel) and integrated device manufacturers.

Market position: Leading semiconductor assembly and packaging

FCF margin: 38%

FCF yield: 2.5%

10-yr FCF/share CAGR: 30%

ROIC: 27%

10-yr return CAGR: 45%

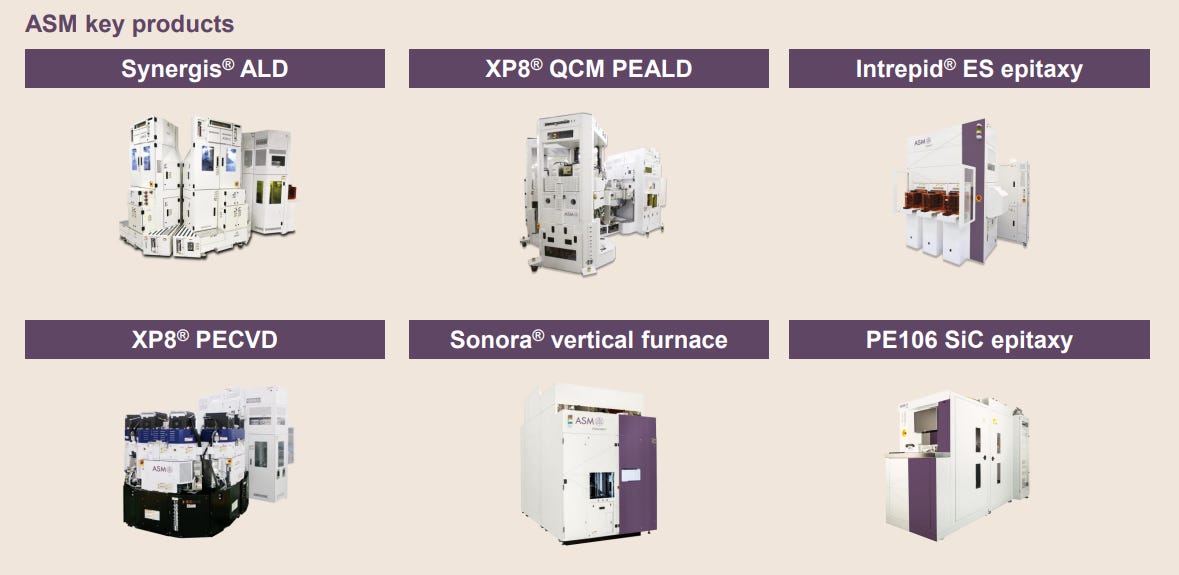

ASM International NV ASM 0.00%↑ ($ASM)

ASM International supplies semiconductor manufacturing equipment, not $ASML; don’t mistake the two. ASM's front-end equipment, such as atomic layer deposition (ALD) and epitaxial tools, prepare silicon wafers and fabricate semiconductor layers. The firm is the top supplier in the ALD equipment segment. ASM's 25%-owned subsidiary, ASM Pacific Technology, manufactures back-end tools to assemble and package semiconductors into their final form.

Market position: 50% share in ALD equipment market

FCF margin: 13%

FCF yield: 2%

5-yr FCF/share CAGR: 73%

ROIC: 21%

10-yr return CAGR: 36%

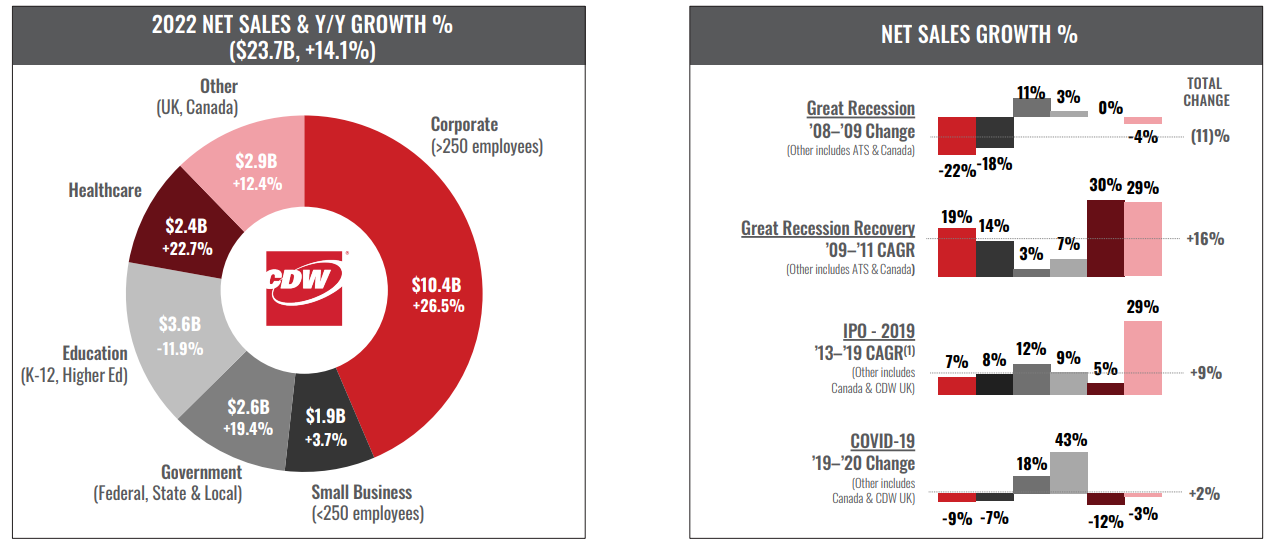

CDW Corp CDW 0.00%↑ ($CDW)

CDW Corp is a value-added reseller operating in the U.S. (95% of sales) and Canada (5%). The company has more than 100,000 products on its line of cards that range from notebooks to data center software. I like that CDW sits between hundreds of thousands of vendor partners and customers, helping both parties navigate complex options and implement the best solution. It is a very difficult moat to replicate once it reaches scale.

Market position: Unknown

FCF margin: 38%

FCF yield: 2.5%

10-yr FCF/share CAGR: 30%

ROIC: 27%

10-yr return CAGR: 45%

Cactus WHD 0.00%↑ ($WHD)

Cactus Inc. designs, manufactures and sells wellheads and pressure control equipment. The company also provides recurring businesses installing, maintaining, and safely handling the wellhead and pressure control equipment and repair services for equipment it sells or rents. The principal clients are onshore unconventional oil and gas wells utilized during drilling, completion (including fracturing), and production.

FCF Margin: 13.0%

FCF Yield: 7.0%

5-yr FCF/share CAGR: 20%

ROIC: 26.6%

CAGR since IPO: 6%

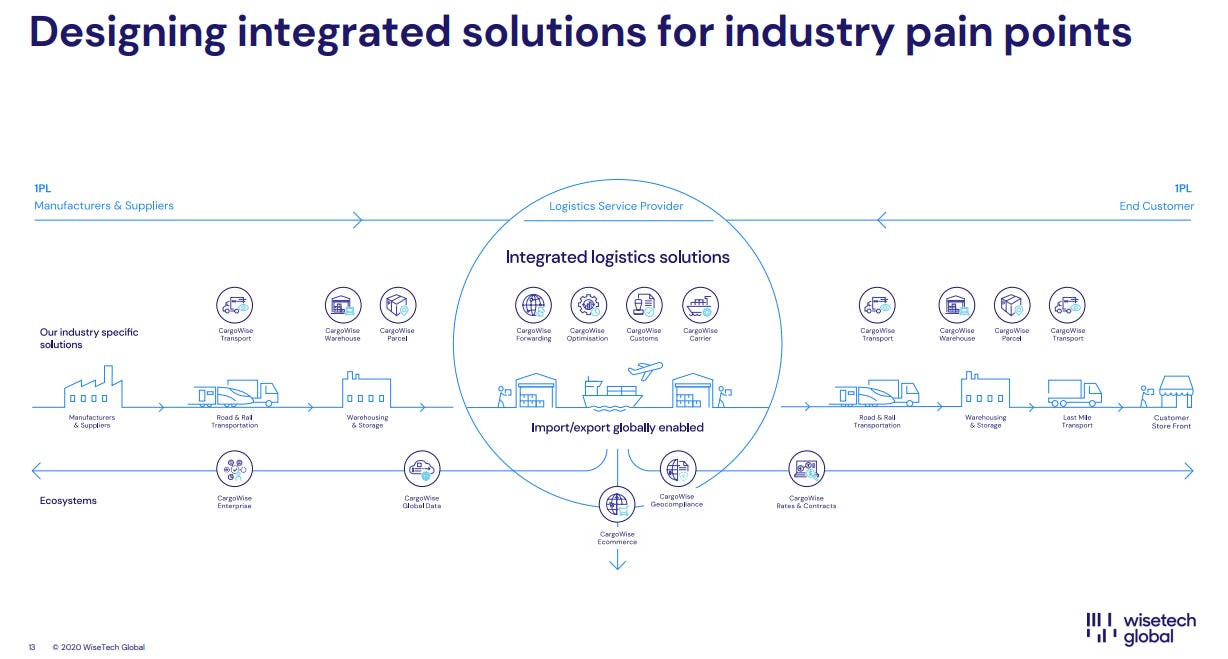

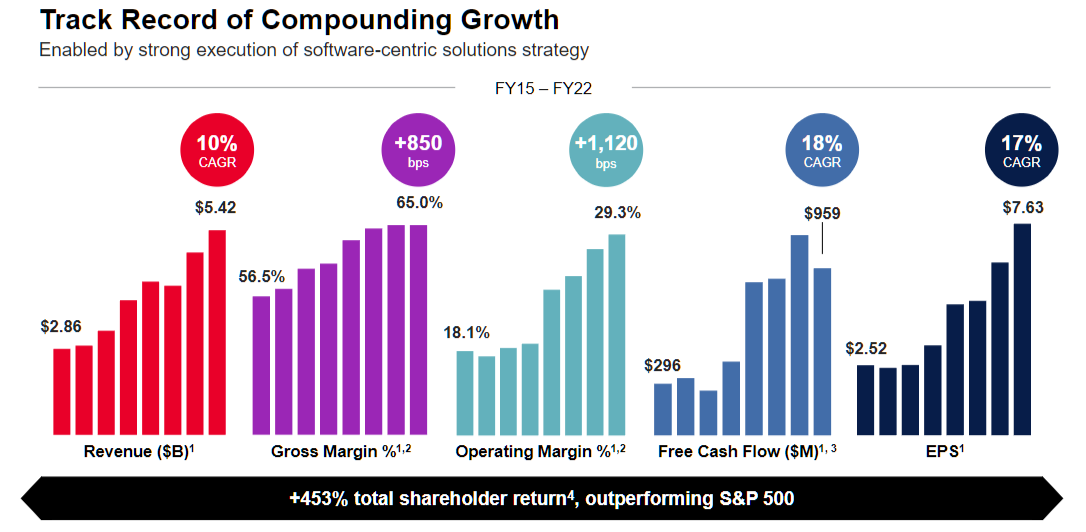

Wisetech ($WTC)

WiseTech is a founder-led technology company that provides logistics software. WiseTech's core product suite, CargoWise, provides the best-in-class software solution for international freight forwarding and boasts industry-leading annual customer retention rates of over 99%. CargoWise's main competition consists of in-house software solutions and manual processes, providing a large and highly winnable market opportunity for WiseTech's current and future products.

FCF margin: 29%

FCF yield: 1.5%

5-yr FCF/share CAGR: 47%

ROIC: 12%

5-yr return CAGR: 28%

WillScot Mobile Mini Holdings ($WSC)WSC 0.00%↑

WillScot Mobile Mini leases modular work space and storage facility. They offer logistics of delivering, installing, and removing after the lease ends and value-added products and services (VAPS), which are the rentals of furniture, appliances, insurance, and maintenance during the lease. In many cases, if the customers want to own these temporary spaces permanently, WSC also sells the units. The unit economics of leasing and selling the units are phenomenal. I have deep-dived into the business and will make Part 1 FREE to read next week. Enjoy, and I appreciate your hitting the like button and sharing it to help me produce more high-quality research like this.

Market position: 50%+ share

FCF margin: 18%

FCF yield: 6.8%

3-yr FCF/share CAGR: 31%

ROIC: 9%

5-yr return CAGR: 16%

WSP Global Inc ($WSP)

WSP Global Inc. provides engineering and design services to many clients in the Transportation and Infrastructure, Property and Buildings, Environment, Power and Energy, Resources, and Industry sectors. It also offers strategic advisory services. WSP is an incredibly resilient business that grew through the financial crisis and has a lot of growth opportunities left despite its size. WSP is high on my research list. Hourglass Investing has done a great job dissecting the company's fundamentals and the industry. Check out his work here.

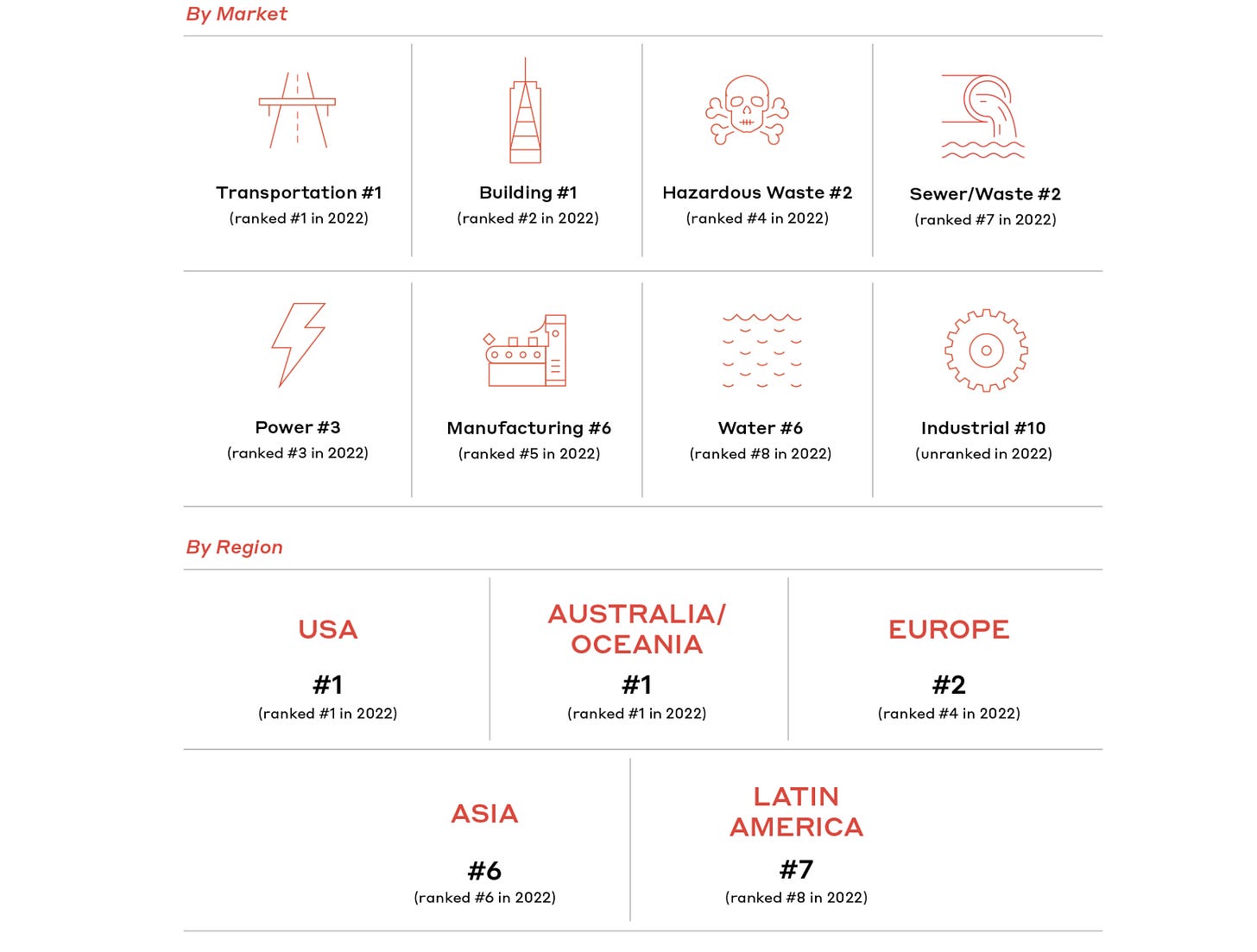

Market position: No.1 in the US, Oceana, No.2 in the EU.

FCF margin: 5%

FCF yield: 2.8%

10-yr FCF/share CAGR: 19%

ROIC: 7%

10-yr return CAGR: 23%

Synopsys Inc SNPS 0.00%↑ ($SNPS)

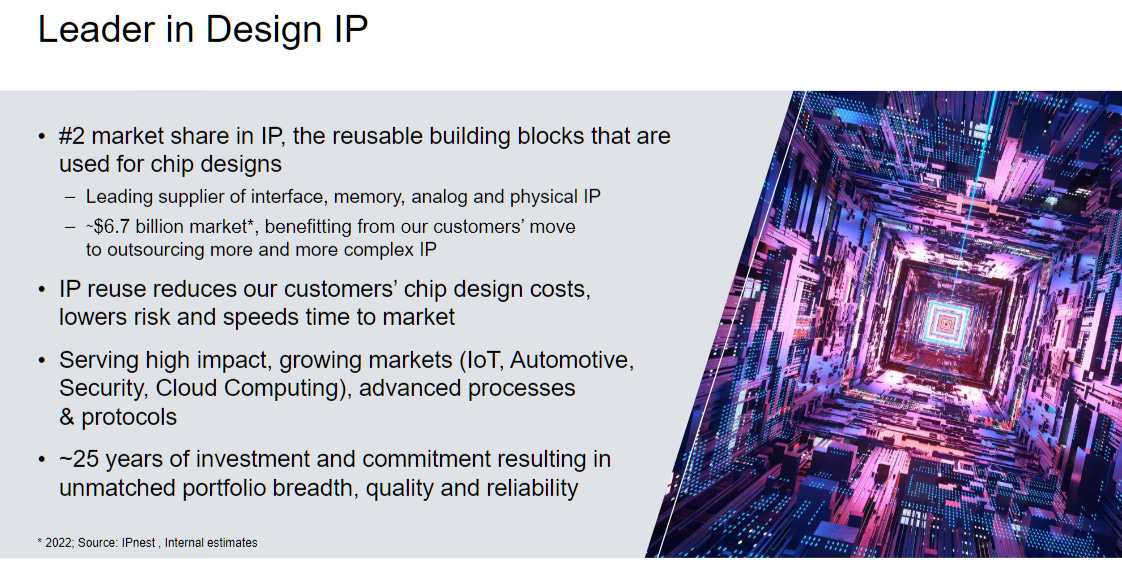

Synopsys, IPO in 1992, provides electronic design automation (EDA) software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution.

Market position: Duopoly with Cadence Design Systems

FCF margin: 29%

FCF yield: 2.1%

10-yr FCF/share CAGR: 13%

ROIC: 13%

10-yr return CAGR: 30%

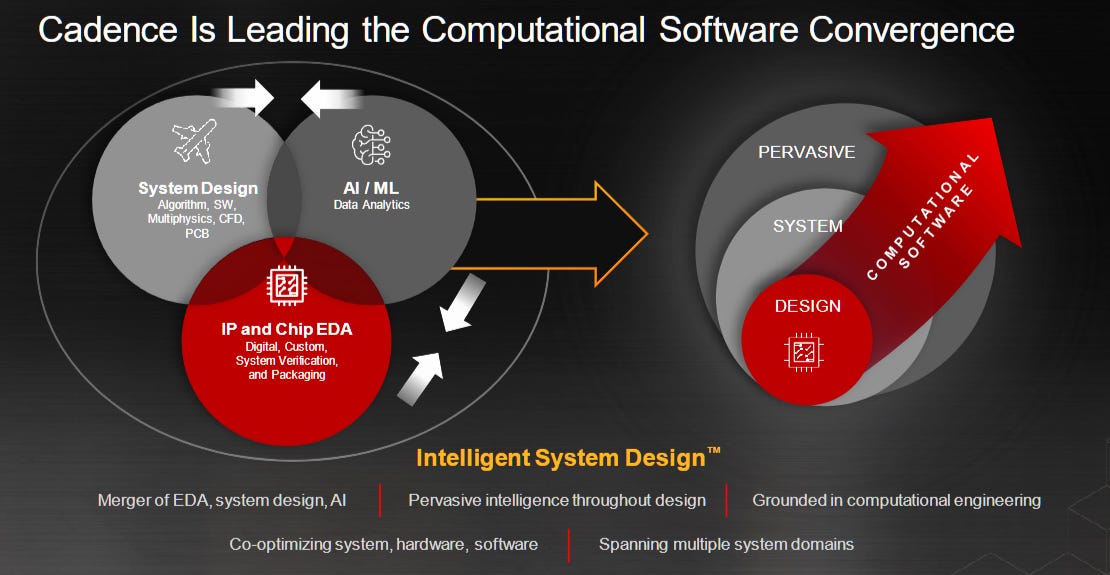

Cadence Design Systems Inc CDNS 0.00%↑ ($CDNS)

Like Synopsys, Cadence Design Systems provides electronic design automation software, intellectual property, and system design and analysis products. Cadence’s metric is also pretty impressive. Tech Investments did a fantastic job in explaining the industry and key players. Check out their work here.

Market position: Duopoly with Synopsys

FCF margin: 24%

FCF yield: 1.8%

10-yr FCF/share CAGR: 17%

ROIC: 23%

10-yr return CAGR: 35%

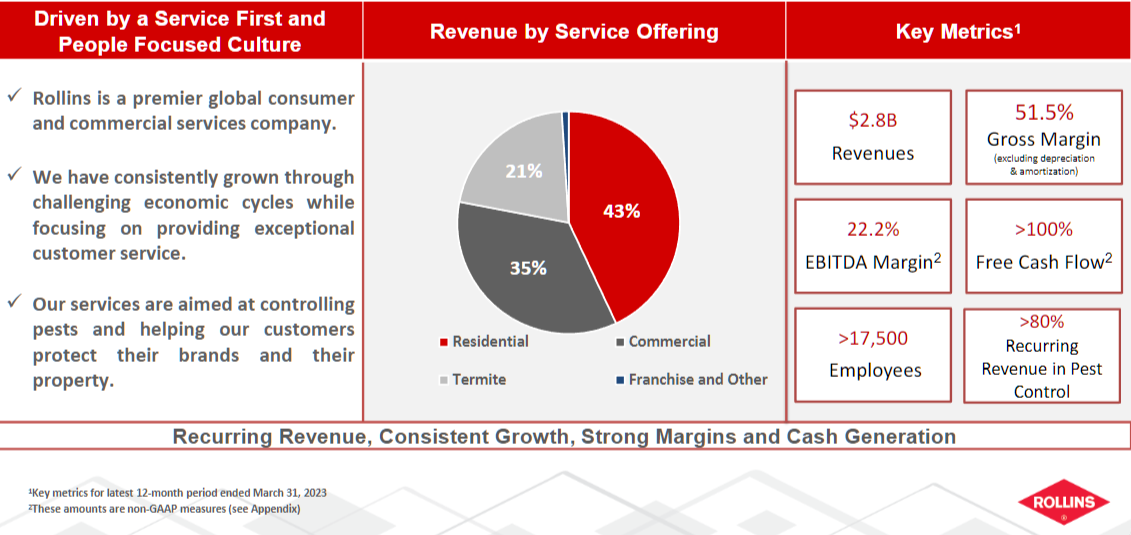

Rollins ROL 0.00%↑ ($ROL)

Market leader in pest and wildlife control services to residential and commercial customers in the United States and internationally. It serves clients directly, as well as through franchisee operations. Rollins, Inc. was incorporated in 1948 and is headquartered in Atlanta, Georgia.

Market position: Leader

FCF margin: 14%

FCF yield: 2.6%

10-yr FCF/share CAGR: 14%

ROIC: 18%

10-yr return CAGR: 18%

Medpace MEDP 0.00%↑ ($MEDP)

Medpace is a late-stage contract research organization, or CRO, that provides full-service drug development and clinical trial services to small and midsized biotechnology, pharmaceutical, and medical device firms. The company was founded over 30 years ago and operates in the US, Europe, Asia, South America, Africa, and Australia.

FCF Margin: 21.1%

FCF Yield: 4.5%

5-yr FCF/share CAGR: 31%

ROIC: 18%

5-yr return CAGR: 37%

Judges Scientific ($JDG)

Judges Scientific is a British serial acquirer of niche scientific instruments, which IPO in 2003. The Company's products include instruments that prepare samples for examination in electron microscopes and instruments used to create motion, heating, and cooling within ultra-high vacuum chambers.

FCF Margin: 15%

FCF Yield: 3.6%

10-yr FCF/share CAGR: 18%

ROIC: 11%

10-yr return CAGR: 19%

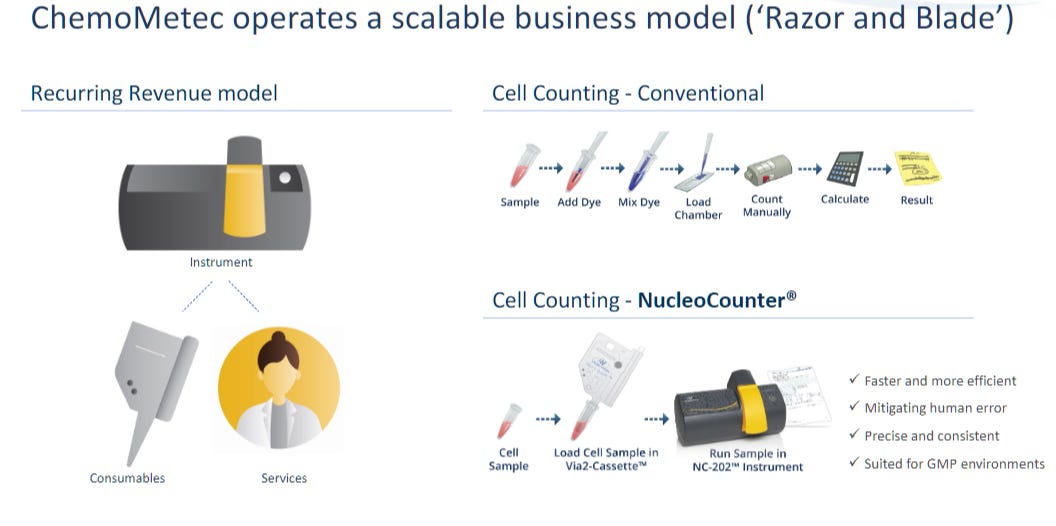

ChemoMetec A/S ($CHEMM)

ChemoMetec A/S is a Danish company that designs, develops, and produces instruments using patented cell counting and evaluation technology. It sells devices and provides platforms for determining the viability and cell count of yeast, veterinary semen, mammalian cells, somatic cells, and image analysis.

FCF Margin: 25%

FCF Yield: 2%

5-yr FCF/share CAGR: 59%

ROIC: 68%

10-yr return CAGR: 58%

Monolithic Power Systems MPWR 0.00%↑ ($MPWR)

Monolithic Power Systems designs and manufactures power management solutions. The Company provides power conversion, LED lighting, load switches, cigarette lighter adapters, chargers, position sensors, analog input, and other electrical components.

FCF Margin: 17%

FCF Yield: 1.3%

10-yr FCF/share CAGR: 29%

ROIC: 40%

10-yr return CAGR: 33% (since IPO in 2004: 25.5%)

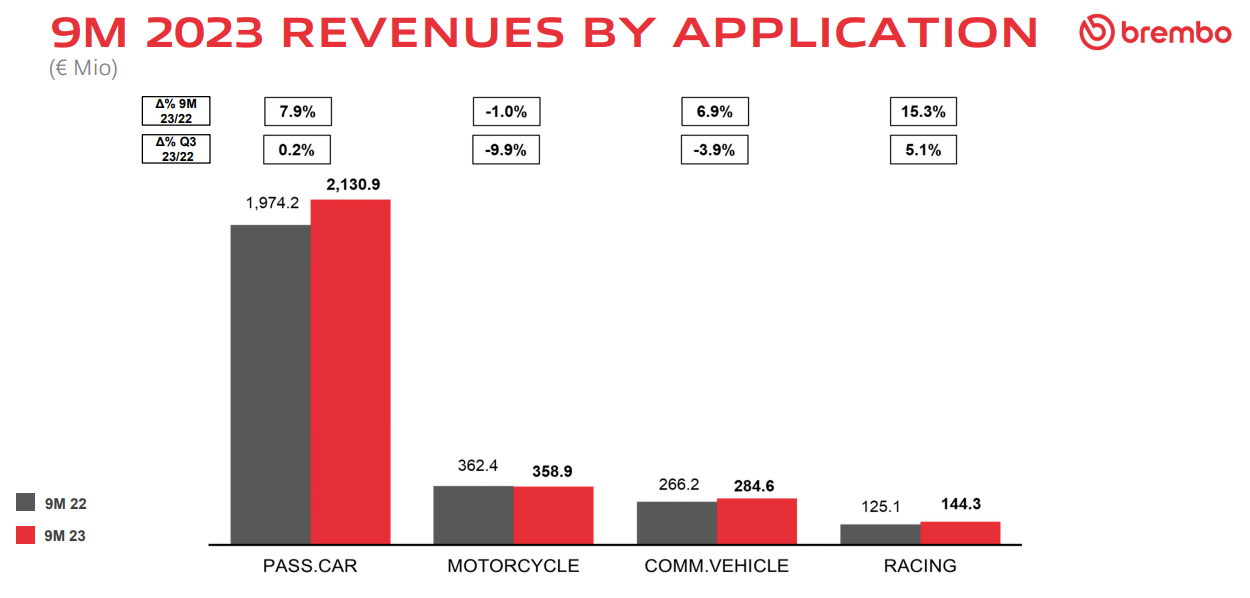

Brembo SpA ($BRE)

Brembo SpA, founded in 1961, manufactures brake discs and calipers for automobiles and motorcycles. The company produces brake systems under its own brand and for commercial vehicle manufacturers worldwide. The company also manufactures master cylinders and lightweight alloy wheels. Brembo offers spare parts in the aftermarket sales, including brake discs, pads, drums, shoes, and hydraulic components.

FCF Margin: 10%

FCF Yield: 11%

10-yr FCF/share CAGR: 19%

ROIC: 9.5%

10-yr return CAGR: 13%

Keysight Technologies Inc KEYS 0.00%↑ ($KEYS)

Keysight Technologies is a leader in testing and measurement devices, helping electronics OEMs and suppliers bring products to market to fit industry standards and specifications. Keysight's solutions include testing tools, analytical software, and services. The firm's stated objective is to reduce time to market and improve efficiency at its more than 30,000 customers.

FCF Margin: 22%

FCF Yield: 5.5%

10-yr FCF/share CAGR: 7.8%

ROIC: 19%

5-yr return CAGR: 16%

Brown & Brown BRO 0.00%↑ ($BRO)

Brown & Brown provides a range of insurance and reinsurance products and services. The Company also provides risk management, employee benefits administration, and managed healthcare services.

FCF Margin: 22%

FCF Yield: 4.5%

10-yr FCF/share CAGR: 13%

ROIC: 7%

10-yr return CAGR: 17%

Watsco WSO 0.00%↑ ($WSO)

Watsco distributes air conditioning, heating, refrigeration equipment, and related parts and supplies. The Company operates various locations in the United States, with primary markets in the Sunbelt.

FCF Margin: 6%

FCF Yield: 3%

10-yr FCF/share CAGR: 13%

ROIC: 24%

10-yr return CAGR: 18%

Medistim ASA MEDI 0.00%↑ ($MEDI)

Medistim (MEDI.OL, 4.5B NOK / $450M) is a Norwegian medical device producer with an 80% market share, measuring blood flow and intraoperative ultrasound imaging for cardiac (CABG), vascular, and transplant surgeries. It was founded in 1984 and IPOed on the Oslo Stock Exchange in 2004. Medistim’s devices check the blood vessels' condition (function and abnormalities) and operating area to ensure the quality of surgeries. I published in-depth research into the company and bought the first position at NOK 180, which I detailed the reasoning for here.

FCF Margin: 20%

FCF Yield: 3%

10-yr FCF/share CAGR: 25%

ROIC: 43%

10-yr return CAGR: 27%

Recap

I wrote a 10K+ research into Willscott and Medistim, among others, and recently bought shares in three (Link to reasoning: 1st, 2nd, and 3rd).

Out of the 20 high-quality businesses you have read, which one would you want me to dive into? Click the button to leave it in the comment section.

Want more?

Please subscribe to Sleep Well Investments, where I provide investors with in-depth investment research of unknown market leaders, updates on their market share gains & losses, and alert you when the prices are right. Feel free to connect with me at trung.nguyen@sleepwellinvestments.com, LinkedIn, or twitter/X@ DTF_Capital

About the author

I was born in Vietnam and moved to the U.K. in 2001 when I was 15. My background is in management and finance.

I am an ex-PwC and KPMG accountant, a Ph.D. doctorate in SME Innovation Management, and a passionate learner of time-tested businesses. I used to host a Value Investing group in London (pre-covid) and managed external capital for family and friends. Since 2022, I have been writing on Sleep Well Investments full-time; it’s my second baby, besides my beautiful 4-year-old daughter.

I strive for simplicity and structure in my investment process because building wealth takes discipline and patience.

You can listen to a recent podcast interview about me here; I shared the reason “Why I invest even after making so many mistakes and why I am sharing my journey to build a portfolio for my daughter, which will only be redeemed in 2037.”

I was surprised to see Brembo on the list, and at the same time pleasantly surprised because their brakes are good ones.

Great ideas! Happy shareholders of WSP and BRO here. I know I can sleep well at night with these two. Holding WSP for more than three years now and BRO for a couple of months. Thanks for sharing your list!