SWI Pick #15 - Sea Limited (SE) - Overcoming Sea Change Challenges, Time To Own The Business

Sea overcame a perfect storm to reemerge as the most dominant tech titan in SEA, execution risks reduced, undervalued at 25xFCF with 20% durable growth.

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

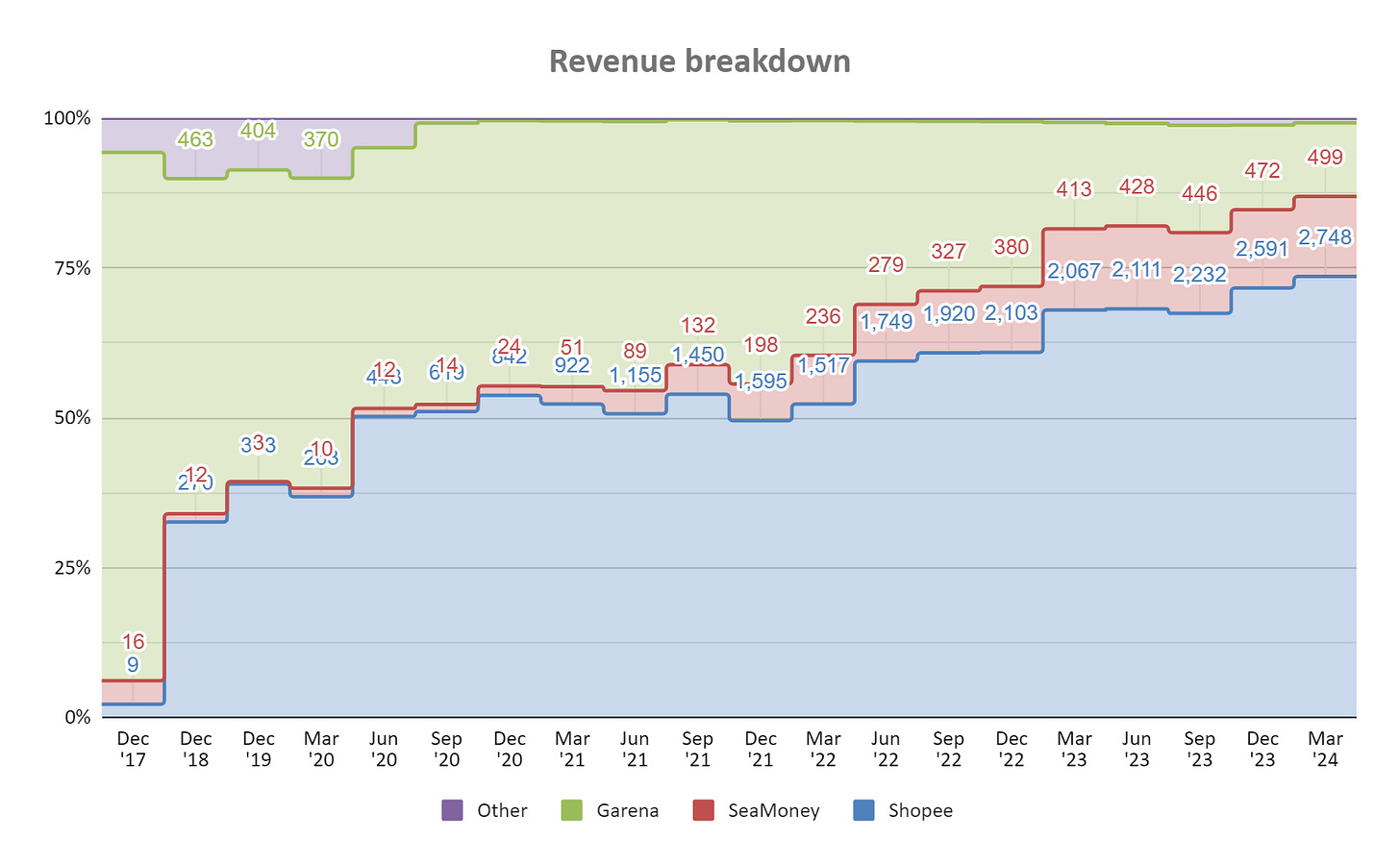

Sea Limited (SE) is a $40B Southeast Asian e-commerce/fintech/gaming success story.

Sea’s growth is nothing short of phenomenal. From humble beginnings, Forrest Li and Gang Ye founded Garena, a gaming platform that ignited a global phenomenon with Free Fire, enjoyed by half a billion players with its fast-paced action and freemium model. Garena’s success blossomed into Sea Limited / ‘Sea,’ a digital empire encompassing e-commerce (vertically integrated with its own logistics and advertising) and fintech.

Shopee, Sea's e-commerce arm, conquered Southeast Asia's burgeoning internet market with 50%+ market share thanks to its mobile-friendly interface, broad SKUs, strategic integration with social media, and competitive pricing. SeaMoney, the company's financial services arm, is seamlessly integrated with Shopee, offering users an intuitive and convenient one-stop shop for digital payments and financial solutions.

Since 2014, sales have compounded 62% annually and are expected to generate at least $1.5B in free cash flow annually.

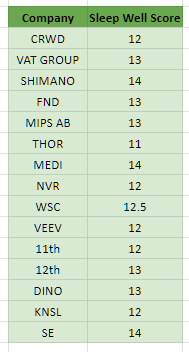

I have owned Sea since 2020 and feel comfortable sharing my thesis with you today. It will replace CrowdStrike as my top position in my PA, and I will add it to the Sleep Well Portfolio this week. Below are all the deep dives and performances.

Why own Sea Limited now?

First, Sea’s phenomenal success has met with crushing depths post-COVID (FY2022 cash burn of $2B). The fall culminated in several internal and external pressures, from (i) economic headwinds, which saw its Gross Merchandise Value (GMV) growth slowing from 85% in 2021 to a mere 28% in 2023, (ii) Free Fire's sharp decline as user downloads dropped from 240 million in 2021 to 150 million in 2023, with revenue dipping proportionally, casting doubts over its durability. (iii) Overambitious, cultural, and local competition miscalculation, leading to ineffective global expansion plans into India, Europe, and Latin America, drained resources from Sea's core markets. (iv) Sea’s aggressive marketing and promotional campaigns at the expense of long-term profitability were deemed unsustainable. Coupled with geopolitical turbulence in the war in Ukraine, it further disrupted supply chains and compounded Sea’s existing challenges, added fuel to the $2B cash burn fire in 2022. Sea’s sharp slowdown was a stark reminder that even the most formidable tech giants are not immune to the market's vicissitudes.

I have watched my share ownership fall 80%+ from $370/share in 2021 to $33/share in Oct 2023. This translates to a staggering $170 billion wiped off the company's market capitalization, leaving me questioning the future Sea.

Today, Sea’s has found the balanced formula to grow sustainably. In the past six quarters, it has proven it has the grit to overcome the ‘sea change’ challenges above and has worked on building defensive qualities to fence off more resourceful competition. The achievement is a testament to its visionary leadership and ability to adapt and capitalize on the region's rapid digital transformation.

As a result, Sea’s has earned my sleep-well label, which I wasn’t entirely comfortable calling it a few years ago.

As we advance, Sea will have three durable cash-generating businesses at the current run rate of over $1.5B free cash flow. Importantly, Sea shows clear evidence of reinvestment opportunities that will expand the empire's resiliency.

Best of all, the market has not given enough credit, valuing it at just 25 times free cash flow for a tech titan with multiple years of 20% growth and margin expansions. Together with future multiple expansions, Sea’s value is well-positioned for outsized long-term gains.

Here is a quick overview of the segments and how they make Sea a sleep-well pick.

Garena, the gaming segment / Digital Entertainment, owns Free Fire, the most successful battle royal game in the past seven years; it attracts nearly 900B views on TikTok, 300B (!) more views than the next most popular games (Roblox and Fortnite), has 595M quarterly active players and 49M paying. After a roller coaster post-COVID, Garena has stabilized and is en route to generating $1B of free cash flow annually for the near future. Adding to the $4B net cash, Sea can redirect this excess cash to fortify Shopee and SeaMoney.

Shopee, with a $85B gross merchandise value (trailing 12-month GMV), commands over 50% market share in Southeast Asia. Shopee is more dominant than Amazon's (AMZN) 38% share in the US or Mercado Libre’s (MELI) 30% in Latin America. The monopoly-like share is a testament to Forrest Li’s leadership and superior local knowledge compared to competitors. Since the last few quarters, Shopee has been breakeven in the core market - South East Asia. Future success is supported by 15%+ e-retail growth, improving logistics and unit economics in live-commerce business thanks to more rational competitive behaviors following Tiktok's merger with Tokopedia.

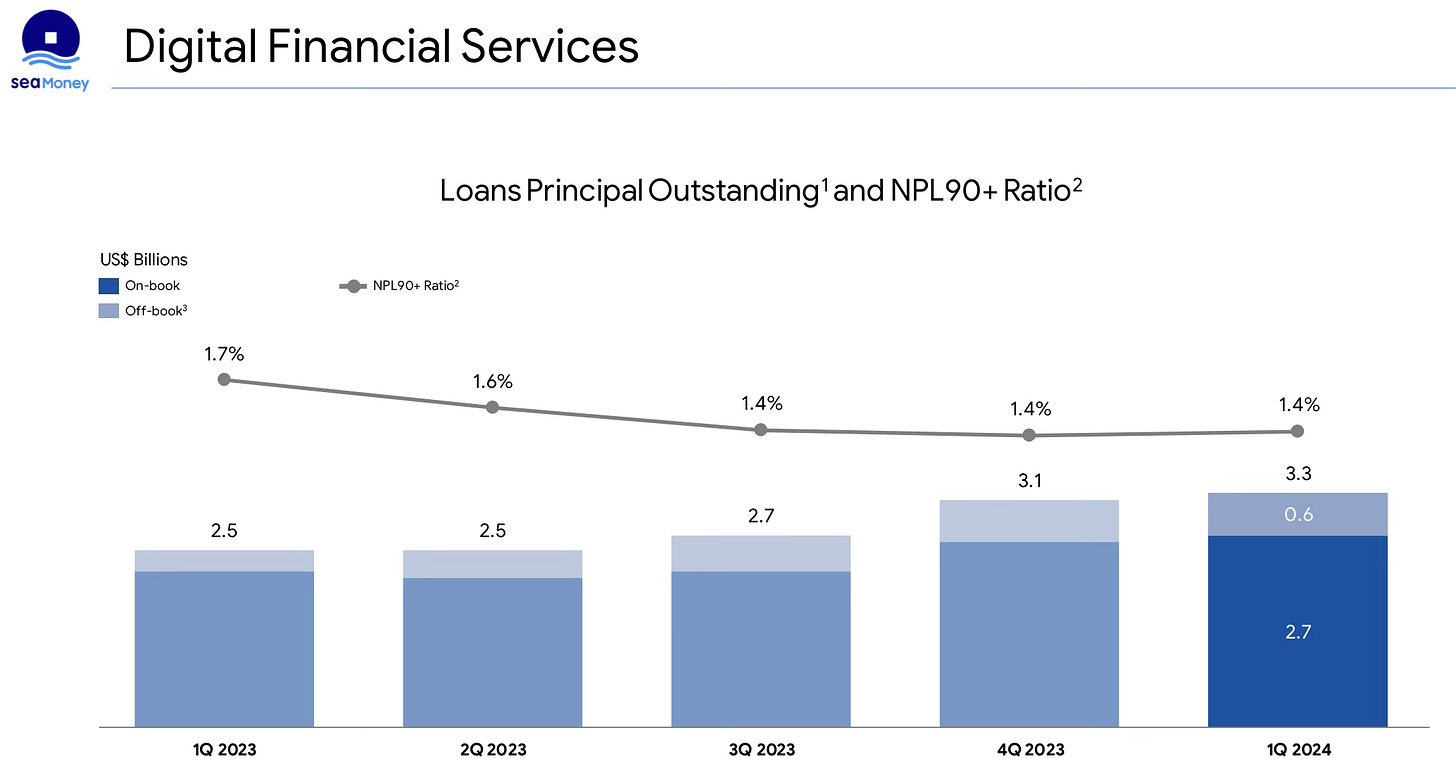

SeaMoney / Digital Financial Services, the fast-growing and high-margin fintech segment, offers credit services to Shopee sellers (SME loans) and buyers (buy-now-pay-later and short-term cash loans). SeaMoney empowered 18 million Southeast Asians to participate in the digital economy, bridging the gap between traditional finance and the world of mobile transactions. It is a direct benefactor of Shopee’s success. SeaMoney generated $500M of free cash flow in the last 12 months and has durable 20%+ growth thanks to Shopee integration, disciplined risk management (decreasing non-performing loan ratio of 1.4%), and growing monetization in insurance and mobile wallet services.

My simple and conservative sum-of-part valuation of Sea indicates an undervalued enterprise of $44B compared to the current market cap of $40B. I value:

Garena at $12B (12x EBITDA, low range of industry 12-20x EBITDA),

Shopee at $25B (2.5x EV/Revenue, lower than peers at 3x), and

SeaMoney at $7B (15x EBITDA).

I believe the market hasn’t appreciated the value in

(i) Garena’s durability, especially if Free Fire is relaunched in India, and

(ii) Shopee’s scale advantage and defensive quality in SPX, its own logistics, and

(iii) a higher advertising take rate towards the end of FY2024, a 0.5% increase, leads to $400M of ad revenue alone.

(iv) a higher multiple as time will show Sea is an enduring enterprise.

Lastly, Jeff Bezos often says that free cash flow per share is the ultimate financial measure. Sea’s free cash flow per share is only starting to move upwards.

Details of my analysis are as follows:

Overcoming challenges

Garena

Staying power

Free fire upside in India

Shopee

Improving unit economics

Moats vs. competition

Market and take rate growth

SeaMoney

High margin

Disciplined execution

Simple valuation

Sleep Well Scores

What to track

Check out my research, including FREE write-ups, in the link below.

1. Overcoming Challenges

Since its inception in 2009, Sea has encountered the following challenges:

Challenge 1: Shopee entered the market in 2015, when Lazada, AliExpress, and Tokopedia had a headstart from 2012, 2010, and 2009, respectively.

Response: Shopee had no notable differentiation, but by focusing on building an intuitive mobile-centric C2C platform with intelligent integration with social media and cheaper items, it was suitable for the region with predominantly small family businesses and a general lack of trust within online retailing. Additionally, Shopee’s hyperlocalizing apps in different countries, data, and cross-promotion from Garena propelled it to the largest e-commerce platform in 2021.

Challenge 2: With Shopee’s meteoric rise, Garena’s cash explosion gave Sea unbounded confidence and budget to expand to Latin America, Europe, and India. But within a year, it was too quick, too soon. Excessive partnership/reliance on external logistics limited Shopee’s quality of service; competition, cultural miscalculations, and lack of interest in Shopee’s promotion strategy in Europe and poor logistic infrastructure in India ended Shoppe’s aggressive expansion. At the end of 2022, it burned $2B in cash. The market questioned whether Shopee’s business model was sustainable.

Challenge 3: India banned Free Fire in February 2022, coinciding with the post-COVID reopening, magnified the impact. Garena’s quarterly active users dropped to 620M from 730M and 56M paying users from 93M. Garena’s cash flow of nearly $900M a quarter was chopped by half within a few quarters.

Response: On 15 September 2022, Sea's CEO and founder, Forrest Li, sent a memo to all employees outlining cost-cutting measures the company would take to achieve "self-sufficiency" within 12-18 months, reducing the reliance on Garena.

Impressively, within 12 months, Shopee exited Europe and India, swiftly cutting mistakes, while Free Fire continued to innovate on new game features and returned to growth. Sea extinguished Shopee’s $2B cash-burning bonfire, turning it into a break-even business. Meanwhile, Garena and SeaMoney have generated over $1.5B in free cash flow at a 12-month run rate.

Going through this period has made us leaner, fitter, and savvier.

There were more challenges, and Sea will always counter unknowns, but I am most impressed with the successful adaptation.

Garena looks more like a durable gaming franchise, and Shopee is profitable across markets; meanwhile, SeaMoney’s high-margin business is growing at 20%+.

This happens amid intense competition from Lazada, Tokopedia, and ByteDance-backed TikTok and uncertain economics and geopolitical environment. I am comfortable saying that Sea will do fine with future challenges.

2. Garena

Like Amazon's AWS, Garena is Sea’s cash cow, providing roughly $1B of free cash flow annually to build market shares in e-commerce and financial arms. This gives Shopee an unfair advantage over Tokopedia, Tiktok, or Lazada, which are reportedly still unprofitable in Southeast Asia.

The question is, how many more years can Garena generate excess free cash flow?

Staying power

Gaming is an ultra-competitive field. Gamers often move on quickly to a new game once there is another exciting one or when new features fail to impress.

I only know a handful of games that have become a global phenomenon and have stayed relevant for over a decade. That’s League of Legends (2009), Grand Theft Auto (2013), Wii Sports (2006). The rest come and go. Remember Age of Empire or StarCraft?

Free Fire is in its 7th year (Dec 2017). It’s hard to say how many more years it will continue to deliver $1B free cash flow. However, I am impressed by the staying power. Despite the recent ban in India, it’s still the most downloaded game in 2024 and has nearly 900B accumulated views on TikTok, over 300B views than the next most popular games (Roblox and Fortnite). There were 595M quarterly active players and 49M paying in Q1’24. Let that number sink in: 1 out of 12 people plays Free Fire.

I am also surprised that Free Fire gamers can compete in tournaments like League of Legends. The Free Fire World Series (FFWS) is Garena's annual professional Free Fire World championship tournament. The 2021 edition of the event became the world's most-watched esports event by peak live viewer count. The total prize pool was $2 million in 2021. Last year, the prize pool was reduced to $1M due to cost-cutting. The 2024 prize pool would be an excellent alternative for judging Free Fire’s relevance.

Growth potential if FF India relaunch

As a bonus, there is a chance that Free Fire will relaunch in India this year; this is an incredible upside, as India represented 40M monthly active users in 2022 before the ban.

Forrest Li said in the Q1’24 conference call:

we are actively working with order -- like stakeholders, including like the regulators, the potential local partners, right? And to figure out what is the best plan to relaunch Free Fire in India. And well, if that is successful, I think that will be a meaningful potential upside in terms of the users and the bookings considering India is a very, very big market.

Interestingly,

just to clarify, at this moment for our outlook for the rest of the year […] is not taking into the consideration of the relaunch of the India.

3. Shopee

Most dominant player

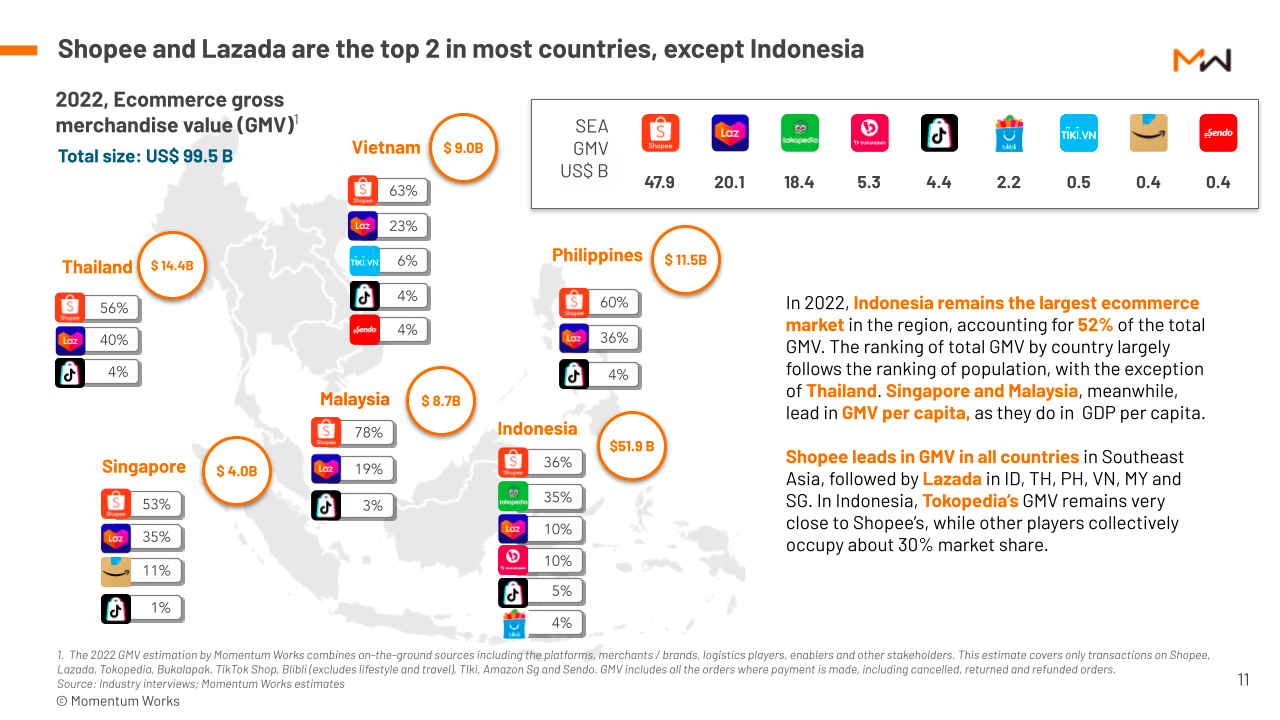

Regarding gross merchandise value (GMV), which is how much users spend on Shopee per year, Shopee has roughly a 55% market share in Southeast Asia.

Sea doesn’t break down its $84B GMV (current run rate) into countries, but per my guesstimates, it has $76B in GMV in SEA and $8B in Brazil, so that’s at least 50% GMV share in a $129B (SEA: $109B + Taiwan $20B) market in 2023.

The dominant share is consistent with Momentum Works’s stats for FY2022, where Shopee had a 48% market share, more than Lazada and Tokopedia combined.

Impressively, Indonesia was the only country where Shopee had ‘real’ competition. Even so, Tokopedia reportedly had only 18M active users in FY2023 (vs. 103M Shopee in Indonesia), a massive drop from 100M at the peak, which prompted the Q1’24 sale to Tiktok for roughly $2B valuation, half of Shopee’s net cash position. Former Tokopedia’s owner GoTo cited ‘intense competition and loss of market share’ and ‘needed large investment to survive’ for the sale to Tiktok.

Shopee rise to domination is incredible: From a measly 10% of Lazada in 2015, then 50% of Lazada in 2016 (Hayden Capital, 2019), to now, over 50%.

This is more dominant than Amazon in the US at 38% and Mercado Libre in Latin America at 30%.

I believe Shopee’s position is unlikely to change as the market has reached a mature stage with 20% e-commerce penetration. Shopee’s customer demographic, which has a median age of around 32 years (Malaysia) and is digitally literate, also ensures a long customer lifetime.

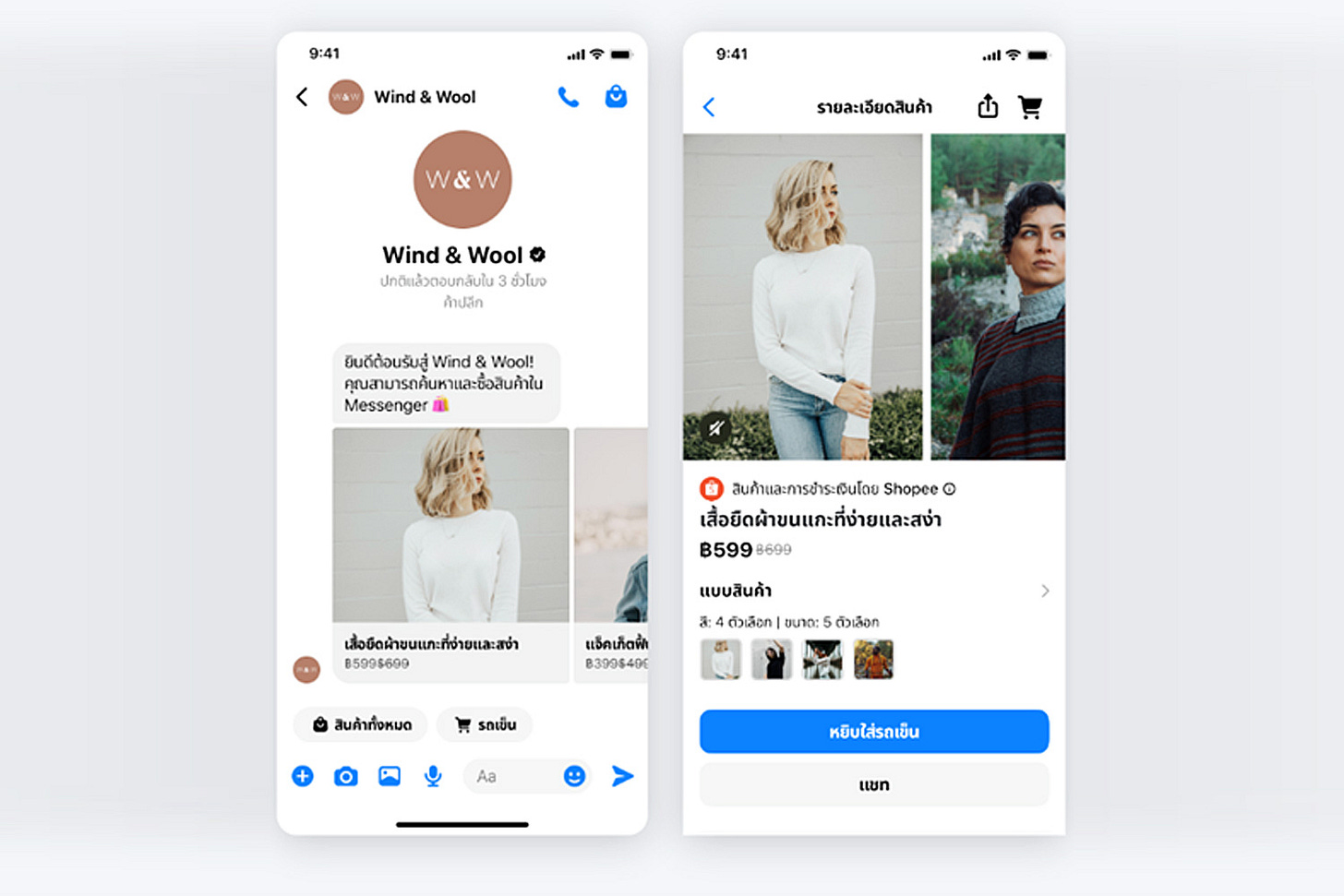

Recently, Facebook / Meta has collaborated with Shopee in Thailand to enable commerce on Messenger.

Meta has integrated shopping features within its messenger service and collaborated with e-marketplace Shopee to use Shopee's merchant product catalogues for Messenger to help Shopee merchants close sales on multiple platforms.

This is a bid to increase Meta's advertising revenue and to compete with TikTok. Meta chose Shopee because of its huge user traffic. This is a nice development, as Thailand has approximately 60M facebook user, the roll out benefits both Shopee and Meta going forward.

Improving unit economics

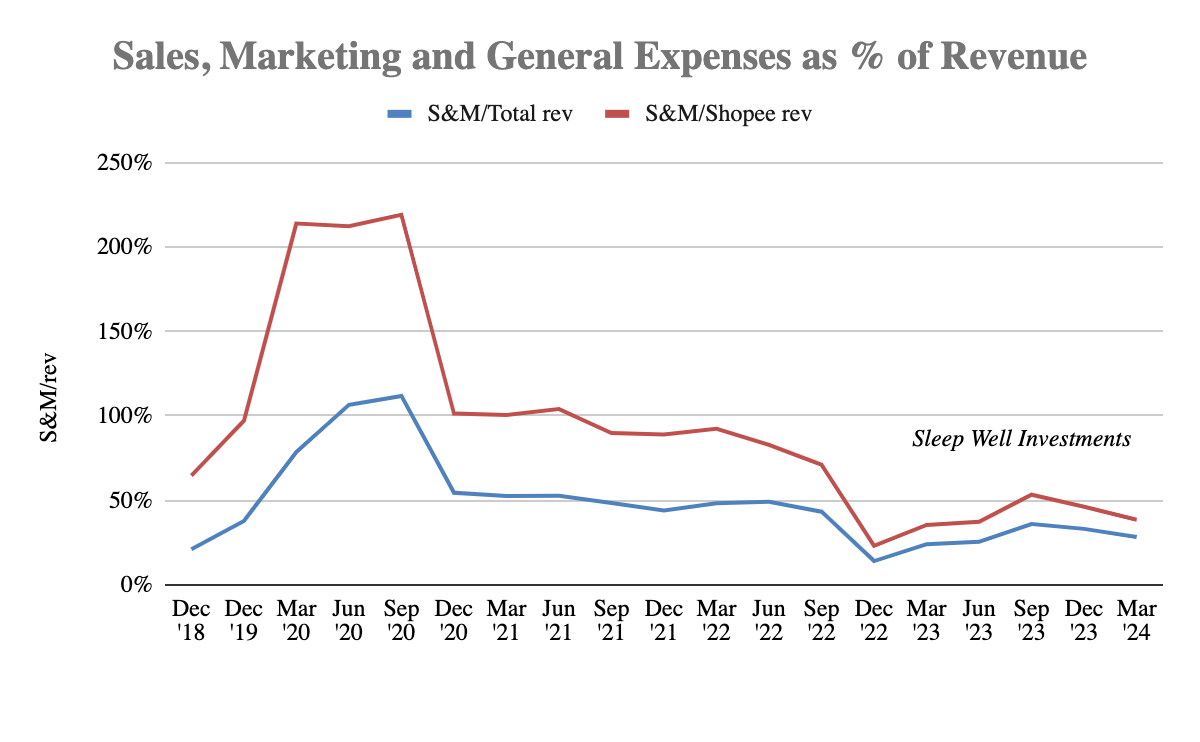

Shopee is the only growing and profitable e-commerce platform in SEA. This is a testament to the aforementioned rapid scale expansion and the following improvement in marketing efficiency and logistics services.

Improving sales and marketing efficiency

Since Forrest Li’s rally to self-efficiency in September 2022, Sea have cut sales, marketing, and general expenses to 20-30% of revenue from 50% while maintaining positive sequential revenue growth!

Alibaba and Mercado Libre spend roughly 12-15% and 15%-20% of sales on selling, marketing, and general expenses, so there is meaningful room to become even leaner.

Investment in own-logistics

E-commerce is ultimately a logistics business. Getting goods from point A to point B requires infrastructure and data, as you’d know from my deep dive into Wisetech. The more Shopee controls, the greater its ability to manage key customer pain points (delivery times, missing parcels, etc.) and drive efficiency.

According to a Momentum Works survey, this was Shoppe’s weak point before 2021.

So, I am excited by the cost and service quality improvements after the company doubled down on its logistics, SPX Express, including building the largest sorting center in SEA in the Philippines and Malaysia in Q1’24 and Vietnam in Q4’23, capable of processing 3M-5M daily orders. The aim is to ship 95% of orders on the same day by working closely with brands, sellers, and partners. It also wants to provide a fuss-free shopping experience by allowing no-question-asked refund-and-return. This is a mighty important promise as, together with the 15-day Shopee Guarantee period and Shopee Mall, it gives customers the confidence to check out their desired products, including high-value goods, that they cannot touch or feel when shopping online.

In the West, the confidence that you can pay for something upfront without touching it and receive it a day later is taken for granted. E-commerce penetration is still relatively lower in Southeast Asia.

The conviction to invest in better logistics gives the consumer all the power (quality guarantee, no-fuss returns, competitive prices) and earns their trust, ensuring Shopee remains the dominant platform.

But this isn’t just for customers. It solves the critical pain points—logistics and fulfillment for merchants. SPX Express completes the end-to-end commerce solution, from infrastructure to the shop front, making it difficult for emerging competitors like TikTok to replicate.

In Q1’24, approximately 70% of SPX Express orders in Asia were delivered within three days, with significant cost reductions per order: 15% in Asia and 23% in Brazil YoY. The return-and-refund service has 45% of cases resolved within one day, a 30% YoY decrease in resolution times. This is particularly important as the region's return rates for e-commerce sales are still high, between 15 and 20 percent, twice the median return rate in mature markets. In terms of days, SPX can complete a return-and-refund within two and half days, compared to the industry median of seven days. It also has two times more drop-off points and doorstep pick-up options.

The management didn’t share these stats in prior years, 2021-2023, but going forward, as customers trust Shopee and purchase higher-value items, these stats would be a good measure of Shopee’s moat.

I’ll leave this quote in Q3 ’23 here as it highlighted the belief in Shopee’s strategy during intense competition (TikTok) last year and that the results of Q1 ’24 were the seeds sown a few years back.

even in the market with the higher competition, we are able to gain market shares. The key is investment efficiencies. This is what allows us to gain market share while having better economics, unit economics than our close competitors in our market. The key for that is our competitive advantage we have built over the past many years. I think number one, if you think about this, will be scale. As a clear market leader, we have a bigger scale that translate to a much better monetization capabilities and also better cost efficiencies, of course. Number two is the local leadership and operations teams. We have a deep understanding of our market with a strong localized execution across very diverse markets in our region.

Moats vs. competition

It’s safe to say Shopee has beaten the biggest competitors, Tokopedia and Lazada, and it is well-positioned to fence off TikTok’s emergence.

First, Shopee’s brand affinity, scale, logistic prowess, and service quality advantages will prevent TikTok's emergence.

Second, TikTok’s success in the US is not easily translated to Southeast Asia or Latin America.

As per Bloomberg 31/May/24 - TikTok is pausing its global e-commerce push to focus on the US market.

TikTok has put on hold plans to launch its fast-growing e-commerce business across major European markets, focusing instead on growth in the US where it’s fighting a divest-or-ban law.

The move, which may catch many merchants in the region by surprise, reflects ByteDance’s objective of entrenching itself in the US as a way to prove its value to domestic merchants and consumers. ByteDance’s leadership wants to concentrate on its most lucrative market — with 170 million monthly users — to thwart a potential US ban that’s discouraged some merchants from signing up for the new platform, the people said.

This isn’t the first time the company has scaled back a global launch. The FT reported in July 2022 that the company abandoned its plans to expand its live e-commerce initiative in Europe and the US after it struggled to gain traction in the UK.

Now that the ban in the US has been signed into law, the company seems to be struggling to sign up merchants onto its platform due to uncertainty.

Lastly, TikTok is likely to have its work cut out in SEA as it intends to use Tokopedia’s operation to run in SEA, which is already far behind Shopee’s in its turf, Indonesia, not to mention regions outside of it.

Growth opportunity

Shopee’s long-term growth is derived from a 10-20% market growth due to still relatively low e-commerce penetration in SEA and increasing take rate (marketplace, transaction fees, logistics, and advertising). In particular, advertising revenue could double Shopee’s business within 3-5 years.

First, using China as a reference point, Southeast Asian markets could sustain robust double-digit annual growth of 15 and 25% for the next five years.

Southeast Asia's average e-commerce penetration rate (excluding food and beverage) is 20%, which suggests a long growth runway before it matches China’s penetration rate of 47%. Between now and 2026, the Southeast Asian market is projected to triple at a compound growth rate of 22% and will reach around $230 billion in gross merchandise volume (McKinsey & Company).

While Indonesia remains the most significant market (50% of incremental GMV), growth is high and robust across the board compared to the US and Europe.

Advertising take rate

Shopee’s overall take rate was 11.6% in Q1’24, rising consistently from 5% in 2019.

This level is still 3% lower than that of Mercado Libre, and the area that will boost the overall take rate the most is advertising. Management doesn't disclose an exact number but mentioned it’s a few percent lower than peers.

compare with our global peers, for example, in China or in the U.S., we are kind of like still meaningfully lower than where they are. We still have a few percentage to catch up to them. So there is meaningful room for us to increase the ad take rate. I think there are a few tools that we can deploy to do that.

How will they achieve that?

improve ad tools, and make it simpler.

increase conversion rate, ad efficiencies through technology

balance between organic (enhanced/popular products) and ad traffic (paid) depending on SKU and conversion rates

When?

We see there is a meaningful potential to increase the ad take rate over the next few quarters.

Advertising take rate potential - 5% of GMV

An online marketplace’s advertising take rate can reach 5% of its GMV. Amazon achieved this point in 2021 and nearly 7% in 2023, attributable to the launch of its demand-side platform in 2019, which enabled advertisers to place ads across various channels, contributing to the excess revenue above the typical saturation level.

Hypothetically, Shopee increases the take rate by 0.5%, translating to $400M in ad revenue. A few percentages could mean another $1-2B in revenue with minimal costs attached. If Shopee maintains its market share and keeps growing its GMV, advertising could be as valuable as the entire Sea Limited market cap of $40B today.

4. SeaMoney

SeaMoney offers customers and merchants products from digital wallets and mobile payments to online insurance and credit services. SeaMoney empowers 18 million Southeast Asians to participate in the digital economy, bridging the gap between traditional finance and the world of mobile transactions.

Thanks to its integration into Shopee, it’s a high-margin business with little acquisition costs.

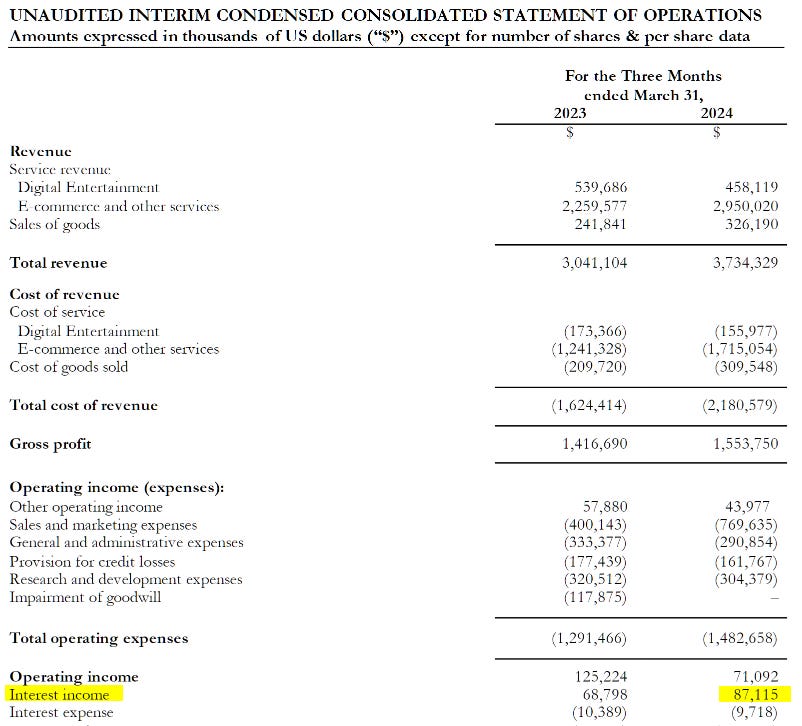

In Q1’24, the number of active users for loans rose by 42% YoY to over 18 million, and the total principal of these loans reached $3.3 billion, marking a 29% YoY and 5% QoQ growth. Revenue and EBITDA grew steadily at 21% and 51% YoY, respectively.

Notably, I am encouraged to see that loans not tied to Shopee now constitute over 40% of the total loans (cash loans and off-Shopee SPayLater), highlighting reduced dependence on Shopee and self-reliance growth opportunities off-platform.

Looking at Mercardo Pago, the fintech arm for Mercardo Libre that has grown revenue to almost the same size as the e-commerce platform, one can see the enormous potential of SeaMoney for Sea Limited. Shopee’s current run rate is $10B, and SeaMoney is $2B. A $10B run rate at a 35%+ free cash flow margin could mean another standalone business multiple times bigger than Sea Limited's current valuation, provided SeaMoney can grow at 15% for the next ten years.

Additionally, SeaMoney shows disciplined execution and prudent risk management. The non-performing loan (NPL) ratio is 1.4% and slowly trending down. This indicates that SeaMoney can be a reliable business on its own. It’s also impressive to compare the NPL90+ for Mercado Pago, which is around 18% (8% for 15-90 days).

5. Simple valuation

At $73/share, the market expects very little of Sea, just 7% FCF growth over the next 14 years.

My sum-of-part valuation of Sea is also simple and conservative to buffer in the surprises and unknowns.

Sea is undervalued at $44B compared to its current market cap of $40B. I conservatively value Garena at $12B (12x EBITDA, low range of industry 12-20x EBITDA), Shopee at $25B (2.5x EV/Revenue, lower than peers at 3x), and SeaMoney at $7B (15x EBITDA).

More upside is on the table if the market’s perception matches mine where:

(i) Garena’s durability is recognized, especially if Free Fire is relaunched in India.

(ii) Shopee maintains 50%+ market share, own-logistics SPX service quality, and unit economics continue to improve

(iii) Management increases advertising take rate

As the market sees Sea as an enduring enterprise, my valuation multiples above will also improve, doubling the chance of capital appreciation.

6. Sleep Well Scores

The Sleep Well Scorecard simplifies my thesis and helps me quantify the business's quality, opportunity, and risks.

Sea Limited - the 15th pick, scores 14 out of 20 points. To see the reasoning behind each criterion - read my sleep well framework writeup here.

+1: Product relevance

Sea scores full points for product relevance. Sea provides essential convenience for consumers. It also becoming an irreplaceable infrastructure for merchants as it expands logistics and Shopee shop front functions and quality. E-commerce penetration is still far off saturation; Sea Limited is less likely to become obsolete anytime soon.

+3: Business model

Sea's business model is efficient, adaptable, and scalable; its three segments are synergistic yet growing more independent and predictable. Garena provides cash flow and cross-sale opportunities for Shopee to grow, which in turns help SeaMoney grow and add more value for Shopee merchants and consumers.

+5: Financial strength

Sea’s financial metrics have improved considerably since the September 2022 letter to become self-sufficient. Notably, Shopee is no longer burning cash in the core market. The balance sheet has $8B+ cash and collects $80M+ per quarter of interest income. Reinvestment opportunities are abundant, and I expect logistics infrastructure to remain a priority.

+2: Management

Forrest Li has built Sea from the ground up and is the right man to lead the business forward; he and insiders collectedly own 42% of the company.

+1: Anti-fragile

Sea Limited's business is cyclical. However, the cash from Garena, the highly recurring nature of Shopee and SeaMoney business, and interest income from the $8B cash can counterbalance the impact when the market is soft. The business has proven adaptable and resilient and can thrive despite high market and political uncertainties.

-3: Competition is intense

Sea faces intense competition from TikTok, Lazada, Tokopedia and others. However, the growing 50%+ market share proves it can compete. The US and Latin America have also shown that dominant players can be profitable even with less market share.

+4: Moats & barriers to entry

Sea has scale/cost advantages and network effects moats, which widen as it takes more shares. Thanks to its investment in logistics and fintech products (loans and BNPL) and focus on the long-tail e-commerce category, where SKUs are broad and change quickly, competitors will find it challenging to replicate what Sea has built.

-2: Moderate to strong risks

Sea has had some execution risks, ‘buying revenue’ through subsidizing shipping costs and charging low commissions. Still, in the end, they pulled it off as more than 1 out of 2 Southeast Asian e-commerce users trust them over other platforms. Today, that trust has resulted in the most extensive user base, which has met with successful and sustainable monetization. However, the white space remains significant, and the competition in TikTok is only starting to work around SEA. Meanwhile, Garena is still looking for the next Free Fire.

2: Reasonable valuation

Sea’s valuation shows that the market hasn’t appreciated the return of Garena, Shopee’s operating leverage, and SeaMoney’s high-margin and expandable business. In my view, Sea’s stock is undervalued, with improved fundamentals and margin expansion at play.

Sea scores 14/20 points and earns a place in the Sleep Well Portfolio at the current $72/share price or $40B market cap.

7. What to track

I will be tracking the following:

+Garena’s continued growth in MAU, Bookings, paying users, and the impact of India relaunch.

+Shopee’s EBITDA progress and investments in logistics.

+SeaMoney’s 20% growth and profit margin.

Conclusion

I am adding Sea to the Sleep Well Portfolio and will post a separate note summarising the reason and providing updates in the future. The funding comes from my trimming of CrowdStrike (CRWD), the biggest position in the PA, as I grow more uncomfortable with its recent exploding multiple (1.5% free cash flow yield).

If my content has had a positive impact, please help me grow by spreading the word. Thank you

Resources to help your further due diligence

Sea Limited annual reports

Hayden Capital thesis 2019

Forrest Li’s self-sufficient Letter 2022

Wolf of Harcourt Street’s Q1’24 review

Tickers mentioned: SE 0.00%↑ MELI 0.00%↑ AMZN 0.00%↑ CRWD 0.00%↑ BABA 0.00%↑

A rumour - but good news for $SE Sea Limited regardless.

Alibaba rumoured to sell Lazada. The post also shows Shopee outperformed Lazada in Thailand between 2021-2023

https://www.bangkokpost.com/business/general/2814180/alibaba-rumoured-to-dump-lazada

Interesting news regarding $SE - that market doesn't quite understand.

Indonesia is imposing tariffs of 100-200% on Chinese imported goods.

This is net positive for Shopee, because its merchant predominately source produces within SEA, whereas its competitors TikTok, Temu and Lazada are mostly from China. Another Indonesian news outlet confirmed this as well.

The stock may be dropping 5% today because an officer put up 250k shares for sale through SEC form 144, but he sold the same number of shares exactly one year ago, so it seems more like an annual thing than a reaction to insider information.

https://www.antaranews.com/berita/4173561/mendag-akan-kenakan-bea-masuk-hingga-200-persen-pada-barang-asal-china