Mercado Libre (MELI) Q3'25 - Balanced Growth, Investments, Profitability

We update market share, core KPIs, valuation, and talked Argentina, OpenAI, TikTok, Advertising.

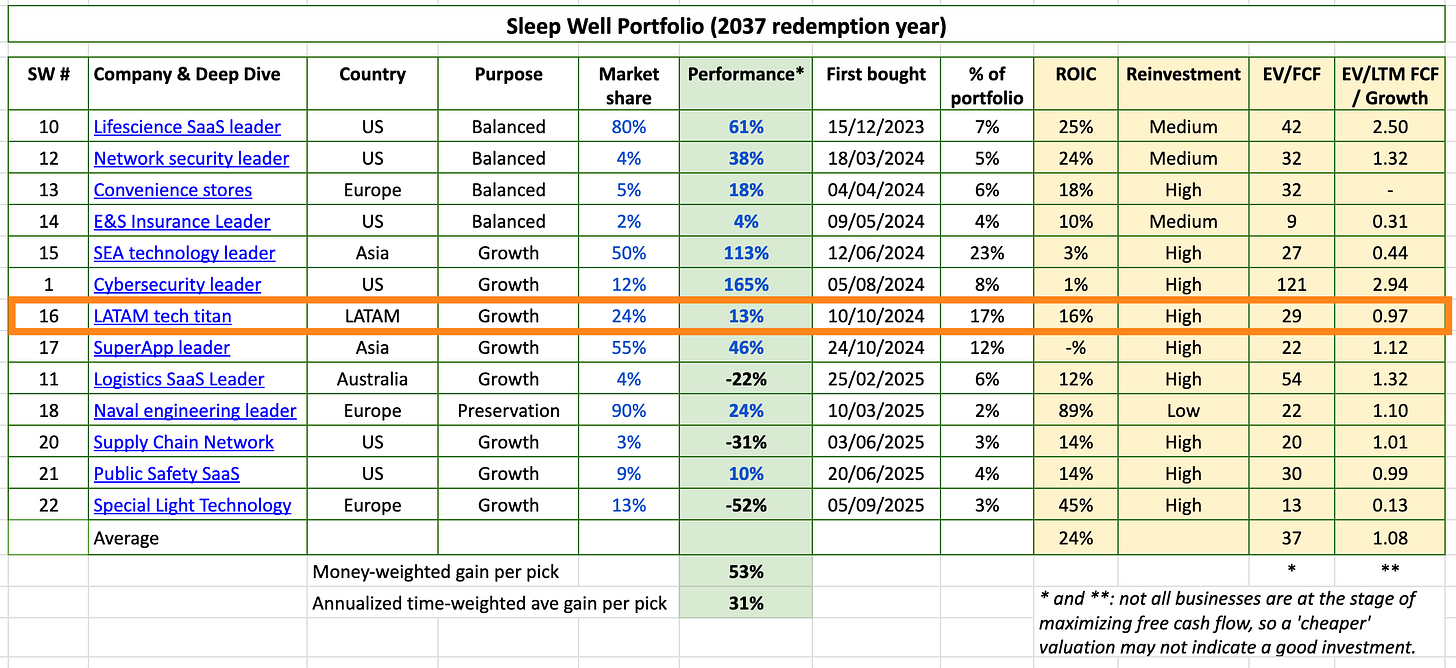

Mercado Libre (MELI), a ~17% position acquired on 24 Oct 2024, is a commerce and technology leader in Latin America.

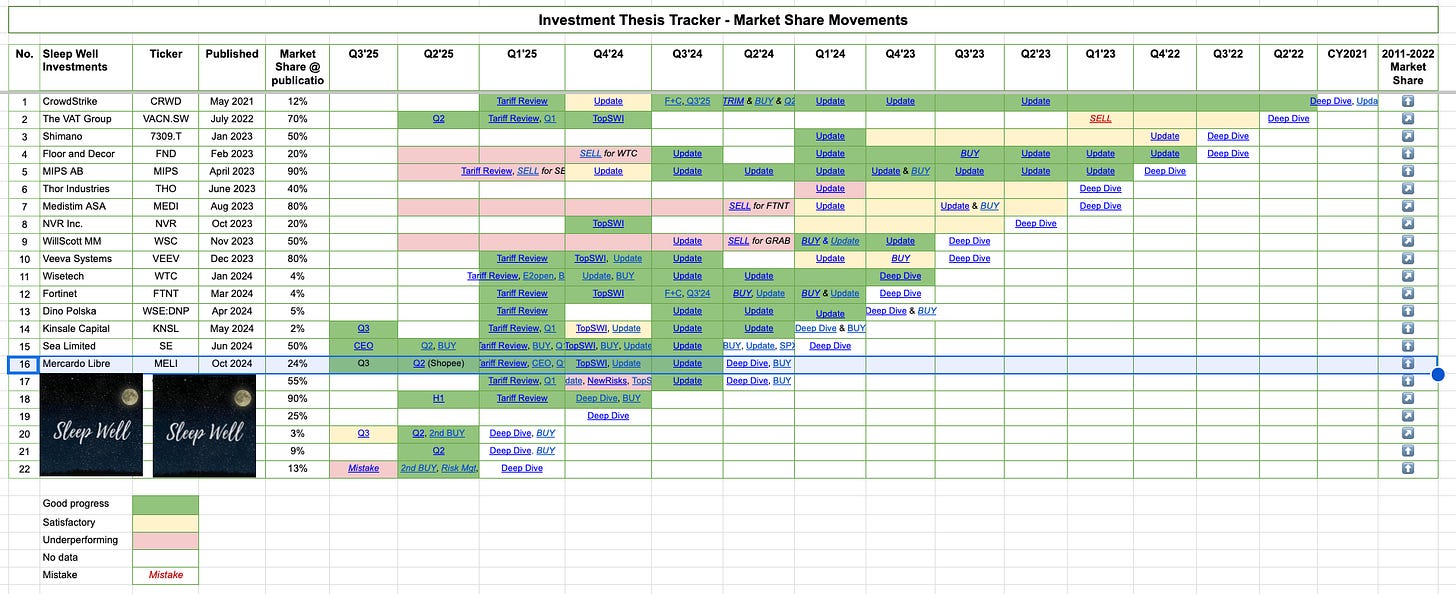

We review the latest quarterly report to see how the business has performed amidst rising competition, namely Shopee (extensively covered here), Amazon, Temu, TikTok, and even OpenAI.

Why do I own it?

KPIs (Operations, Financials, Market share)

Other highlights (Argentina, OpenAI, TikTok, Advertising)

Valuation

To understand the discussion, read my Meli’s writeups: CEO transition, Q2’25, Q1’25, The Most Sleep Well Investment Of LATAM, Top pick for 2025, Q4’24, Q3’24, and Buy Alert.

Don’t miss out on the first Best Buy list. The next one will come in a week.

For everything else, start here. Please use the FAQ alongside the SWI Manual to get the most out of your subscription.

1. Why do I own it?

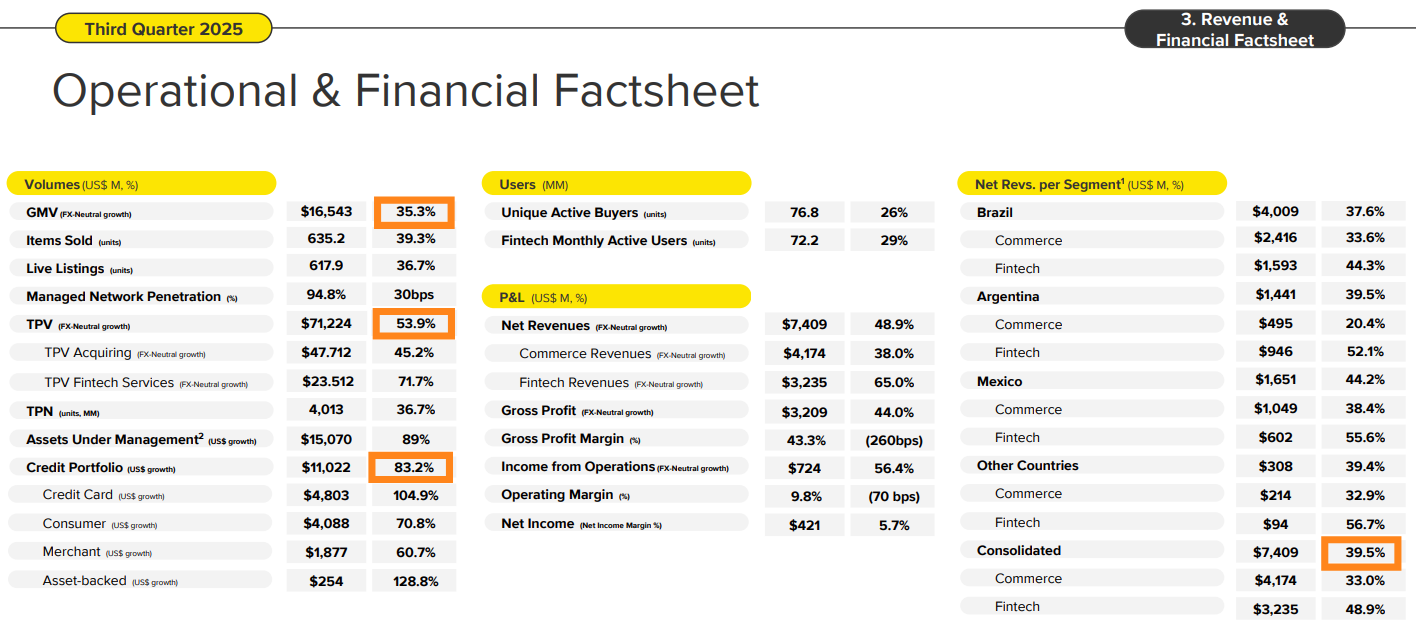

This is Meli’s Q3’25 results. Revenue grew ~40%! – the 27th consecutive quarter of growth above 30% YoY.

More impressively, it’s an acceleration from the 37% CAGR since 2012.

Before we dive in, why do I own it?

2. KPIs (Operations, Financials, Market share)

Meli is the largest and fastest-growing octopus in Latin America, extending its tentacle across Latin America yet avoiding all the political landmines since 1999.

There are lots of stats to digest. Everything in my original deep dive is going well. But since it’s nearly a ~20% position, I’ll try to cover as much as possible.

The core takeaway is that Meli is expertly balancing growth, investment, and profitability. The runway is incredibly long, so if you own shares, do remember that Meli’s goal is to build an ecosystem that enables ordinary people to engage in trade, online and offline, as seamlessly and cost-effectively as possible. This will take time and investment into a proper foundation. Competition will come, but the population is young, digitally versed, and served by traditional commerce and banks, so there is room for multiple winners. Meli would be one of those.

In 10 years, Marcos Galperín quantified a goal to triple Meli’s customer base, serving 300M active buyers (100M today). That’s roughly half of the region’s population. To get there, you need an ultra-long-term mindset… so quarterly fluctuations mean very little here.

This is what he said last year.

“Every time we have invested in enhancing our customer experience, in the past, we have been rewarded with strong growth and improvements in our market position.”

Marcos Galperín, CEO

The above refers to the logistic investment (and free shipping) in 2017.

And what’s special is that despite the high investments, we don’t have to trade it for negative free cash flow or disrupted growth.

You will see what I mean. Let’s dive in.